Futex Live – Price Ladder Training

$1,200.00 Original price was: $1,200.00.$25.00Current price is: $25.00.

Futex Live Price Ladder Training Course [Instant Download]

1️⃣. What is Price Ladder Training:

Futex Live Price Ladder Training teaches you how to read order flow and trade like an institutional trader using the Price Ladder (DOM) platform.

The course uses FutexLive’s Replay technology to help you practice reading real market patterns. You’ll learn to spot large orders, identify algorithm patterns, and trade during volatile market events.

This training shows you exactly how professional traders use order flow to find profitable trading opportunities. Each lesson combines replay drills with hands-on practice to build your trading skills.

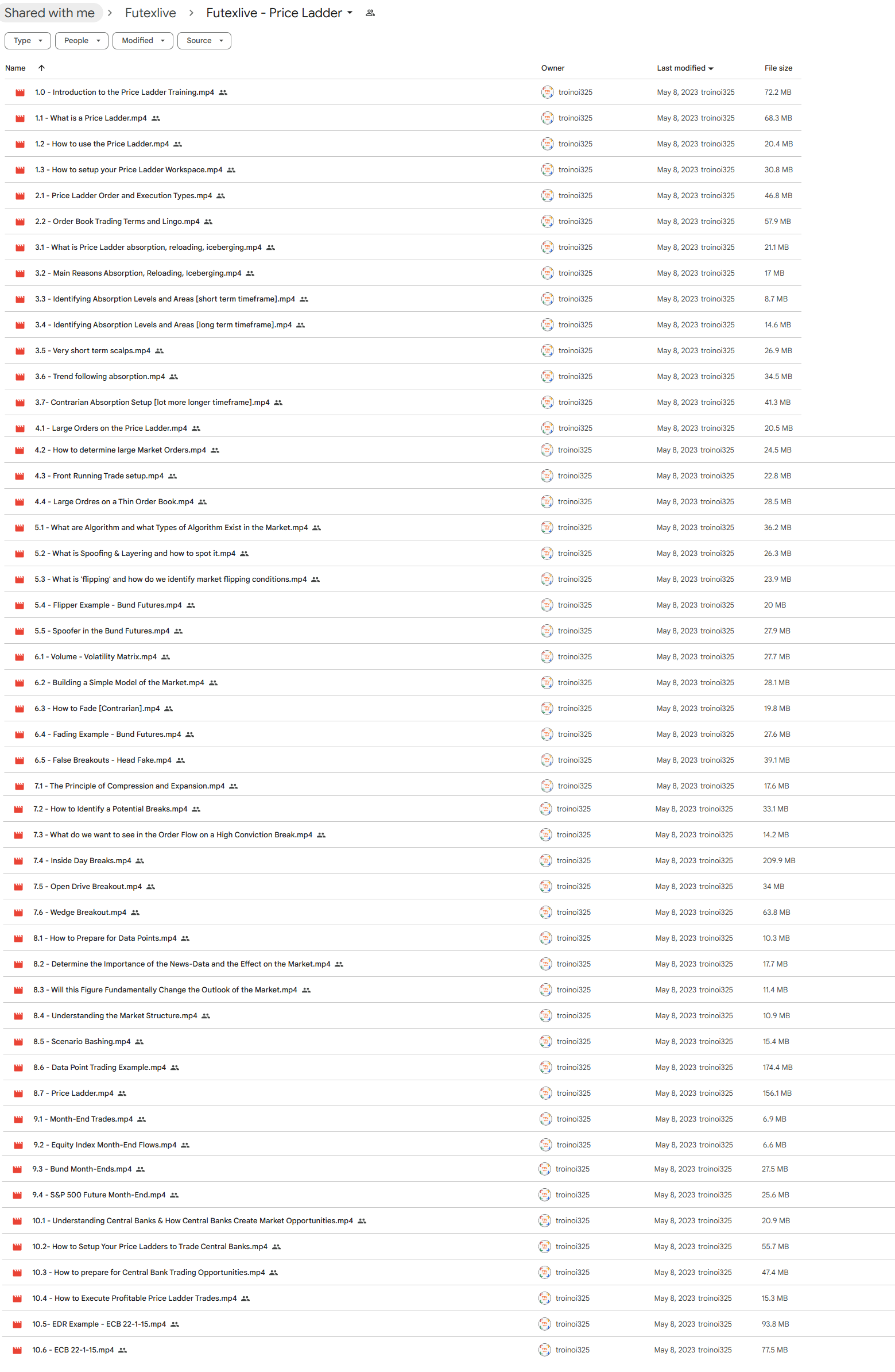

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Price Ladder Training:

