Ultimate Guide To Swing Trading ETF’s

$590.00 Original price was: $590.00.$50.00Current price is: $50.00.

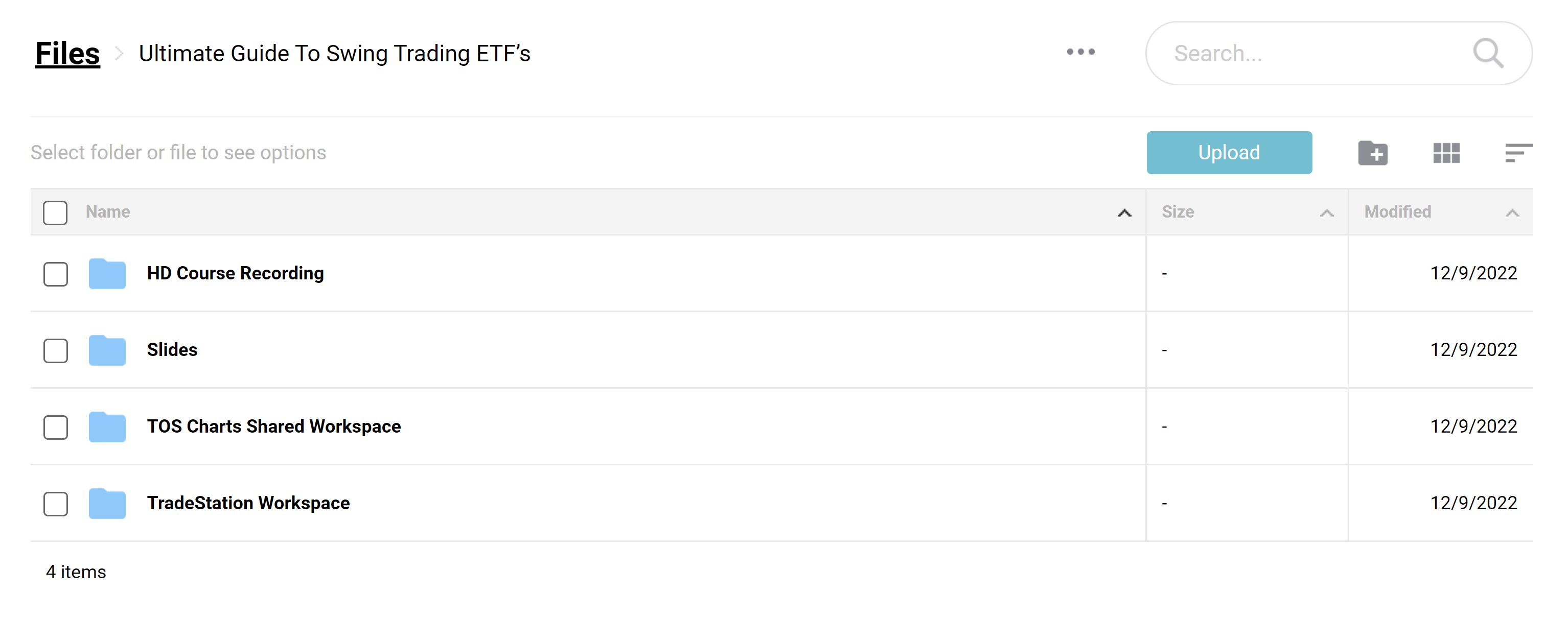

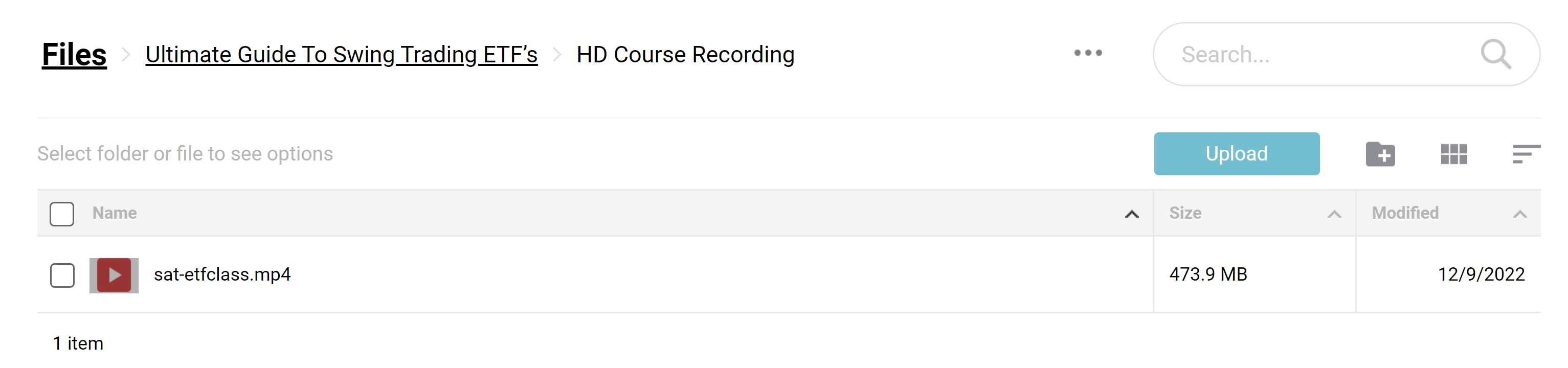

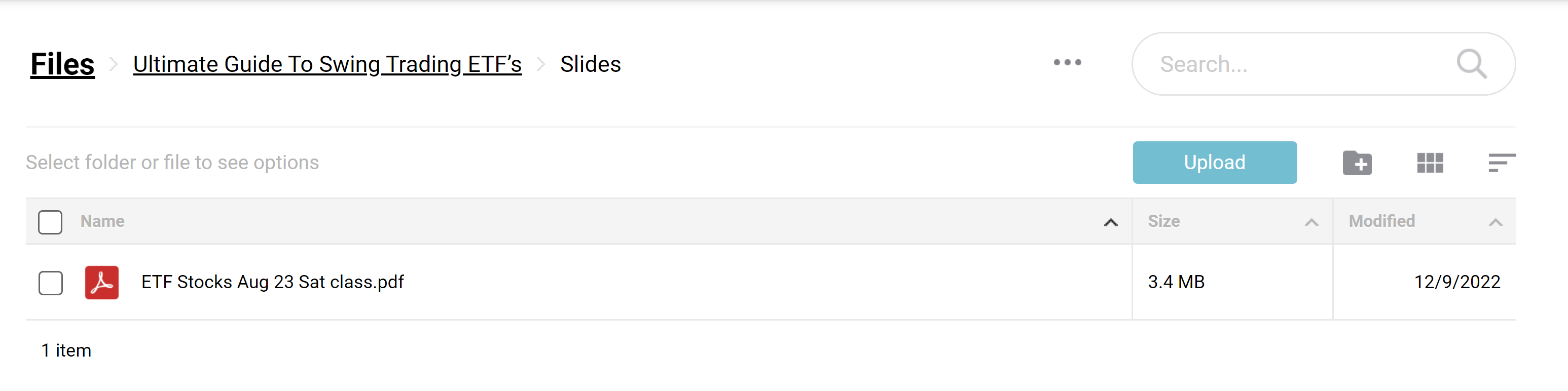

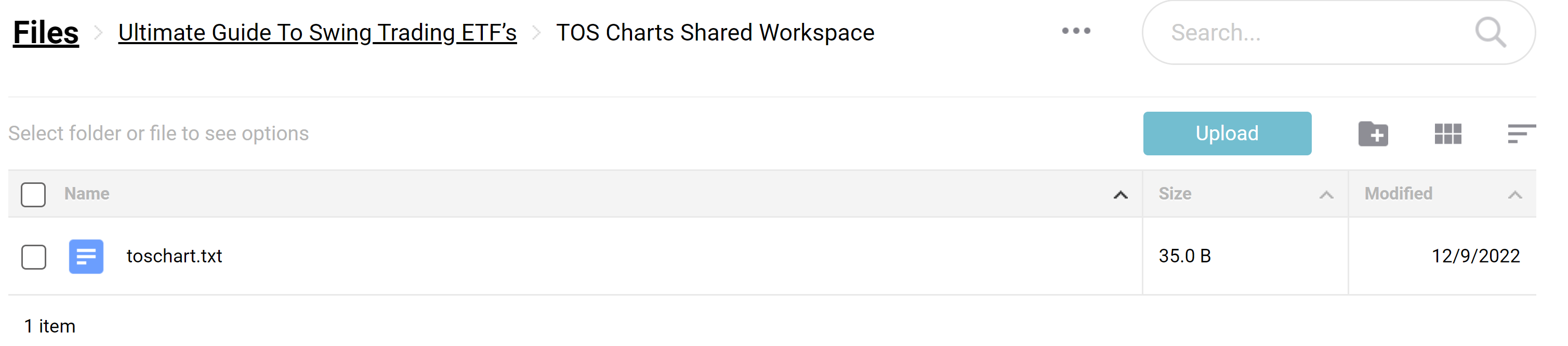

[Download] Simpler Stock Ultimate Guide To Swing Trading ETF’s

📚 PROOF OF COURSE

What is Ultimate Guide To Swing Trading ETF Course:

NOTE: We will sent you the Downloadable files after purchase, we dont ship any physical DVDs

Discover the intricacies of the stock market with the “Ultimate Guide To Swing Trading ETFs.”

This comprehensive 4-hour class, instructed by Henry Gambell, provides solid instruction suitable for options traders at every level.

Delve into simpler stock strategies and ensure your trading is profitable and informed.

What You Will Learn in this Swing Trading ETF Course:

- Utilization of Moving Averages: Learn how to effectively use moving averages for both Day and Swing Trading, ensuring you can navigate short and long-term market movements.

- Secret Support and Resistance: Uncover trend lines’ secret support and resistance, providing you with the knowledge to identify potential market reversals.

