John Jackson – Lease Options Course

$997.00 Original price was: $997.00.$69.00Current price is: $69.00.

John Jackson Lease Options Course [Instant Download]

What is John Jackson Lease Options Course:

John Jackson’s Lease Options Course teaches real estate investing using lease options. It covers practical skills for property transactions, addressing common challenges in real estate.

The course aims to help both beginners and experienced investors build wealth and establish a successful real estate business. It combines theory with John’s real-world experience to provide valuable insights into lease options.

📚 PROOF OF COURSE

What you will learn in this Lease Options Course:

- Understanding the fundamentals of lease options and their role in real estate investing.

- Strategies for identifying and securing profitable lease option deals.

- Techniques for effectively managing and negotiating lease agreements.

- Insights into legal considerations and compliance, particularly in Texas.

- Practical tips for creating a sustainable income stream through lease options.

- Leveraging John Jackson’s experience to avoid common pitfalls and maximize success.

Lease Options Course curriculum:

The Lease Options Course is structured to provide a thorough understanding of all aspects of lease options in real estate. The curriculum includes:

- Detailed exploration of lease option principles.

- Step-by-step guidance on setting up and running a lease option business.

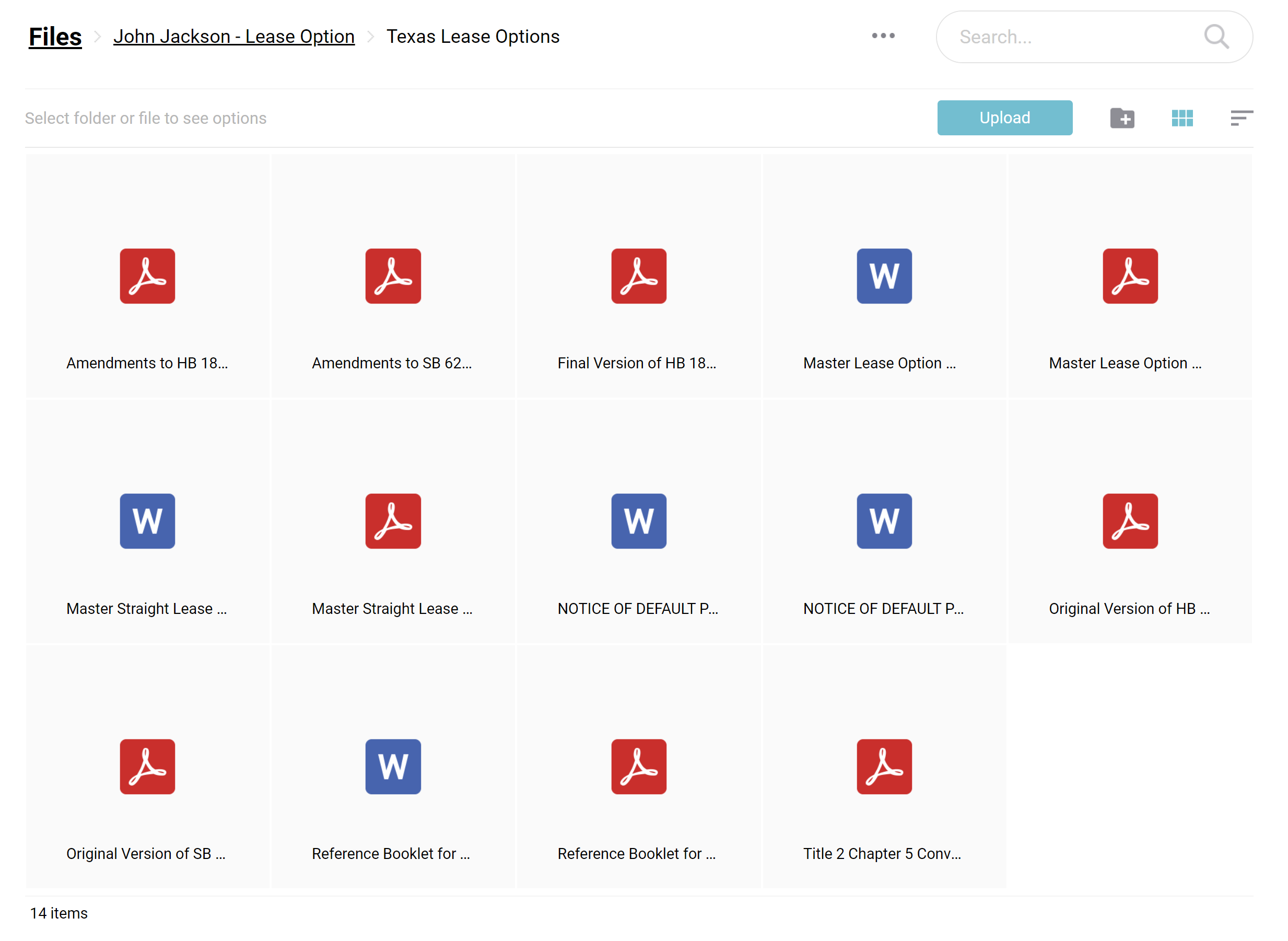

- Comprehensive coverage of legal frameworks, with a special focus on Texas lease options.

