Orderflows – The Point of Control and Imbalance Course

$99.00 Original price was: $99.00.$15.00Current price is: $15.00.

Michael Valtos The Point of Control and Imbalance Course [Instant Download]

What is The Point of Control and Imbalance Course?

Michael Valtos’ Point of Control and Imbalance Course is a trading program teaching order flow analysis used by professional traders.

The course focuses on identifying “Point of Control” – price levels with the highest trading volume – and market imbalances that show when institutions are buying or selling.

You’ll learn how to spot reliable support and resistance levels, recognize market turning points, and confirm trade direction using real-time order flow data. These techniques work across futures, forex, stocks, and CFDs to help you trade like professionals instead of guessing market direction.

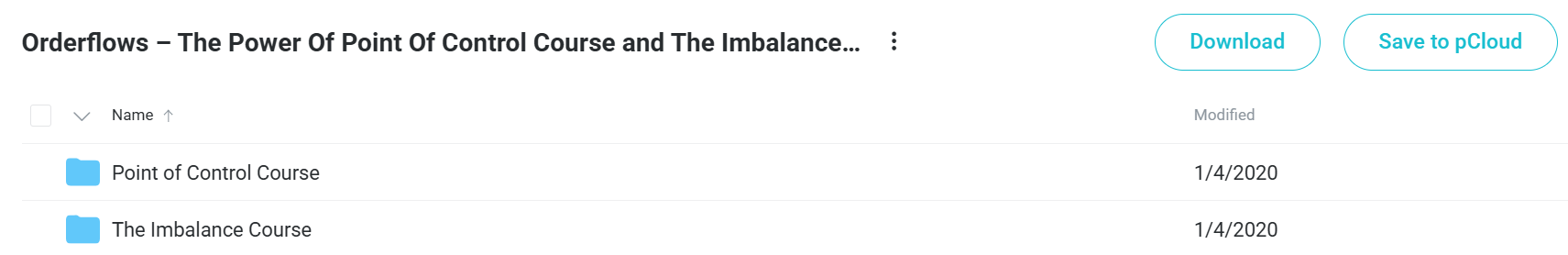

📚 PROOF OF COURSE

What you’ll learn in The Point of Control and Imbalance Course:

The Point of Control and Imbalance Course teaches you how to read markets like professional traders by understanding order flow patterns. Here’s what you’ll learn:

- Advanced order flow analysis: See key price levels where institutions are trading

- Point of Control techniques: Use highest volume price levels for reliable support and resistance

- Imbalance identification: Spot when institutions enter or exit positions

- Trade confirmation methods: Know when you’re in a good trade or should exit

- Market turning point recognition: Identify stopping volume when aggressive traders turn passive

- Practical trade setups: Learn 19 order flow setups for futures, forex, stocks, and CFDs

This course works for all markets and timeframes. You’ll learn to see what institutions are doing in real-time and use this information to make better trading decisions.

3️⃣. The Point of Control and Imbalance Course Curriculum:

