Quantreo – Alpha Quant Program

$497.00 Original price was: $497.00.$21.00Current price is: $21.00.

Quantreo Alpha Quant Program Course [Instant Download]

1️⃣. What is Quantreo Alpha Quant Program?

Quantreo Alpha Quant Program is a trading bot course that teaches you to build profitable automated trading systems in just one month.

This step-by-step program guides you through importing market data, creating trading strategies, testing on historical data, and launching live trades through MetaTrader 5.

Lucas Inglese designed this system with a key principle: protect your money first, then grow it. This approach helps you avoid mistakes that cause 90% of traders to fail.

You’ll learn to build trading bots using both technical indicators and machine learning – no advanced coding skills needed. The program includes templates that make it easy to start quickly.

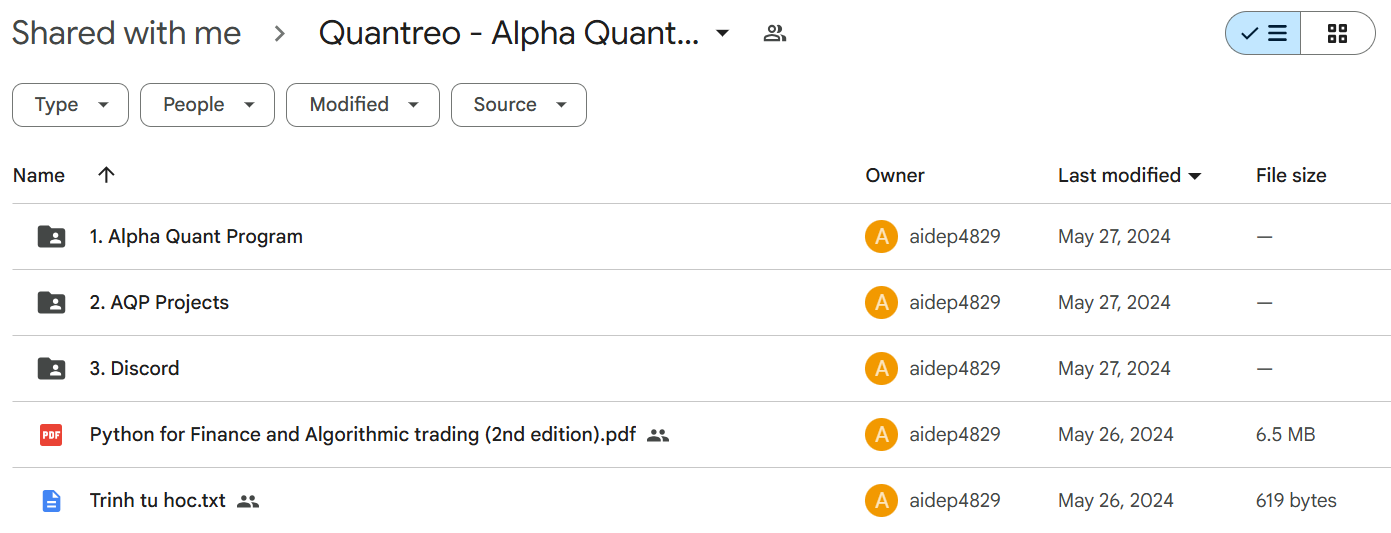

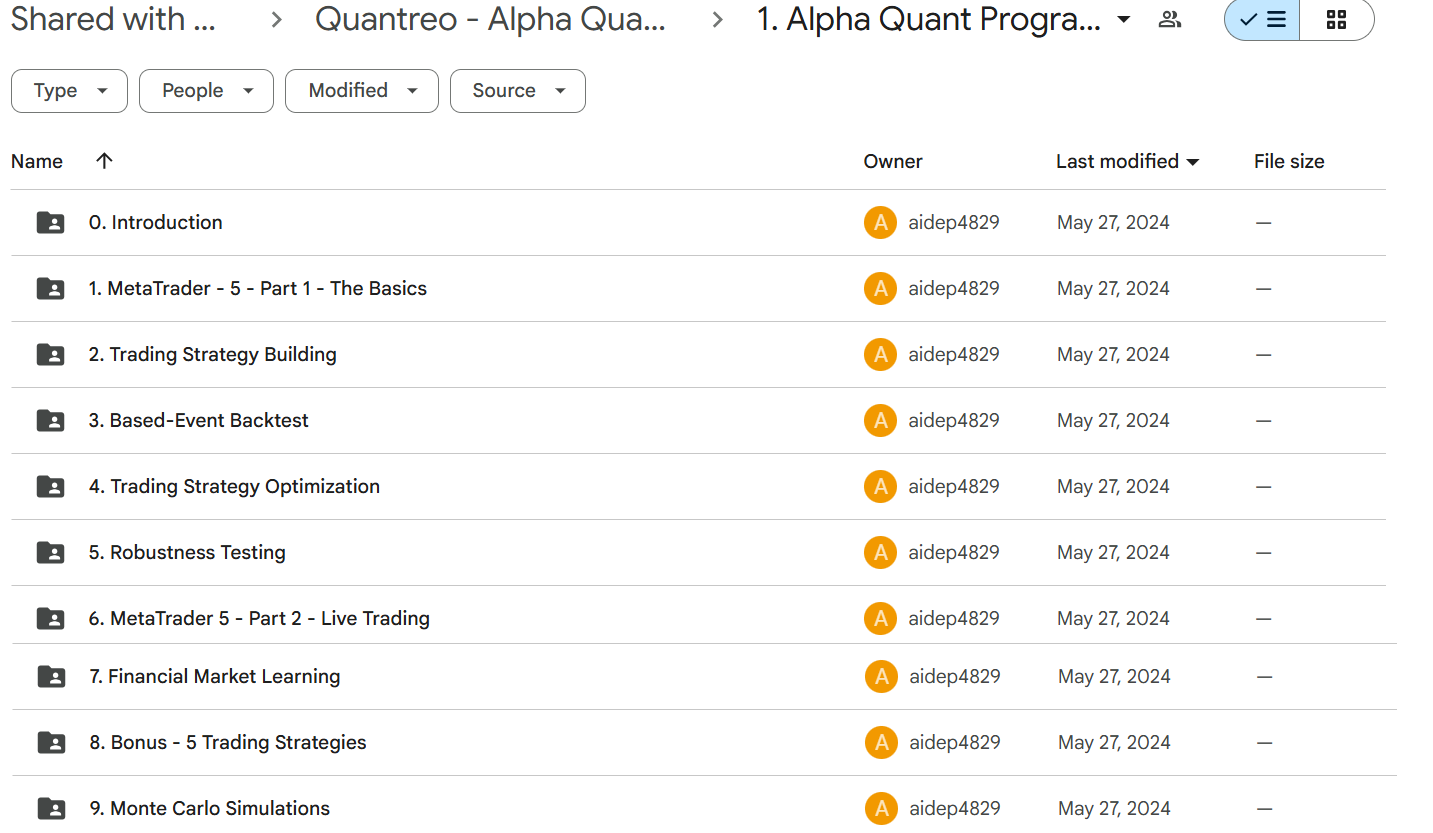

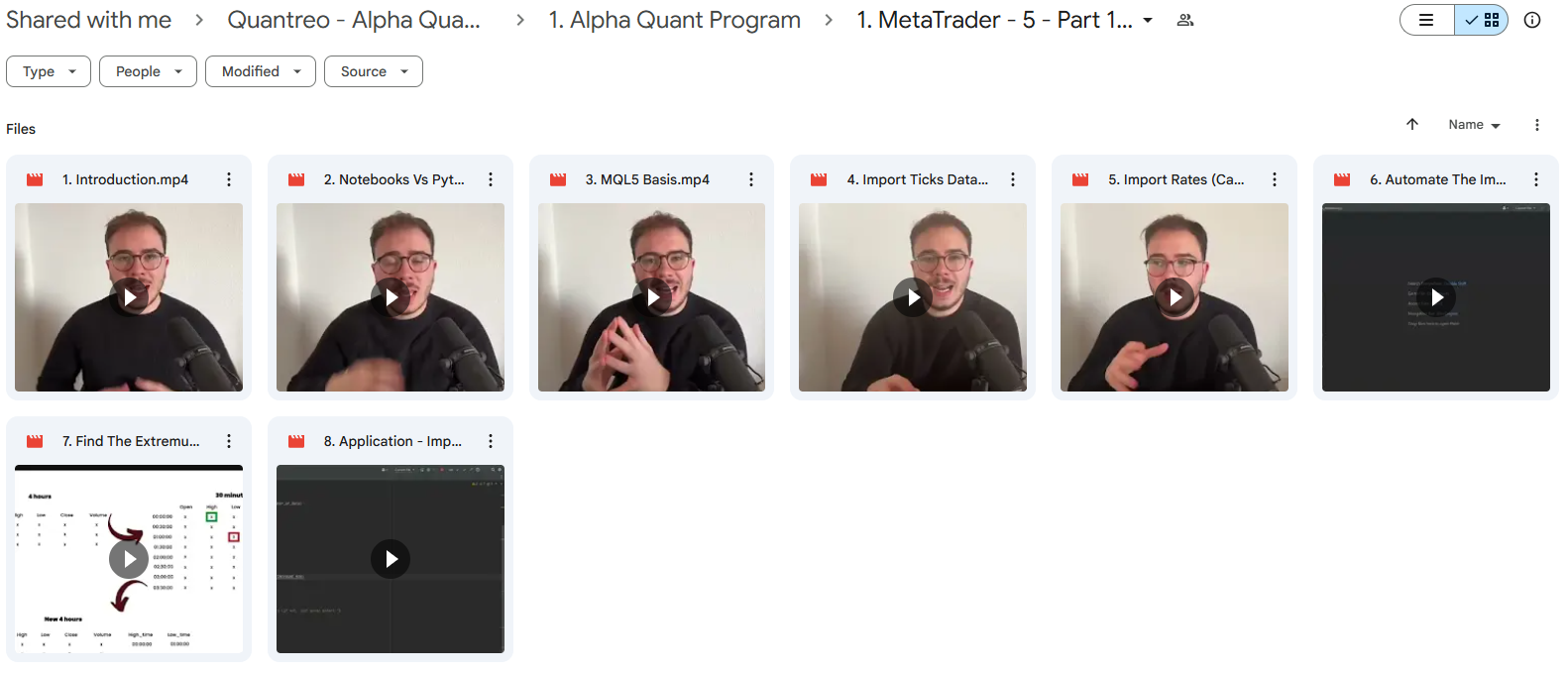

