Learning

Real Estate Flipping Explained: 4 Essential Steps for Profits

What is Real Estate Flipping?

Real estate flipping is an exciting journey where you buy properties, make improvements, and sell them for a profit.

It’s like a puzzle where you combine investment smarts, renovation skills, and perfect timing. This guide will break down the process into simple steps, making it easy to understand.

Is Real Estate Flipping working in 2023?

Before we dive into the practical steps, let’s take a quick look at some essential facts:

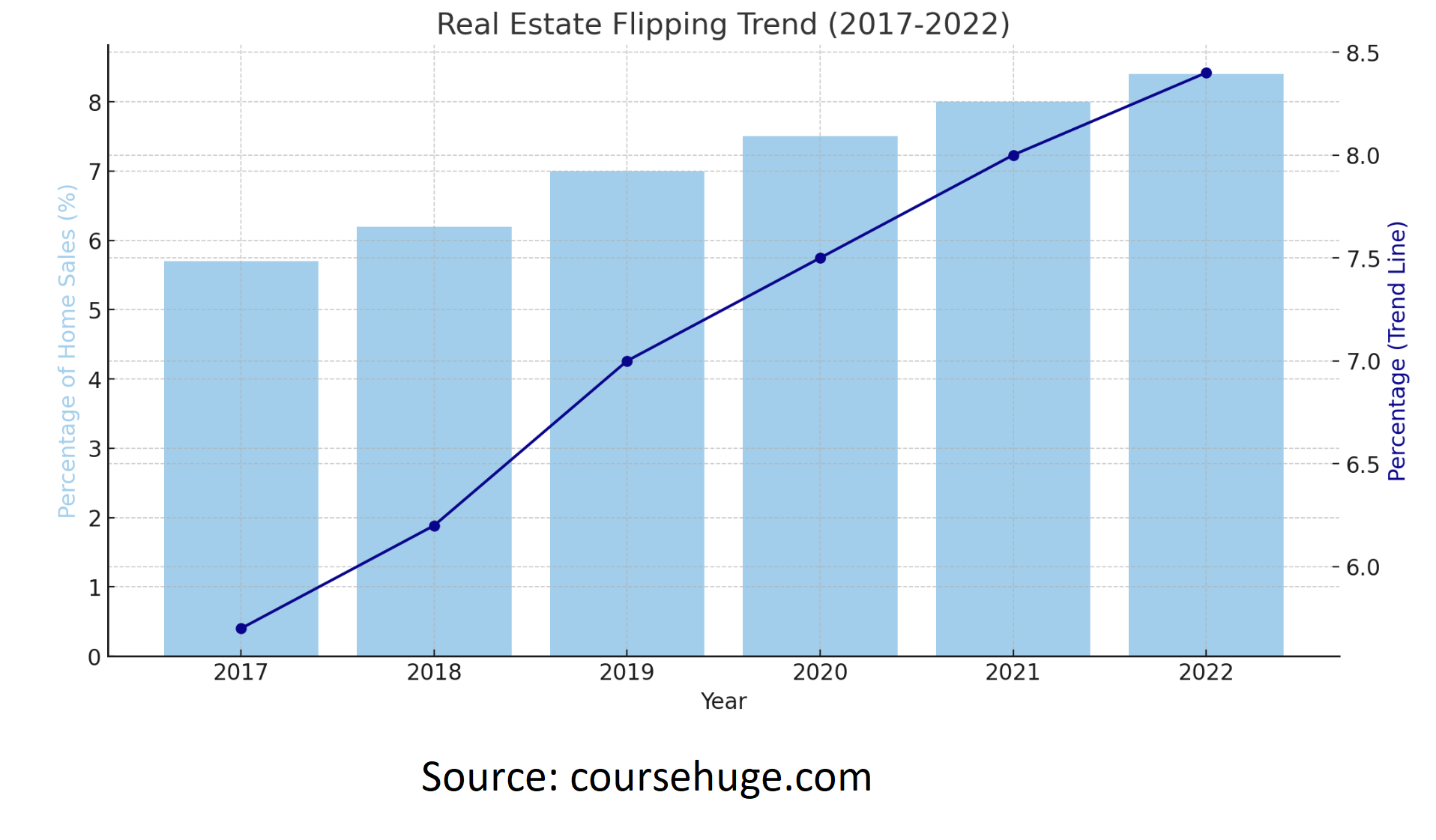

Rising Popularity: The significant increase in home flipping, from 5.7% of all home sales in 2017 to 8.4% in 2022, indicates a growing interest in this type of real estate investment. Various factors could influence this trend, including market conditions, increased availability of information and resources on home flipping, and changes in consumer behaviour and investment strategies.

Profit Margins: The average profit of $67,900 with a return on investment (ROI) of 26.9% in 2022 strongly indicates the potential financial benefits of home flipping. It highlights that, on average, flipping homes can be lucrative. However, it’s important to note that these are average figures, and actual profits and ROIs can vary significantly based on location, property condition, market dynamics, and the skills and experience of the flipper.

