Peter Schultz – The Winning Secret Training

$399.00 Original price was: $399.00.$19.00Current price is: $19.00.

Peter Schultz The Winning Secret Training Course [Instant Download]

What is Peter Schultz The Winning Secret Training?

Peter Schultz’s The Winning Secret Training teaches credit spreads and iron condors for short-term options trading income.

You’ll learn how to profit from options selling in 10-17 day windows, focusing on strategies that generate immediate cash flow from time decay.

Peter Schultz shares proven techniques through video lessons, manuals, and real examples to help you trade options confidently and minimize risk.

📚 PROOF OF COURSE

What you’ll learn in The Winning Secret Training?

The Winning Secret Training shows you a proven way to make money with options trading. Here’s what the course covers:

- Credit Spread Trading: Learn how to use credit spreads and iron condors to create monthly income

- Trade Protection: Learn when to exit trades and how to defend your positions if markets move against you

- ThinkorSwim Setup: Step-by-step guide to set up automated trades on the ThinkorSwim platform

- Weekly Trading: Specific strategies to profit from weekly options for faster returns

- Time Value: How to make money from options that lose value over time

In this course, you’ll learn exactly how to find, place, and manage profitable options trades. By the end, you’ll know how to generate regular income from the options market with confidence.

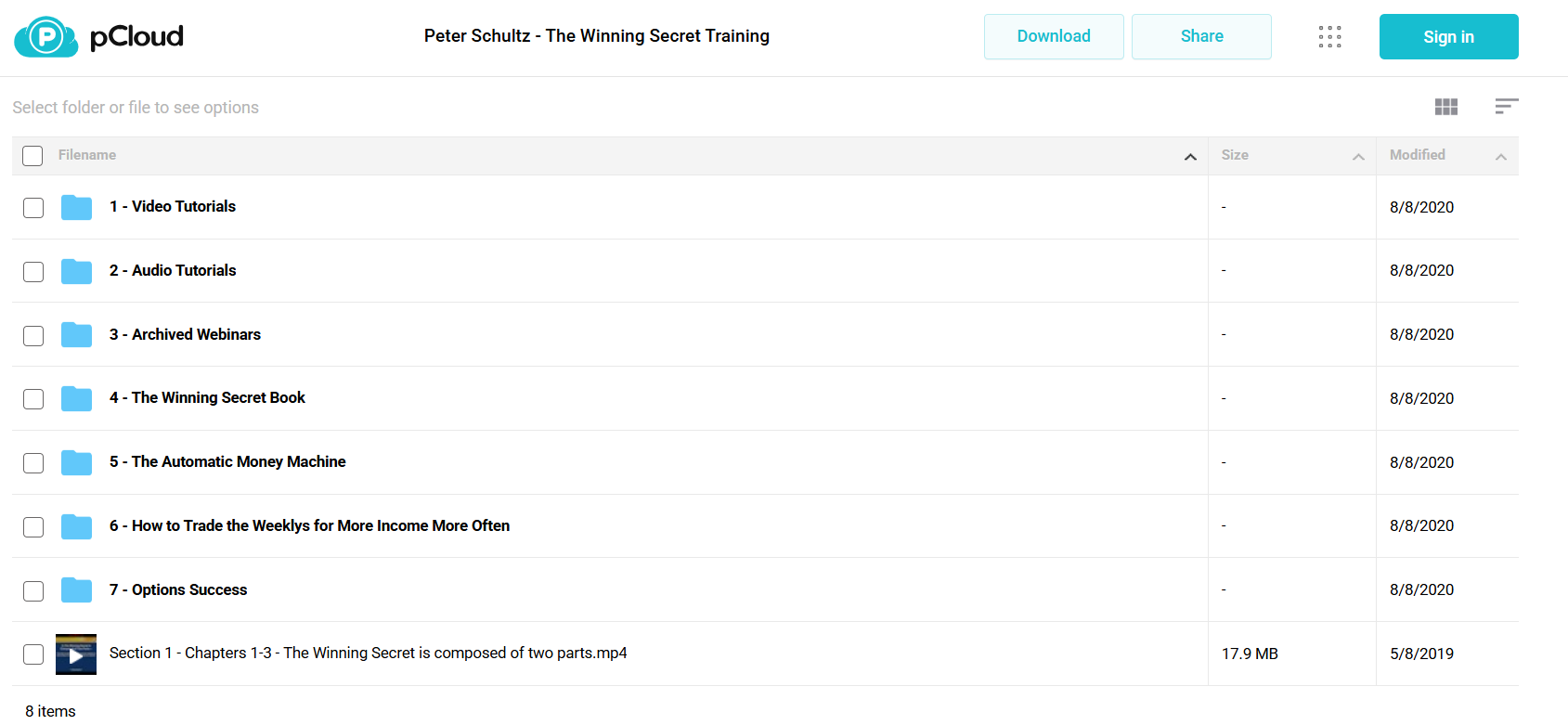

The Winning Secret Training Course Curriculum:

This comprehensive options trading curriculum is designed to take traders from foundational concepts to advanced strategies, with a particular focus on credit spreads, iron condors, and weekly options trading. The course combines video tutorials, audio content, webinars, and practical implementation guides to provide a well-rounded educational experience.

✅ Section 1: Core Fundamentals

This section introduces the fundamental principles of options trading through comprehensive video content. Students learn the essential “Winning Secret” methodology split across multiple chapters, establishing the groundwork for successful options trading strategies.

