The Forex Scalpers – Supply Demand Masterclass Package

$499.00 Original price was: $499.00.$15.00Current price is: $15.00.

The Forex Scalpers Supply Demand Masterclass Package Course [Instant Download]

What is The Forex Scalpers Supply Demand Masterclass?

The Forex Scalpers Supply Demand Masterclass Package is a course that teaches you how to trade forex using supply and demand zones, institutional levels, and price action strategies.

Learn to identify liquidity exits, spot market manipulation, and trade like institutions. The course includes 16 video modules with assignments for real trading progress.

With 12 years of trading experience, The Forex Scalpers shares proven methods that consistently profit from forex markets. You get lifetime community access and personal feedback on your trades.

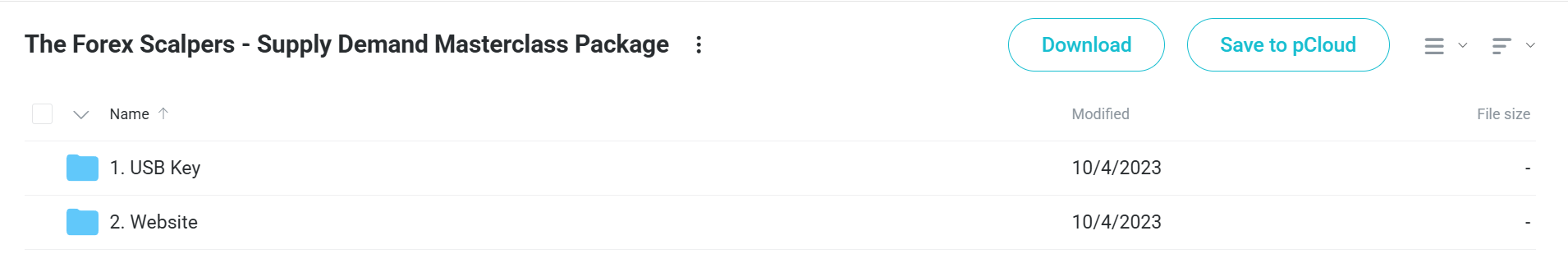

📚 PROOF OF COURSE

What you’ll learn in Supply Demand Masterclass Package:

The Supply Demand Masterclass shows you the strategies professional traders use to make money from forex markets. You’ll learn:

- Supply and demand zones: Find institutional levels where price reverses

- Market manipulation: See how large institutions operate and trade with them

- Liquidity exits: Spot where smart money enters and exits trades

- Risk management: Use proper position sizing to protect your capital

- Trading psychology: Build the mindset for consistent profits

- Support and resistance: Master key levels for best trade entries

The course has 16 video modules with assignments and lifetime community access. You get personal feedback on your homework to ensure real trading progress.

Supply Demand Masterclass Package Course Curriculum:

