Steven Primo – Professional Swing Trading College

$3,995.00 Original price was: $3,995.00.$43.00Current price is: $43.00.

Steven Primo Professional Swing Trading College [Instant Download]

What is Professional Swing Trading College:

Steven Primo’s Professional Swing Trading College teaches systematic swing trading methods for indices, equities, and options. You’ll learn CORE strategies backed by performance data and practice with real account trading sessions.

The course covers essential market knowledge and advanced techniques to capture short to medium-term market moves. You’ll also learn how to structure your swing trading as a business for long-term success.

This course suits new and experienced traders in different market conditions.

📚 PROOF OF COURSE

What you will learn in Professional Swing Trading College:

In this comprehensive course, you’ll gain a wealth of knowledge and skills to become a proficient swing trader. Here’s what you can expect to learn:

- Foundation of market dynamics and price behavior predictors

- Multiple CORE trading methods for indices, equities, and options

- Real-time trade execution and analysis

- Performance statistics and method rules for each strategy

- Portfolio management and risk control techniques

- Business structuring for trading success

The course combines theoretical knowledge with practical application, ensuring you’re well-equipped to navigate the markets confidently.

Professional Swing Trading College Course Curriculum:

The Professional Swing Trading College offers a comprehensive curriculum spread across 14 sessions. Here’s a detailed breakdown:

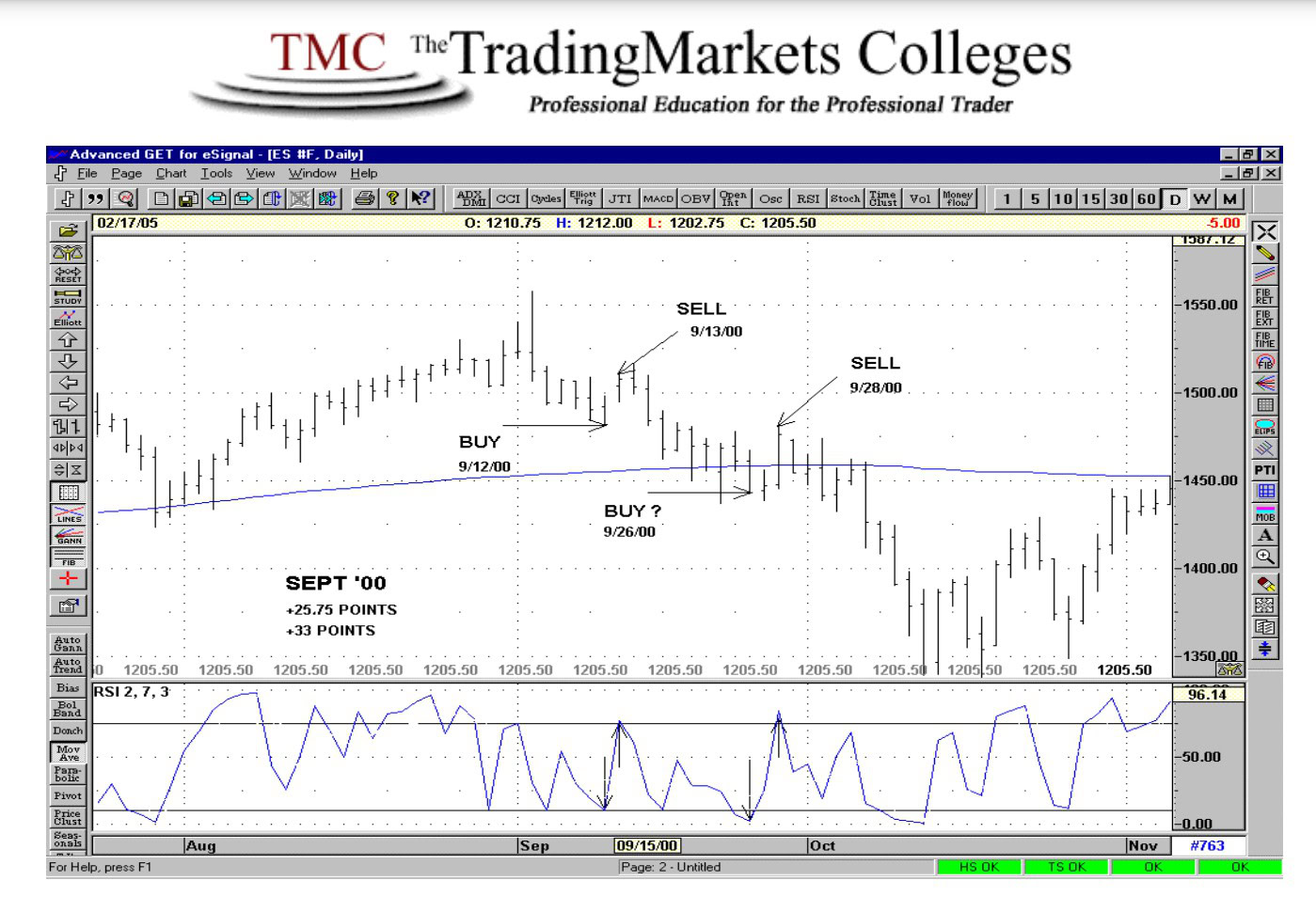

✅ Sessions 1-2: CORE Foundation Knowledge and RSI Methods

These sessions introduce essential market concepts and the CORE R3, RSI 20, and RSI 1% methods for trading indices and ETFs.

✅ Sessions 3-4: CORE R4 Method for Equity Swing Trading

Focus on systematic swing trading of equities, particularly Nasdaq stocks, using the R4 method.

✅ Sessions 5-7: Advanced CORE Methods

Learn the RS2/DW System, 4/10/60 Method, and 20/30/40 Method for options trading.

✅ Sessions 8-10: Strategy Integration and Business Structure

Cover aggressive swing trading, portfolio management, and how to structure your trading as a business.

✅ Sessions 11-14: Real Account Trading

Observe and learn from Steven Primo’s live trading sessions, gaining practical insights into method application.

This curriculum ensures a comprehensive understanding of professional swing trading strategies and their real-world application.

Who is Steven Primo?

Steven Primo has traded for over 40 years. He started at the Pacific Stock Exchange in 1977 and became a Stock Exchange Specialist, handling over 50 stocks. Since 1994, he’s focused on managing money and creating new trading methods.

Primo is known in trading magazines and on big finance websites. His trading ideas are used in over 100 countries, helping all kinds of traders do well in the markets.

In his Professional Swing Trading College, Primo shares his market know-how and real trading experience. He teaches useful swing trading skills, helping students trade better in tough markets.

Be the first to review “Steven Primo – Professional Swing Trading College” Cancel reply

Related products

Forex Trading

Swing Trading

Trading Courses

Forex Trading

Trading Courses

Swing Trading

Reviews

There are no reviews yet.