Jessica Laine – Jess Invest Total Forex Course

$3,000.00 Original price was: $3,000.00.$48.00Current price is: $48.00.

Jessica Laine Jess Invest Total Forex Course [Instant Download]

1️⃣. What is Jess Invest Total Forex Course?

Jess Invest Total Forex Course is a course by Jessica Laine, it’s teaches you how to trade currencies and create generational wealth.

Learn forex from basics to advanced strategies with clear, step-by-step instruction. Master technical analysis, chart patterns, market structure, and Fibonacci techniques to find profitable trades.

Jessica Laine’s seven-figure trading experience powers this program that has helped thousands of students. The course simplifies forex trading with practical methods for reading the market and executing winning trades.

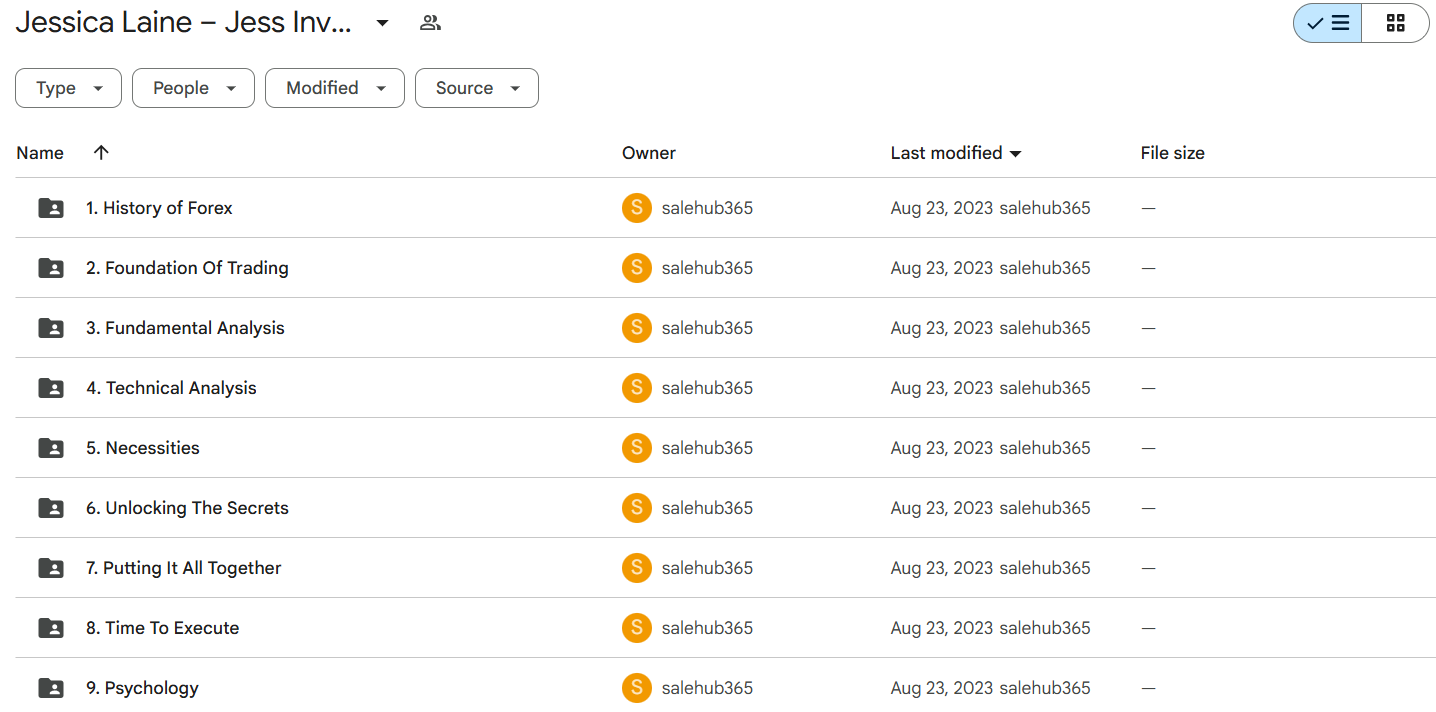

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Jess Invest Total Forex Course:

The Jess Invest Total Forex Course teaches you everything from basics to advanced trading. Here’s what you’ll learn:

- Forex fundamentals: Learn the history and core principles of the foreign exchange market

- Technical analysis: Master chart reading, patterns, and Fibonacci tools to find profitable trades

- Trading psychology: Build the mindset for consistent success and overcome emotional trading mistakes

- Entry strategies: Learn exact entry methods with multiple confluence points for better trades

- Market structure: Spot market flows to predict price movements

- Fundamental analysis: See how economic news and global events affect currency prices

After finishing this course, you’ll have all the skills to trade forex with confidence, whether you’re brand new or want to improve your existing knowledge.

