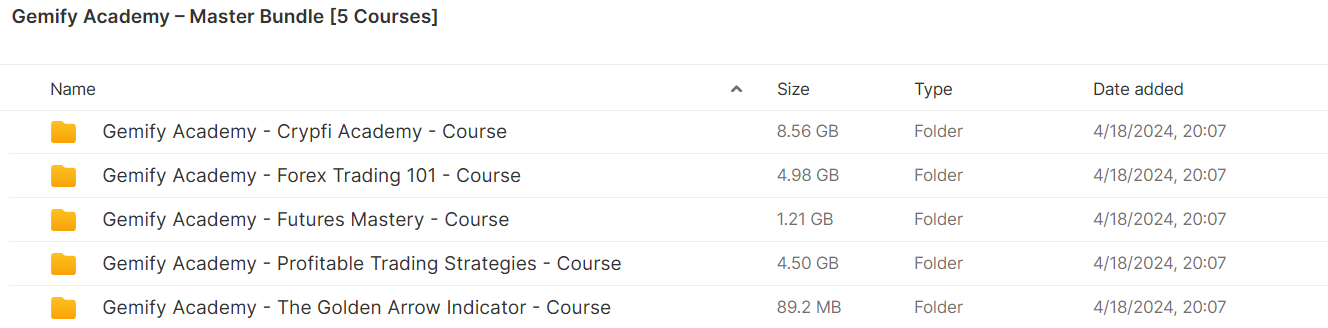

Gemify Academy – Master Bundle (5 Courses)

$397.00 Original price was: $397.00.$12.00Current price is: $12.00.

Gemify Academy Master Bundle Course [Instant Download]

1️⃣. What is Gemify Academy Master Bundle?

Gemify Academy’s Master Bundle teaches comprehensive trading skills through five specialized courses.

Learn to trade Forex, Cryptocurrency, DeFi, Futures markets, and apply proven strategies using the exclusive Golden Arrow Indicator.

Access Gemify’s active Discord community and save 65% compared to individual course purchases. This bundle gives you everything needed to trade multiple financial markets with confidence.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Master Bundle:

Gemify Academy’s Master Bundle teaches you everything needed for trading success across different markets. Here’s what you’ll learn:

- Trading psychology basics to build the right mindset for steady profits

- Technical analysis skills to read charts and make better trading decisions

- Market-specific strategies for Forex, Futures, Cryptocurrencies, and DeFi

- Portfolio building methods to grow your trading account wisely

- Risk management techniques to protect your money while making more

- Golden Arrow Indicator use to spot the best trading opportunities

The courses mix key concepts with real trading examples and live webinars. When finished, you’ll know how to trade confidently across many financial markets.

3️⃣. Master Bundle Course Curriculum:

