PDS Trader – Option Insanity Strategy

$997.00 Original price was: $997.00.$68.00Current price is: $68.00.

PDS Trader Option Insanity Strategy Course [Instant Download]

What is PDS Trader Option Insanity Strategy?

PDS Trader’s Option Insanity Strategy teaches you how to trade unconventional option spreads for consistent profits. The course focuses on finding high probability trade setups that other traders miss.

Ryan Jones shows you exactly how to spot and execute these unique spread patterns through step-by-step demonstrations. Each strategy is designed to give you a statistical edge in the market.

You’ll learn specific spread configurations, entry timing, and risk management rules based on Jones’s 30 years of options trading experience.

📚 PROOF OF COURSE

What you’ll learn in Option Insanity Strategy:

Option Insanity Strategy shows you proven techniques to trade options more effectively. Here’s what you’ll learn:

- Spread Patterns: Learn how to create unique option spreads that have a higher chance of success

- Risk Control: Master ways to protect your account and manage risk on every trade

- Live Trading: Watch real trades being placed and learn how to execute them properly

- Setup Recognition: Learn to spot the best trade opportunities using tested spread patterns

- Trade Management: Know exactly when to adjust your spreads for better results

After completing the course, you’ll know how to use these option strategies confidently in any market condition. The techniques work in both up and down markets.