3️⃣. Jess Invest Total Forex Course Curriculum:

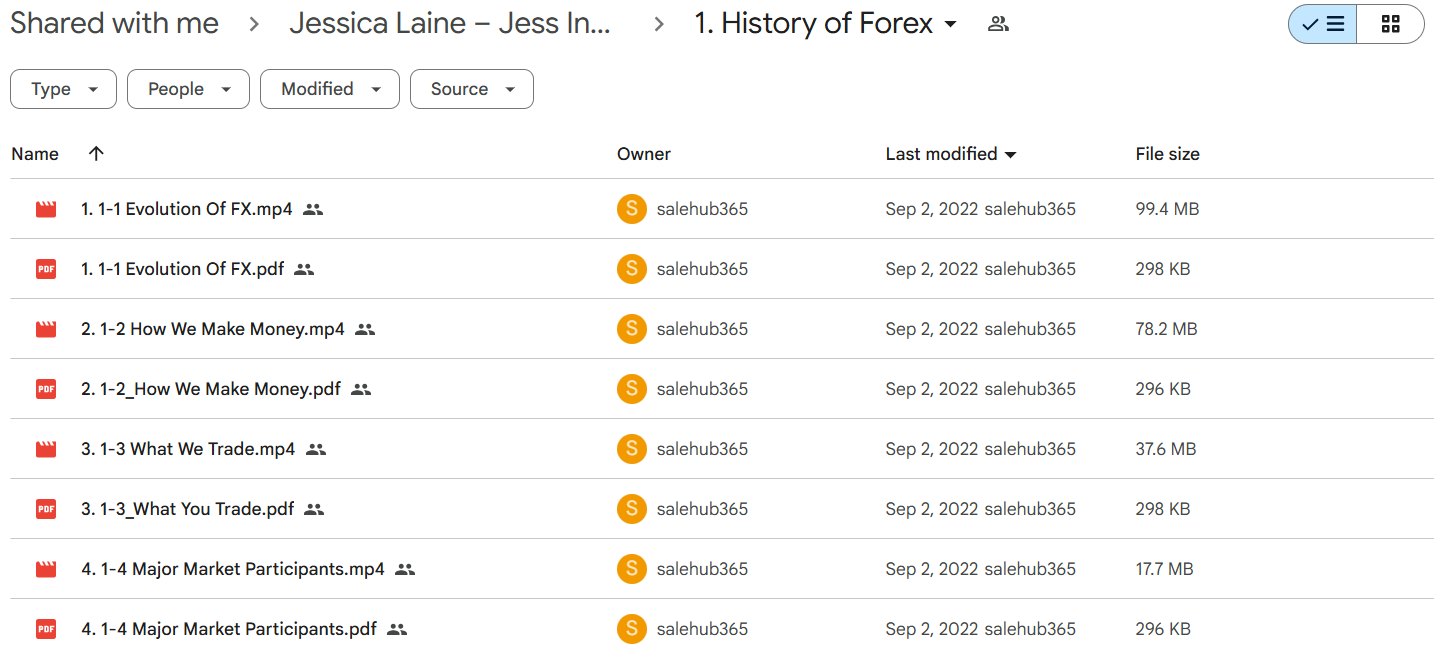

✅ Module 1: History of Forex

This foundational module introduces students to the evolution of the foreign exchange market and sets the stage for understanding how traders generate profits. Students learn about the specific currency pairs available for trading and gain insights into the major participants who influence market movements.

The Evolution of FX lesson provides historical context that helps traders understand why the market behaves as it does today. How We Make Money breaks down the profit mechanisms in forex trading, while What We Trade focuses on currency pairs and their characteristics. Major Market Participants examines banks, corporations, and other key players whose actions impact market conditions.