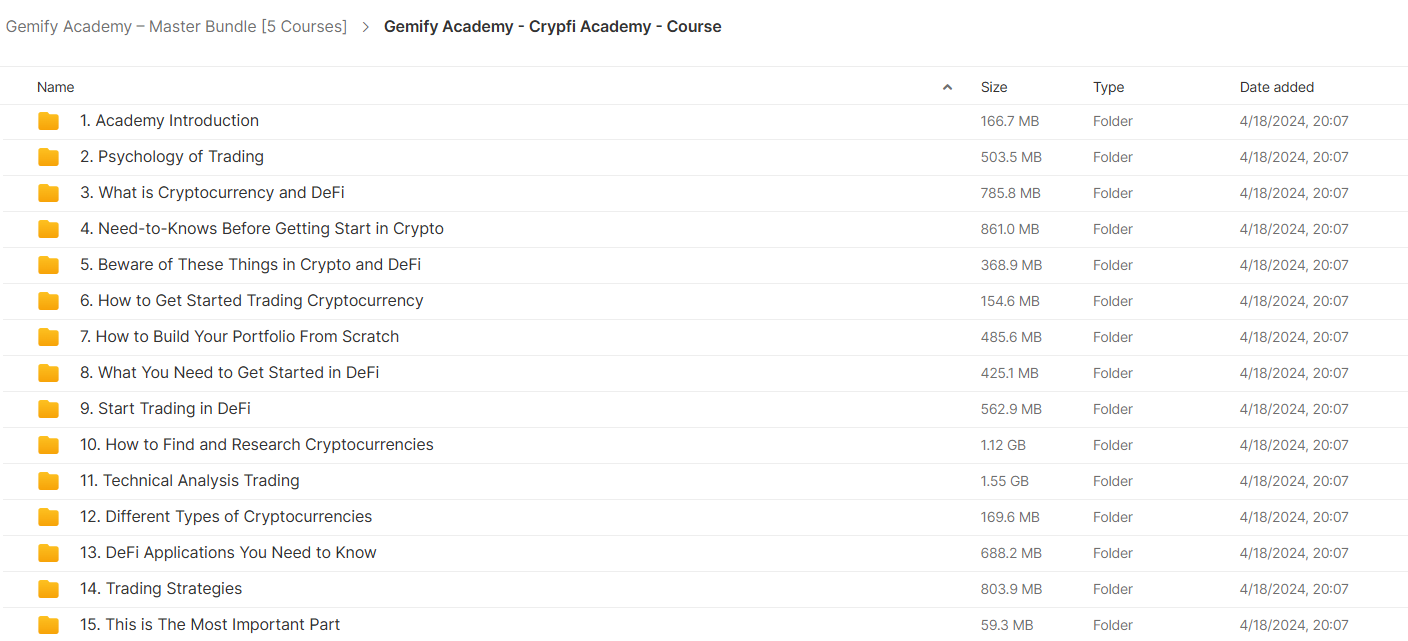

✅ Section 1: Gemify Academy – Crypfi Academy

This comprehensive cryptocurrency and DeFi trading course provides beginners with essential knowledge to navigate digital asset markets. From psychological fundamentals to advanced trading techniques, students gain practical skills for building and managing a crypto portfolio.

Module 1.1: Academy Introduction

The introductory module welcomes students and sets clear expectations for the entire course. Students receive an overview of learning objectives and the educational journey ahead.

Module 1.2: Psychology of Trading

This module explores the mental aspects of trading, emphasizing that real money is at stake. Students learn invaluable mindset principles including taking profits, avoiding emotional attachments to investments, and capitalizing on market corrections.

Module 1.3: What is Cryptocurrency and DeFi

A foundational module explaining the core concepts of cryptocurrency, blockchain technology, and decentralized finance. Students explore the fundamental building blocks of the crypto ecosystem including dApps and smart contracts.

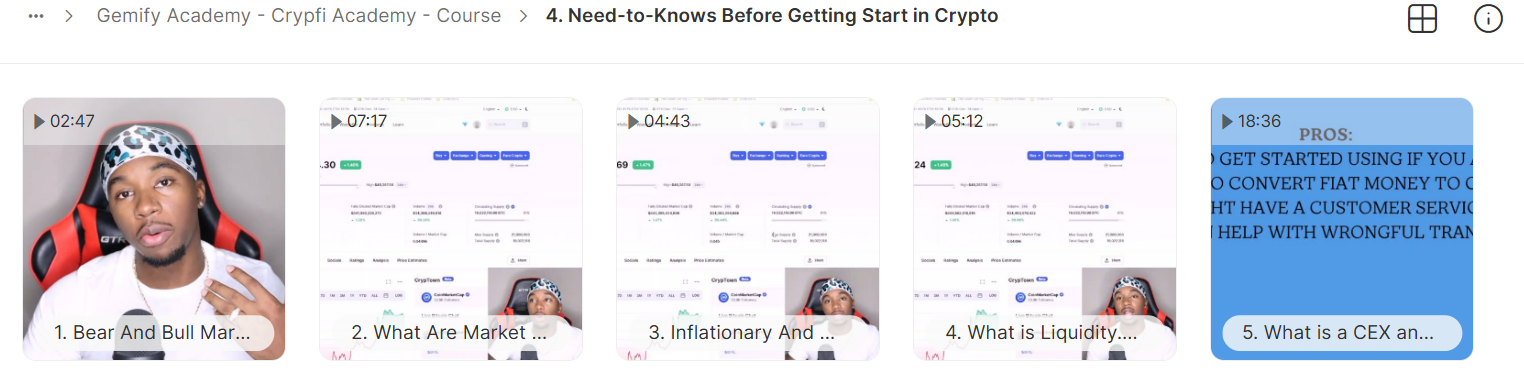

Module 1.4: Need-to-Knows Before Getting Started in Crypto

This module covers essential market terminology and concepts crucial for new investors. Students learn about market cycles, capitalization metrics, monetary policy in cryptocurrencies, liquidity fundamentals, and exchange platforms.

