Intro to Short Selling – Madaz Money

$2,990.00 Original price was: $2,990.00.$39.00Current price is: $39.00.

Madaz Money Intro to Short Selling Course [Instant Download]

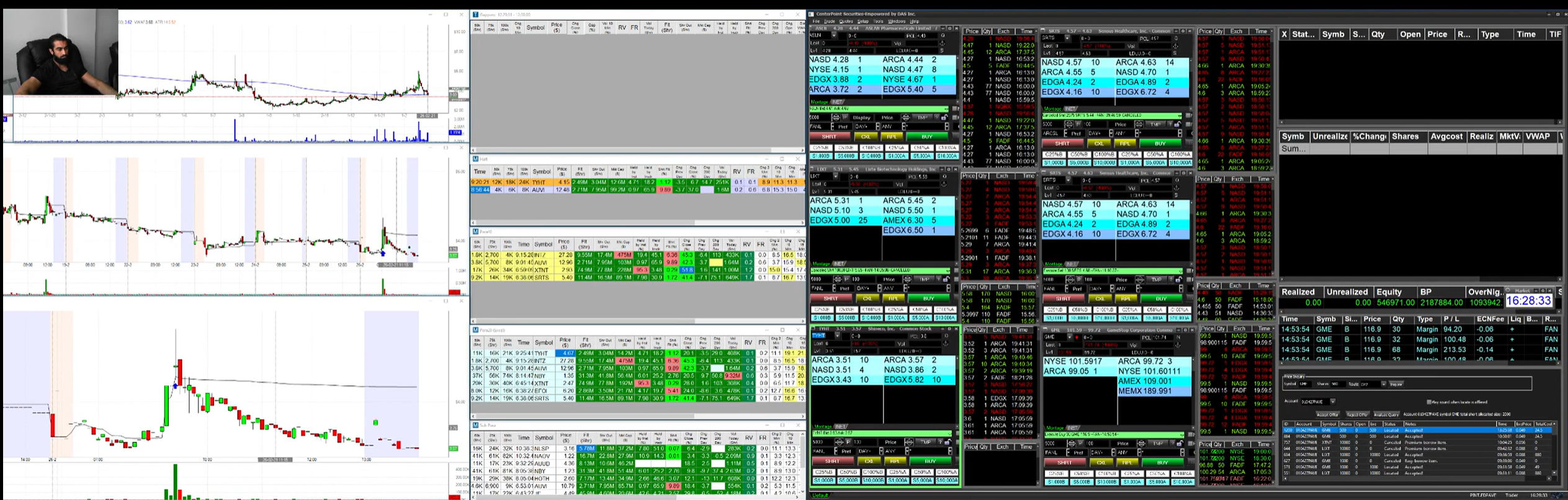

📚 PROOF OF COURSE

What is Madaz Money Intro to Short Selling:

Madaz Money’s Intro to Short Selling is a comprehensive course designed for traders looking to master the art of short selling.

This course delves into the nuances of bearish market strategies, offering insights into effective risk management and technical analysis. It’s tailored to enhance your trading skills, focusing on real-world applications and psychological resilience in volatile markets.

Whether you’re an experienced trader or looking to expand your trading repertoire, this course provides the tools and knowledge to navigate the complexities of short selling confidently.

What is Short Selling?

Short selling is a trading strategy where investors sell stocks they do not own, anticipating the stock’s price will decline. Here’s how it works:

- Step #1: Borrowing the Stock: Traders borrow shares from a broker.

- Step #2: Selling the Borrowed Stock: These borrowed shares are sold on the open market.

- Step #3: Buying Back the Stock: The goal is to buy back the stock at a lower price in the future.

- Step #4: Profiting from the Difference: If the stock price drops, traders buy it back at the lower price, return the shares to the broker, and keep the difference as profit.

Short Selling Strategies:

- Scalping: This involves making quick, small profits by taking advantage of price changes quickly.

- Swing Trading: This strategy aims to profit from stocks within a short to medium timeframe, capitalizing on patterns or trends in the market.

- Contrarian Trading involves betting against market trends, selling stocks when others are buying, and vice versa.

- Technical Analysis: Traders use charts and historical data to predict stock movements and make short selling decisions.

These strategies require a good understanding of market trends, risk management, and, often, a solid psychological mindset to handle the potential stress and rapid changes in the stock market.

What you will learn in Madaz Money Short Selling course:

- Understanding Short Selling Fundamentals: Grasp the core concepts of short selling, including market analysis and trade setups.

- Risk and Reward Management: Learn to balance potential gains with risks, ensuring informed decision-making in trading.

- Advanced Trading Techniques: Dive into specialized strategies like the Kris Verma Special and the Gap Up Short.

- Psychological Resilience: Develop mental strength to maintain composure and make calculated decisions under market pressure.

- Performance Tracking: Master data-driven methods for evaluating and enhancing your trading strategies.

Madaz Money Short Selling Course curriculum:

The Intro to Short Selling course by Madaz Money includes:

- Chapter 1: Intro to Short Selling – A foundational overview of short selling, covering essential strategies and market insights.

- Chapter 2: Trader Psychology – Focusing on the mental aspects of trading, this chapter teaches how to maintain emotional balance and make clear decisions under pressure.

- Chapter 3: The Kris Verma Special – Detailed exploration of the Kris Verma Special strategy, including its application and effectiveness in various market conditions.

- Chapter 4: The Gap Up Short – An in-depth look at the Gap Up Short strategy, discussing its nuances and implementation.

- Chapter 5: Mathematical Approach to Trading – Introduces a quantitative perspective on trading, emphasizing the importance of mathematical analysis in strategy development.

- Chapter 6: Data Tracking – Highlights the significance of tracking and analyzing trading data for continuous improvement and strategy refinement.

- Chapter 7: Trade Review – Offers practical insights into reviewing and learning from past trades, enhancing future trading performance.

Who is Madaz Money?

Madaz Money, known in the trading world as Max or Madaz, is a former structural engineer who pivoted to a highly successful career in day trading. Based in Los Angeles, California, Max’s journey into trading began amidst the challenges of the recession. With a Bachelor’s Degree in Civil/Structural Engineering from UC Irvine and a stint in graduate school at CSU Long Beach, Max’s early career was far from the trading floors.

His foray into trading was sparked by curiosity and necessity. Starting with a modest E*Trade account, Max experienced the highs and lows of trading, from beginner’s luck to significant losses and the eventual development of a winning strategy. His approach is characterized by high percentage scalp setups and a focus on minimizing stress and emotions in trading.

Max’s trading style and strategies, including the washout long, panic pop short, and halt and resume washout long, have gained him respect and recognition in the trading community. He emphasizes the importance of trading psychology, advocating for a fun and stress-minimized approach.

Max’s remarkable trading success, highlighted by a record year in 2020 with over $4 million in profits, is a testament to his skill and strategy. His background, journey, and achievements make him not just an expert in short selling but also a relatable and inspiring figure for aspiring traders.

1 review for Intro to Short Selling – Madaz Money

Add a review Cancel reply

Related products

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Options Trading

Anonymous (verified owner) –

worth every penny