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Alpha Quant Program:

The Alpha Quant Program gives you the skills to build and launch profitable trading bots in just one month. Here’s what you’ll learn:

- Data management: How to import and clean up financial market data

- Strategy building: Create trading systems with clear buy and sell signals

- Backtesting: Test your strategies on past data to see how they would have performed

- Optimization: Fine-tune your strategies using walk-forward testing to make them more reliable

- Live trading: Connect your strategies to MetaTrader 5 for real-market execution

- Machine learning: Use AI models to find better trading opportunities

This program takes you from idea to actual trading, showing you every step needed to create working trading bots that can run on their own.

3️⃣. Alpha Quant Program Course Curriculum:

✅ Module 1: Introduction

This first module helps you get started with everything you need for the program. You’ll learn how to install the right software, set up your trading environment, and create your first simple trading bot. The module also shows you how to join the private community and explains the monthly projects you’ll work on throughout the course.

✅ Module 2: MetaTrader 5 – Part 1 – The Basics

This module teaches you how to use MetaTrader 5, a popular trading platform for algorithmic trading. You’ll learn the basics of MQL5 (MetaTrader’s programming language), how to import price data (both tick-by-tick and candle data), and how to automate this process. The module ends with a practical exercise using real EURUSD currency pair data.

✅ Module 3: Trading Strategy Building

You’ll learn how to create trading strategies using a structured, object-oriented approach. The module covers how to organize your strategy code, process market data, create technical indicators, and generate buy and sell signals. By the end, you’ll see a complete example that shows how all these pieces work together.