- Access to essential documents and contracts for lease option transactions.

- Interactive sessions on market analysis and investment decision-making.

- Exclusive insights into John Jackson’s proven lease option strategies and methods.

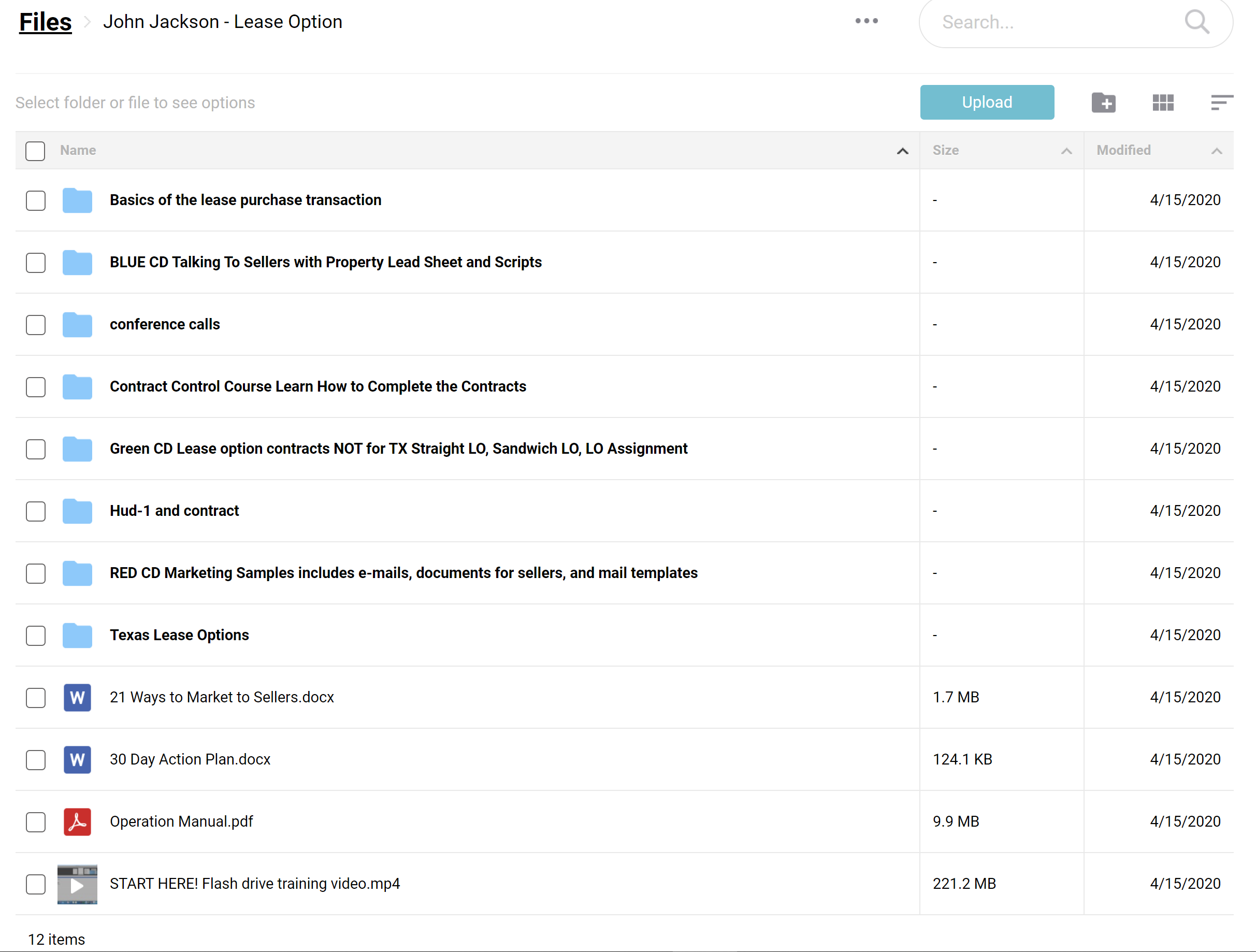

Content Breakdown:

- 30 Day Action Plan.docx

- Operation Manual.pdf

- START HERE! Flash drive training video.mp4

- Basics of the lease purchase transaction

- BLUE CD Talking To Sellers with Property Lead Sheet and Scripts

- conference calls

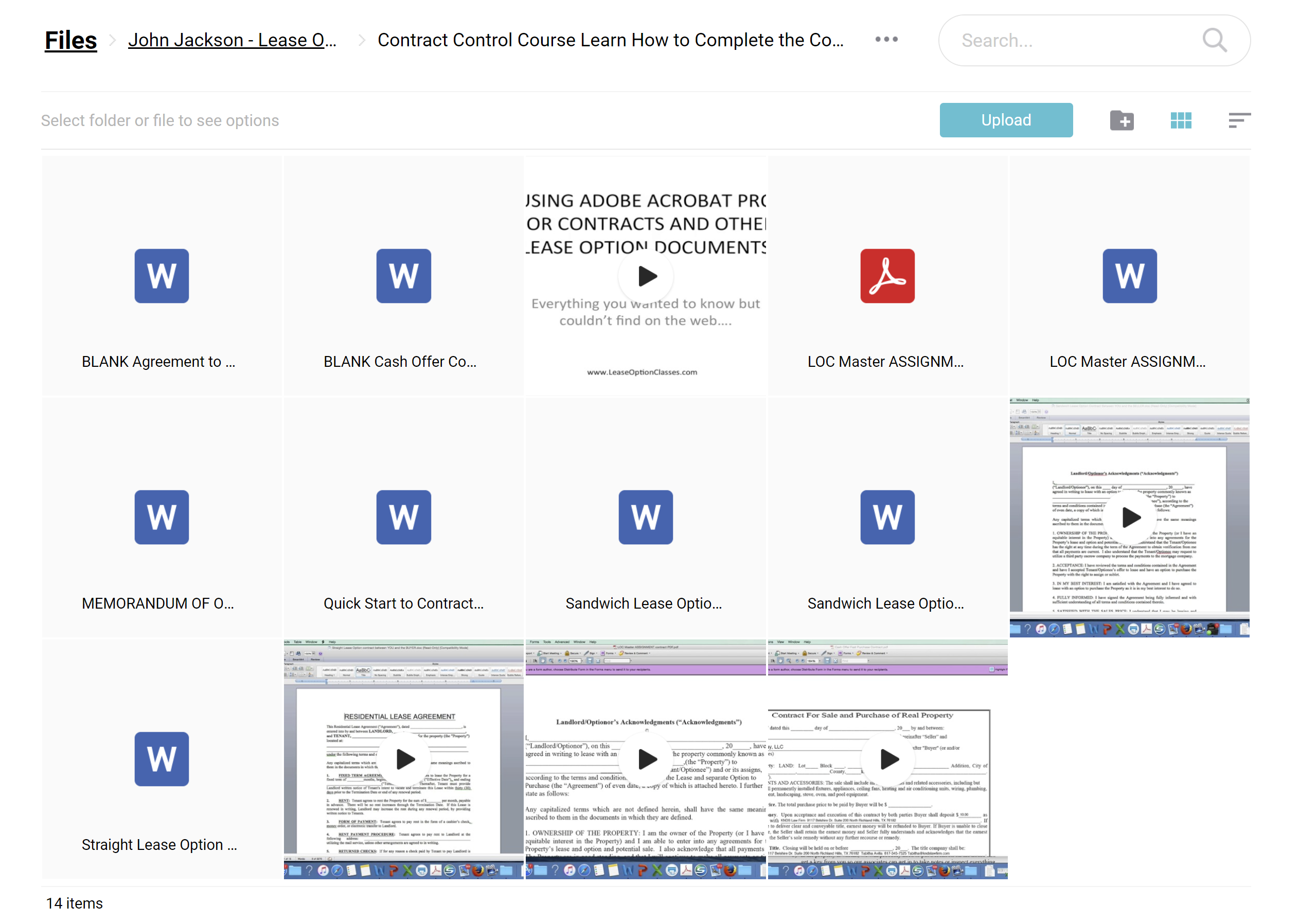

- Contract Control Course Learn How to Complete the Contracts

- Green CD Lease option contracts NOT for TX Straight LO, Sandwich LO, LO Assignment

- Hud-1 and contract

- RED CD Marketing Samples includes e-mails, documents for sellers, and mail templates

- Texas Lease Options

- 21 Ways to Market to Sellers.docx

Who is John Jackson?

John Jackson is known as the “King of Lease Options” in real estate. He founded Leasing To Buy® in 2003, specializing in lease options, particularly in Texas. Jackson has completed over 600 lease option deals and mentored many successful students.

His expertise includes:

- Texas lease option laws and regulations

- Innovative lease option strategies

- Risk management in real estate transactions

- Marketing and closing lease option deals

Jackson is a bestselling author and has appeared on FOX, NBC, podcasts, and radio shows, sharing his real estate knowledge. His course likely draws from this extensive experience, offering practical insights into the lease option market.

2 reviews for John Jackson – Lease Options Course

Add a review Cancel reply

Related products

Lease Options

Larry (verified owner) –

great product

Heather (verified owner) –

Very happy, thank you!