Simon Ree – Options Academy Elevate – Tao of Trading

$2,497.00 Original price was: $2,497.00.$32.00Current price is: $32.00.

Simon Ree Options Academy Elevate Tao of Trading [Instant Download]

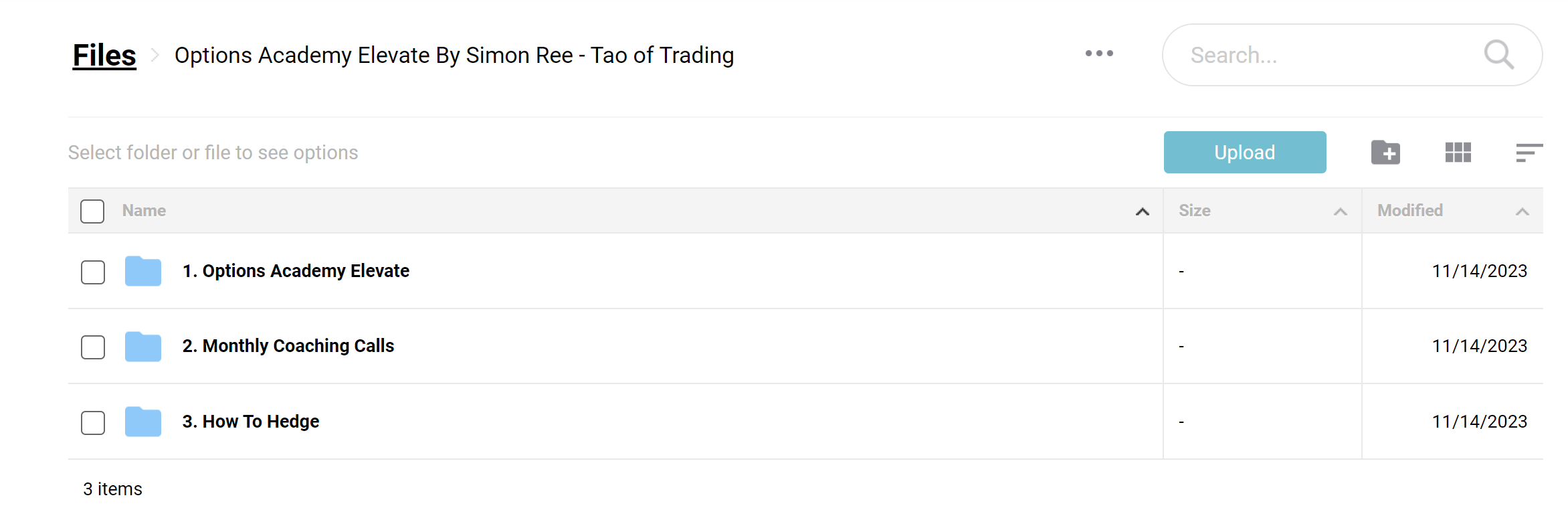

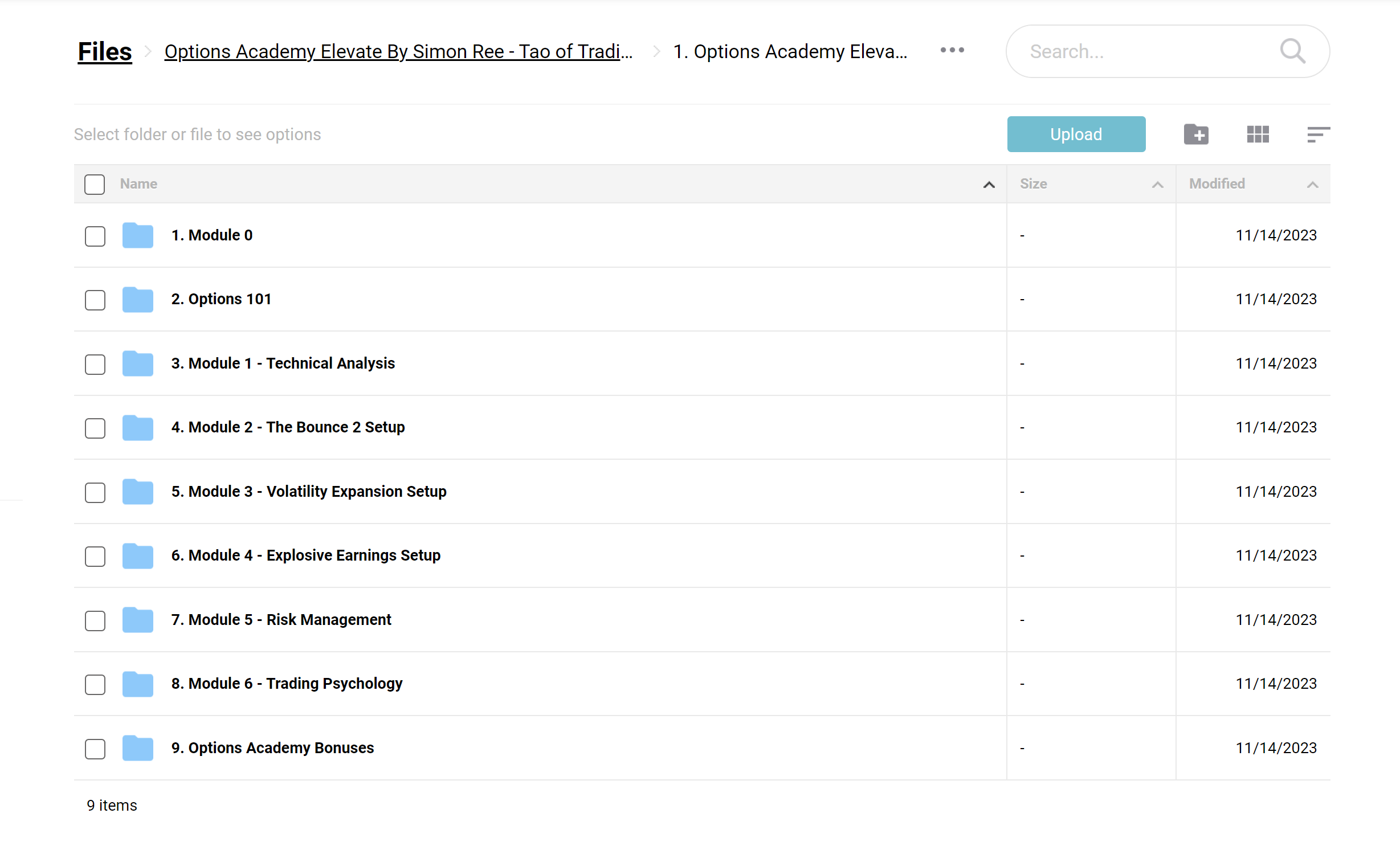

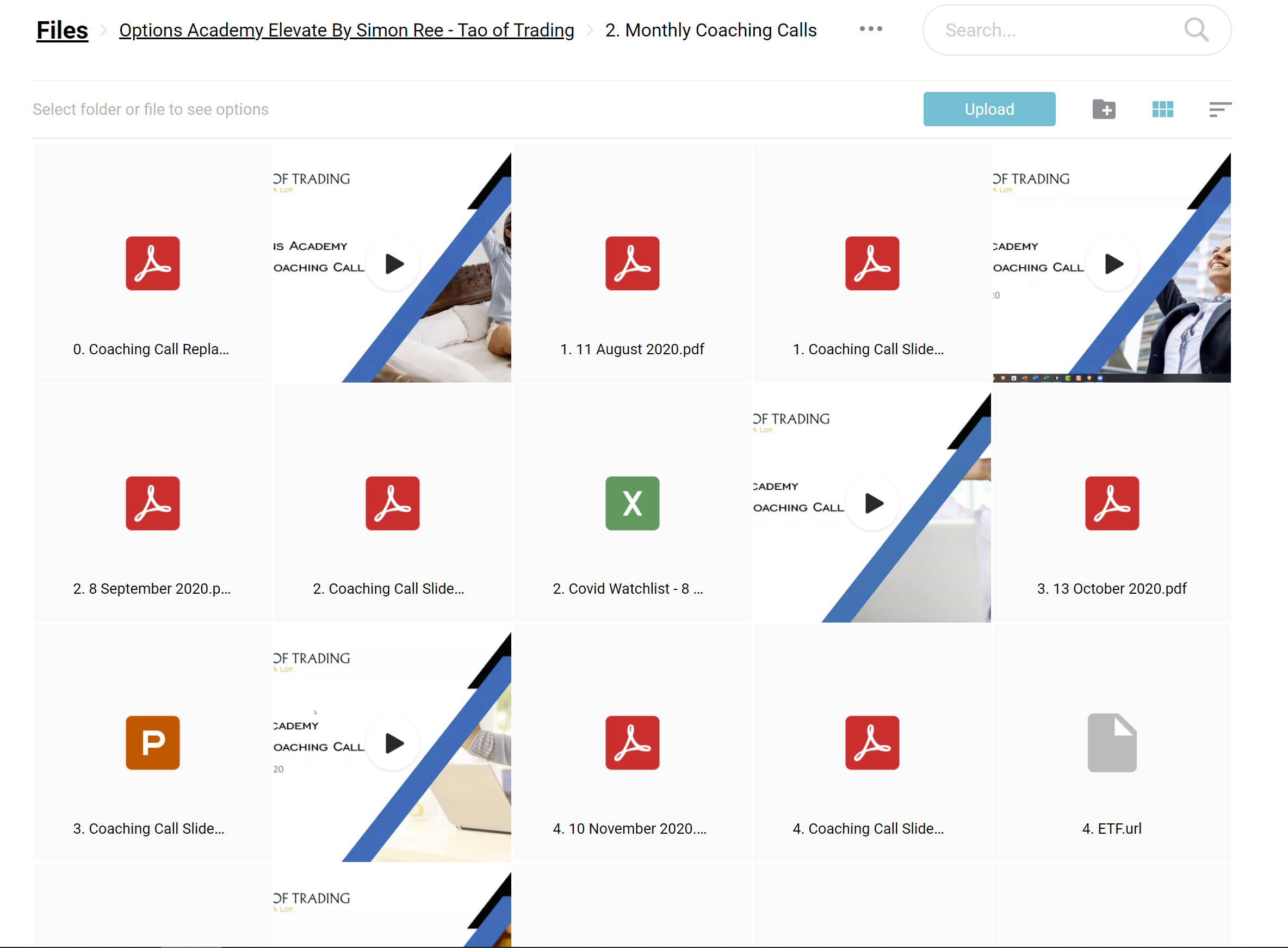

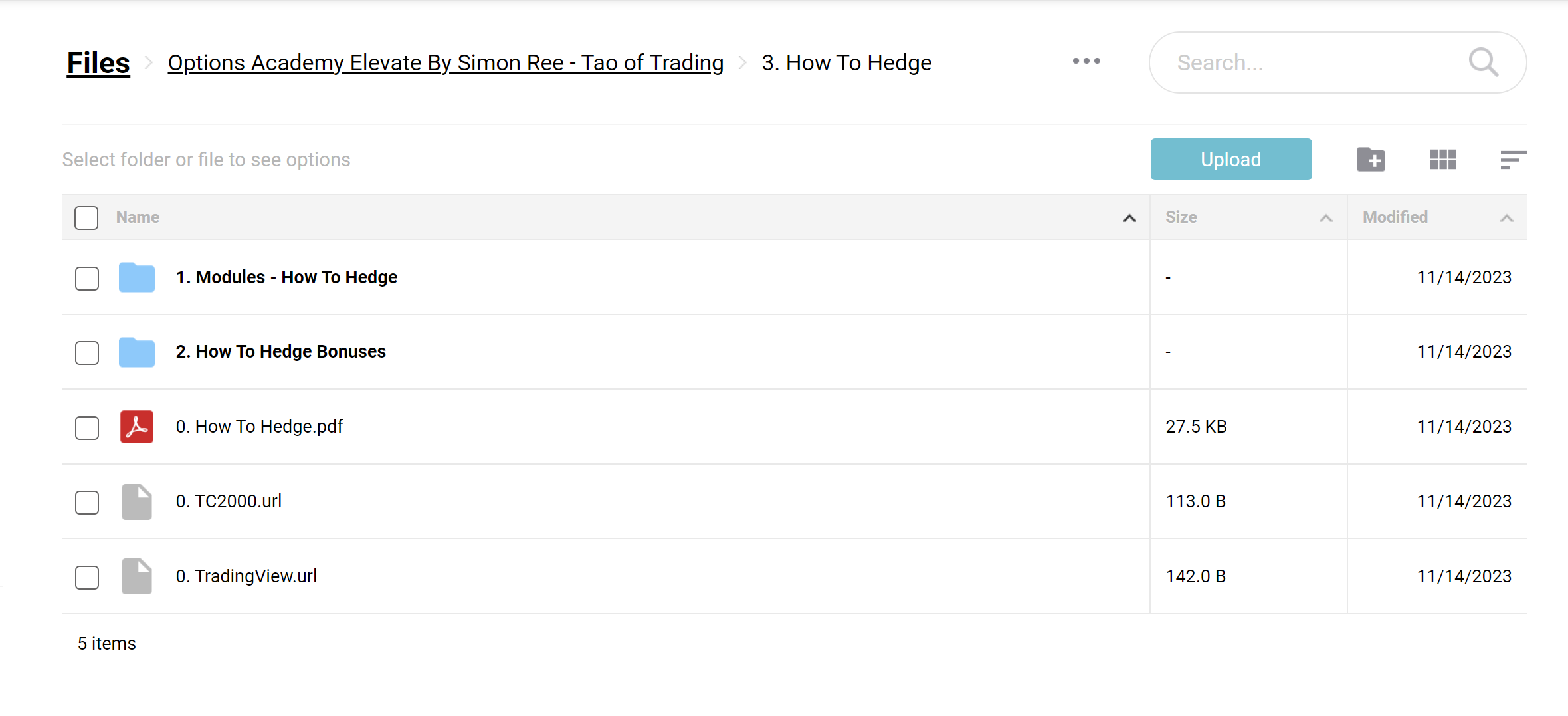

📚 PROOF OF COURSE

What is Options Academy Elevate Tao of Trading:

Simon Ree’s Options Academy Elevate: Tao of Trading is a transformative online course designed to empower traders at every level.

