Karla Dennis – Tax Reduction Strategy Program 2.0

$1,497.00 Original price was: $1,497.00.$79.00Current price is: $79.00.

Karla Dennis Tax Reduction Strategy Program 2.0 [Instant Download]

📚 PROOF OF COURSE

What is Tax Reduction Strategy Program 2.0?

Karla Dennis’ Tax Reduction Strategy Program 2.0 is a course teaches you how to legally lower your tax bill. The course, created by tax expert Karla Dennis, breaks down complex tax laws into understandable strategies.

With 30 video lessons and a workbook, you’ll learn how to keep more of your money. The program helps both individuals and business owners navigate taxes confidently, revealing methods to minimize what you owe.

What you will learn in Tax Reduction Strategy Program 2.0:

- Understanding the Dual Tax System: Grasp the fundamental differences in employee and business owners’ tax treatment.

- Legal Tax Loopholes: Discover legitimate strategies to reduce your tax bill, just like the savvy, high-income earners.

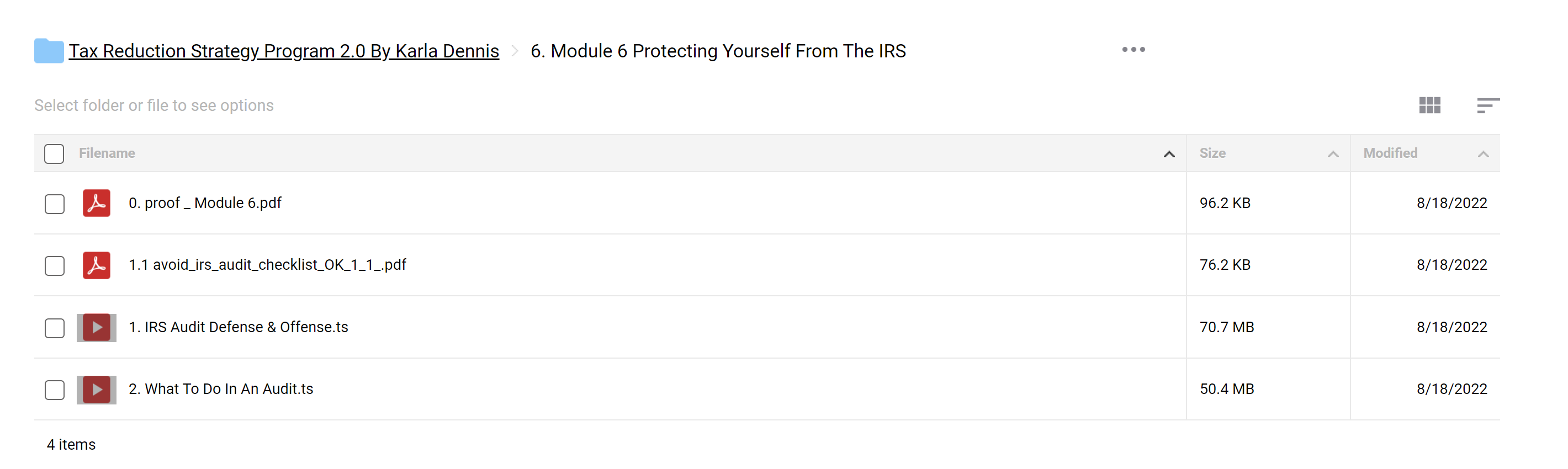

- Audit-Proofing Your Business: Learn how to set up and operate your business to minimise the risk of IRS audits.

