John Keppler – Market Profile Trading Strategies: Beyond the Basics

$1,250.00 Original price was: $1,250.00.$62.00Current price is: $62.00.

[Download] John Keppler Market Profile Trading Strategies: Beyond the Basics

📚 PROOF OF COURSE

The course “Market Profile Trading Strategies: Beyond the Basics,” is a meticulously designed 12-hour program aimed at elevating your understanding and application of market profile concepts. This course is not just about theories but a gateway to practical application, enabling you to effectively identify and seize potential trading opportunities.

Practical Application of Market Profile Tools

This course segment showcases fundamental trading strategies based on profile parameters and technical indicators. It provides a hands-on approach to understanding trade entries, profit targets, and risk management strategies, ensuring you are well-equipped to navigate the trading landscape.

Interpreting Market Profile Structures

Much of the course teaches how market profile structures can be read and interpreted alongside technical tools and footprint charts. This knowledge is crucial for planning trades and capturing market moves, making you a more adept trader.

Charting Techniques

The course introduces charting techniques that seamlessly integrate candlestick patterns with profile parameters, enhancing your analytical skills and trading strategies.

Delving into Order Flow and Volume Analysis

Understanding Order Flow Patterns, Volume Imbalances, Footprint Data, Delta Min, Delta Max, and Delta Finish is crucial for gaining insights into market activity and direction. This segment elucidates how these parameters can aid in timing and identifying points of trade entries and exits.

Advanced Risk Management Strategies

The course delves into advanced risk management strategies for intraday and swing trading activities. Dr. Keppler introduces the Keppler Volume Tracking Indicator (KVT) and explains how it can validate market analysis.