Hot Markets: Identifying specific areas, such as parts of Pennsylvania and Delaware, with Delaware experiencing ROIs as high as 96.1%, suggests regional variations in the profitability of home flipping. Economic growth, housing demand, and property availability might drive these hot markets. Such high ROIs indicate that investors in these areas are finding particularly favourable conditions for flipping homes.

Home flipping has become an increasingly popular and potentially profitable real estate investment strategy. However, potential flippers must conduct thorough market research, understand regional dynamics, and manage risks effectively to succeed in this venture.

Step-by-Step Guide to Flipping Houses

Step #1: Market Research: Identifying the Right Property for flipping

The success of your real estate flipping venture begins with thorough market research. In this phase, you must pinpoint the perfect property to transform into a profitable investment. Here’s a breakdown of how to do it in simple terms:

1. Finding Undervalued Homes

Start your search by seeking out homes that are undervalued. These properties might need to be living up to their full potential in terms of price. Here’s what to consider:

- Up-and-Coming Neighborhoods: Focus on neighbourhoods showing signs of growth and improvement. Often, these areas are where property values are on the rise.

- Foreclosures: Keep an eye out for properties that have been foreclosed on. These homes are often cheaper because the previous owners couldn’t meet their mortgage obligations.

- Auction Properties: Properties up for auction can be hidden gems. Auctions can be a great way to snag a property at a lower price, especially if there isn’t a lot of competition.

2. Crunching the Numbers

Once you’ve identified potential properties, it’s time to do some number crunching to estimate your potential profit. Here’s how to do it:

- Purchase Price: Consider the cost of acquiring the property, which includes the purchase price and any associated fees or taxes.

- Renovation Costs: Calculate how much it will cost to renovate the property. This includes materials, labour, permits, and any unexpected expenses arising during the renovation process.

- Expected Sale Price: Research the local real estate market to determine the expected sale price for a renovated property. This will give you an idea of how much you can sell the property once it’s improved.

- Profit Margin: Subtract the total cost (purchase price + renovation costs) from the expected sale price. This will give you an estimate of your potential profit.

Example:

Suppose you find a property in an up-and-coming neighbourhood for $100,000. You estimate that renovations will cost $30,000. After researching the market, you can sell the property for $160,000 once it’s renovated.

- Purchase Price: $100,000

- Renovation Costs: $30,000

- Expected Sale Price: $160,000

To calculate your potential profit:

$160,000 (Expected Sale Price) – $100,000 (Purchase Price) – $30,000 (Renovation Costs) = $30,000

In this example, your potential profit would be $30,000.

Following these simple steps of identifying undervalued homes and crunching the numbers, you can make informed decisions when selecting properties for your real estate flipping venture.

Remember that research and careful consideration are your keys to success in this exciting field.

Step #2: Financing Your Flip

Once you’ve identified the right property, securing the necessary finances is the next step in your real estate flipping journey. It’s essential to ensure you have the funds to cover every aspect of your project, from acquiring the property to financing renovations and covering holding costs. Let’s break down this step into simple terms:

1. Budgeting:

Before you dive into the world of real estate flipping, take a good look at your finances. Here’s how to do it:

- Total Project Costs: Calculate the total expenses involved in your project, including the purchase price of the property, renovation costs, and holding costs (such as property taxes, insurance, and utilities during the renovation period).

- Contingency Fund: Setting aside some extra money as a contingency fund is wise. Renovations can sometimes uncover unexpected issues that need fixing, so having a cushion for these surprises is essential.

- Cash Reserves: Ensure you have enough cash reserves to cover your living expenses and any unexpected personal financial needs while working on the flip.

2. Cash vs Financing:

Now, you must decide whether to use your cash or seek financing for your project. Here are some key considerations:

- Cash Offers: Paying with cash can attract sellers because it eliminates the uncertainty of financing falling through. However, it requires a significant amount of personal funds upfront.

- Financing: If you opt for financing, you must have a solid financial plan. This includes a good credit score and a clear strategy for repaying the loan or mortgage you secure.

- Types of Financing: Explore different financing options, such as traditional mortgages, hard money loans, or lines of credit. Each has pros and cons, so choose the one that aligns with your financial situation and project goals.

Example:

Let’s say your total project costs, including the purchase price, renovations, and holding costs, amount to $150,000. You’ve set aside an additional $20,000 as a contingency fund. In total, you need $170,000 to complete the project successfully.

- Total Project Costs: $150,000

- Contingency Fund: $20,000

To calculate the amount you need for financing:

$150,000 (Total Project Costs) + $20,000 (Contingency Fund) = $170,000

In this example, you would need $170,000 to cover all project expenses.

By careful budgeting and considering your financing options, you can ensure you have the financial resources to embark on your real estate flipping venture. Remember that proper financial planning is crucial to your journey to success in this field.

