G7fx – G7FX Pro & Foundation Courses

$789.00 Original price was: $789.00.$37.00Current price is: $37.00.

Neerav Vadera G7FX Pro & Foundation Courses Course [Instant Download]

What is Neerav Vadera G7FX Pro & Foundation Courses?

G7FX Pro & Foundation Courses is a forex trading program that teaches you how to trade forex like institutional professionals at major banks and prop firms.

You’ll master order flow analysis, VWAP profiling, and market structure techniques that big money uses to move markets.

The program shows you how to read market depth, analyze volume profiles, and understand institutional trading behavior. Vadera breaks down complex bank trading methods into simple, practical steps you can apply immediately.

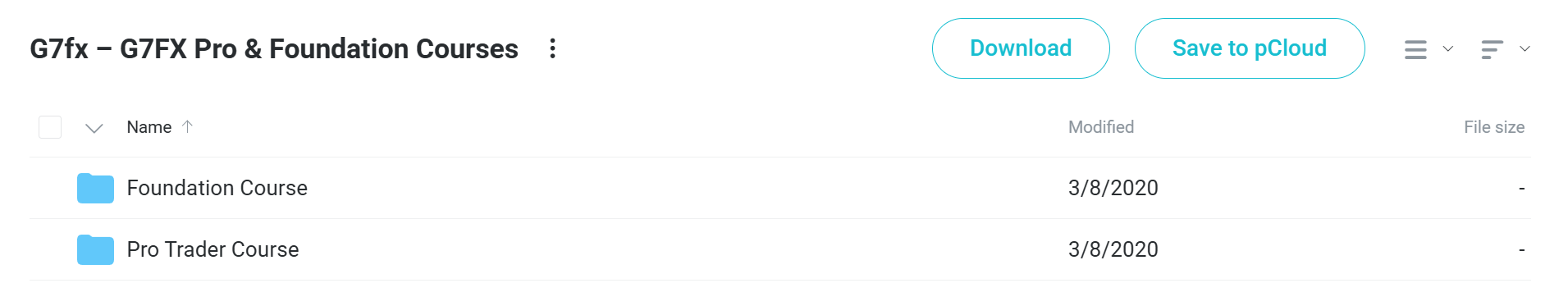

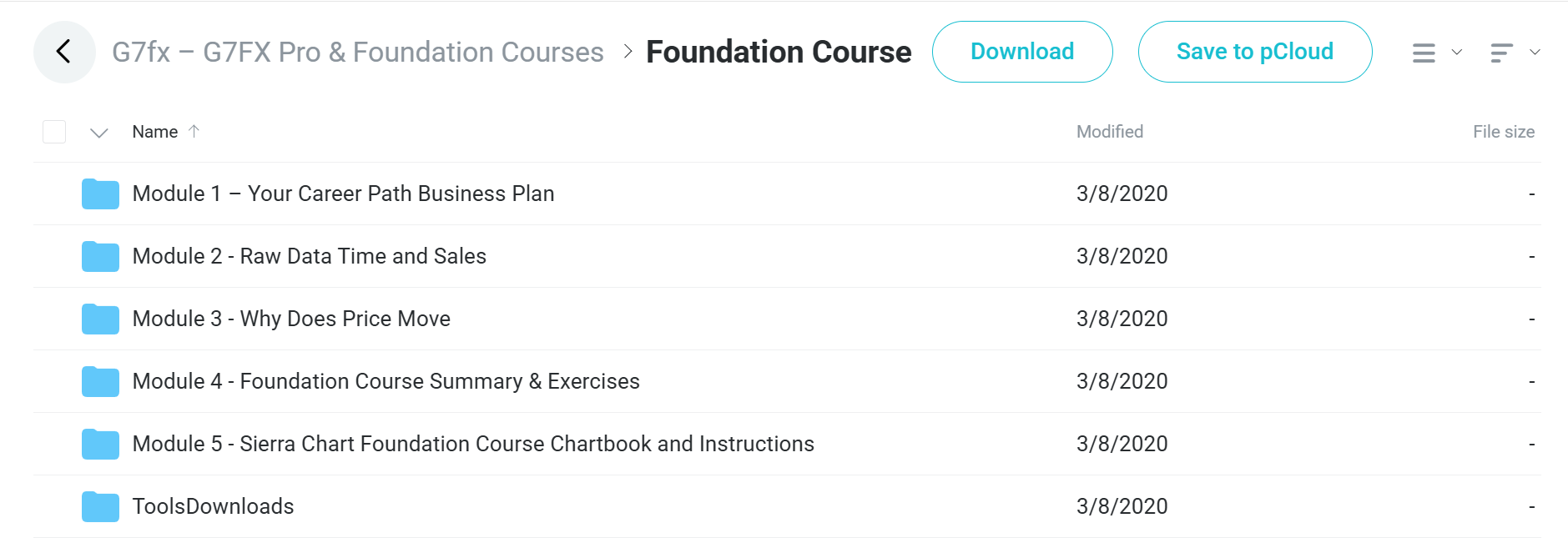

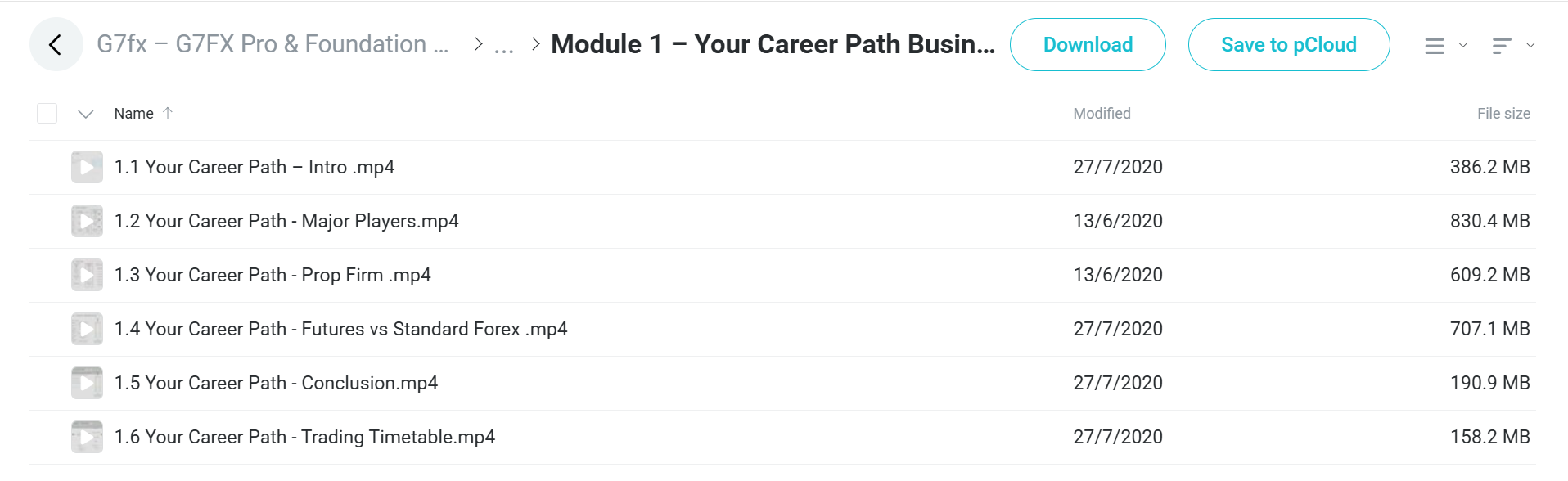

📚 PROOF OF COURSE

What you’ll learn in G7FX Pro & Foundation Courses:

This trading education teaches you institutional forex strategies used by professional traders. Here’s what you’ll learn:

- Foundation trading concepts: Career path planning, raw data analysis, and understanding why price moves in the markets.

- Advanced Market Theory (AMT): Supply side control, balance vs imbalance, and how to measure trading probability well.

- VWAP analysis: Dynamic vs static value concepts, idea building, and institutional entry/exit strategies for better timing.

- Order flow techniques: Footprint charts, cumulative delta analysis, and DOM trading methods to read real market activity.

- Professional tools: Sierra Chart platform setup, chartbook setup, and real-time market analysis for live trading.

- Practical use: Live trading examples, hands-on exercises, and institutional journaling methods to track your progress.

The course connects theory with practice through real market examples and exercises. You’ll develop skills to trade like institutional professionals using proven strategies that work in live markets.

G7FX Pro & Foundation Courses Course Curriculum:

✅ Module 1: Your Career Path Business Plan

Students build a clear plan for their trading career by understanding the professional trading world. The module looks at major market players including prop firms, hedge funds, and big trading companies, helping students find their best career path.