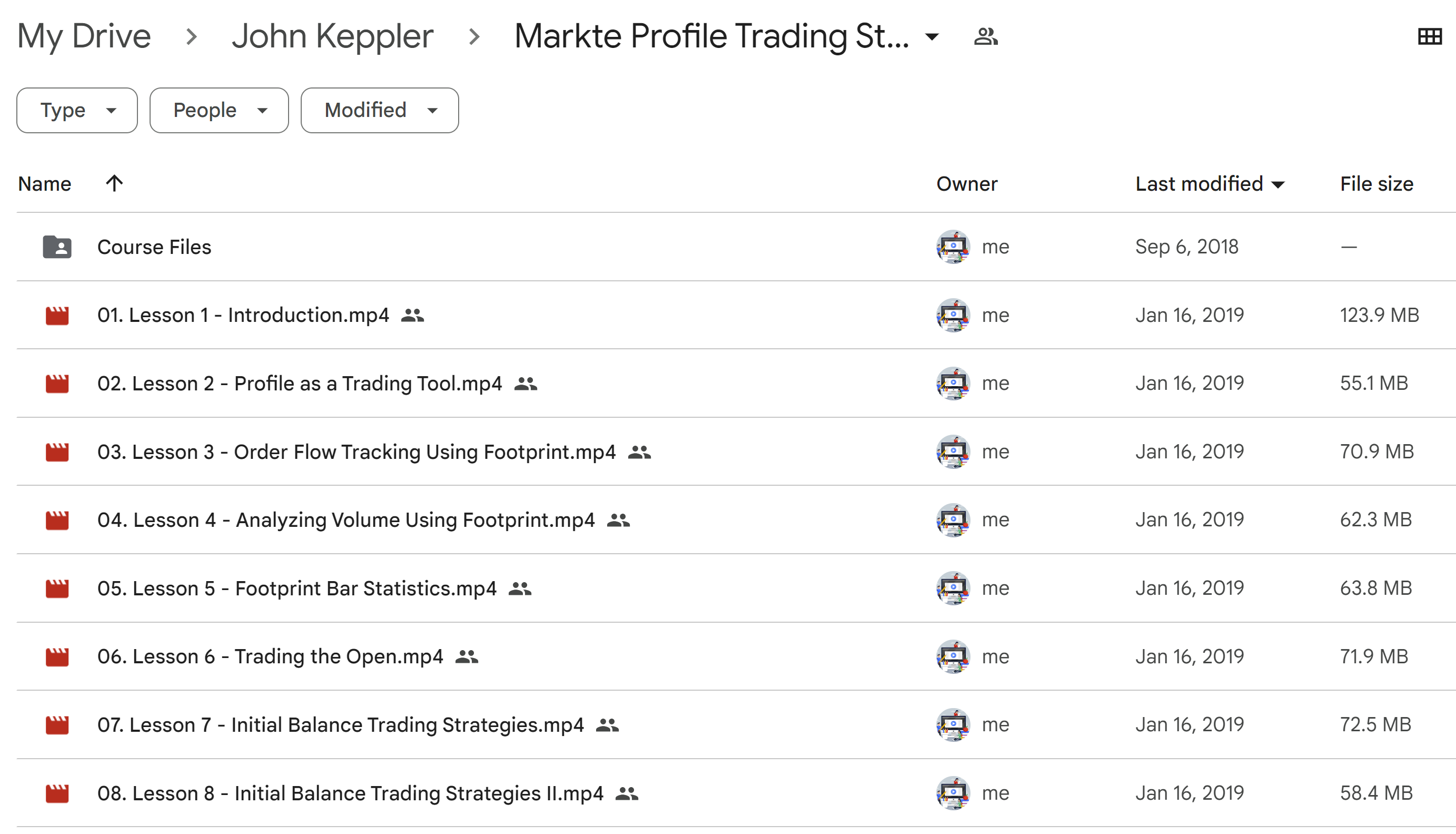

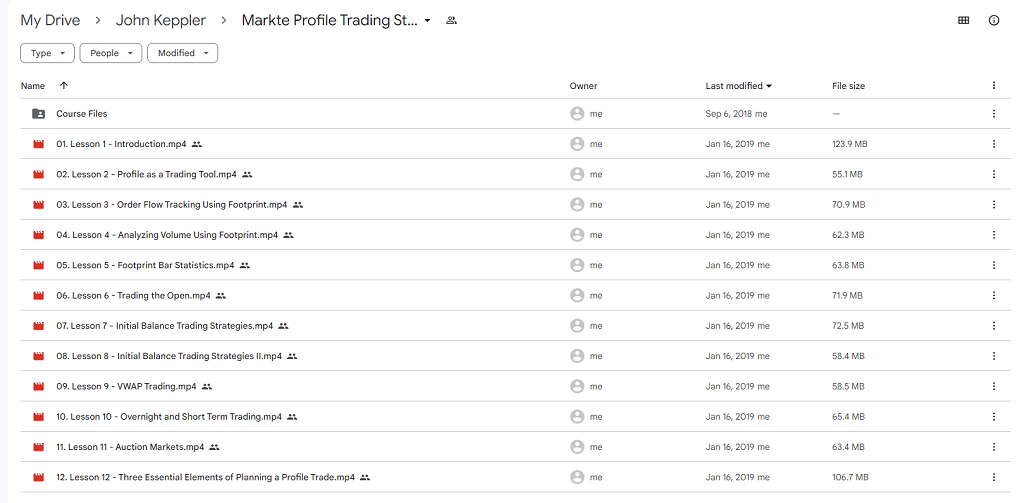

John Keppler Market Profile Trading Strategies Course Modules:

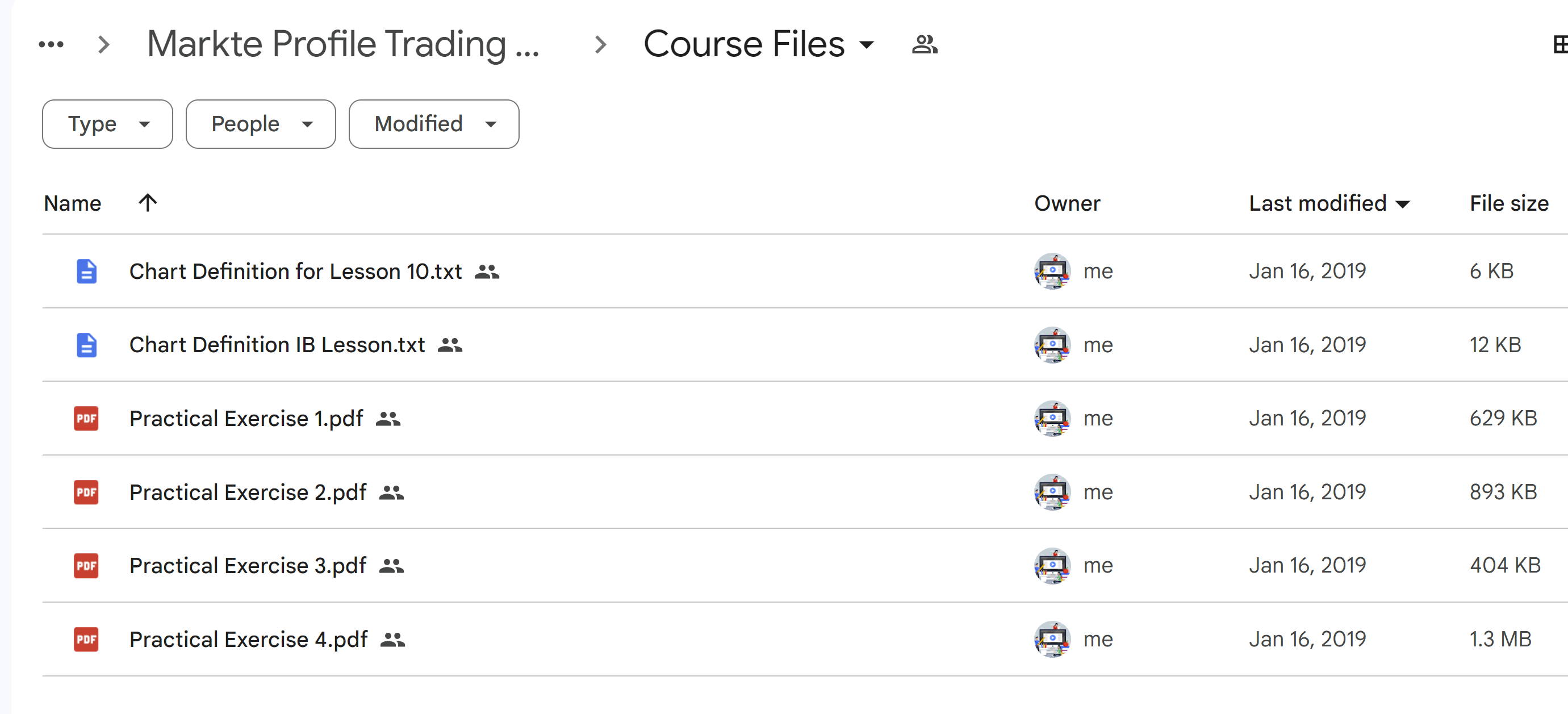

The course is structured into twelve insightful lessons and four practical exercises covering a range of topics from introducing market profile as a trading tool, order flow tracking using footprint, analyzing volume using print, and trading the open and initial balance trading strategies. Each lesson is a step towards mastering market profile trading strategies.

The course includes the following twelve lessons and four practical exercises:

- Lesson 01 – Introduction

- Lesson 02 – Profile as a Trading Tool

- Lesson 03 – Order Flow Tracking Using Footprint

- Lesson 04 – Analyzing Volume Using Footprint

- Lesson 05 – Footprint Bar Statistics

- Lesson 06 – Trading the Open

- Lesson 07 – Initial Balance Trading Strategies

- Lesson 08 – Initial Balance Trading Strategies II

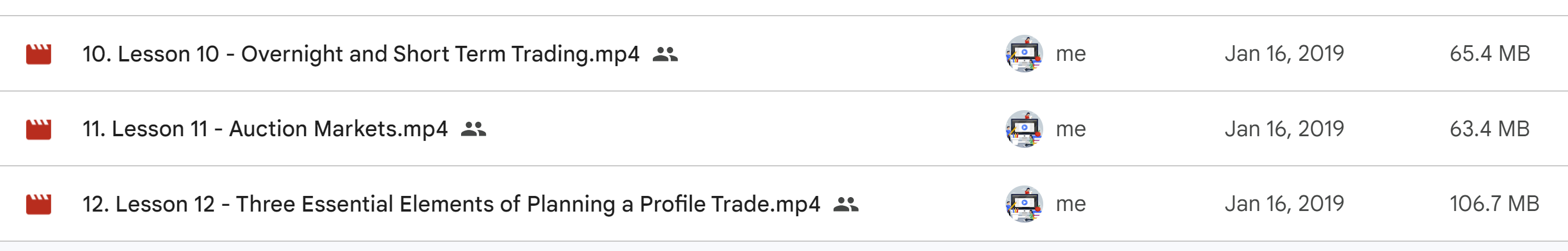

- Lesson 09 – VWAP Trading

- Lesson 10 – Overnight and Short-Term Trading

- Lesson 11 – Auction Market Opportunities

- Lesson 12 – Three Essential Elements of Planning a Profile Trade

Who is John Keppler?

Dr. Keppler, the esteemed Director of the Strategic Trading educational program and the author of the book “Profit with the Market Profile,” brings a wealth of knowledge and experience to the Market Profile Trading Strategies course. With a robust educational background and over twenty years of experience as a business professor and a strategic trader, Dr. Keppler holds a Bachelor’s Degree in Electrical Engineering, a Bachelor’s Degree in Business, an MBA, and a PhD in Business.

Dr. Keppler has had the privilege of teaching at reputable institutions such as the University Of Utah School Of Business, the University of California, the College of Notre Dame, and the University of Baltimore. His academic journey has equipped him with a solid grounding in fundamental and technical market analysis techniques.