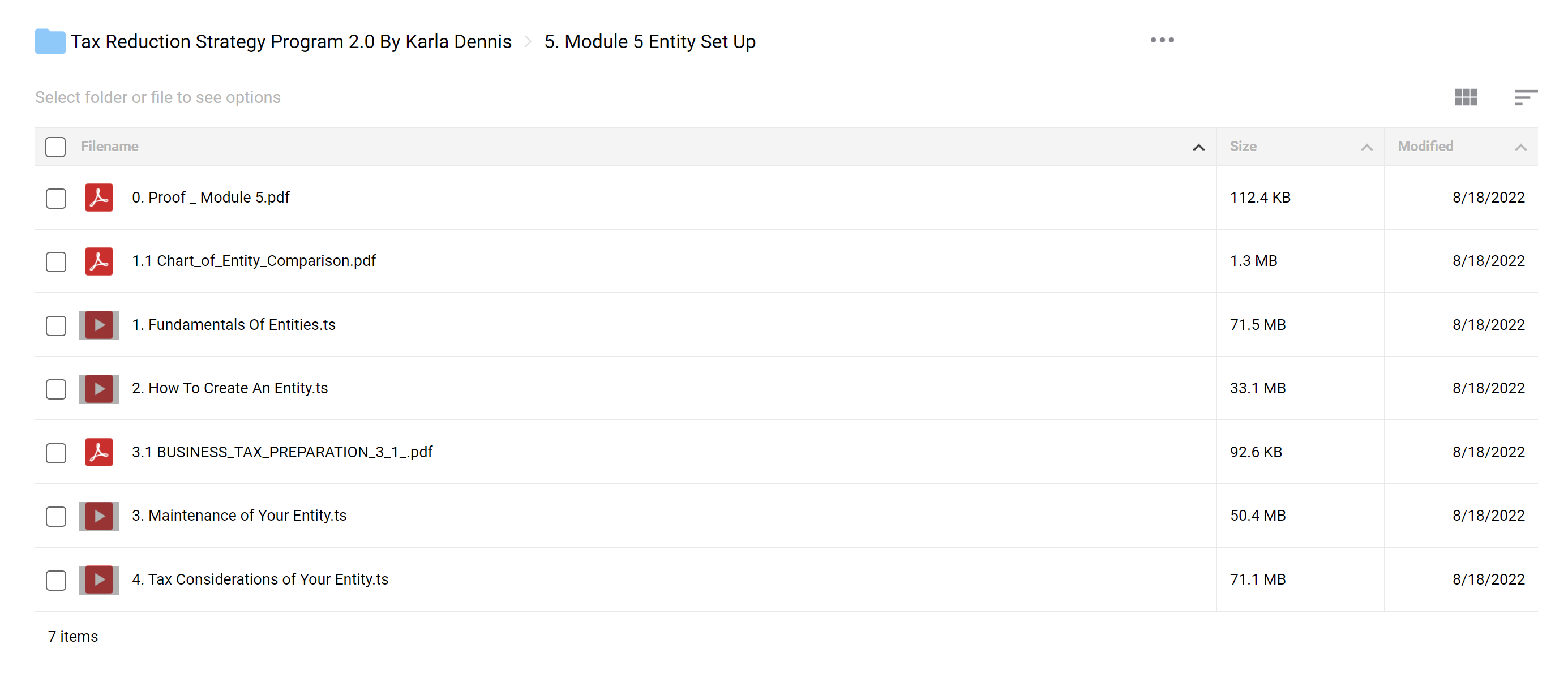

- Entity Setup and Management: Get clarity on the best business structures for tax efficiency and how to maintain them.

- Maximizing Deductions: Uncover how to legally claim deductions from home offices for medical expenses, ensuring you pay the lowest tax possible.

