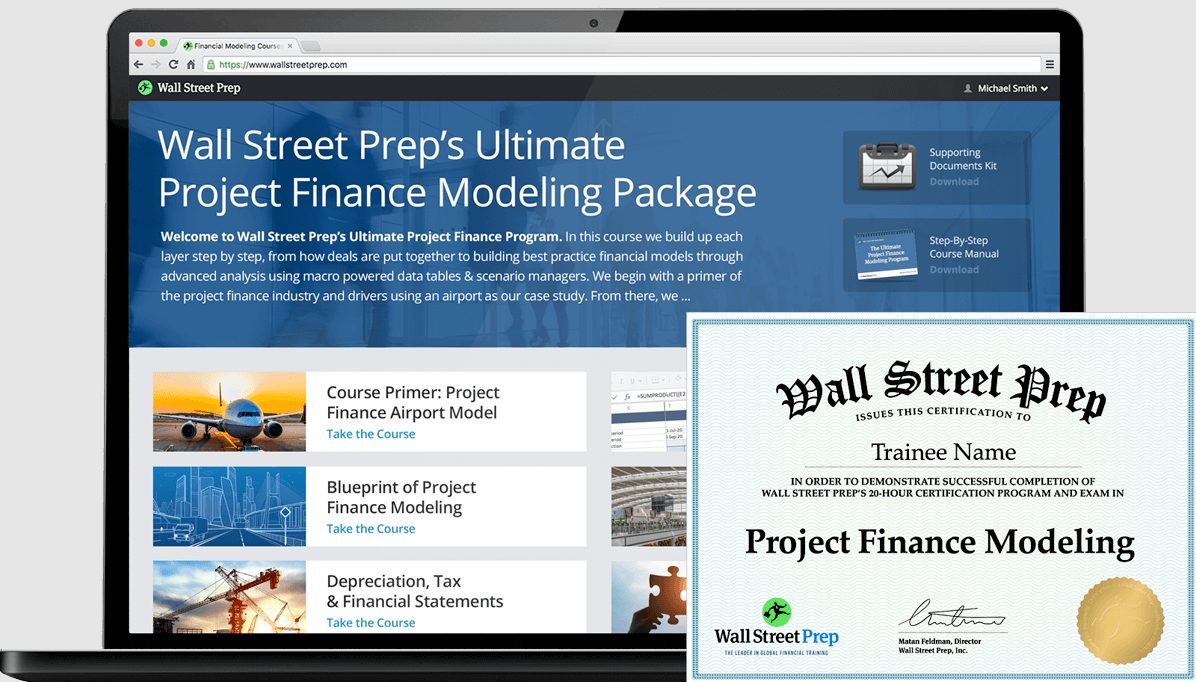

Wall Street Prep – The Ultimate Project Finance Modeling Package

$499.00 Original price was: $499.00.$48.00Current price is: $48.00.

Wall Street Prep Project Finance Modeling Course [Instant Download]

What is Wall Street Prep Project Finance Modeling?

Wall Street Prep The Ultimate Project Finance Modeling course teaches you how to build complex financial models used in infrastructure and project finance deals.

The course shows you step-by-step how to model debt sizing, financial statements, cash flows, and scenario analysis – skills required at top investment banks and infrastructure funds.

It includes 6 courses with 18+ hours of video training, proven effective by over 73,000 students. Each module breaks down advanced concepts into clear, actionable steps.

📚 PROOF OF COURSE

What you’ll learn in Project Finance Modeling?