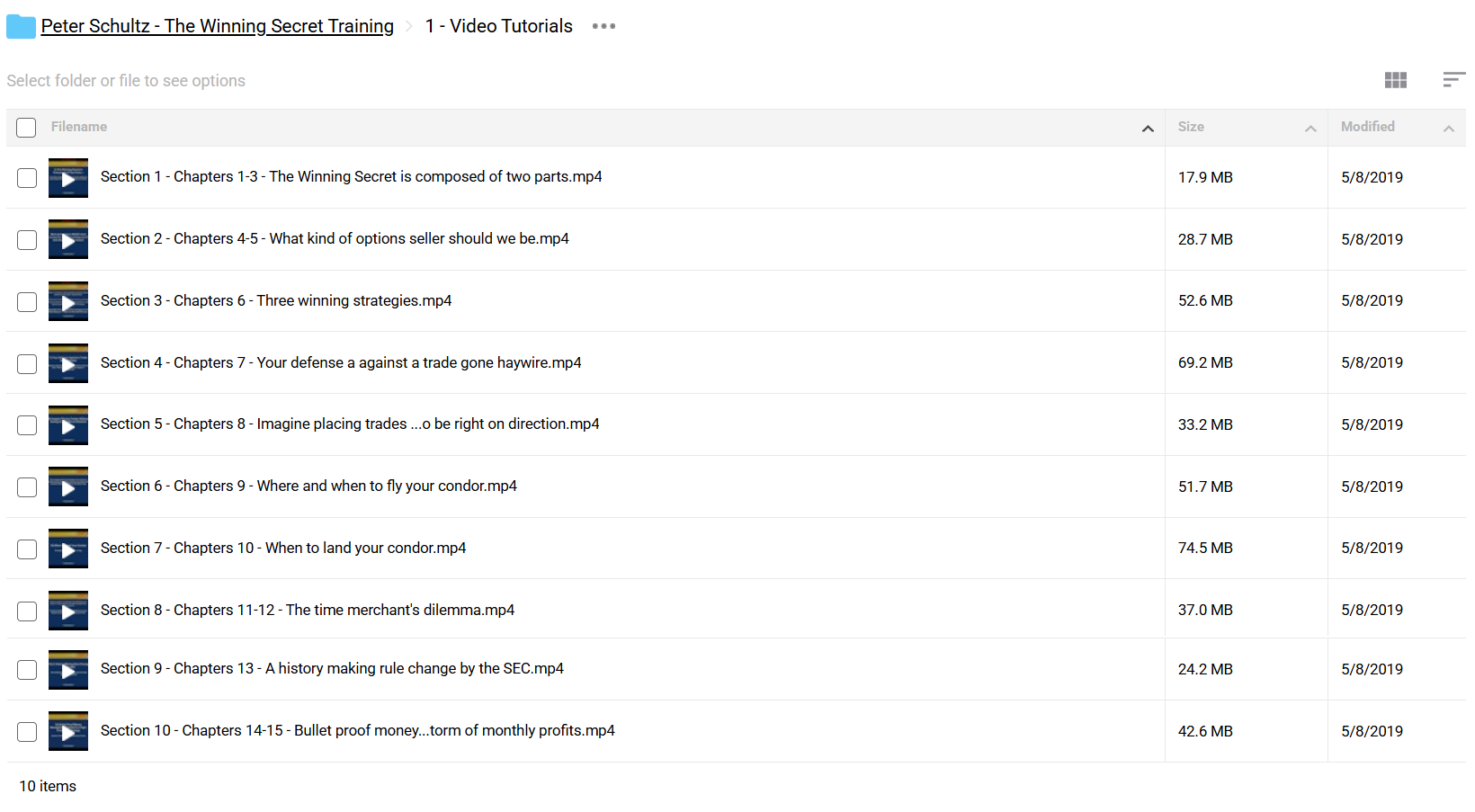

Module 1.1: Video Tutorials

The primary instructional content is delivered through detailed video chapters covering:

- The Winning Secret Foundations (Chapters 1-3)

- Options Seller Methodology (Chapters 4-5)

- Winning Strategies Implementation (Chapter 6)

- Defense Mechanisms (Chapter 7)

- Directional Trading Concepts (Chapter 8)

- Advanced Condor Strategies (Chapters 9-10)

- Time Value Management (Chapters 11-12)

- Regulatory Environment (Chapter 13)

- Risk Management and Profit Generation (Chapters 14-15)

Module 1.2: Audio Supplements

Complementary audio tutorials (ws01-ws14) reinforce video content, offering additional insights and practical applications of core concepts.

✅ Section 2: Strategic Implementation

This section focuses on practical application through archived webinars, covering essential trading strategies and income generation methods.

