Investopedia Day Trading Course (David Green)

$197.00 Original price was: $197.00.$18.00Current price is: $18.00.

Day Trading Course by Investopedia Academy [Instant Download]

What is Investopedia Day Trading Course?

Investopedia Day Trading Course teaching you how to trade stocks using professional strategies.

The program shows you six different types of trades that work in any market condition, from trending stocks to consolidation patterns.

You’ll master technical analysis using charts, candlesticks, moving averages, and RSI to spot profitable trading opportunities daily.

Green teaches proper money management and position sizing to protect your capital while maximizing profits through strategic stop losses.

The course includes trading psychology rules that keep you disciplined and profitable, based on Green’s 35 years of Wall Street experience.

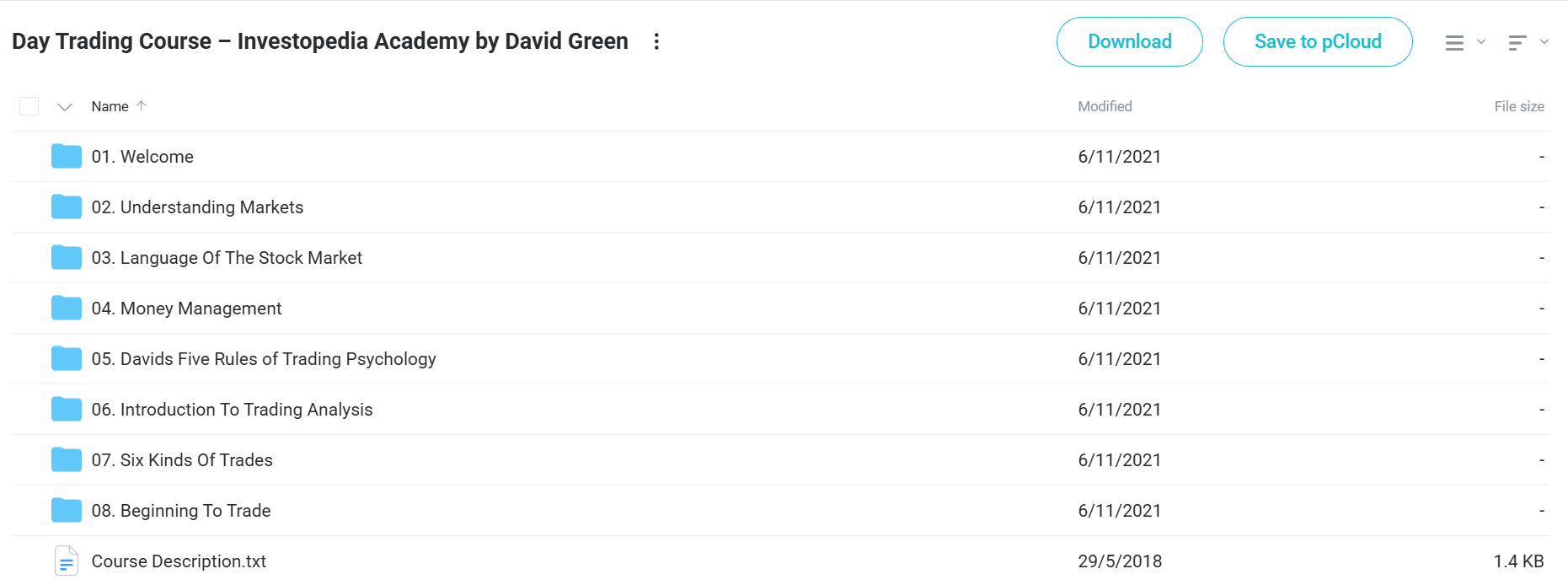

📚 PROOF OF COURSE

What you’ll learn in Investopedia Day Trading Course:

This complete day trading course teaches you everything to trade like a professional. Here’s what you’ll master:

- Six proven trading strategies: Learn trend trades, moving average trades, base trades, consolidation trades, double top-bottom trades, and far from moving average trades that work in any market.

- Technical analysis skills: Master charts, candlesticks, moving averages, and relative strength index to make better trading decisions and spot profitable opportunities.

- Money management techniques: Apply proper position sizing, stop losses, and risk management to protect your money and maximize profits from every trade.

- Trading psychology rules: Follow David’s five key rules to stay disciplined and control emotions while trading for consistent results.

- Market basics: Understand exchanges, order types, volume, volatility, and trading language to communicate like a professional trader.

- Live trading setup: Get hands-on guidance for platform setup, news trading strategies, and daily planning tools to start trading immediately.

The course includes over 5 hours of video lessons, practical exercises, and connects you to David’s live trading platform with a free trial period.