Learn the project finance modeling skills used by leading banks and funds. Here’s what you’ll gain:

- Model Building: Create project finance models from scratch with proven methods and best practices

- Debt Modeling: Learn debt service reserve accounts, refinancing, and how to structure shareholder loans

- Financial Analysis: Master financial statements, tax modeling, and working capital calculations

- Infrastructure Focus: Apply your skills to different infrastructure projects and handle multi-phase developments

- Risk Analysis: Use macros and data tables to test different scenarios and outcomes

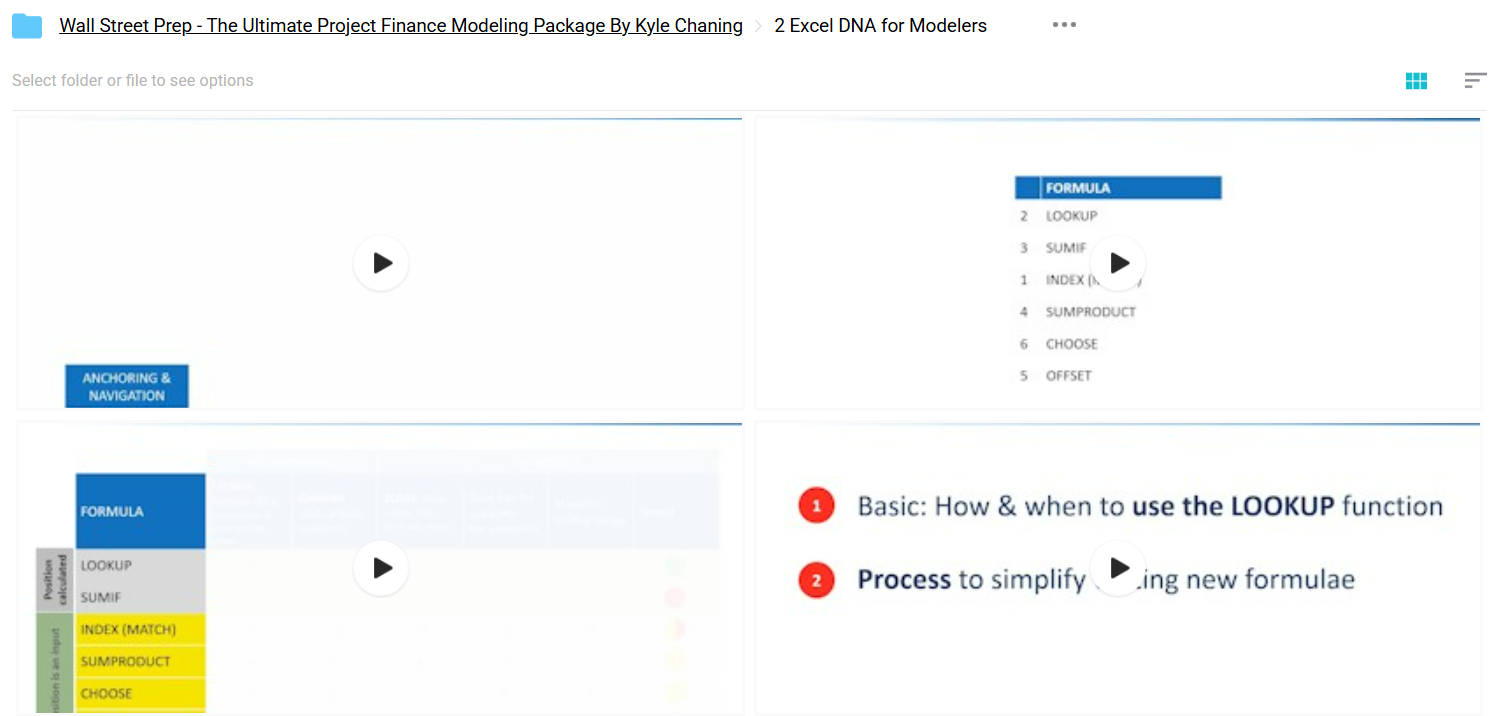

- Excel Skills: Master key Excel functions and shortcuts that speed up your modeling work

You’ll practice everything through real case studies, combining theory with hands-on experience.