His trading repertoire is as diverse as it is extensive, encompassing Stock Trading, ETF Trading, Futures Trading, Forex Trading, Options Trading, and Commodity Futures Trading. This vast trading experience has endowed Dr. Keppler with a unique understanding of the interrelationships between various markets and the delicate connections between different trading instruments.

Beyond the classroom, Dr. Keppler has shared his expertise through numerous seminars and workshops conducted worldwide. He has also contributed significantly to the field through his research papers and articles on technical analysis, trading methods, trading strategies, risk management, and market price auction theory.

Dr. Keppler has shared knowledge and created value by developing proprietary strategic trading systems. In collaboration with MarketDelta & Investor/RT, he developed the Keppler Volume Tracking Indicator (KVT), a powerful tool that enables real-time tracking of different volume levels. This indicator is a testament to Dr. Keppler’s ability to blend his trading knowledge with his educational background to develop practical tools for traders and investors.

What is market profile in trading?

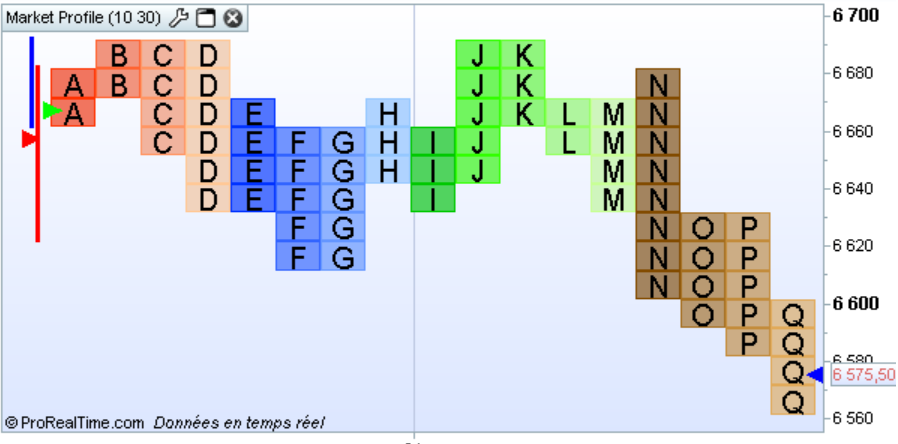

A Market Profile is a unique tool that allows traders to observe the market’s behavior. It’s a technique developed in the early 1980s by Peter Steidlmayer, a trader at the Chicago Board of Trade (CBOT). The primary aim was to provide transparency for off-floor traders and attract new traders to the exchange. Over the years, Market Profile has evolved, but its core principles remain the same.

The Essence of Market Profile

Market Profile organizes price, time, and volume in a way that illustrates market dynamics in a clear and precise manner. Here are the key components:

- Time Price Opportunity (TPO): It represents the price distribution during a specified time, helping traders to understand at what price levels the market spent more time.

- Value Area: This is the range where 70% of the trading occurred, indicating a consensus of value.

- Point of Control (POC): The price level with the most activity, where the highest trading volume occurred.

Benefits of Using Market Profile

Market Profile offers a plethora of benefits for both short-term and long-term traders:

- Market Understanding: It provides a deep insight into market dynamics, helping traders to understand the ongoing market scenario.

- Identifying Key Levels: The market Profile helps identify support and resistance levels, which are crucial for making informed trading decisions.

- Volume Analysis: By analyzing the volume at different price levels, traders can understand the strengths or weaknesses of the market.

Practical Application

Market Profile is a theoretical concept and a practical tool traders use worldwide. Here are some practical applications:

- Intraday Trading: Traders use Market Profile for intraday trading to identify key levels and potential price movements.

- Swing Trading: It helps understand the bigger picture and plan trades over several days.

- Risk Management: By identifying key groups, traders can set stop losses and manage risk effectively.

Statistical Significance

Market Profile’s statistical approach provides a factual basis for analyzing market behavior. For instance, the 70% value area is a statistically significant range indicating where most trading activity occurred. Moreover, the Point of Control (POC) represents the price level with the highest trading activity, providing a factual basis for identifying key market levels.

Real-World Examples

Market Profile is used across various financial markets, including stocks, futures, and forex. For instance, understanding the Initial Balance (the range of the first hour of trading) is crucial in futures trading as it sets the tone for the rest of the trading day. Similarly, in forex trading, the Market Profile helps understand the currency pair’s behavior and plan trades accordingly.

Be the first to review “John Keppler – Market Profile Trading Strategies: Beyond the Basics” Cancel reply

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Crypto Trading

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Best 100 Collection

![[Bundle] Best 4 FutexLive Courses](https://coursehuge.com/wp-content/uploads/2024/08/Bundle-Best-4-FutexLive-Courses-300x300.jpg)

Reviews

There are no reviews yet.