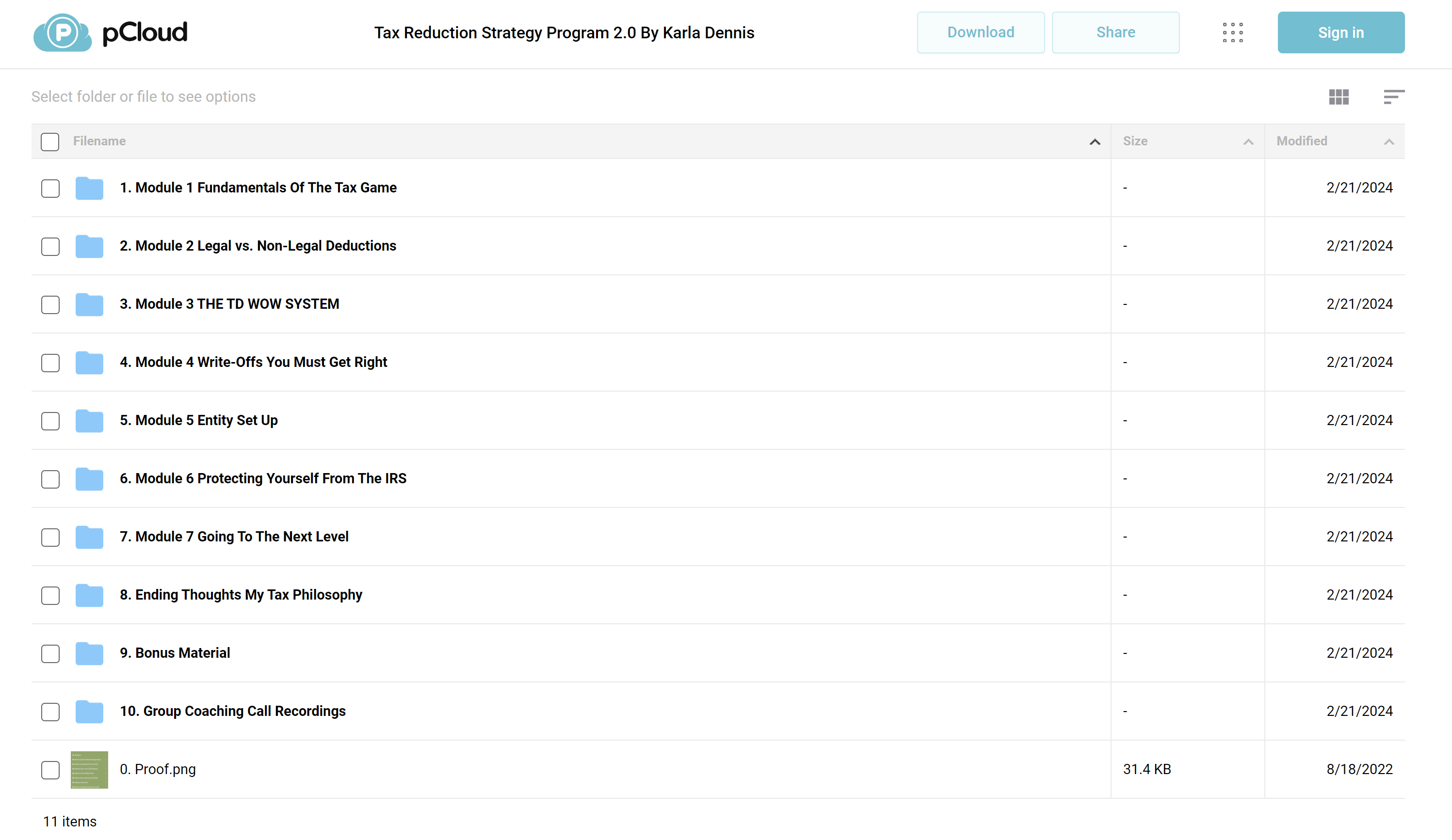

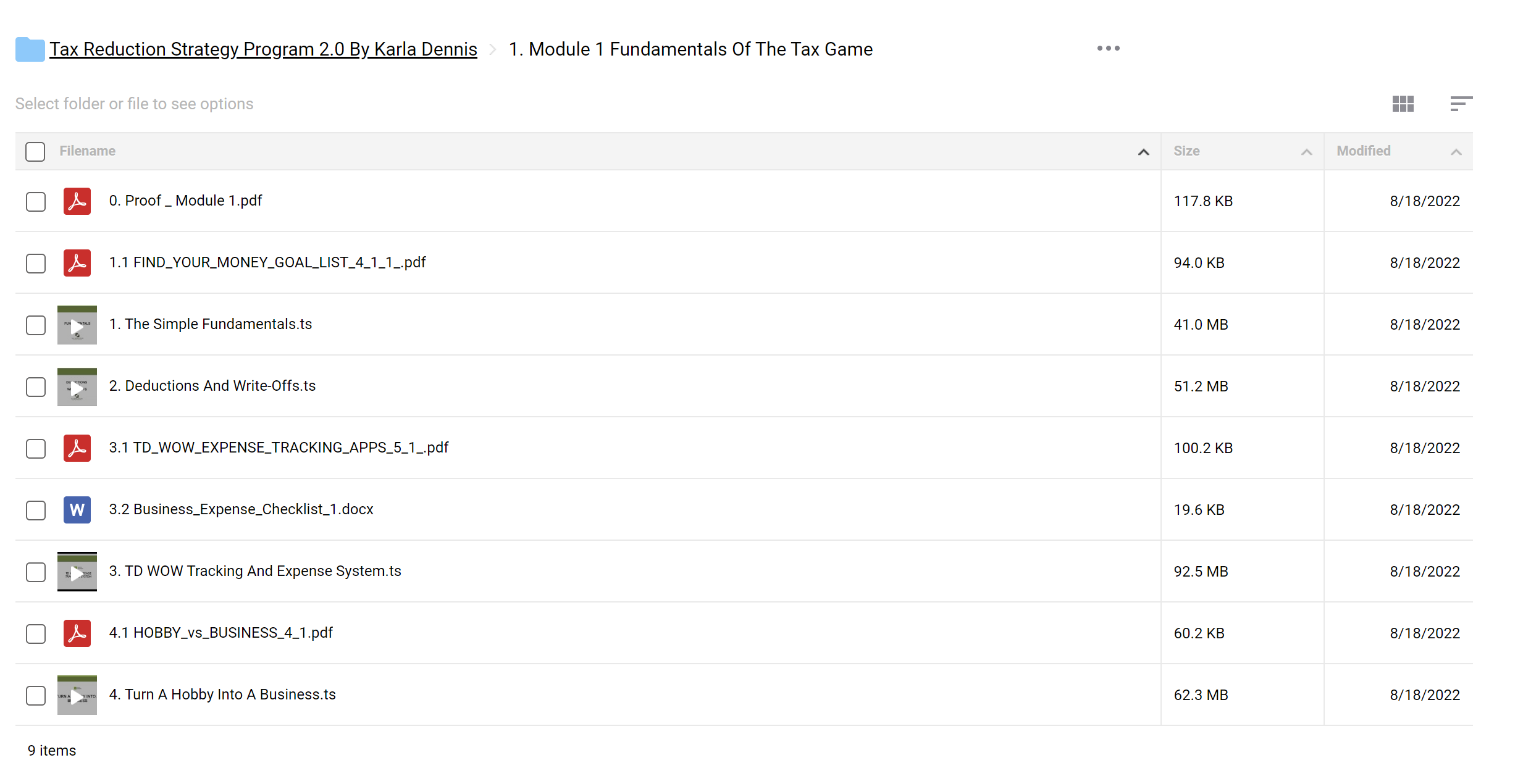

Tax Reduction Strategy Program 2.0 Curriculum:

- Module 1: Karla In A Box Done For You Taxes

- Module 2: Understanding New Tax Laws

- Module 3: Business Stimulus Package

- Module 4: Live Events

- Module 5: Advanced Tax Strategies For Real Estate Investors

- Module 6: 22 Wealth Multipliers In The Biden Tax Plan

- Module 7: IRS Insider Secrets

- Module 8: Creating A Million Dollar Business

- Module 9: Unadvertised Bonus Get Rent Checks From the Government

- Module 10: 12 Month Free Hurdlr Income & Expense App

- Module 11: Action Workbook

Who is Karla Dennis?

Karla Dennis, an acclaimed tax expert and business strategist, is the visionary behind the Tax Reduction Strategy Program 2.0. With a Master’s in Taxation and Business Development, Karla is not just an academic; she’s a seasoned practitioner who has saved her clients millions in taxes.

Her approachable method of demystifying tax strategies has made her a sought-after speaker and media personality. Karla’s mission extends beyond tax savings; she’s dedicated to educating entrepreneurs and business owners, empowering them to achieve financial freedom and success.

Be the first to review “Karla Dennis – Tax Reduction Strategy Program 2.0” Cancel reply

Related products

Property Management

Real Estate

Reviews

There are no reviews yet.