Investopedia Academy Day Trading Course Curriculum:

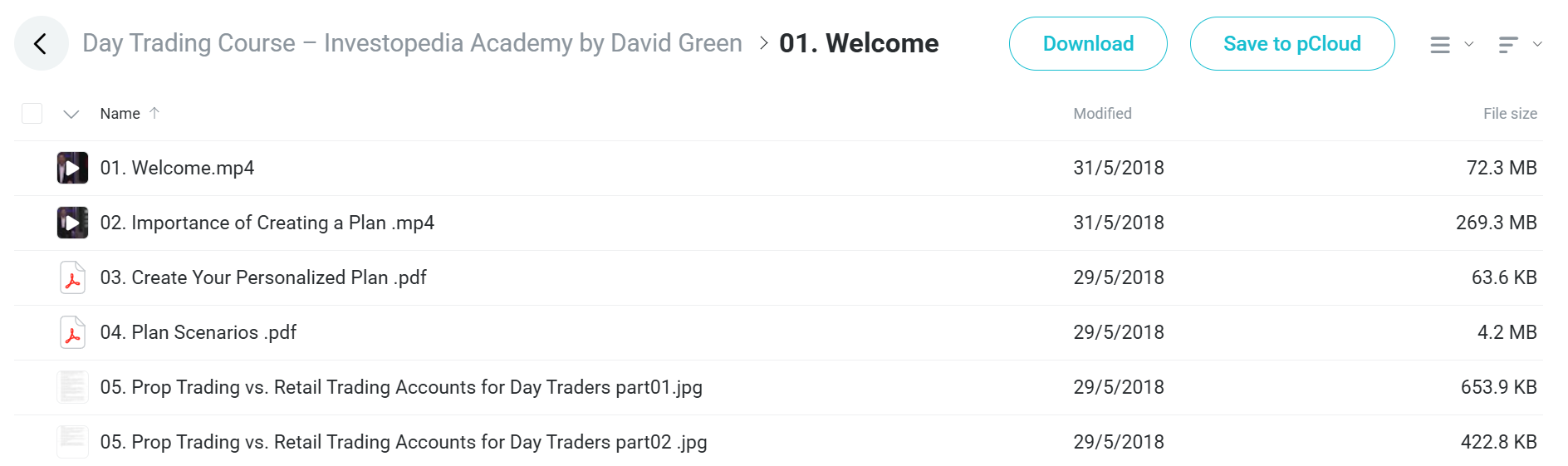

✅ Module 1: Welcome

The first module builds the foundation for successful day trading by stressing the importance of creating your own trading plan. David Green shows students different planning options and compares professional trading accounts versus regular trading accounts, helping new traders understand their choices and set realistic goals.

Key lessons include how to make planning documents that fit your own financial situation and comfort with risk. The module also shows the differences between professional and regular trading settings, giving students insight into the benefits and limits of each approach.

✅ Module 2: Understanding Markets

This short but important module gives students basic knowledge about how markets are structured and how exchanges work. Students learn how different markets function, including how exchanges, market makers, and traders interact, building a basic understanding of the environment they’ll be trading in.

The video lesson breaks down complex market concepts into easy-to-understand ideas, making sure students grasp how orders are processed and trades are completed across various exchanges before moving to more advanced trading topics.

✅ Module 3: Language Of The Stock Market

Students learn the basic terms and concepts that make up trading communication. The module covers important order types (limit, market, and stop orders), explains what volume and volatility mean, and clarifies the basic concepts of buying (long) and selling (short) positions.

These lessons ensure students can understand market information correctly and express their trading intentions clearly. By learning this trading vocabulary, students develop the ability to read market signals and use the right trading strategies based on current market conditions.

