J. Bravo – Bear Market Money 2023

$1,000.00 Original price was: $1,000.00.$92.00Current price is: $92.00.

[Download] J. Bravo Bear Market Money 2023 Course

📚 PROOF OF COURSE

1️⃣. What is J.Bravo Bear Market Money:

The Bear Market Money 2023 course by J. Bravo offers a clear guide to making money when the market is down.

It makes the scary idea of a bear market easy to understand, giving you real steps to keep your money safe and grow it. J. Bravo uses his deep knowledge and practical tips to help you feel confident about handling money in 2023.

You’ll learn the basics of bear markets and how to use intelligent strategies to do well when others might not. This course is an excellent tool for anyone wanting to get better with money during tough market times.

2️⃣. What you will learn in this course:

This section will restructure the course content, highlighting the key learning outcomes for students:

- Understand Bear Markets: Grasp the fundamentals of what constitutes a bear market and its implications on investments.

- Strategic Investment: Learn to devise and implement investment strategies that are effective during market downturns.

- Market Analysis Tools: Get acquainted with essential tools and indicators like RSI, MACD, and Candlestick Patterns to analyze market trends.

- Risk Management: Master techniques to manage and mitigate risks associated with bear market investments.

- Practical Trading Skills: Gain hands-on experience with platforms like TradingView and TradeStation for informed trading decisions.

- Market Psychology: Understand the psychological aspects of trading and investing during market downturns.

- Portfolio Diversification: Learn the importance of diversification with insights into commodities like Gold, Silver, and Bitcoin.