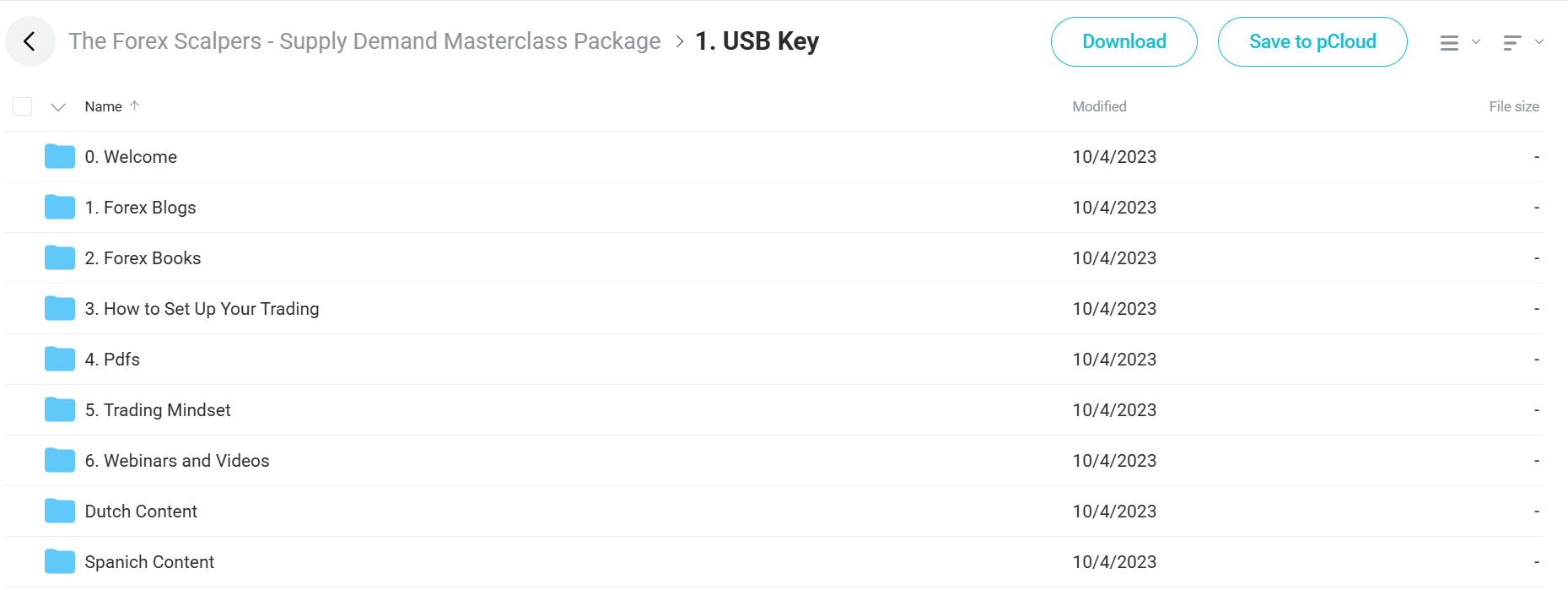

✅ Section 1: Welcome & Forex Basics

The course starts with basic Forex knowledge through easy-to-read articles and learning materials. Students first learn the five main things that move Forex markets and the best times to trade for making money.

The basics include important trading words, how money exchanges work, and how much money actually moves in Forex markets. Students learn to read trading charts, spot fake price moves, and use trend lines properly.

Main lessons show how support and resistance work, special challenges for women traders, and common mistakes that beginners make. The section ends with successful trader thinking patterns and how to trade using chances and risks.

✅ Section 2: Important Forex Books

This large collection of trading books helps students understand deeper ideas while learning advanced methods. The famous “BabyPips” guide gives step-by-step learning for beginners, while Steve Nison’s candle pattern book teaches classic chart reading.

Students learn how big banks and investment funds trade through detailed explanations of their methods. The collection includes special guides for finding Supply and Demand zones and complete candle pattern books.

Mental training gets major attention through Mark Douglas’s books including “The Disciplined Trader” and “Trading in the Zone.” The Wyckoff method and “Naked Forex” approach show different ways to trade without using standard indicators.

✅ Section 3: Setting Up Your Trading

This hands-on section shows students how to set up their complete trading workspace. Detailed broker comparisons help traders pick the best platforms based on what they need and how they trade.

The MetaTrader 4 (MT4) section gives important tools including candle timers, spread checkers, and the key FX Blue Trading practice simulator for safe learning. Students learn to add support and resistance tools and use trade copying software for managing accounts.

The Trading Plan part is especially useful, giving templates, checklists, and real examples of professional trading plans. Videos show how to make and follow a personal trading strategy that fits your comfort with risk and goals.

✅ Section 4: Chart Reading Deep Dive

This section is the technical heart of the course, breaking hard ideas into easy pieces. The candle patterns part covers twelve major shapes including Bullish/Bearish Engulfing, Doji types, and Morning/Evening Stars.

Chart pattern spotting focuses on classic shapes like Head and Shoulders and Triangle patterns. The EMA (Moving Average) section shows the “magic” of these tools for finding trends and timing entries.