Key lessons include comparing futures versus standard forex trading, understanding prop firm setups and what they require, and creating a personal trading schedule. Students learn to treat trading as a business rather than gambling, setting realistic goals and professional standards from the start.

✅ Module 2: Raw Data Time and Sales

This module teaches students the basic building blocks of market data through Time and Sales (T&S) analysis. Students learn to read raw market trades and understand how individual trades create price movement patterns.

The course focuses on real practice through live market examples, teaching students to read the “tape” and spot big trader activity. Students learn skills in recognizing important volume patterns and understanding how large orders affect price discovery in real-time market conditions.

✅ Module 3: Why Does Price Move

Students learn the reasons behind price movement through Depth of Market (DOM) analysis across two complete live examples. This module shows how order flow imbalances create trading opportunities and price momentum.

The focus moves from learning theory to real practice, showing students how to spot supply and demand imbalances before they become obvious on price charts. Students learn to predict price moves by reading what market players want to do through order book activity.

✅ Module 4: Foundation Course Summary & Exercises

This hands-on module brings together foundation ideas through real trading exercises and real-world practice. Students complete five step-by-step tasks covering trade placement, supply side games, absorption analysis, and introduction to Auction Market Theory (AMT).

The exercises include live DOM trading examples and working with the G7FX Discord community levels. Students learn to combine multiple analysis methods while building confidence in their ability to make trades based on order flow ideas rather than traditional chart analysis.

✅ Module 5: Sierra Chart Foundation Course

Students get complete training on the Sierra Chart platform, which is the main analysis tool used throughout the program. The module covers chartbook setup, futures code explanation, and platform setup for order flow analysis.

This technical foundation makes sure students can use professional-grade tools for their analysis. The module connects learning theory with real practice by giving the technology foundation needed for advanced trading methods.

✅ Stage 1: Context (AMT – Auction Market Theory)

Students master Auction Market Theory as the basic framework for understanding market structure and how traders behave. The course covers supply side dominance, balance versus imbalance ideas, and probability measurement methods that big traders use.

Market Profile and Volume Profile analysis forms the main part of this stage, teaching students to find value areas and market acceptance levels. Students learn to think like big traders, understanding how large players position themselves and influence market direction through their trading activities.

The stage includes complete hands-on tasks and access to the G7FX Discord community, where students can apply their learning in real-time market conditions. The Value Expectations Framework gives a step-by-step approach to evaluating trading opportunities based on big trader logic.

✅ Stage 2: Hypothesis Building (VWAP & Profile)

This advanced stage teaches students to build trading ideas using Volume Weighted Average Price (VWAP) analysis combined with Profile methods. Students learn to tell the difference between static and dynamic value ideas, understanding how big traders use these levels for position building.

The course focuses on real practice through multiple tasks focusing on higher timeframe VWAP analysis and key market player identification. Students build skills in recognizing Other Timeframe (OTF) players and their impact on current market activity.

Advanced ideas include big trader journaling methods and step-by-step trade planning using VWAP-based strategies. Students learn to think beyond simple chart levels, understanding the underlying big trader logic that drives significant price movements and trend development.

✅ Stage 3: Order Flow (Footprint & Cumulative Delta)

The final stage combines advanced order flow analysis through Footprint charts and Cumulative Delta indicators. Students learn to read the “footprint” of big trader activity, spotting significant buying and selling pressure before it becomes clear in traditional price action.

Cumulative Delta analysis teaches students to track the ongoing battle between buyers and sellers, giving early warning signals for potential reversals or continuation patterns. The course focuses on real practice through live market examples and step-by-step analysis methods.

Students master the combination of time-based versus non-time-based charting methods, understanding when each approach gives better insight. The final parts include delta statistics reading and real-time footprint analysis, preparing students for professional-level trading execution.

Who is Neerav Vadera?

Neerav Vadera is the founder of G7FX and a former institutional trader with over 16 years in financial markets. He started his career on the trading floor at Barclays Investment Bank.

At Barclays, Vadera worked with a team that managed about 10% of the global forex market. This gave him real experience in how big money moves markets.

After Barclays, he worked with top prop trading firms and advised central banks and hedge funds. His banking background helps students learn real trading strategies used by major institutions.

Vadera created G7FX to teach institutional trading methods to retail traders. His courses teach order flow analysis, market structure, and professional trading techniques he used during his banking career.

Be the first to review “G7fx – G7FX Pro & Foundation Courses” Cancel reply

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.