✅ Module 4: Event-Based Backtesting

This module shows you how to properly test your trading strategies using event-based backtesting. You’ll learn how to set up a backtest system, run tests on your strategies, and create charts and statistics to measure performance. The module emphasizes how to create useful metrics and implement a complete testing process.

✅ Module 5: Trading Strategy Optimization

Building on previous modules, you’ll learn how to fine-tune your strategies for better results. The module covers different ways to optimize parameters, generate combinations of settings, and find the best performing options. You’ll learn to handle common problems by testing on different market periods and creating smoother results.

✅ Module 6: Robustness Testing

This module teaches you how to make sure your strategies work well in different market conditions. You’ll learn to set up robustness tests, create different market samples, run optimizations across these samples, and analyze the results. The module includes a complete example showing the entire testing process.

✅ Module 7: MetaTrader 5 – Part 2 – Live Trading

You’ll learn how to move from testing to actual trading using MetaTrader 5. The module covers how to place orders in the market, create a live trading framework, generate real-time signals, and execute trades automatically. By the end, you’ll know how to run your complete strategy in real market conditions.

✅ Module 8: Financial Market Learning

This module introduces how to use machine learning in trading strategies. You’ll explore how to combine finance and machine learning techniques, with special focus on using logistic regression to predict market moves. The module covers building strategies with machine learning, optimizing them, and implementing them in live trading.

✅ Module 9: Bonus – 5 Trading Strategies

You’ll get access to five complete trading strategies you can study and use. These include strategies based on traditional indicators like RSI and ATR, as well as more advanced approaches using machine learning techniques. Each strategy shows different ways to analyze markets and make trading decisions.

✅ Module 10: Monte Carlo Simulations

This advanced module teaches you how to assess risk using probability-based simulations. You’ll learn what Monte Carlo methods are and how to implement them. The module covers creating simulations, running multiple test scenarios, and analyzing the results. You’ll learn how to use these techniques to better understand how your strategies might perform in different market conditions.

✅ Module 11: AQP Projects

The projects section gives you hands-on practice with real-world trading tasks. The first projects focus on getting, storing, and cleaning financial data. Later projects teach you how to create alternative price charts and develop market condition indicators. These assignments help reinforce what you’ve learned with practical challenges.

4️⃣. What is Quantreo?

Lucas Inglese founded Quantreo and created the Alpha Quant Program. He’s an independent trader with 8+ years of experience in algorithmic trading using Python and machine learning.

His trading philosophy is simple: protect your capital first, then grow it. This approach helps him avoid mistakes that trap most traders.

Lucas has taught over 66,310 people through his courses and books. Traders respect his practical, careful approach to quant trading.

He explains complex trading concepts in simple ways that even beginners can understand. Students love his step-by-step guidance and ready-to-use frameworks for backtesting and live trading.

Lucas stays active in the trading community, offering monthly projects and daily support through his private Discord group.

5️⃣. Who should take Quantreo Course?

The Alpha Quant Program is for traders who want to automate their strategies using data-driven methods. This course is perfect for:

- New algo traders who want to build their first profitable trading system with no prior experience

- Manual traders who want to automate their strategies and remove emotional decisions

- Developers looking to use their coding skills in financial markets

- Finance professionals wanting to learn quantitative trading techniques

- Careful investors who prefer organized systems and good risk management

You don’t need to be a math genius or coding expert to start. The clear, step-by-step lessons help beginners build working trading systems using the strategies taught in the program.

6️⃣. Frequently Asked Questions:

Q1: What’s the best platform for running trading bots?

Q2: Is algorithmic trading profitable for beginners?

Q3: What’s the difference between algorithmic trading and manual trading?

Q4: How long does it take to learn algorithmic trading?

Q5: Do I need coding skills for algorithmic trading?

Be the first to review “Quantreo – Alpha Quant Program” Cancel reply

Related products

Forex Trading

Stock Trading

Trading Courses

Options Trading

Forex Trading

Trading Courses

Forex Trading

Reviews

There are no reviews yet.