Through this course, Simon Ree, a seasoned trader and bestselling author, shares his wealth of knowledge and experience in the financial markets. The course is meticulously crafted to guide you through the intricacies of options trading, helping you build abundant wealth regardless of market conditions.

It’s not just about strategies; it’s about understanding the market’s ebb and flow, making informed decisions, and managing risks effectively.

Whether you’re looking to generate a steady income or secure your financial future, this course equips you with the tools and insights needed to thrive in the dynamic world of trading.

What you will learn in this course:

In the Options Academy Elevate – Tao of Trading course, you’ll gain deep insights into:

- Technical Analysis: Master the art of interpreting market charts and indicators to make well-informed trading decisions.

- Proven Trading Setups: Learn Simon Ree’s time-tested trading setups, including The Bounce 2.0, Volatility Expansion, and Explosive Earnings, to identify high-probability trades.

- Risk Management: Understand the principles of managing your trading risk to preserve capital and maximize profits.

- Trading Psychology: Dive into the psychological aspects of trading to maintain discipline and a positive mindset, crucial for long-term success.

- Options Trading Fundamentals: Get a solid foundation in options trading with the Options 101 Online Workshop, ensuring you’re well-equipped to navigate the options market.

- Advanced Trading Strategies: Elevate your trading with advanced strategies, including hedging techniques and mastering debit and diagonal spreads.