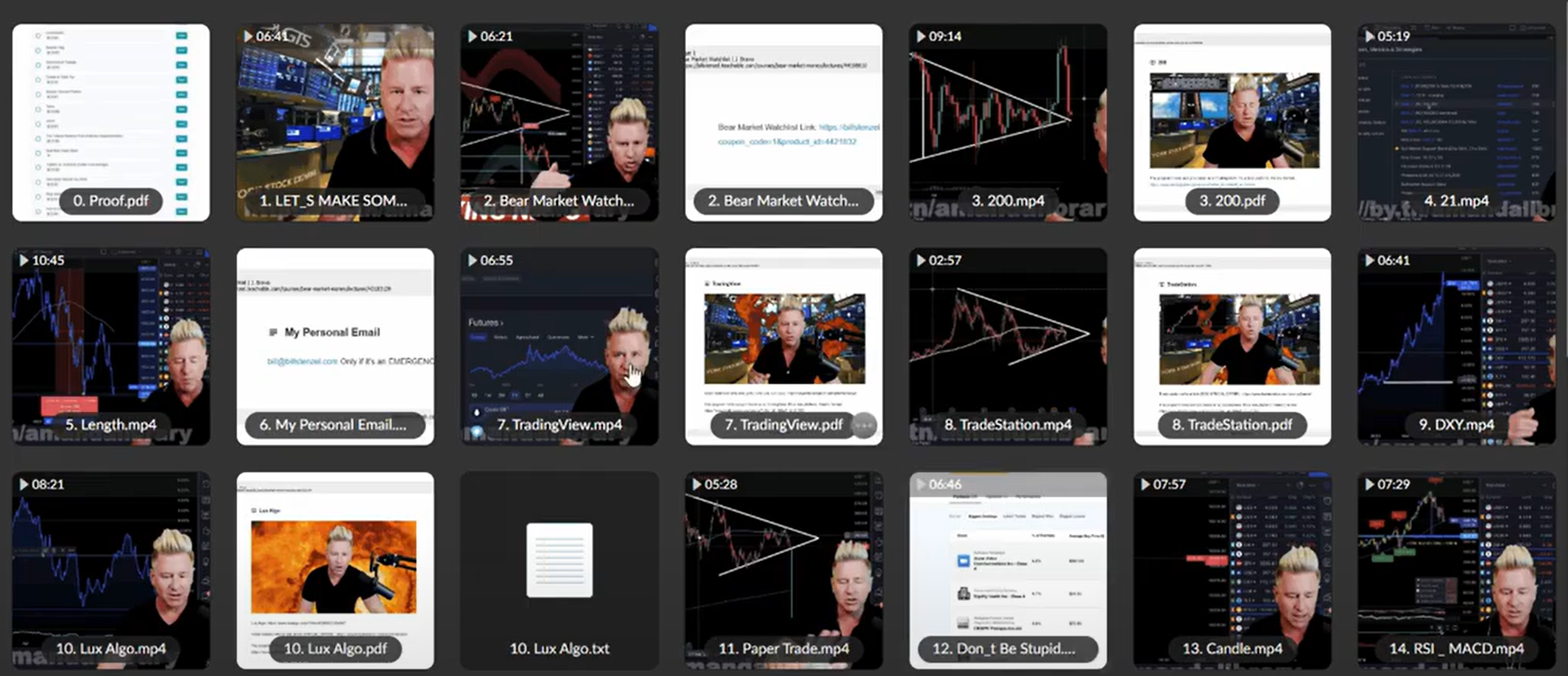

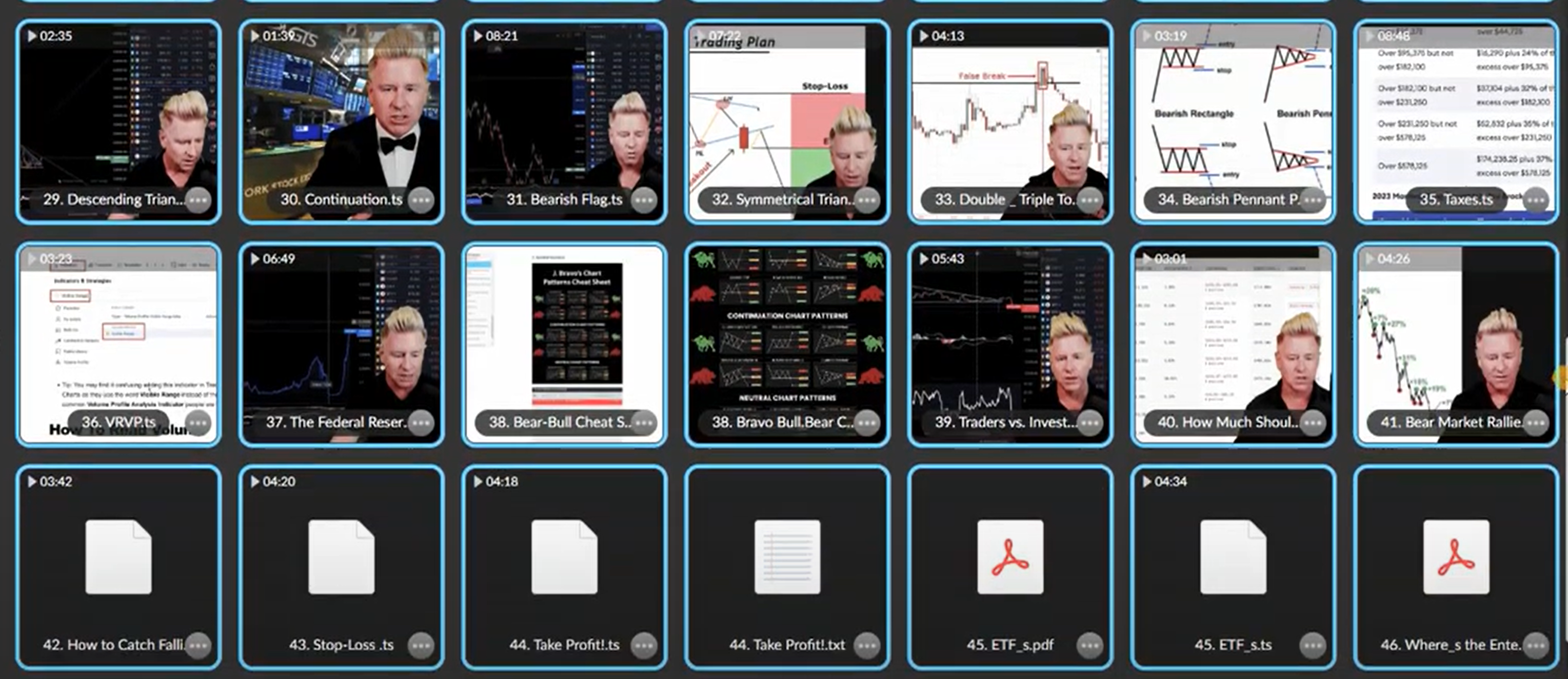

3️⃣. Bear Market Money 2023 Course curriculum

- First Section

- LET’S MAKE SOME MONEY 💰💰💰 (6:41)

- Bear Market Watchlist (6:21)

- 200 (9:14)

- 21 (5:19)

- Length (10:45)

- My Personal Email

- TradingView (6:55)

- TradeStation (2:57)

- DXY (6:41)

- Lux Algo (8:21)

- Paper Trade (5:28)

- Don’t Be Stupid (6:46)