Module 1.5: Beware of These Things in Crypto and DeFi

A critical module focused on security awareness and scam prevention in the cryptocurrency space. Students learn to identify common fraudulent schemes and assess project legitimacy through contract ownership verification.

Module 1.6: How to Get Started Trading Cryptocurrency

This practical module guides students through the process of creating and utilizing a Coinbase wallet. Students gain hands-on experience with one of the most popular cryptocurrency exchanges.

Module 1.7: How to Build Your Portfolio From Scratch

This strategic module provides realistic approaches to portfolio development. Students learn sustainable growth strategies, including maintaining stable income sources and leveraging passive crypto income for reinvestment.

Module 1.8: What You Need to Get Started in DeFi

A technical module covering essential wallet setup for decentralized finance participation. Students learn to configure MetaMask, connect to various blockchain networks, and navigate analytics platforms like Dextools.

Module 1.9: Start Trading in DeFi

This applied module introduces students to decentralized trading across multiple networks. Students explore exchange options, gas optimization techniques, and centralized alternatives including KuCoin trading procedures.

Module 1.10: How to Find and Research Cryptocurrencies

This investigative module teaches discovery methods for high-potential crypto projects. Students develop analytical skills to evaluate cryptocurrency fundamentals and growth potential.

Module 1.11: Technical Analysis Trading A comprehensive module on chart analysis for cryptocurrency trading. Students learn to interpret price patterns, recognize candlestick formations, develop trading strategies, perform historical testing, and execute specific scalping techniques.

Module 1.12: Different Types of Cryptocurrencies

This classification module examines major cryptocurrency categories and their unique characteristics. Students gain understanding of stablecoins, gaming tokens, and meme coins within the broader crypto ecosystem.

Module 1.13: DeFi Applications You Need to Know

This practical module explores essential decentralized finance products and services. Students learn about staking mechanisms, yield farming strategies, and platforms for borrowing and lending crypto assets.

Module 1.14: Trading Strategies

An extensive module covering diverse approaches to cryptocurrency trading. Students explore methodologies from conservative long-term investing to high-risk trading, including technical and fundamental analysis frameworks.

Module 1.15: This is The Most Important Part

The culminating module delivers critical insights that tie together the entire course curriculum. Students receive essential guidance that reinforces key learning objectives from previous modules.

✅ Section 2: Gemify Academy – Forex Trading 101

This introductory foreign exchange trading course provides students with essential knowledge for currency market participation. The curriculum balances technical skills with psychological resilience needed for consistent forex trading success.

Module 2.1: Basic Forex Knowledge

This foundational module introduces the foreign exchange market structure. Students learn about major currency pairs, global trading sessions, and essential terminology used by forex professionals.

Module 2.2: Trading Psychology

This critical module addresses the mental aspects of currency trading. Students develop disciplined approaches to risk management, personal trading style awareness, and sustainable profit-building strategies.

Module 2.3: Technical Analysis

A comprehensive module on chart-based trading methodologies. Students learn to interpret market patterns, recognize candlestick signals, develop systematic strategies, conduct historical testing, and implement specific approaches including Heikin Ashi analysis.

Module 2.4: How to Start Trading

This practical module guides students through the technical setup process for forex trading. Students learn to select appropriate brokers and configure MetaTrader 4 on different operating systems.

Module 2.5: This is the Most Important Part

The culminating module delivers essential insights that integrate previous learning components. Students receive critical guidance that maximizes their potential for forex trading success.

Module 2.6: Live Webinars

This supplementary module provides recordings of interactive training sessions. Students gain access to expert commentary, market analysis, and answers to common questions from five different webinar dates throughout 2023.

✅ Section 3: Gemify Academy – Futures Mastery

This specialized course focuses on derivatives trading in futures markets. Students learn contract mechanics, platform navigation, and professional trading approaches including prop firm participation.

Module 3.1: Join The Exclusive Discord

This community access module connects students with other futures traders. Students receive resources for ongoing support beyond the course materials.

Module 3.2: Introduction

The introductory module establishes foundational concepts for the futures trading curriculum. Students gain a broad overview of course objectives and learning expectations.

Module 3.3: Basic Trading Knowledge

This practical module covers essential technical tools for futures analysis. Students learn to utilize TradingView effectively and interpret specialized Heikin Ashi candlestick patterns.