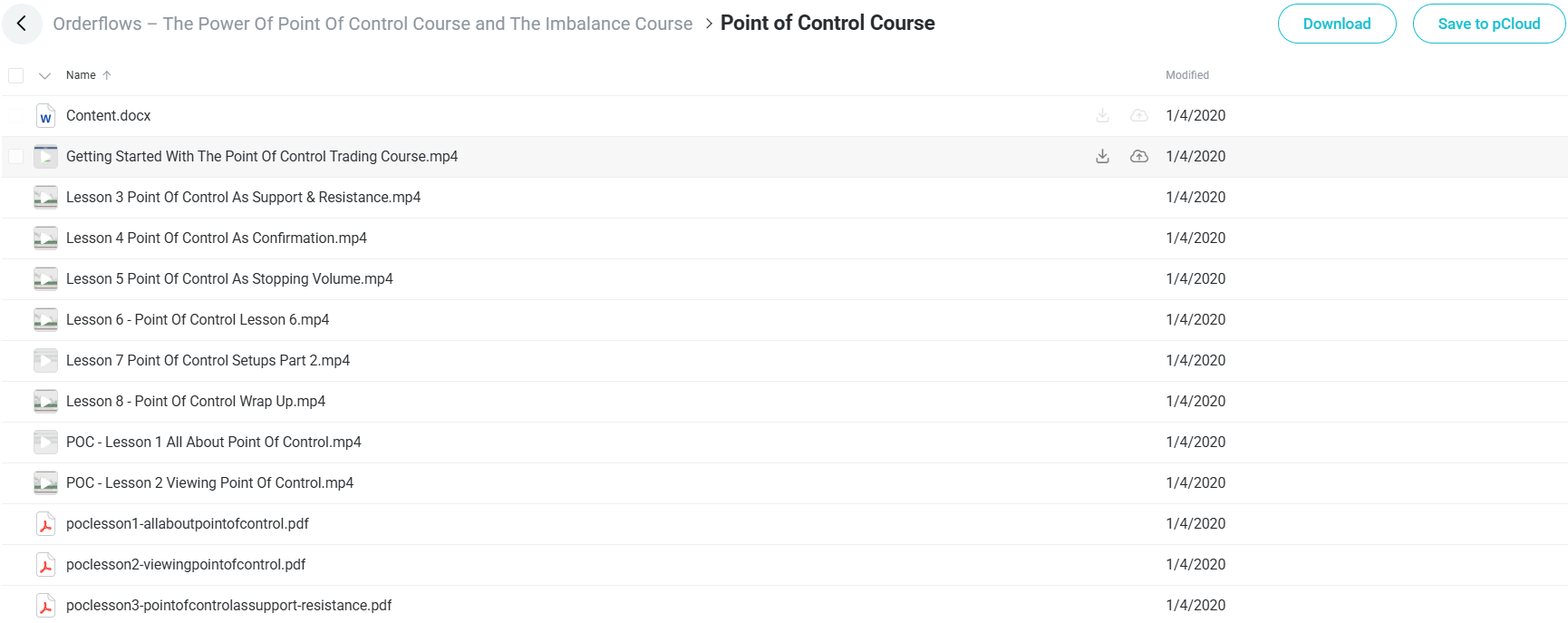

✅ Section 1: Point Of Control Course

The Point of Control section teaches traders how to use the price level with the highest trading volume. Students learn to find POC on charts and use it as support/resistance areas. The course shows how POC can confirm trade ideas and reveal where big players are active. By the end, traders will know several trade setups that use POC to find good entry and exit points in the market.

Lesson 1: All About Point of Control

Learn the fundamental concepts behind Point of Control analysis, including what POC represents in terms of market psychology and institutional participation. Understand how POC reveals underlying market structure and why this high-volume node often becomes significant in future price action.

Lesson 2: Viewing Point of Control

Master the practical aspects of identifying and displaying POC on your charts. Explore different methods for visualizing volume distribution and learn how to recognize POC across various timeframes and market conditions.

Lesson 3: Point of Control As Support & Resistance

Discover how POC naturally functions as dynamic support and resistance zones. This lesson explains why price often respects these high-volume nodes, creating opportunities for trades when price approaches previous POC levels.

Lesson 4: Point of Control As Confirmation

Learn to use POC as a powerful confirmation tool for your existing trade setups. This lesson shows how incorporating POC analysis can increase your confidence in entries and improve timing when combined with other technical factors.

Lesson 5: Point of Control As Stopping Volume

Understand the concept of “stopping volume” at POC levels, where large players absorb selling or buying pressure to build positions. This advanced lesson reveals how to identify when POC represents institutional accumulation or distribution.

Lesson 6: Point of Control Setups Part 1

Begin exploring specific trading strategies built around POC behavior. This lesson introduces practical trade setups that utilize POC for entries, stops, and targets in different market contexts.

Lesson 7: Point of Control Setups Part 2

Continue developing your POC trading arsenal with additional sophisticated strategies. Learn nuanced approaches for different market conditions and how to combine POC with other technical indicators for higher-probability trades.

Lesson 8: Point of Control Wrap Up

Synthesize all POC concepts into a cohesive trading approach. This final lesson integrates the previous material while providing best practices for implementation and addressing common challenges traders face when applying these techniques.