- Candle (7:57)

- RSI & MACD (7:29)

- Bear/Bull Market: Be Careful (7:24)

- Bear Market 9 (20:08)

- OVERREACTION!!! (6:28)

- Let’s Make a Trade! (11:06)

- PDT (3:11)

- Support & Resistance (8:15)

- Investors (12:11)

- CM_Williams (6:12)

- 200 Weekly (DCA for Investors) (6:40)

- Gold/Silver/Bitcoin (8:12)

- False Break Out (6:23)

- False Break Out Confirmation (3:13)

- Head & Shoulders (10:12)

- Rising Wedge / Finviz (13:39)

- Descending Triangle (5:43)

- Continuation (3:00)

- Bearish Flag (10:07)

- Symmetrical Triangle (10:57)

- Double & Triple Top (9:10)

- Bearish Pennant Pattern (4:47)

- Taxes (13:59)

- VRVP (6:07)

- The Federal Reserve Pivot (Indicator Implementation) (11:55)

- Bear/Bull Cheat Sheet

- Traders vs. Investors (Dollar-Cost Average) (11:02)

- How Much Should You RISK (5:22)

- Bear Market Rallies and FED Pivots (8:18)

- How to Catch Falling Knives! Buy The Dip! (5:29)

- Stop-Loss (6:43)

- Take Profit! (7:12)

- ETF’s (8:03)

- Where’s the Enter & Exit (8:47)

- Step-by-Step Trade Setup (3:48)

- How To Swing Trade (15:28)

- Fundamentals (8:59)

- Bear Market Watchlist (6:21)

4️⃣. Who is J. Bravo?

J. Bravo, also known as William “Bill” Stenzel, is not just a name in the financial world; he’s a beacon of innovation and wisdom. Born on October 1, 2002, in San Diego, California, Bravo’s journey from creating playful videos to becoming a financial guru is remarkable. His early foray into the digital world with “JBravoTV” on YouTube laid the foundation for his unique entertainment and financial education blend.

With over 2 million subscribers today, J. Bravo stands out for his relatable and engaging approach to complex financial topics. His transition from vlogging to providing in-depth financial insights showcases his versatility and commitment to empowering others. Bravo’s content not only entertains but educates, making the daunting world of finance accessible to all.

His role in the financial community is further solidified by his keen investment insights and strategies, particularly in bear markets. Bravo’s ability to decode market trends and offer practical advice has earned him a respected place among financial enthusiasts. Beyond the screen, his contributions to discussions and panels add depth to his online persona, bridging the gap between digital content and real-world financial wisdom.

J. Bravo’s journey is a testament to the power of passion and adaptability. From a young YouTuber to a trusted financial educator, his evolution reflects a deep understanding of market dynamics and a genuine desire to make financial literacy accessible to everyone.

5️⃣. Who is this course for?

The Bear Market Money 2023 course is tailored for diverse learners, from beginners to seasoned investors seeking to enhance their financial acumen during economic downturns. Here’s who will benefit the most:

- Beginners in Investing: If you’re new to the investing world, this course offers a solid foundation, making complex concepts accessible and understandable.

- Experienced Investors: For those with a background in investing but looking to refine their strategies specifically for bear markets, this course provides advanced insights and tactics.

- Financial Enthusiasts: Individuals keen on financial markets and economic trends will find the course’s in-depth analysis and case studies particularly enriching.

- Career Professionals: Professionals looking to diversify their income streams through investments will discover practical advice and strategies to navigate market downturns.

6️⃣. Course Level:

The Bear Market Money 2023 course is designed to cater to a wide range of learners, ensuring accessibility regardless of prior experience:

Beginner to Intermediate: The course starts with the basics, making it suitable for those new to investing, and gradually progresses to more complex topics and strategies, catering to intermediate level investors looking to specialize in bear market strategies.

7️⃣. Frequently Asked Questions:

Q1: What is a bearish market?

Q2: What are bear market investments?

Q3: Is it good to invest in a bear market?

Q4: What do investors do during a bear market?

Q5: How can you identify a bear market early?

Q6: What indicators does J Bravo use?

He also emphasizes the importance of understanding Candle patterns and utilizes RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) to gauge market momentum and trend reversals. These indicators help make informed decisions by highlighting potential entry and exit points in the market.

Be the first to review “J. Bravo – Bear Market Money 2023” Cancel reply

Related products

Forex Trading

Trading Courses

Investment Management

Trading Courses

Trading Courses

Trading Courses

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Reviews

There are no reviews yet.