Price Ladder Training shows you how to trade using advanced order flow techniques that professional traders use. Here’s what you’ll learn:

- Order Flow Reading: Learn to read market depth and spot trading opportunities in the order book

- Price Ladder Mastery: Use the Price Ladder/DOM tool to enter and exit trades with precision

- News Trading: Make profits from major news events and central bank announcements

- Algorithm Spotting: Learn to identify and trade alongside automated trading patterns

- Risk Control: Build a systematic approach to protect your capital while trading

- Market Understanding: Read how big institutions trade and follow price movements

You’ll practice these skills using FutexLive’s replay technology, which lets you trade real market scenarios until you master them.

3️⃣. Price Ladder Training Course Curriculum:

✅ Section 1: Price Ladder Fundamentals

This section introduces the foundational concepts of price ladder trading and workspace setup. Students learn essential tools and configurations for successful order flow trading.

Module 1.1: Introduction to Price Ladder

Comprehensive overview of price ladder trading principles and basic setup configurations. Students learn core concepts and practical implementation methods. (MP4)

- Introduction to Training (MP4)

- Price Ladder Fundamentals (MP4)

- Implementation Techniques (MP4)

- Workspace Configuration (MP4)

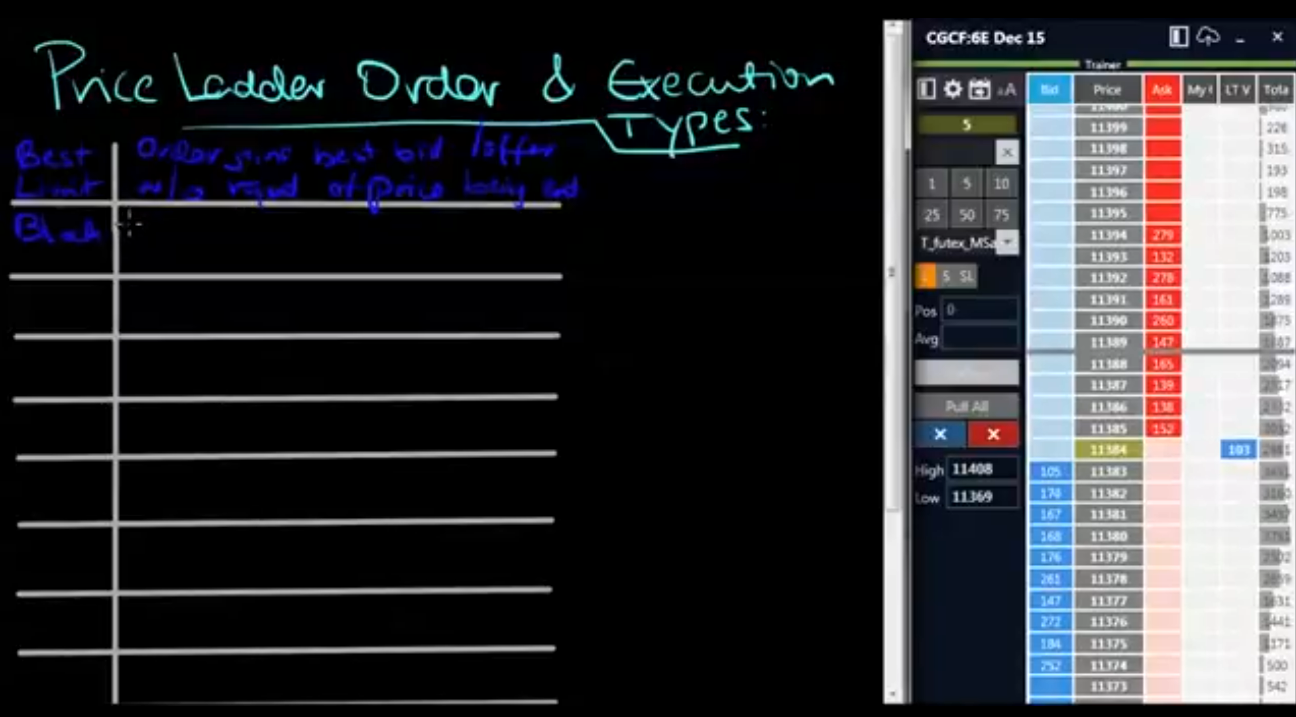

✅ Section 2: Order Flow Mechanics

This section covers the technical aspects of order execution and market terminology. Students develop understanding of core trading concepts and industry terminology.