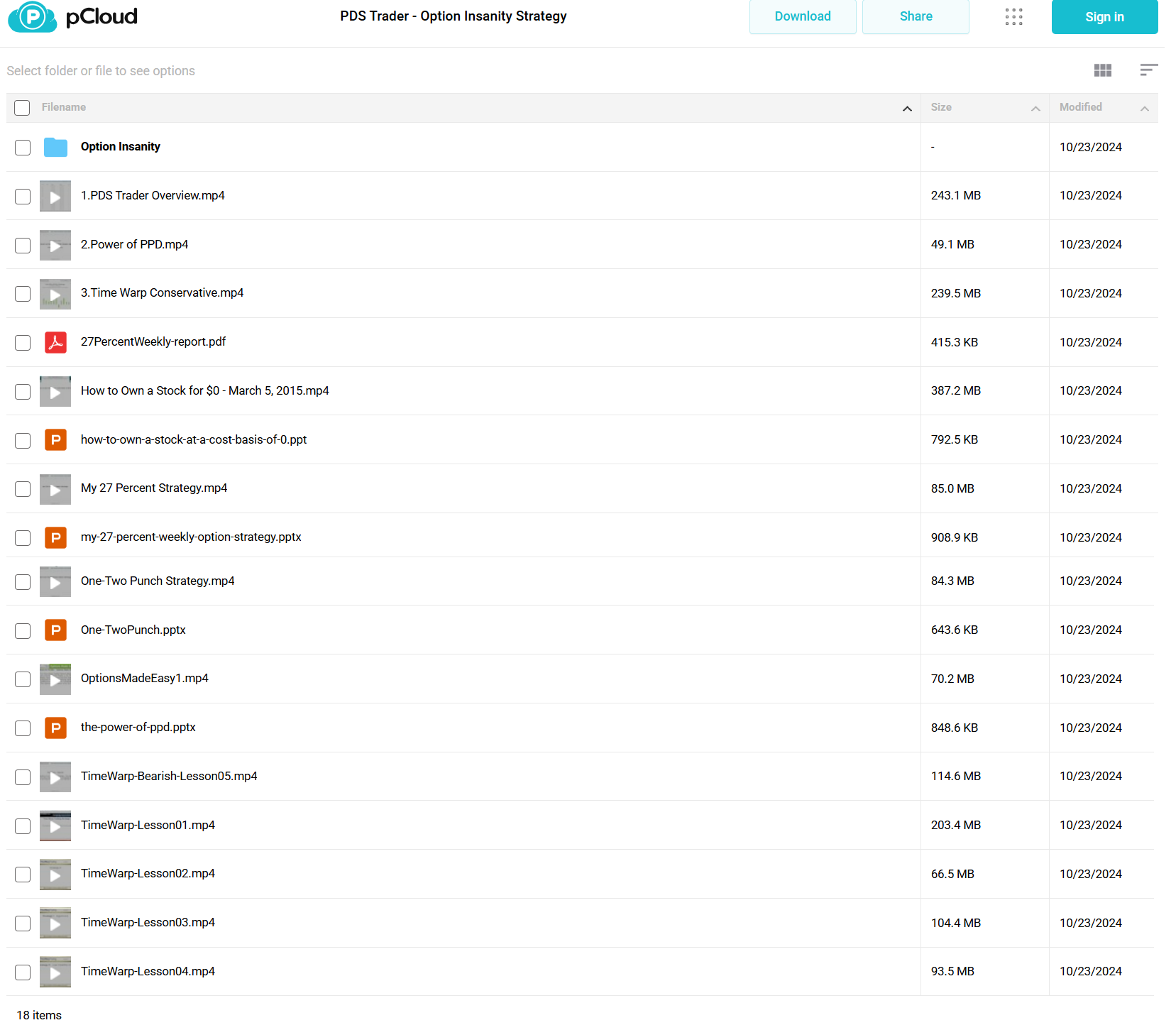

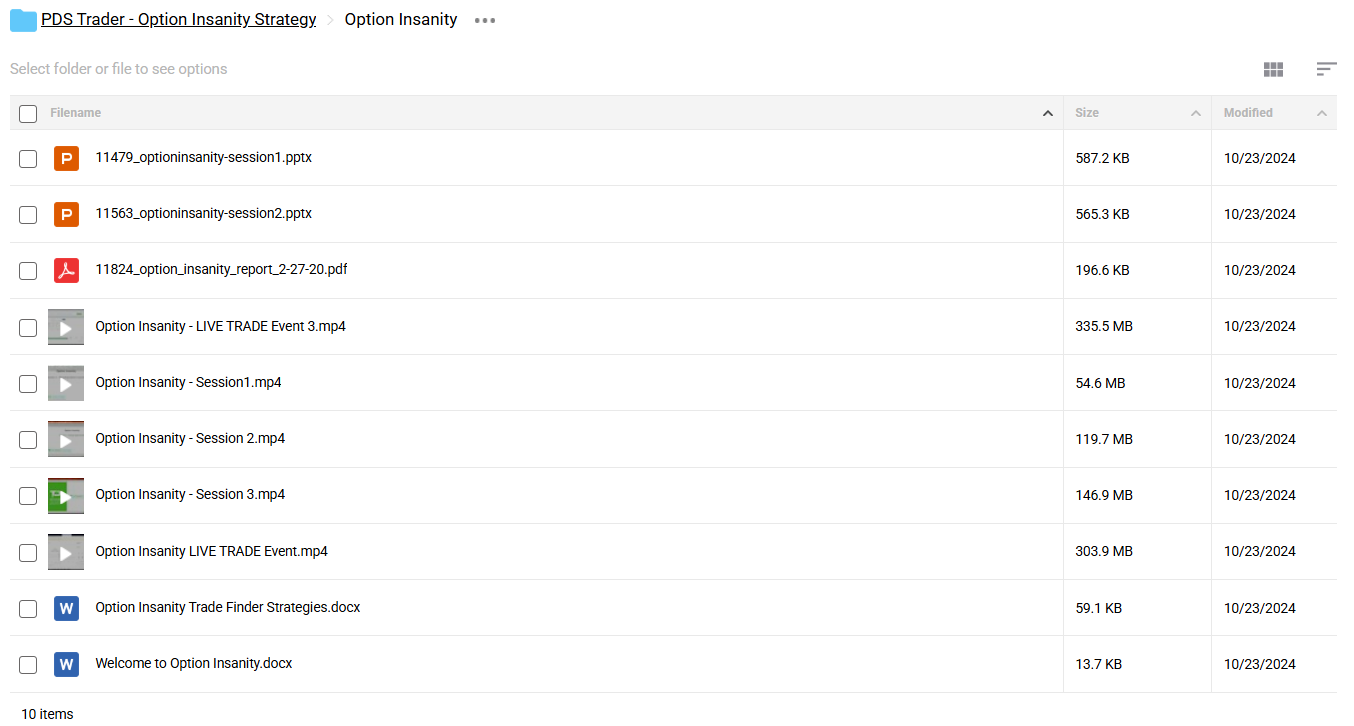

Option Insanity Strategy Course Curriculum:

The Option Insanity Strategy curriculum is designed to progressively build your options trading skills through comprehensive modules and hands-on practice.

✅ Section 1: Foundation and Overview

Start with a complete introduction to the Option Insanity methodology. This section establishes the core concepts you’ll need for successful options trading.

Module 1.1: Getting Started

Welcome to Option Insanity introduces the strategy fundamentals and course structure. You’ll understand how the entire system works together for consistent trading results.

Module 1.2: Core Strategy Sessions

Three intensive sessions cover the complete Option Insanity system. Each session builds on the previous one, teaching you specific spread patterns and trade setups through detailed presentations and video instruction.

✅ Section 2: Live Trading Implementation

Experience real-world application of the Option Insanity strategy through recorded live trading sessions. Watch actual trades being placed and learn practical implementation techniques.

Module 2.1: Live Trading Events

Multiple live trading demonstrations show you exactly how to execute the strategies in real market conditions. Each event focuses on different market scenarios and trade opportunities.

✅ Section 3: Advanced Trading Strategies

Learn specialized trading techniques that complement the core Option Insanity system. This section expands your trading arsenal with proven methodologies.

Module 3.1: Time Warp Trading Series

Five comprehensive lessons on the Time Warp strategy, including both bullish and bearish applications. This module teaches you how to capitalize on time decay while managing risk.

Module 3.2: Specialized Strategies

Advanced techniques including the Power of PPD, 27 Percent Weekly Strategy, and the One-Two Punch approach. Each strategy is explained through video instruction and supporting documentation.

✅ Section 4: Trade Management and Optimization

Learn how to find the best trading opportunities and manage your positions effectively. This section focuses on practical trade execution and portfolio management.

Module 4.1: Trade Finder System

Detailed guide on identifying and qualifying trade opportunities using the Option Insanity criteria. Includes specific entry and exit rules for different market conditions.

✅ Section 5: Stock Cost Basis Strategies

Master techniques for reducing your cost basis in stock positions using options. This advanced module shows you how to potentially own stocks at zero cost through strategic option trading.

What is PDS Trader?

Ryan Jones founded PDS Trader after trading options for over 30 years. He specializes in creating high-probability trading strategies that work in real market conditions.

His unique approach to option spread patterns has helped many students become successful traders. The strategies focus on practical methods anyone can learn and use.

Long-time student Perry M., who has traded since 1980, says Jones’s teaching is the best he’s seen in 35 years. Another student, Guido M., became an independent trader after studying with Jones for 3 years.

Through PDS Trader, Jones teaches traders how to use these strategies while keeping risks under control.

Be the first to review “PDS Trader – Option Insanity Strategy” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Mastertrader – Master Trader Option Strategies Series for Investors and Active Traders

Options Trading

Options Trading

Reviews

There are no reviews yet.