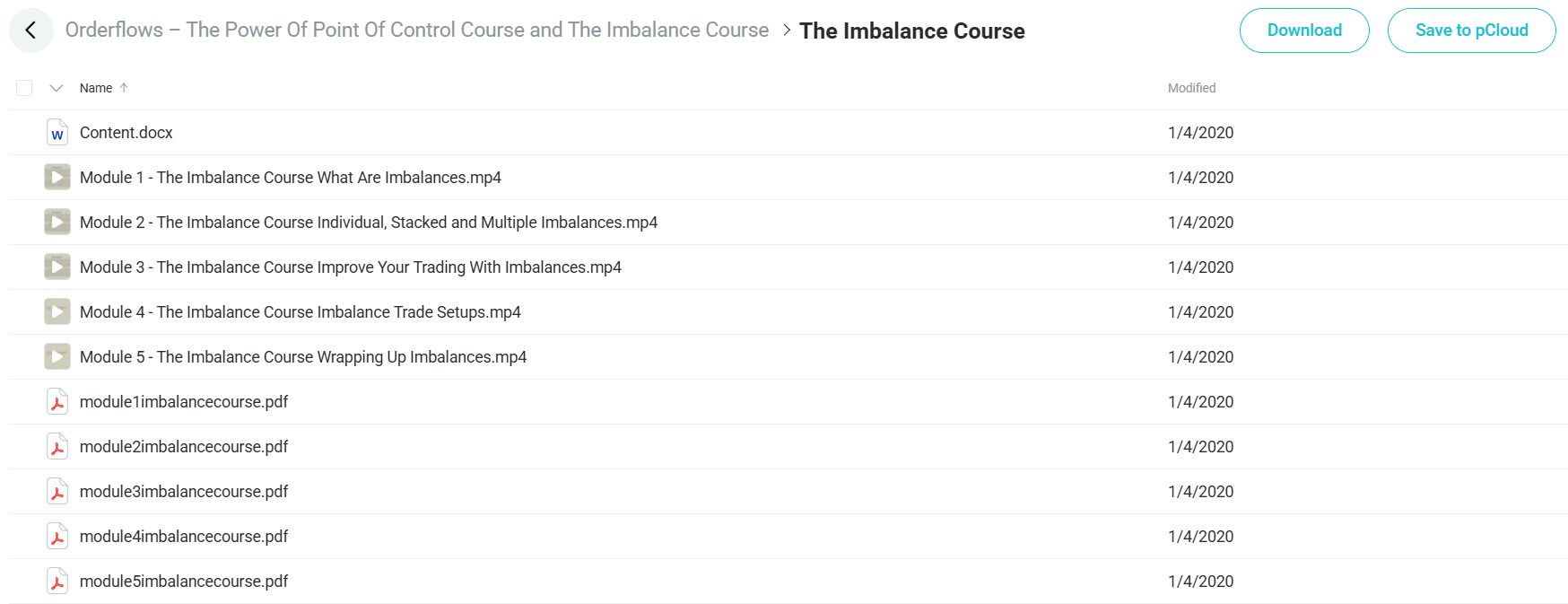

✅ Section 2: The Imbalance Course

The Imbalance section teaches traders about price gaps and unfilled orders that create trading chances. Students learn about different types of imbalances and how strong each type is. The course shows how to use imbalances to improve trade entries, stops, and targets. Traders learn specific setups based on imbalances and how to combine them with POC analysis for better results.

Module 1: What Are Imbalances

Establish a solid foundation by understanding what market imbalances are and why they form. Learn to identify these inefficiencies where buyers and sellers are not in equilibrium, creating potential energy for future price movements.

Module 2: Individual, Stacked and Multiple Imbalances

Develop the ability to distinguish between different types of imbalance patterns and their relative significance. This module teaches you to recognize when imbalances appear in isolation versus when they form more complex structures that may indicate stronger directional bias.

Module 3: Improve Your Trading With Imbalances

Discover practical applications for incorporating imbalance analysis into your existing trading system. Learn how identifying imbalances can enhance your entry precision, stop placement, and target selection across various trading styles.

Module 4: Imbalance Trade Setups

Master specific, actionable trading strategies centered around market imbalances. This hands-on module provides concrete setups with clear entry criteria, risk management guidelines, and profit-taking approaches for real-world application.

Module 5: Wrapping Up Imbalances

Integrate all imbalance concepts into a comprehensive trading framework. This concluding module shows how imbalance analysis complements Point of Control techniques, creating a powerful synergistic approach to reading market structure through order flow.

Who is Michael Valtos?

Michael Valtos traded professionally for nearly two decades at JP Morgan, Cargill, and Commerzbank. He specializes in order flow trading and market analysis.

Valtos founded Orderflows.com to teach retail traders how professionals read markets. He focuses on practical techniques that work across all markets.

He’s an expert in market-generated information like Point of Control and imbalances that show institutional activity. His methods help traders understand price acceptance and rejection patterns.

Unlike most educators, Valtos has real institutional trading experience. He teaches what works in real markets, not just theory or indicators.

Valtos explains complex trading concepts in simple, actionable steps. His courses have helped thousands of traders improve their results.

Be the first to review “Orderflows – The Point of Control and Imbalance Course” Cancel reply

Related products

Trading Courses

Trading Courses

Options Trading

Trading Courses

Forex Trading

Forex Trading

Trading Courses

Reviews

There are no reviews yet.