Module 2.1: Trading Mechanics

Detailed exploration of order types, execution methods, and professional trading terminology. Focus on practical application of order flow concepts. (MP4)

- Order and Execution Types (MP4)

- Market Terminology (MP4)

✅ Section 3: Advanced Order Flow Analysis

This section explores sophisticated order flow patterns and trading strategies. Students learn to identify and capitalize on market absorption patterns.

Module 3.1: Market Absorption Patterns

In-depth analysis of market absorption, reloading, and strategic trading approaches across different timeframes. (MP4)

- Absorption Fundamentals (MP4)

- Pattern Recognition (MP4)

- Trading Applications (MP4)

✅ Section 4: Large Order Analysis

This section focuses on identifying and trading around significant market orders. Students learn to recognize and capitalize on institutional order flow.

Module 4.1: Institutional Order Flow

Strategic approaches to identifying and trading large market orders and thin order book conditions. (MP4)

- Large Order Identification (MP4)

- Market Order Analysis (MP4)

- Trading Strategy Implementation (MP4)

✅ Section 5: Market Algorithms and Patterns

This section examines algorithmic trading patterns and market manipulation techniques. Students learn to identify and respond to various market conditions.

Module 5.1: Algorithm Analysis

Comprehensive coverage of market algorithms, pattern recognition, and strategic responses. (MP4)

- Algorithm Types (MP4)

- Pattern Recognition (MP4)

- Market Conditions Analysis (MP4)

✅ Section 6: Advanced Trading Strategies

This section explores sophisticated trading approaches including contrarian strategies and market modeling. Students learn practical implementation of advanced concepts.

Module 6.1: Strategic Trading

Advanced trading strategies and market analysis techniques with practical examples. (MP4)

- Market Modeling (MP4)

- Contrarian Approaches (MP4)

- Strategy Implementation (MP4)

✅ Section 7: Market Structure Analysis

This section covers market dynamics and breakout patterns. Students learn to identify and trade various market conditions effectively.

Module 7.1: Market Dynamics

Comprehensive analysis of market compression, expansion, and breakout patterns. (MP4)

- Market Principles (MP4)

- Breakout Analysis (MP4)

- Pattern Trading (MP4)

✅ Section 8: Event-Driven Trading

This section focuses on trading around significant market events and data releases. Students learn to prepare for and execute trades during high-impact events.

Module 8.1: Event Trading

Strategic approaches to trading market events and analyzing market impact. (MP4)

- Event Preparation (MP4)

- Market Impact Analysis (MP4)

- Trading Implementation (MP4)

✅ Section 9: Seasonal Trading Patterns

This section explores recurring market patterns and institutional flows. Students learn to identify and capitalize on predictable market movements.

Module 9.1: Market Flows

Analysis of month-end flows and seasonal patterns across various markets. (MP4)

- Month-End Trading (MP4)

- Market-Specific Patterns (MP4)

✅ Section 10: Central Bank Trading

This section covers trading around central bank events and policy decisions. Students learn to prepare for and execute trades during these high-impact situations.

Module 10.1: Policy Trading

Comprehensive coverage of central bank trading opportunities and execution strategies. (MP4)

- Central Bank Analysis (MP4)

- Trading Setup (MP4)

- Implementation Strategy (MP4)

4️⃣. What is Futex Live?

Futex Live was a London trading firm that trained professional traders in order flow trading. They were known for their high-quality training programs and practical teaching methods.

Working with EasyScreen, they created special replay technology that lets traders practice with real market data. Their training focused on repeated practice, just like how athletes train.

Though Futex Live closed in 2017, their Price Ladder Training program captures years of institutional trading expertise. The course teaches the same methods used by their successful traders.

5️⃣. Who should take Futex Live Course?

Price Ladder Training is for traders who want to learn professional-level market analysis. This course is perfect for:

- Day Traders who want to learn how to read order flow and market depth like the pros

- Active Traders looking to improve their trading with Price Ladder/DOM tools

- New Prop Traders ready to learn institutional trading strategies

- Market Traders who want to understand how price moves in the markets

- Trading Professionals wanting to master order flow analysis

The course is especially useful if you trade futures, forex, or any market where understanding order flow gives you an edge.

6️⃣. Frequently Asked Questions:

Q1: How do you read order flow?

Q2: What is Depth of Market (DOM) trading?

Q3: How does order flow impact price movement?

Q4: What are key indicators to analyze order flow?

Q5: Can order flow trading be applied to forex and crypto?

Be the first to review “Futex Live – Price Ladder Training” Cancel reply

Related products

Forex Trading

Options Trading

Forex Trading

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.