The Complete Guide to Multiple Time Frame Analysis & Reading Price Action

$1,399.00 Original price was: $1,399.00.$18.00Current price is: $18.00.

Trading Terminal The Complete Guide to Multiple Time Frame Analysis & Reading Price Action Course [Instant Download]

What is The Complete Guide to Multiple Time Frame Analysis & Reading Price Action?

Trading Terminal’s Multiple Time Frame Analysis is a trading course that teaches you to predict price movements before they happen.

The program shows you how to read charts across different timeframes – from weekly all the way down to 1-minute. You’ll learn to spot key entry levels, recognize market phases, and understand price action to make better trading decisions.

Dr. Aiman Almansoori shares his professional trading strategies that help you identify the best trade setups, avoid choppy markets, and master dip-buying with his pinpoint strategy. These techniques were previously only available to prop traders at Peak Capital Trading.

📚 PROOF OF COURSE

What you’ll learn in this course:

This course teaches you essential chart reading skills every day trader needs, no matter what indicators or strategies you use.

Here’s what you’ll learn:

- Market phase identification: Spot accumulation, distribution, and ranging phases before they happen

- Pinpoint strategy: Learn exact dip-buying methods with clear entry rules

- Multiple timeframe analysis: Connect weekly charts to 1-minute entries for full market context

- Position management: Discover ways to add to winning trades and avoid common traps

- Price action mastery: Predict the next candle using proven rules and real scenarios

By the end of this training, you’ll master reading price action across multiple timeframes – a skill you need for consistent trading success.

Course Structure:

✅ Module 1: Basics of Candle Prediction

Module 1 covers the key ideas of predicting where prices might go next by studying market phases and candle patterns. Students learn to spot important market situations and follow specific rules to guess the next candle’s direction and shape.

The module starts with an introduction to market phases, showing students how to recognize different market conditions and spot phase changes before they happen. Lessons 4-5 cover common daily patterns and set out the main rules for predicting the next candle, giving a clear framework for analysis.

Real examples using stocks like AMD, CCL, and CVX help students see these prediction methods in action across different market settings. The module ends with ways to find stocks that might make big moves, helping students focus on opportunities with the best profit potential.

✅ Module 2: Looking at Multiple Timeframes & Entry Methods

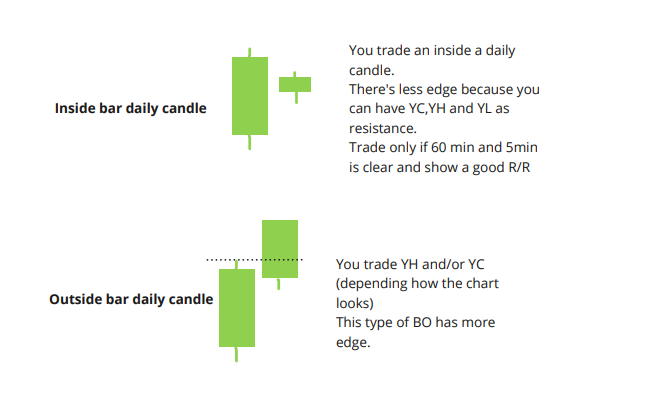

Module 2 builds on the foundation by teaching how to match daily, hourly, and minute charts for better trade entries. Students learn to use pre-market information with different chart timeframes to create complete trading plans.

A big part focuses on breakout trading methods, with real examples of both winning and losing breakouts to help students tell them apart. The module compares trading on daily charts versus 60-minute charts, teaching when each works best.

Later lessons move to more detailed analysis, going from 60-minute and 5-minute charts down to 1-minute entries, showing students how to keep their strategy lined up across all timeframes. The module ends with an introduction to buying dips using the pinpoint method, setting up for the detailed scenarios in Module 3.

✅ Module 3: Specific Trading Situations

Module 3 explores seven clear trading situations, giving exact entry and exit rules for each high-probability setup. Each scenario is explained with practical examples showing how to spot, confirm, and make trades.

Students first learn to find key price levels for day trading that work as the base for all pinpoint scenarios. The module then covers special setups including the 20-200 moving average pattern, pullback days, continuation moves, gap trading, and what to do after a big price run.

The module puts special focus on reading price movement signals, teaching students to understand market mood and what big players are doing. This section is where theory turns into actual trading plans you can use right away.

✅ Module 4: Better Chart Reading & Making Watch Lists

Module 4 improves students’ chart reading skills by focusing on weekly charts and smart price action reading. The weekly chart becomes a powerful tool for both day trading prep and finding longer swing trades.

Students learn step-by-step ways to build focused watch lists using weekly chart patterns, making sure they’re looking at the best opportunities. The module deepens price action skills, helping students spot subtle market signals most traders miss.

This shorter but more advanced section connects chart reading with practical trading, getting students ready for the trade management methods covered in the final module.

✅ Module 5: Managing Trades & Advanced Methods

The final module focuses on trading well, teaching students how to grow profits and cut losses through smart trade management. Opening Range Breakout (ORB) methods show students specific ways to trade the important first hour of the day.

Two full lessons on position sizing and adding to trades give students multiple ways to build and grow winning positions. Students learn to spot common traps that push regular traders out of good trades too early.

The course ends with advanced techniques for trading market turns that bring together all the time frame analysis methods, connecting all previous ideas into one complete trading approach. The PDF guide serves as a handy reference for continued learning after finishing the videos.

Who is Dr. Aiman Almansoori?

Dr. Aiman Almansoori is a senior trader at Peak Capital Trading. He started trading in 2017 and joined Peak Capital in 2021, becoming known as a reversals expert.

He has mentored over 100 active traders, helping many become consistently profitable. His mentoring gives him insight into common trading problems and how to solve them.

As a full-time prop trader, Dr. Almansoori uses significant capital and has created strategies previously only available to select Peak Capital traders and his private students. He combines theory with practical skills from his daily trading.

Dr. Almansoori specializes in reversal strategies and multiple timeframe analysis – areas where most retail traders struggle. Through Trading Terminal Academy, he now shares these professional trading techniques that are usually only taught to prop firm traders.

Be the first to review “The Complete Guide to Multiple Time Frame Analysis & Reading Price Action” Cancel reply

Related products

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Best 100 Collection

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.