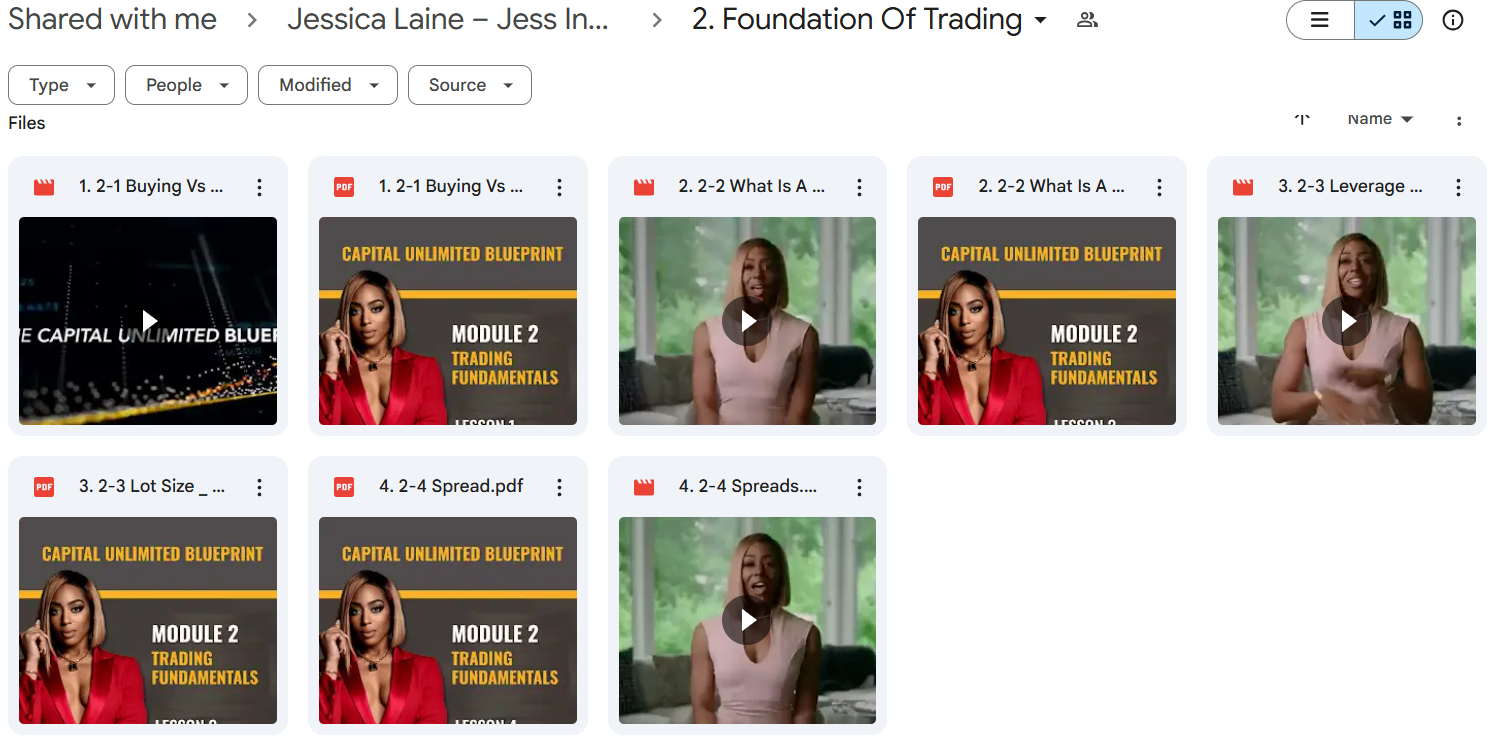

✅ Module 2: Foundation of Trading

This module covers the essential mechanics of forex trading that every participant must understand before placing trades. Jessica explains the differences between buying and selling currencies, along with crucial concepts like pips, leverage, lot sizes, and spreads.

Buying vs Selling clarifies the fundamental concept of going long or short on currency pairs. What Is A Pip explains the smallest unit of price movement and how it translates to profit and loss. Leverage & Lot Sizes teaches proper position sizing and the power and risks of leverage. The Spread lesson details trading costs and how they affect overall profitability.

✅ Module 3: Fundamental Analysis

This comprehensive section examines how economic data and central bank policies drive currency movements. Jessica breaks down major economic indicators and explains how traders can interpret this information to make informed trading decisions.

Monetary Policy explores how central bank decisions impact currency values and market trends. GDP, CPI, and Employment Data lessons show how these critical economic metrics influence forex prices. The module also covers Trade Balance and Housing Data as additional fundamental factors that can create trading opportunities.

✅ Module 4: Technical Analysis

This module shifts focus to chart-based decision making, teaching students how to analyze price patterns, trends, and market structure. Jessica emphasizes the integration of technical analysis with fundamental factors for a more robust trading approach.

