Larry Connor – TradingMarkets Swing Trading College 2019

$1,250.00 Original price was: $1,250.00.$20.00Current price is: $20.00.

Larry Connors TradingMarkets Swing Trading College 2019 Course [Instant Download]

What is TradingMarkets Swing Trading College:

The TradingMarkets Swing Trading College teaches essential swing trading skills. Led by Larry Connors, it has trained over 1,000 traders since 2005. The course helps address common issues like lack of trade control and poor discipline.

You’ll learn to manage investments effectively, avoiding costly trial-and-error methods. Larry Connors brings 30+ years of professional trading experience and quantified research to the program.

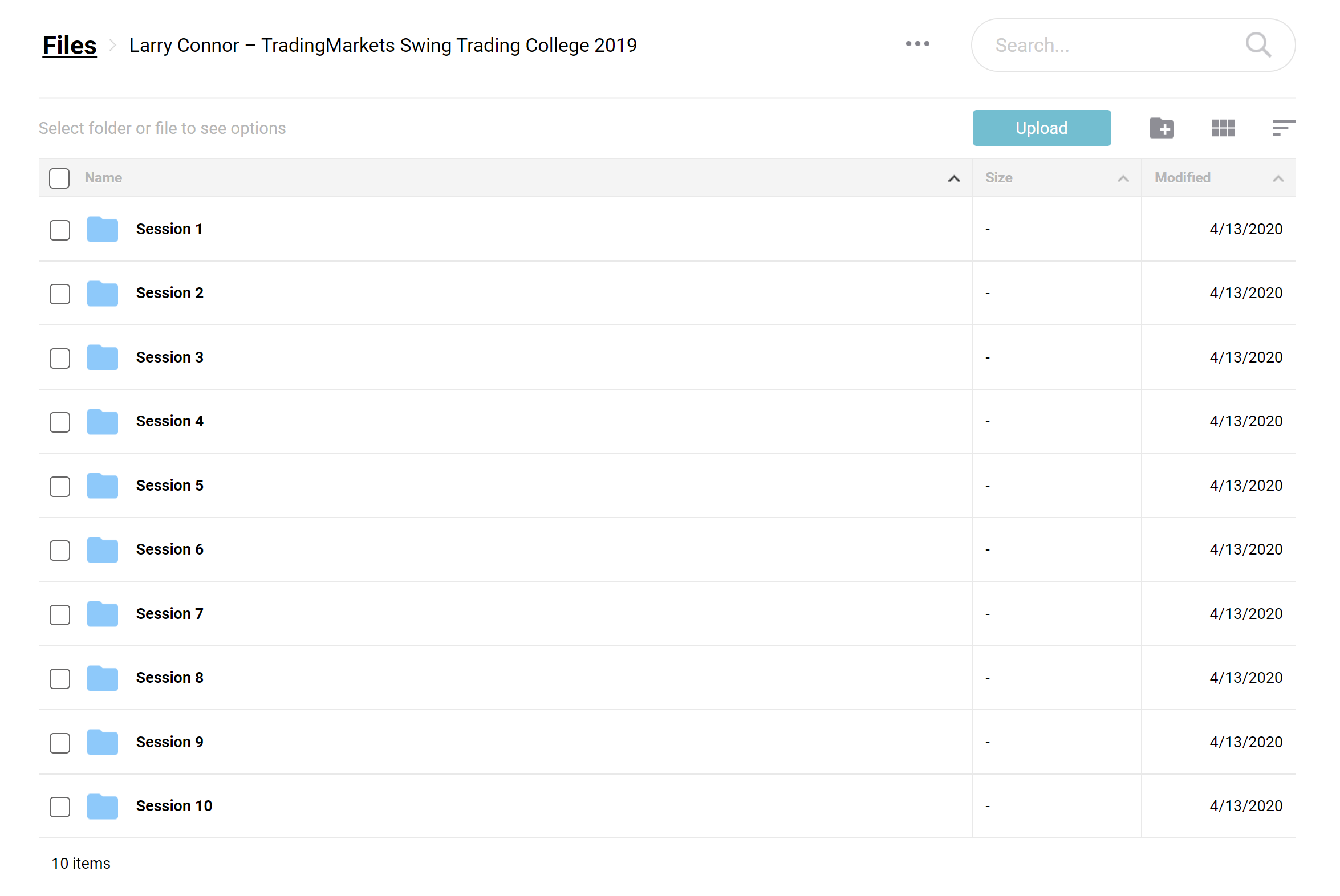

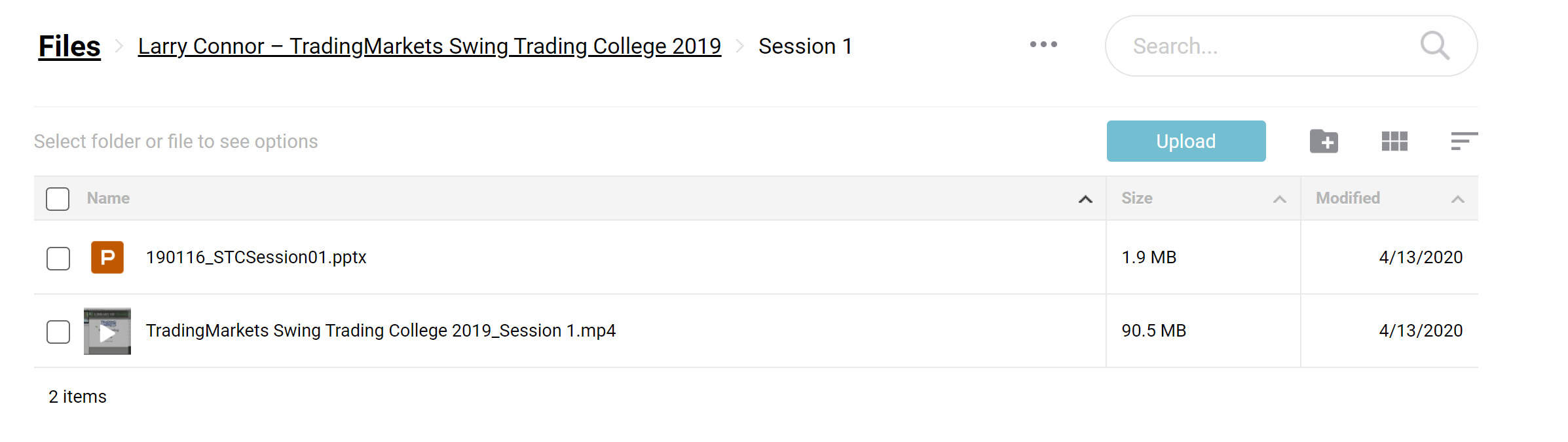

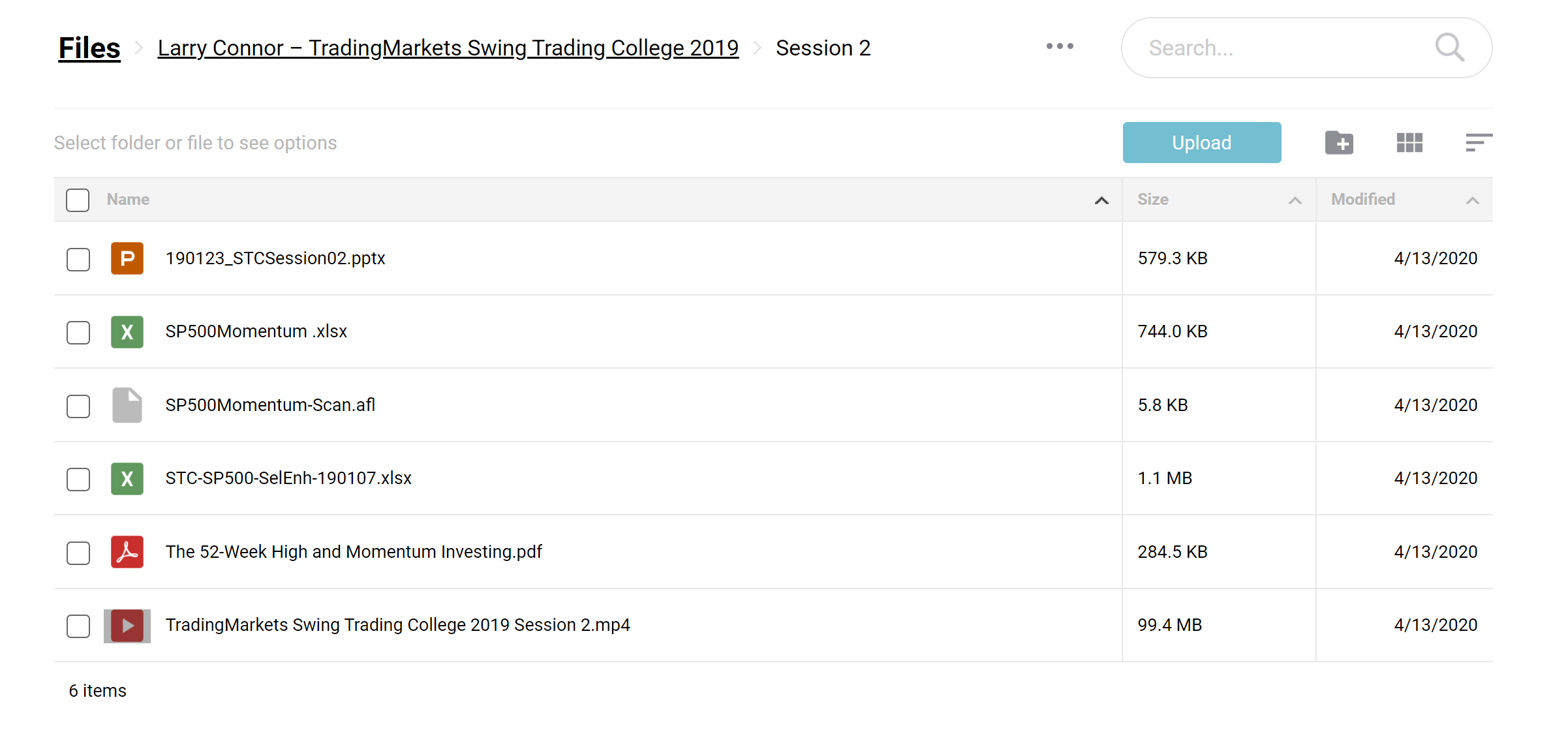

📚 PROOF OF COURSE

What you will learn in TradingMarkets Swing Trading College:

In the TradingMarkets Swing Trading College, you will learn:

- The essential skills necessary for success with swing trading

- How to trade systematically like top-performing hedge fund managers

- Identifying and executing high-probability pullback trades

- Strategies for shorting stocks and taking advantage of declining markets

- Trading ETFs and volatility products for increased opportunities

- Using options to generate additional monthly income

- Building your “Personal Trading Business” with proper risk management and trading psychology