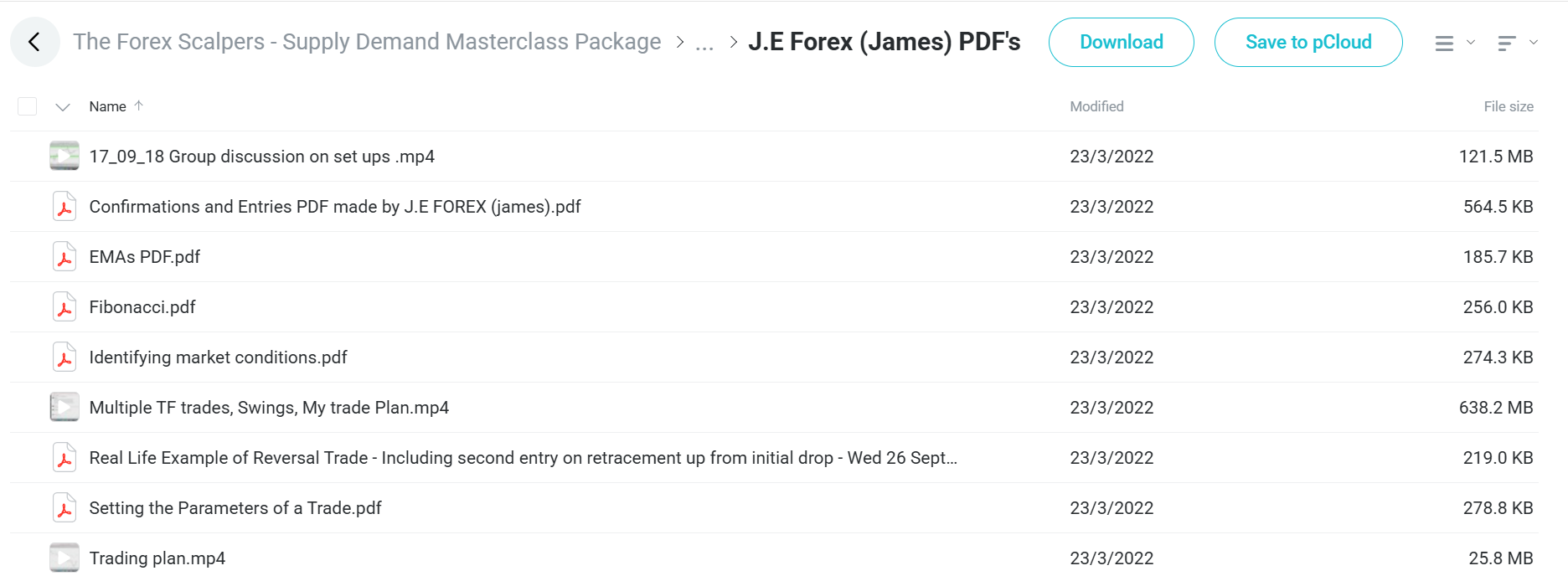

James from J.E Forex shares special content about reading market conditions, using multiple time frames, and real-world examples of reversal trades. The section explains market tricks that big players use to trap small traders.

Risk control gets special focus with specific lessons on position sizing and protecting your money. The section ends with complete chart reading systems and advanced zone trading methods.

✅ Section 5: Trading Mind & Thinking

This key section deals with the mental side of trading through carefully picked books and practical guides. Mark Douglas’s full audio version of “Trading in the Zone” lets students learn while driving or relaxing.

Mental strength training made just for traders helps students beat mental blocks. Adding “Rich Dad Poor Dad” teaches money skills beyond just trading.

Practical mind guides cover building self-confidence, understanding why most traders lose money, and specific traps to avoid. The risk control part here focuses on mentally accepting losses and staying disciplined.

✅ Section 6: Live Trading Lessons

The video content makes ideas real through hands-on demos. Members’ area videos cover every major trading idea including breakout trades, channel trading, and price squeeze patterns.

Supply and Demand pattern videos (DBR, RBD, RBR, RBS/SBR) give visual learning for complex shapes. Entry and stop-loss placement get detailed coverage for both Support/Resistance and Supply/Demand methods.

Weekly live sessions offer current market reviews and question time, while special topics like market tricks and fake-out spotting get their own coverage. The weekly review videos give ongoing learning through current market examples.

✅ Section 7: Other Language Content

The Dutch section gives complete translations of main ideas including risk control, profit targets, and stop-loss placement. Videos cover trend lines, channels, and full Support/Resistance lessons in Dutch.

The Spanish section offers even more content with twenty detailed PDFs covering everything from swing points to complete trading methods. This includes Spanish versions of key ideas like “We Don’t Need No Stinking Indicators” and complete EMA strategies.

Both sections keep the same high teaching quality as the English content while making everything easy for non-English speakers. The Spanish section especially stands out by giving a complete course on its own.

What is The Forex Scalpers?

The Forex Scalpers is a professional day trader from The Netherlands with 12+ years trading experience. He started at 18 as a young father, blowing several accounts before becoming profitable.

His breakthrough came when he learned to control emotions and focus on pips, not money. After mastering trading psychology, he transformed from struggling trader to consistent professional.

Seven years ago, he founded his trading education platform and built a global community. He’s taught supply and demand strategies to thousands of students, helping them master order flow trading.

Using forex profits, he built a real estate portfolio that created financial independence for his family. He continues teaching to help others achieve similar success.

His philosophy is simple: master your mindset before your strategy. He believes winning the internal battle with yourself is key to trading success.

Be the first to review “The Forex Scalpers – Supply Demand Masterclass Package” Cancel reply

Related products

Forex Trading

Crypto Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.