Step #3: Real Estate Renovation Process

Now that you’ve secured the property and sorted out your finances, it’s time to roll up your sleeves and begin the renovation process. This step can significantly impact the success of your real estate flipping project. Here’s a straightforward breakdown:

1. Planning

Creating a Detailed Renovation Plan: Your renovation plan is like a roadmap for your project. Here’s how to make one:

- Prioritize Improvements: Identify which areas of the property need the most attention. Focus on improvements that can increase the property’s value significantly. Common areas to consider are the kitchen, bathrooms, and curb appeal.

- Set a Budget: Determine how much you will spend on renovations. It’s essential to have a clear budget in mind to prevent overspending.

- Timeline: Develop a timeline for the renovation project. Consider how long each aspect of the renovation will take and when you plan to have the property ready for sale.

2. Execution

Hiring Reliable Contractors: Renovation work often requires specialized skills, so hiring reliable contractors is crucial:

- Research and Interviews: Do your research to find reputable contractors with experience in the renovations you plan. Interview multiple contractors and ask for references.

- Get Detailed Bids: Request detailed bids from contractors that outline the scope of work, materials, labour costs, and a timeline for completion.

- Contract Agreement: Once you’ve selected a contractor, ensure a clear and legally binding contract is in place. This should include payment terms, deadlines, and a process for addressing any unexpected issues during the renovation.

- Budget and Schedule Adherence: Monitor the renovation’s progress closely to ensure it stays within budget and is completed on schedule. Delays can lead to extra costs, so staying on track is essential.

Example:

Your renovation plan includes updating the kitchen and bathrooms, as these areas typically provide the most value. You’ve set a budget of $30,000 for the renovations; your timeline is three months.

- Prioritizing Improvements: Kitchen and bathroom upgrades

- Budget: $30,000

- Timeline: Three months

During the execution phase, you hire a reliable contractor who provides a detailed bid outlining the scope of work, materials, labour costs, and a timeline for completing the kitchen and bathroom renovations. The contractor adheres to the agreed-upon budget and finishes the job within three months.

Planning carefully and executing the renovation efficiently can enhance the property’s value and increase your chances of a profitable sale.

Remember that renovation is critical to real estate flipping, so meticulous planning and management are essential to a successful outcome.

Step #4: Selling the Property – Making the Sale a Success

Now that your renovated property is ready to hit the market, your focus shifts to selling it effectively. Achieving a successful sale is the ultimate goal of real estate flipping. Here’s how to do it:

1. Pricing it Right

Setting the Perfect Price: One of the most critical aspects of selling a property is determining the right price. Here’s how:

- Market Analysis: Conduct thorough research to understand the current state of the local real estate market. Analyze comparable properties in the area to gauge their selling prices.

- Consider Improvements: Consider the value-added through renovations and improvements made to the property. These enhancements should be reflected in the asking price.

- Competitive Pricing: Strive to set a competitive price that aligns with market trends and your enhancements. Being realistic and competitive can attract potential buyers.

2. Marketing Strategies

Effective Marketing Campaigns: Once you’ve set the price, it’s time to market your property to potential buyers:

- Online Presence: Utilize online platforms, such as real estate websites and social media, to showcase your property. High-quality photos and engaging descriptions can attract more attention.

- Professional Help: Consider enlisting the services of a real estate agent with experience in your target market. They can provide valuable insights and assist with marketing.

- Staging for Appeal: Consider staging the property to enhance its visual appeal. Staging helps potential buyers envision themselves living in the space.

- Open Houses and Showings: Host open houses and showings to allow interested buyers to see the property in person. Make sure the property is well-presented during these events.

Example:

You’ve thoroughly researched the local real estate market and determined that similar renovated properties in your neighbourhood sell for around $250,000. Based on your improvements, you decide to list your property for $265,000, which reflects both market trends and the value you’ve added through renovations.

For marketing, you hire a real estate agent specialising in your area. They create an attractive online listing with professional photos and descriptions. You also invest in home staging to make the property inviting and ready for potential buyers. The agent arranges open houses and showings to allow interested buyers to experience the property firsthand.

Setting the right price and implementing effective marketing strategies increases your chances of a successful sale, maximizing your return on investment in the real estate flipping venture.

In conclusion, selling the property is the final piece of the real estate flipping puzzle, and getting it right ensures you reap the rewards of your hard work and intelligent planning.

In Conclusion

Real estate flipping can be profitable if you approach it with research and a well-thought-out strategy. By understanding the market, managing your budget effectively, and executing renovations efficiently, you can successfully flip properties and enjoy significant returns on your investment.

Remember, every flip is a learning experience, and each success builds your expertise in this exciting real estate venture.

Learn more from out Top Real Estate Courses:

- Josiah Grimes – AstroFlipping Acquisitions Academy

- Brian Page – BNB Formula 2020

- Sean Terry – Flip2Freedom Academy 3.0

- Cris Chico – Find Motivated Sellers Online