The course is designed to give you the strategies and tools to manage your money systematically. You’ll benefit from Larry Connors’ 30+ years of experience as a professional trader and publisher of quantified trading research.

TradingMarkets Swing Trading College Curriculum:

The Trading Markets Swing Trading College 2019 covers the following topics:

✅ Introduction to Quantified Research and Model-Driven Trading

- Benefits of model-driven trading

- Best order placement rules for swing trading

✅ High Probability Pullback Trades

- Common mistakes to avoid when buying pullbacks

- Finding the best stocks and ETFs to trade long

- S&P 500 stock trading strategy

✅ Short Selling Strategies

- Importance of having strategies to short stocks

- Identifying overbought stocks to short

- Systematic short-selling method with 18 years of positive gains

✅ Trading ETFs

- Using Inverse ETFs in declining markets

- Trading ETF Options

- Scaling into positions like professionals

- Building a balanced ETF portfolio

✅ Volatility Products

- High-performing Volatility strategies (VXX Swing Trading, VXX Trend Following)

- New strategy with over 90% tested accuracy

✅ Options Trading for Monthly Income

- Trading weekly options to improve results (without complicated formulas)

✅ Building Your “Personal Trading Business”

- Writing an integrated business plan for swing trading

- Setting specific target-driven goals

✅ 20 Ways to Improve Trading Performance

- Proper risk management tools

- Efficient daily set-up process

- Importance of trading psychology

✅ Special Session with Professional Trader Chris Cain

- Statistically backed momentum trading

Who is Larry Connors?

Larry Connors is a professional trader with over 30 years of experience in the financial markets. He is the founder and CEO of TradingMarkets.com, one of the leading publishers of quantified trading research. Larry has been at the forefront of providing traders with cutting-edge strategies and tools to improve their performance and profitability.

Larry has developed numerous trading strategies throughout his career based on extensive research and analysis. His work has been featured in major financial publications, including The Wall Street Journal, Barron’s, and Forbes. He is also the author of several highly acclaimed books on trading, such as “How Markets Really Work” and “Short Term Trading Strategies That Work.”

In addition to his trading expertise, Larry is a sought-after educator who has taught thousands of traders through his TradingMarkets Swing Trading College. Many of his students have gone on to successful careers in trading, with some managing their investments and others running investment firms.

Larry’s commitment to sharing his knowledge and helping traders succeed has earned him a reputation as one of the most respected figures in the trading community. Professional trading desks and individual traders continue to rely upon his insights and strategies.

Be the first to review “Larry Connor – TradingMarkets Swing Trading College 2019” Cancel reply

Related products

Trading Courses

Forex Trading

Swing Trading

Stock Trading

Forex Trading

Swing Trading

Swing Trading

Reviews

There are no reviews yet.