Module 3.4: Understanding Futures Contracts and Key Terms

This comprehensive module explains the mechanics and terminology of derivatives markets. Students explore the benefits of futures trading, essential vocabulary, and standardized contract designation systems.

Module 3.5: Getting Started Trading

This applied module guides students through practical aspects of futures market participation. Students learn about popular contracts, information interpretation, market behavior patterns, platform selection, Tradovate usage, and data access procedures.

Module 3.6: Prop Firm Trading

This advanced module introduces professional trading opportunities through proprietary firms. Students learn about advantages of funded accounts and receive recommendations for reputable futures prop firms.

Module 3.7: This is The Most Important Part

The culminating module delivers critical insights that integrate previous futures trading concepts. Students receive essential guidance that maximizes their potential for success in derivatives markets.

Module 3.8: Live Masterclass Webinar

This supplementary module provides an interactive training recording with expert Q&A. Students gain access to comprehensive futures trading instruction with direct answers to common questions.

✅ Section 4: Gemify Academy – Profitable Trading Strategies

This advanced course delivers specific, actionable trading methodologies across multiple markets. Students gain practical techniques supported by real examples and expert commentary from regular webinars.

Module 4.1: The Money Makers

This extensive module provides seven distinct trading methodologies. Students learn scalping approaches, breakout strategies for different timeframes, support and resistance techniques, and specialized Natural Gas trading methods.

Module 4.2: Real Examples Of Strategies

This practical application module demonstrates the taught strategies in actual market conditions. Students observe how four key methodologies perform in real trading scenarios.

Module 4.3: This is The Most Important Part

The culminating module delivers essential insights that integrate previous strategic concepts. Students receive critical guidance that maximizes their potential for implementing profitable trading approaches.

Module 4.4: Live Webinars

This supplementary module provides recordings of interactive training sessions. Students gain access to expert commentary, market analysis, and answers to common questions from five different webinar dates throughout 2023.

✅ Section 5: Gemify Academy – The Golden Arrow Indicator

This specialized tool-based course teaches students to implement a proprietary trading indicator. The curriculum focuses on practical setup and effective application for market analysis.

Module 5.1: Join the Exclusive Discord

This community access module connects students with other indicator users. Students receive resources for ongoing support beyond the course materials.

Module 5.2: Setup and Use

This technical module provides step-by-step guidance for indicator implementation. Students learn proper configuration procedures and effective application methods for the Golden Arrow trading tool.

4️⃣. What is Gemify Academy?

Gemify Academy teaches practical trading skills for multiple financial markets.

Their courses work for both beginners and experienced traders, focusing on real-world trading with actual examples rather than just theory.

All instructors actively trade the markets they teach. The academy hosts regular live webinars where students see instructors analyze current markets using the taught strategies.

Gemify offers an exclusive Discord community for ongoing support. Members connect with other traders and continue learning through regular interaction.

The academy created the Golden Arrow Indicator, a special tool that helps traders find high-probability trading setups across different timeframes and markets.

Gemify puts strong emphasis on trading psychology, with dedicated lessons on developing the right mindset for consistent profits.

5️⃣. Who should take Gemify Academy Course?

Gemify Academy’s Master Bundle helps traders of all levels improve their skills across different markets. This course is perfect for:

- Beginning traders who need a clear learning path with key trading concepts and how to use them

- Forex traders wanting to expand into cryptocurrency, DeFi, or futures markets with expert guidance

- Cryptocurrency enthusiasts ready to move from just holding coins to active trading using technical analysis

- Experienced traders looking for new strategies or access to the special Golden Arrow Indicator

- Prop firm candidates getting ready for trading tests who need proven strategies and risk management skills

This complete bundle has everything you need to start or grow your trading career while saving 65% compared to buying each course separately. If you want to become better at trading in multiple markets, this bundle gives you great value.

6️⃣. Frequently Asked Questions:

Q1: How long does it take to become proficient in trading?

Q2: What’s the difference between Forex and cryptocurrency trading?

Q3: Can I trade Forex and crypto at the same time?

Q4: What are the most important skills for a trader?

Q5: How much capital do I need to start trading?

Be the first to review “Gemify Academy – Master Bundle (5 Courses)” Cancel reply

Related products

Crypto Trading

Trading Courses

Trading Courses

Forex Trading

Trading Courses

Options Trading

Trading Courses

Stock Trading

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-300x300.jpg)

Reviews

There are no reviews yet.