Technical Analysis Intro provides the conceptual foundation for reading charts and identifying patterns. TA With Charts demonstrates practical application of various technical tools and indicators. Technicals With Fundamentals teaches students how to combine both analytical approaches for confirmation and higher probability trades.

✅ Module 5: Necessities

This practical module helps students set realistic expectations and develop proper study habits for successful forex trading. Jessica provides guidance on structuring homework and utilizing the TradingView platform effectively for analysis.

Expectations sets realistic goals for what students can achieve and the work required. How To Structure Homework provides a framework for consistent improvement through deliberate practice. How To Use TradingView offers technical instruction on maximizing this popular charting platform for analysis and execution.

✅ Module 6: Unlocking The Secrets

This advanced module reveals Jessica’s proprietary approach to market analysis, focusing on chart structure and Fibonacci techniques that form the backbone of her trading strategy. Students learn both what to do and what to avoid when applying these powerful tools.

The Foundation of Your Chart teaches proper chart setup for accurate analysis. Structure reveals how to identify key market levels and patterns that signal potential reversals or continuations. The Fibonacci lessons provide detailed instruction on this powerful tool while highlighting common mistakes traders make when applying Fibonacci analysis.

✅ Module 7: Putting It All Together

This integration module shows students how to synthesize all previous knowledge into a cohesive trading approach. Jessica focuses on entry techniques, confluence factors, and recognizing high-probability trading opportunities in real-time.

Entries & Confluence teaches how to identify multiple confirming factors before entering trades. Putting it All Together demonstrates the complete analytical process from start to finish. Entries on Fibs shows specific techniques for using Fibonacci levels as entry triggers. Seeing The Right Now Money helps traders identify immediate opportunities in current market conditions.

✅ Module 8: Time To Execute

This implementation module transitions students from theory to practice with real-market examples and analytical walkthroughs. Jessica provides a structured approach to reading markets and preparing for trading sessions.

Reading The Market develops the skill of interpreting current price action within larger contexts. Top Down Analysis Run Throughs demonstrates Jessica’s multi-timeframe approach to finding opportunities. Reading The Market Sunday Night Call Structure provides a weekly preparation ritual for the upcoming trading week.

✅ Module 9: Psychology

This crucial final module addresses the mental aspects of trading that often determine success or failure. Jessica covers emotional management, discipline, and the importance of having a structured trading plan to guide decisions.

Psychology Of Trading introduces the mental challenges traders face and their impact on performance. The Fear and Greed lessons tackle the two dominant emotions that sabotage trading results. Discipline explores the importance of following rules and maintaining consistency. Trading Plan guides students in creating their own personalized framework for trading decisions.

4️⃣. Who is Jessica Laine?

Jessica Laine is a forex trader and educator who changed her life through currency trading. She graduated with top honors from Spelman College and worked as a news reporter before finding her passion in trading.

Jessica left traditional employment to learn investing from successful mentors. Through dedication and strategy, she became a seven-figure forex trader.

In 2018, she started Jess Invest to teach others. Her platform has helped thousands learn profitable trading and work toward financial freedom.

Jessica shares trading insights on social media and believes in faith, family, and finance. She teaches that forex education can build generational wealth.

Her journey from journalism to forex success shows her commitment to financial empowerment. Jessica’s teaching makes complex market concepts simple with practical trading strategies.

As Jess Invest CEO, she provides honest forex education that focuses on real trading skills, not hype.

5️⃣. Who should take Jessica Laine Course?

The Jess Invest Total Forex Course is for anyone who wants to learn profitable forex trading. This course is perfect for:

- Complete beginners who want to learn forex trading from scratch with a clear, step-by-step approach.

- Struggling traders who haven’t been profitable and need better technical analysis skills and trading psychology.

- Working professionals looking to build a skill that can create extra income and possibly replace their job.

- Financial independence seekers who want to learn a skill that can build generational wealth through trading.

- Existing investors wanting to add currency trading to their portfolio using proven methods.

If you’re ready to learn this valuable financial skill and follow disciplined trading principles, this course gives you everything to build a strong foundation for long-term trading success.

6️⃣. Frequently Asked Questions:

Q1: How can I start trading currencies?

Q2: What are the best strategies for creating generational wealth?

Q3: What are the key skills for advanced forex trading?

Q4: How risky is forex trading?

Q5: Can forex trading be a full-time career?

Be the first to review “Jessica Laine – Jess Invest Total Forex Course” Cancel reply

Related products

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Forex Trading

Forex Trading

Forex Trading

Day Trading

Reviews

There are no reviews yet.