ICT Charter Complete Course (2019)

$1,200.00 Original price was: $1,200.00.$17.00Current price is: $17.00.

ICT Charter Complete Course (2019) Course [Instant Download]

What is ICT Charter Complete Course?

ICT Charter 2019 is a forex trading course that teaching institutional price action through 12 proven models that banks and big institutions use.

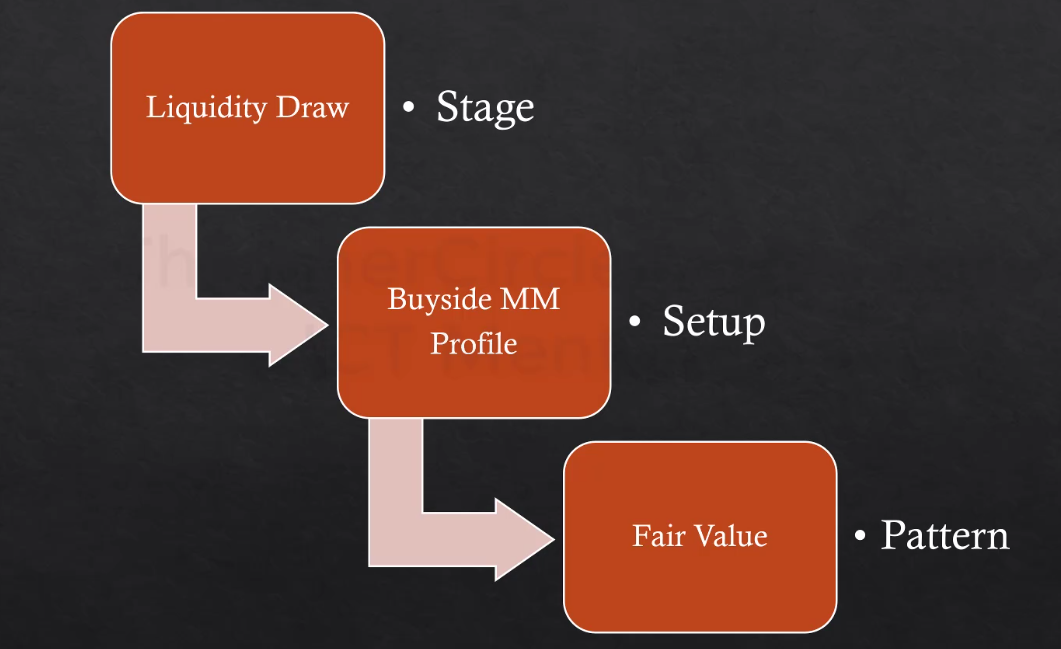

The course shows you order blocks, liquidity concepts, and market structure – the real tools institutions use to move markets.

You’ll learn how to find high-probability trades by understanding where smart money enters and exits.

ICT’s methods show market workings that most retail traders never see, giving you the same advantage institutional traders have.

📚 PROOF OF COURSE

What you’ll learn in ICT Charter Complete Course (2019):

This trading program teaches institutional methods that banks and large funds use. Here’s what you’ll master:

- Order Blocks theory: How institutions place orders and create market structure

- High probability FVGs: Where Fair Value Gaps form for best entries

- Market Makers Buy Models: Trade with institutional buying patterns

- Interbank vs Institutional Order Flow: The key differences between these concepts

- Advanced patterns: Including Clutch pattern and Artemis setup

- 12 complete trading models: From scalping to position trading

By the end, you’ll understand real market mechanics and trade with institutional precision using ICT’s methods.

ICT Charter Complete Course (2019) Course Curriculum:

✅ Price Action Model 1: Intraday Scalping Model

This part teaches the fastest trading style, where you make quick trades during the day using very small price movements. Students learn to spot and trade when big players push prices quickly within trading hours.

The first video shows basic ideas about how prices move during the day, how orders work, and signs that big traders are active. The second teaching video shows advanced ways to get in and out of trades fast, manage many quick trades, and stay focused when trading rapidly. You’ll learn about 15-minute and 5-minute charts, how to spot when big players are buying or selling, and how to trade with small losses.

✅ Price Action Model 2: Short Term Trading Model

This part increases your trading time to catch big weekly price moves and major turns during the week. Students learn to find important turning points that offer bigger profits than quick scalping.

The weekly range video teaches how to predict and trade strong moves that happen when prices break out of tight ranges. The reversal lessons show how to spot big midweek turns where smart traders change market direction. Students learn about weekly patterns, Wednesday reversals, and Friday closing analysis to get ready for big market moves.

✅ Price Action Model 3: Swing Trading Model

The swing trading part teaches daily chart reading, helping students catch moves that last several days or weeks. This model shows how big traders move prices between important daily levels.

Students learn to find daily highs and lows where lots of orders sit, understanding how big players use these levels. The extra lesson shows real examples of multi-day trades, teaching how to follow trends while avoiding common mistakes. Main skills include finding daily direction, failed breakout patterns, and best places to enter trades.

✅ Price Action Model 4: Position Trading Model

This detailed part teaches the longest trading style, focusing on three-month market changes and yearly patterns. Students learn to spot and trade major turns that can last months.

The video explains how big traders prepare for quarterly changes and yearly market patterns. The extra lesson gives past examples and data showing repeating yearly opportunities in different markets. Students learn quarterly patterns, yearly tendencies, and long-term market reading.

✅ Price Action Model 5: Session Day Trading Model

This model shows how to trade price jumps that happen during certain trading times. Students learn to use the different behaviors of Asian, London, and New York trading sessions.

The video explains how each session creates different chances based on order patterns and when big traders are active. The extra lesson gives practical ways to trade each session, including when sessions overlap and news events. You’ll learn session patterns, best trading times, and setups specific to each session.

✅ Price Action Model 6 & 7: Universal Trading Models

These advanced parts teach pattern-based models that work on all time frames and markets. Model 6 looks at upward price runs while Model 7 focuses on downward moves.

Students learn complex ideas about repeating patterns and how price shapes repeat on different time frames. The multiple videos allow deep study of easy price runs, teaching how to find paths where price moves easily. These models are the peak of ICT methods, giving tools that work in any trading situation.

✅ Price Action Models 8-12: Specialized Trading Methods

The final parts present specific trading plans with exact profit targets and risk rules. Model 8 shows the “6% Trading Model” for steady weekly gains, while Model 9’s “One Shot One Kill” method focuses on very likely setups.

Model 10 returns to swing trading with specific profit goals, Model 11 improves day trading to catch 30 pips per trade, and Model 12 goes back to scalping with better accuracy. Each model gives a complete trading system with rules for getting in, getting out, and managing risk for specific goals.

What is ICT (Inner Circle Trader)?

Michael J. Huddleston, known as The Inner Circle Trader (ICT), is a forex trader and educator with 25+ years experience. He created special trading methods based on institutional order flow.

ICT became famous through free YouTube content sharing advanced ideas usually kept by institutional traders. His teaching shows how banks and institutions move price action.

In 2016, he started private mentorship programs including the Charter series. ICT’s approach focuses on market structure, liquidity concepts, and time-based analysis.

His methods have helped thousands of traders worldwide. ICT explains difficult market workings in clear, easy-to-understand ideas.

Be the first to review “ICT Charter Complete Course (2019)” Cancel reply

Related products

Forex Trading

Forex Trading

Day Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.