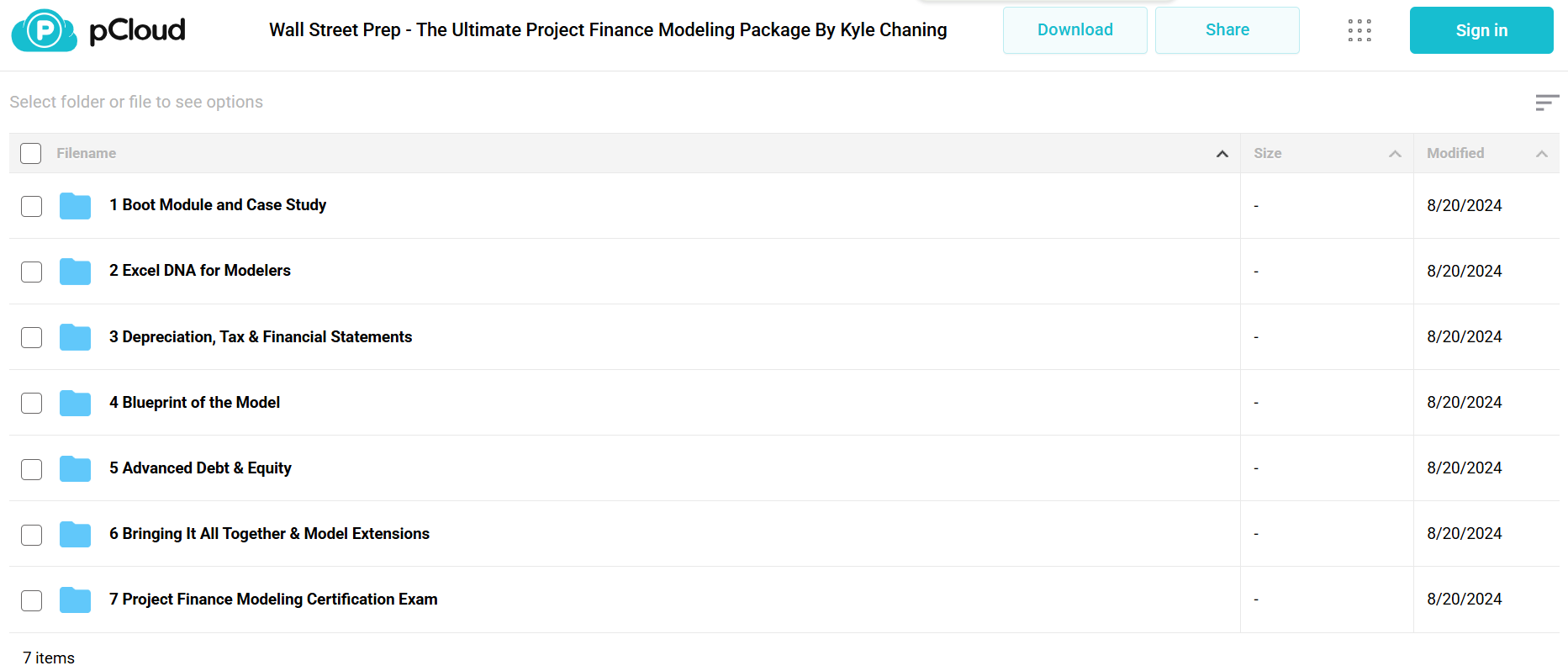

Project Finance Modeling Course Curriculum:

The Ultimate Project Finance Modeling Package takes you from basics to advanced modeling through 7 carefully structured parts. Each part builds on the previous one, helping you master project finance step by step. The course curriculum includes:

