MarketGauge – The A.M. Trader

$497.00 Original price was: $497.00.$39.00Current price is: $39.00.

MarketGauge The A.M. Trader Course [Instant Download]

What is MarketGauge The A.M. Trader?

MarketGauge’s The A.M. Trader is a stock market trading course focused on profiting in the first 30 minutes of market open using Opening Range patterns.

The program teaches specific rules for identifying profitable trades at market open, including entry points during price drops and exit strategies during price jumps. These methods are based on real floor traders’ experience.

You’ll learn a step-by-step system for spotting the best trading opportunities immediately after market opening, with clear instructions on trade entries, stop placement, and profit-taking strategies.

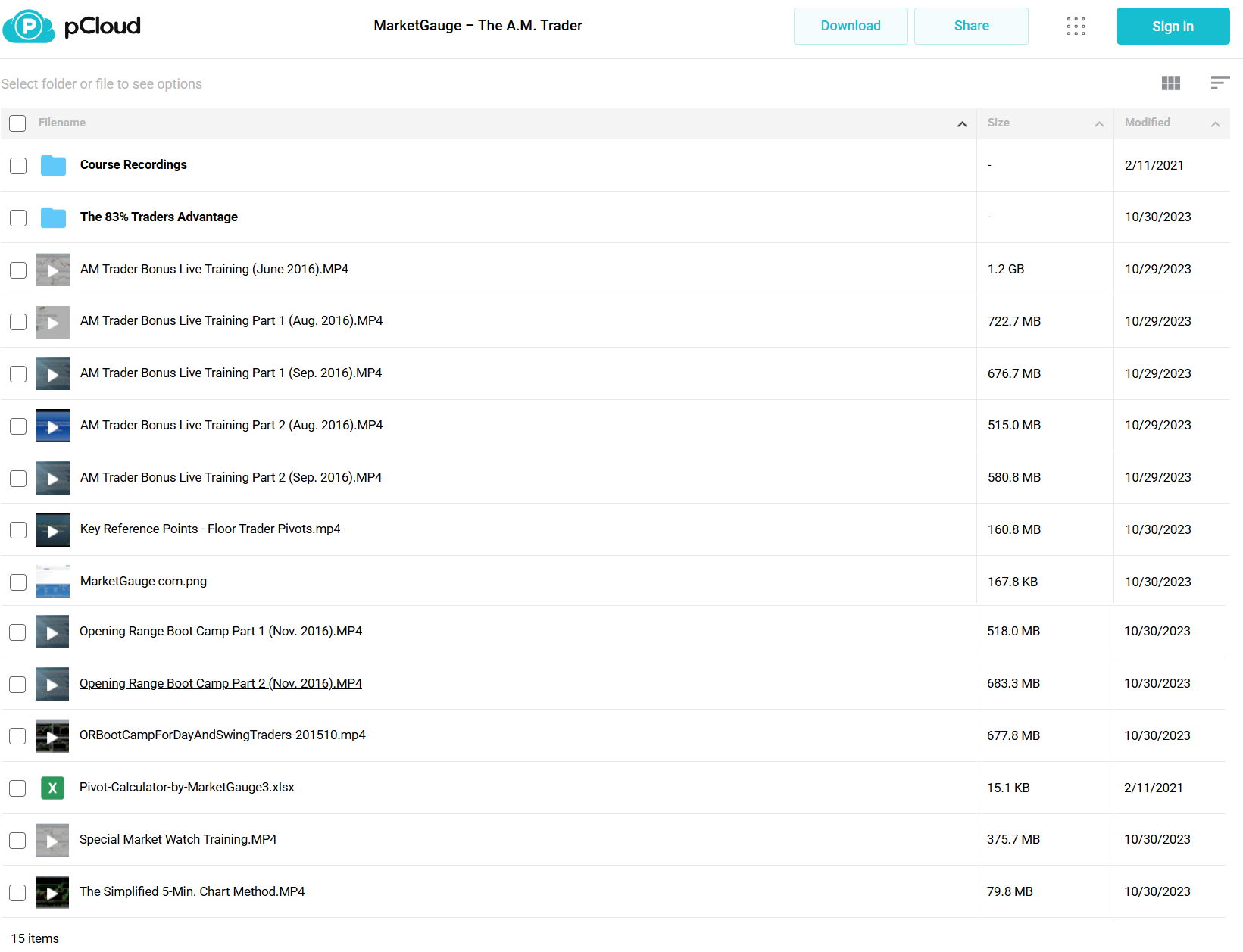

📚 PROOF OF COURSE

What you’ll learn in The A.M. Trader:

Learn proven ways to profit from market moves right after the opening bell. Here’s what you’ll master:

- Opening Range Trading: How to spot and trade patterns in the first 30 minutes that set up the day’s moves

- Market Reversals: Simple methods to buy when prices are low and sell when they’re high

- Quick Breakouts: How to catch fast price moves in the first 5 minutes of trading

- Smart Protection: Clear rules for where to place stops and take profits

- Best Trade Setups: How to find the safest trading opportunities and stay away from risky ones

After completing this course, you’ll know exactly how to trade the market open with a clear plan and confidence in your decisions.