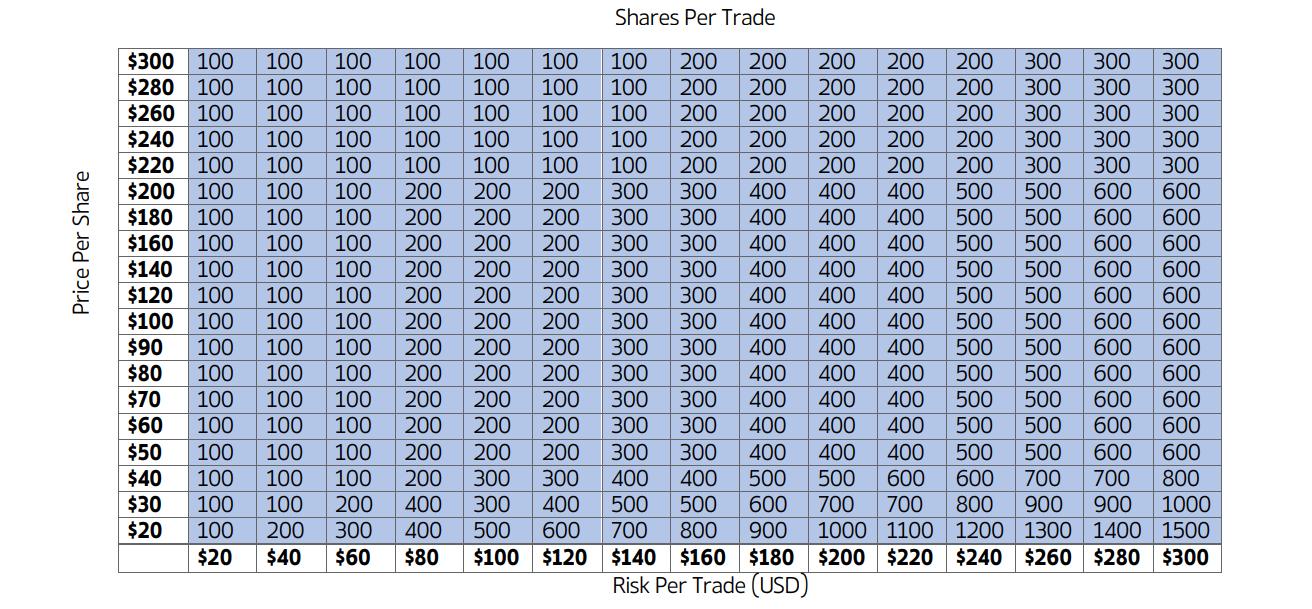

✅ Module 4: Money Management

This key module addresses one of the most important aspects of successful trading: protecting your money and managing risk. Students learn to create a trading matrix that helps measure and manage risk in different market conditions. The video explains practical money management techniques that protect trading capital while positioning for growth.

The trading matrix provides a step-by-step approach to deciding position sizes, where to place stop-losses, and setting profit targets based on personal risk comfort. This organized approach to money management helps prevent making emotional decisions during trades.

✅ Module 5: David’s Five Rules of Trading Psychology

Green shares his personal mental framework for staying disciplined and emotionally controlled while trading. The five rules—doing your own research, trading at your level, paying attention, leaving your ego behind, and moving on from losses—form a complete approach to the mental side of trading.

Each rule is explored in its own lesson with practical examples and how to use them. This module helps students recognize and overcome common mental traps that lead to trading mistakes, building healthy trading habits that support long-term success.

✅ Module 6: Introduction To Trading Analysis

Students learn essential chart analysis tools that help with trading decisions. The module covers how to read charts with focus on candlestick patterns, moving averages as trend indicators, and the Relative Strength Index (RSI) for identifying when prices might be too high or too low.

These analysis tools are presented with practical uses, showing students not just how to calculate these indicators but how to interpret them in real market conditions. The lessons build a foundation for the specific trading strategies covered in later modules.

✅ Module 7: Six Kinds Of Trades

The largest module of the course introduces students to six specific trading strategies with multiple real examples for each approach. Students learn to spot and execute trend trades, moving average trades, base trades, consolidation trades, double top/bottom trades, and trades based on price distance from moving averages.

Each strategy is shown with detailed examples showing entry points, stop-loss placement, profit targets, and trade management techniques. By providing two examples for most strategies, Green shows how the same principles work across different market conditions and stocks, helping students develop pattern recognition skills.

✅ Module 8: Beginning To Trade

The final module moves students from theory to practice, providing guidance on setting up trading workstations, understanding news events, and making actual trades. Students receive practical documents including a daily planning template and David Green’s personal watchlist method to put their new knowledge to use right away.

The module ends with a wrap-up that reinforces key course concepts and provides direction for continued learning and practice. The daily plan and watchlist documents offer ready-to-use templates that students can adapt to their personal trading style, creating a bridge between finishing the course and trading independently.

Who is David Green?

David Green is a Wall Street trader with over 35 years of experience in financial markets. He started on the New York Stock Exchange floor in 1985 and became a Specialist/Broker by 2000.

Green traded major companies like IBM, Bank of America, Goldman Sachs, and Best Buy during his career. His success let him retire before age 40.

Since 2009, Green has taught day trading to thousands of students. He created trading courses now available through Investopedia Academy and other platforms.

Green runs several trading education sites including The Green Room Trading Live, Wealth365, and ProfitAdvice. He combines real Wall Street experience with practical teaching methods.

His teaching uses micro-learning to break down complex trading ideas into simple lessons. This helps students learn faster and gain confidence for live trading.

Be the first to review “Investopedia Day Trading Course (David Green)” Cancel reply

Related products

Day Trading

Day Trading

Day Trading

Day Trading

Day Trading

Day Trading

Reviews

There are no reviews yet.