- Personal Growth: Beyond trading, this course encourages personal development and a proactive approach to learning and growth.

This comprehensive curriculum is designed to provide a thorough understanding of the trading landscape, ensuring you’re ready to take on the markets with confidence.

Options Academy Elevate Tao of Trading Course Curriculum:

The Options Academy Elevate: Tao of Trading course is structured into easily digestible modules, each designed to build upon the last, ensuring a comprehensive understanding of each topic. Here’s what the curriculum includes:

- Module 0: Options 101 – A foundational overview of options trading, covering the basics to ensure all participants start from the same level of understanding.

- Module 1: Technical Analysis – This module analyses market charts, trends, and patterns, empowering you to make data-driven trading decisions.

- Module 2: The Bounce 2.0 Setup – Learn a reliable trading setup that can help you identify potential market rebounds and entry points.

- Module 3: Volatility Expansion Setup – Understand how to capitalize on market volatility for profitable trades with this specialized setup.

- Module 4: Explosive Earnings Setup – Focuses on strategies for trading around earnings announcements to capture potential market movements.

- Module 5: Risk Management – Essential strategies and practices to effectively manage and mitigate trading risks.

- Module 6: Trading Psychology – Addresses the mental and emotional aspects, teaching you to maintain discipline and a clear mindset under pressure.

- Bonus Content:

- Options Trading Workshops – Interactive sessions that reinforce the course material and clarify complex concepts.

- Hedging Techniques – Use effective hedging strategies to protect your portfolio from significant losses.

- Advanced Options Strategies – Detailed guides on advanced strategies like debit and diagonal spreads to enhance your trading toolkit.

- Personalized Resources – Including Simon Ree’s personal watch list, trade blueprints, and scanning criteria to help you identify potential trades.

- Monthly Coaching Calls – Ongoing support and learning through regular coaching calls to discuss market conditions strategies and answer any questions.

This curriculum is designed to be thorough yet accessible, ensuring that whether you’re a beginner or an experienced trader, you’ll find valuable insights and strategies to enhance your trading skills.

Who is Simon Ree?

Simon Ree is a beacon in the trading world, having navigated the financial markets with expertise and insight for over three decades. Starting his career 1992 as a futures broker, Simon’s journey through the economic landscape is marked by significant achievements and profound experiences. His tenure at Goldman Sachs, where he established and led the Markets Desk in Sydney, and his senior roles at Citibank in Singapore underscore his deep understanding of financial markets, particularly stocks and options.

In 2017, Simon shifted from the corporate sphere to focus solely on trading. This move highlighted his passion for the markets and his commitment to personal trading excellence. His book, “The Tao Of Trading,” which achieved #1 Amazon Best Seller status, reflects his philosophy and approach to trading, emphasizing the importance of knowledge, strategy, and mindset in achieving financial abundance.

Simon’s vision transcends financial success; he desires to inspire and empower individuals to lead creative, joyful, and inspired lives free from financial stress. By founding Tao Of Trading, Simon has revolutionized financial education, demystifying complex concepts and challenging Wall Street myths with clarity and simplicity.

His mentorship has guided thousands towards consistent cash flow from the stock market, using straightforward techniques that Simon himself employs. Dedicated to the success of his students, Simon’s approach is both personal and profound, making him a mentor and a true leader in the trading community.

Be the first to review “Simon Ree – Options Academy Elevate – Tao of Trading” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Anton Kreil – Professional Options Trading Masterclass (POTM)

Options Trading

Best 100 Collection

Options Trading

Options Trading

Mastertrader – Master Trader Option Strategies Series for Investors and Active Traders

![[Bundle] Best 14 Dan Sheridan Courses](https://coursehuge.com/wp-content/uploads/2023/09/Bundle-Best-14-Dan-Sheridan-Courses-100x100.jpg)

![[Bundle] Best 14 Dan Sheridan Courses](https://coursehuge.com/wp-content/uploads/2023/09/Bundle-Best-14-Dan-Sheridan-Courses-300x300.jpg)

Reviews

There are no reviews yet.