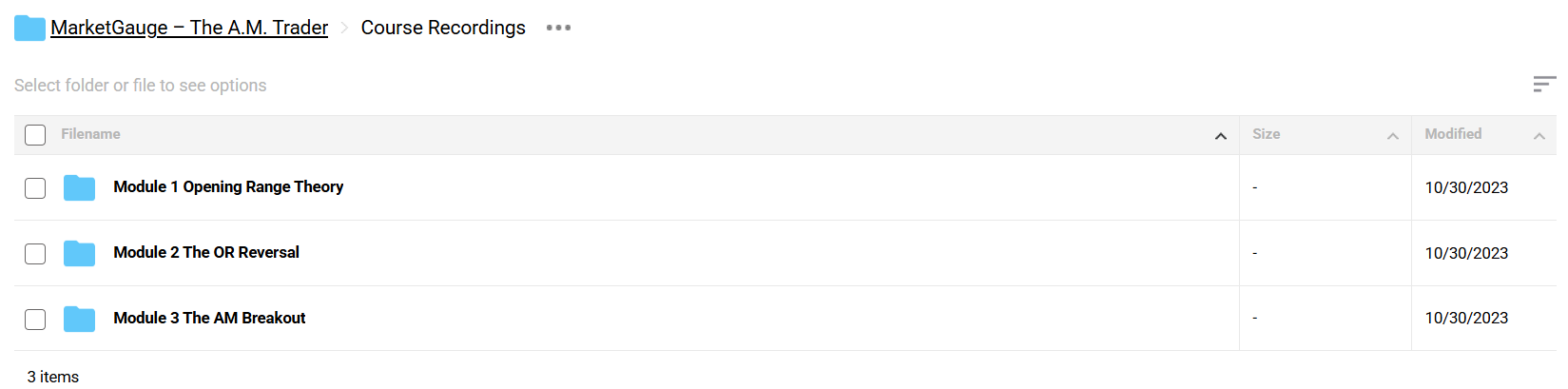

The A.M. Trader Course Curriculum:

The A.M. Trader delivers professional trading education through three core modules and extensive bonus content. Each section builds upon previous knowledge, creating a complete understanding of Opening Range trading strategies.

✅ Section 1: Core Trading Foundations

Module 1: Opening Range Theory

This foundational module introduces the core concepts of Opening Range trading. Students learn essential statistics, pattern recognition, and rule-based trading through comprehensive video training and practical guides.

Key Components:

- Opening Range Fundamentals (Video Training)

- Trading Rules and Guidelines (PDF Reference)

- Opening Range Statistics and Analysis (Video Training)

- Live Coaching Session: Rules in Action (Video Training)

Module 2: Opening Range Reversal Strategy

Advanced training focusing on capturing market reversals and gap trading opportunities. This module teaches specific techniques for identifying high-probability reversal points during market opens.

Key Components:

- Opening Range Reversal Core Strategy (Video Training)

- Gap Trading Techniques and Market Direction (Video Training)

- Critical Reversal Patterns Analysis (Video Training)

Module 3: The Morning Breakout System

Complete instruction on trading momentum breakouts in the first minutes of market open. Students learn confirmed entry signals and pattern recognition for fast-moving markets.

Key Components:

- Morning Breakout Strategy (Video Training)

- Five-Minute Opening Range Patterns (Video Training)

- Breakout Confirmation System (Video Training)

✅ Section 2: Advanced Trading Resources

The 83% Traders Advantage Program Comprehensive training on maximizing trading probability and risk management. Includes special market analysis techniques and proven trading strategies.

Components:

- Opening Range Boot Camp Guide (PDF)

- Market Watch Special Training (Video)

- Trading Advantage System Overview (Video)

✅ Section 3: Bonus Trading Education

Extended learning materials to reinforce core concepts and provide additional trading techniques:

- Monthly Live Training Sessions (June-September 2016)

- Floor Trader Pivot Analysis Training

- Opening Range Boot Camp (Complete Series)

- Professional Pivot Calculator Tool (Excel)

- Five-Minute Chart Trading Method

Each component includes practical examples, real market applications, and specific trading rules to ensure comprehensive understanding and successful implementation of the Opening Range trading strategy.

What is MarketGauge?

MarketGauge was created by experienced floor traders who know the markets inside out. They teach day trading strategies that actually work in real market conditions.

The team focuses on trading the market open, using methods proven on major trading floors. They’ve turned their successful trading approaches into clear, step-by-step strategies anyone can learn.

Their teaching combines hands-on experience with specific trading rules. Thousands of traders have improved their results using MarketGauge’s structured training and mentoring.

They support traders with daily coaching, market updates, and ongoing education to help ensure trading success.

Be the first to review “MarketGauge – The A.M. Trader” Cancel reply

Related products

Stock Trading

Stock Trading

Stock Trading

Day Trading

Day Trading

Stock Trading

Day Trading

Reviews

There are no reviews yet.