- Recognizing Key Swing Lows and Highs: Develop the ability to recognize key swing lows and highs across multiple time frames, enhancing your market timing.

- Using Price Channels: Understand how to use price channels for identifying 10/20 day highs and lows, aiding in identifying potential breakouts or breakdowns.

- Mastering Chart Patterns: Learn the 5 chart patterns every professional trader knows, ensuring you can read the market with precision.

Ultimate Guide To Swing Trading ETF Course Curriculum:

The course curriculum is meticulously designed to guide traders through the various aspects of swing trading ETFs. Henry Gambell delivers in-depth knowledge on utilizing moving averages for different trading styles, revealing trend lines’ secret support and resistance, recognizing pivotal swing lows and highs across various time frames, employing price channels for identifying market highs and lows, and mastering essential chart patterns.

Who is Henry Gambell ?

Henry Gambell, a seasoned trader and respected instructor, brings you the “Ultimate Guide To Swing Trading ETFs.” With a knack for simplifying complex trading concepts, Henry ensures that traders, regardless of their experience level, can grasp and apply the strategies taught. His expertise in utilizing moving averages, deciphering trend lines, and identifying critical swing lows and highs across multiple time frames has empowered numerous traders to navigate the stock market proficiently.

Who is this course for:

- Novice Traders: Those new to the trading world who wish to understand the nuances of swing trading ETFs and desire to apply simpler stock strategies effectively.

- Intermediate Traders: Individuals with some trading experience seek to enhance their knowledge and skillset, particularly in swing trading ETFs.

- Experienced Traders: Seasoned traders looking to refresh their knowledge or explore new strategies in swing trading ETFs to diversify their trading approach.

Be the first to review “Ultimate Guide To Swing Trading ETF’s” Cancel reply

Related products

Forex Trading

Swing Trading

Stock Trading

Trading Courses

Stock Trading

Swing Trading

Forex Trading

Reviews

There are no reviews yet.