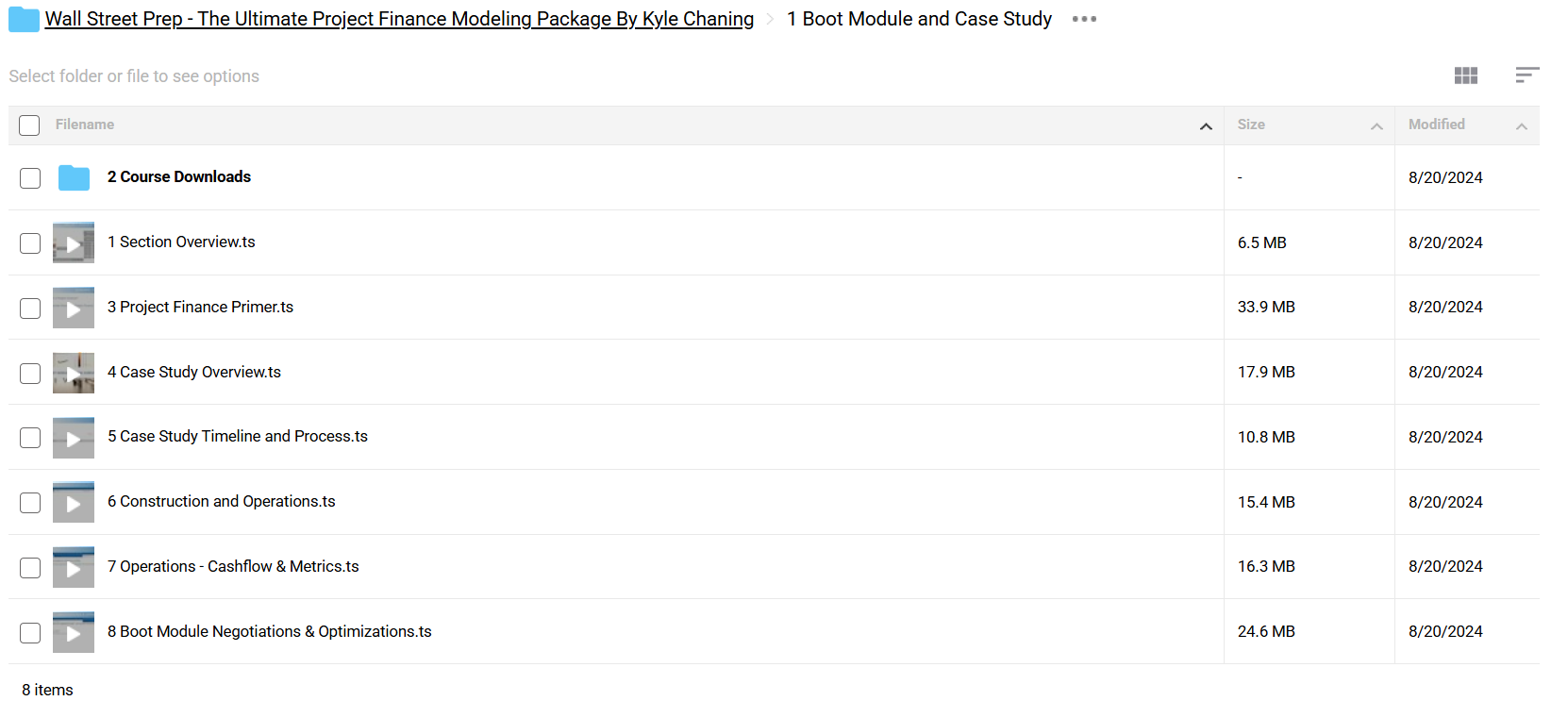

- Part 1: Boot Module and Case Study

- Part 2: Excel DNA for Modelers

- Part 3: Depreciation, Tax & Financial Statements

- Part 4: Blueprint of the Model

- Part 5: Advanced Debt & Equity

- Part 6: Bringing It All Together & Model Extensions

- Part 7: Project Finance Modeling Certification Exam

By the end of this course, you’ll have built several complete project finance models and gained skills used by top infrastructure funds and investment banks.

Author profile: Who is Kyle Chaning?

Kyle Chaning is a financial modeling expert and founder of Finmodo, a company that makes financial modeling easier to learn.

He worked at Deloitte and Corality Financial Group, building his expertise in complex financial models. He studied finance at the University of California, Berkeley, and the University of Canterbury.

Kyle also co-founded Maxwell, a private club in New York City built around an open kitchen concept for members to cook and entertain.

Through Finmodo, he has taught financial modeling to thousands of professionals, using his real-world experience to make complex topics easy to understand.

Be the first to review “Wall Street Prep – The Ultimate Project Finance Modeling Package” Cancel reply

Related products

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Business & Finance

Reviews

There are no reviews yet.