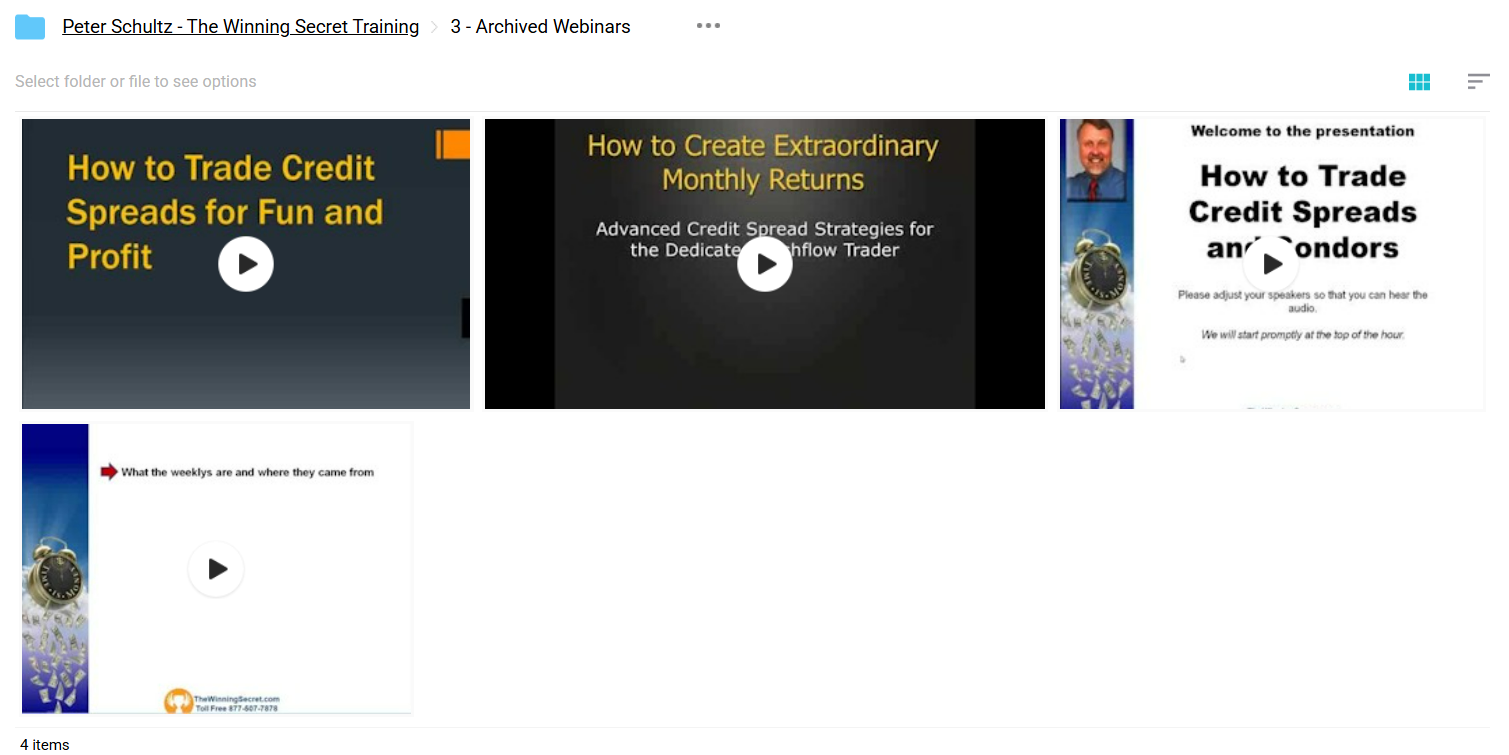

Module 2.1: Webinar Series

Four comprehensive webinars covering:

- Credit Spread Trading Fundamentals

- Monthly Income Generation Strategies

- Iron Condor Implementation

- Weekly Options Trading Techniques

✅ Section 3: Technical Resources

This section provides detailed technical documentation and practical guides for implementation.

Module 3.1: Reference Materials

- The Winning Secret Book (PDF format)

- Comprehensive guide for consistent income generation

Module 3.2: Platform Implementation

The Automatic Money Machine series covers:

- Credit Spread Trading on thinkorswim

- Contingent Order Management

- Analysis Tool Usage

- Automated Order Implementation

✅ Section 4: Advanced Weekly Options Trading

This specialized section focuses on weekly options strategies for enhanced income generation.

Module 4.1: Weekly Options Mastery

Ten detailed lessons covering:

- Weekly Options Market Evolution

- Asset Selection and Analysis

- Strategic Trade Timing

- Greeks Application

- Volatility Event Trading

- Technical Analysis Implementation

- Risk Management

- Expiration Trading Strategies

- Performance Metrics

- Return Calculation and Probability Assessment

✅ Section 5: Practical Application

The final section focuses on real-world implementation and ongoing success strategies.

Module 5.1: Options Success

- Advanced order management techniques

- Practical application of core concepts

- Implementation of trailing stops

- Real-world trading scenarios

Congratulations on taking your first step toward becoming an options trader! Remember, every successful trader started exactly where you are now. Take your time with each lesson, practice what you learn, and don’t rush. The videos, audio lessons, and guides are here to help you every step of the way.

Who is Peter Schultz?

Peter Schultz founded Cashflow Heaven Publishing and has taught options trading since 1996. His focus is on safe, income-generating trading strategies.

He created The Winning Secret Training to help regular people make consistent income from options trading. His method has already helped thousands of students succeed in options markets.

Through his company, Peter provides updated trading strategies and resources. He is known for teaching practical, low-risk approaches to options trading that work in any market condition.

Be the first to review “Peter Schultz – The Winning Secret Training” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Anton Kreil – Professional Options Trading Masterclass (POTM)

Trading Courses

Trading Courses

Options Trading

Options Trading

Mastertrader – Master Trader Option Strategies Series for Investors and Active Traders

Options Trading

Reviews

There are no reviews yet.