Evolved Trader – Mark Croock – Options Bootcamp 2023

$1,500.00 Original price was: $1,500.00.$50.00Current price is: $50.00.

Mark Croock Evolved Trader Options Bootcamp 2023 [Instant Download]

What is Evolved Trader Options Bootcamp:

Mark Croock’s Evolved Trader Options Bootcamp 2023 is an intensive course designed to teach you advanced options trading strategies.

This program focuses on blue-chip stocks, helping you learn how to potentially generate significant profits in volatile markets.

The course will teach you how to execute trades effectively, manage risk, and grow your trading account.

📚 PROOF OF COURSE

What you will learn in Evolved Trader Options Bootcamp 2023:

In the Evolved Trader Options Bootcamp 2023, you’ll learn options trading strategies and risk management techniques.

Key learning points include:

- Identifying ideal stocks for options trading

- Executing trades to limit losses and protect your account

- Analyzing market sectors for potential opportunities

- Implementing blue-chip stock trading strategies

- Understanding entry and exit strategies for options trades

- Interpreting and utilizing weekly watchlists effectively

By the end of the course, you’ll have a comprehensive understanding of options trading and the tools to potentially grow your trading account.

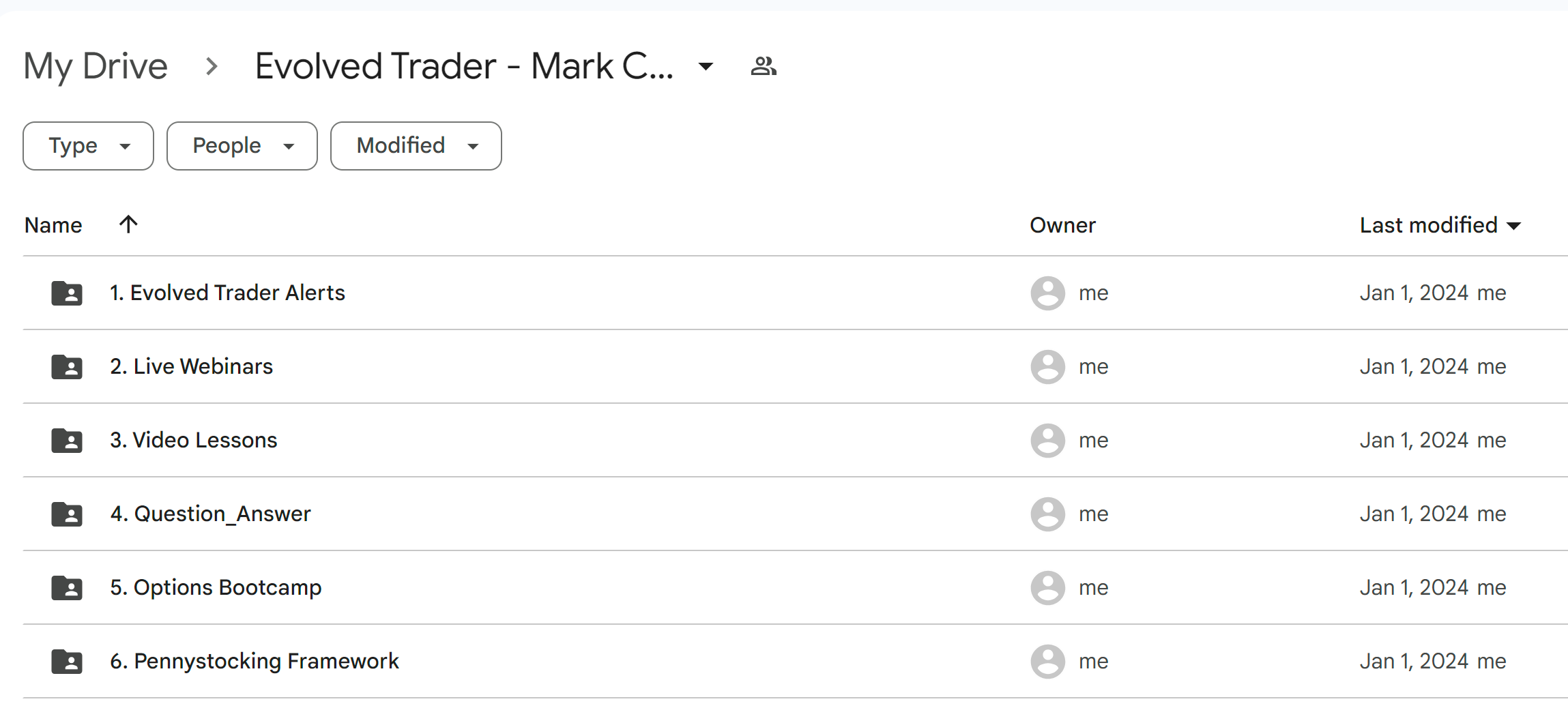

Evolved Trader Options Bootcamp 2023 Course Curriculum:

The Evolved Trader Options Bootcamp 2023 offers a comprehensive curriculum designed to enhance your options trading skills.

Course components include:

- Evolved Trader Alerts (PDF)

- Live Webinars

- Video Lessons

- Question & Answer Sessions

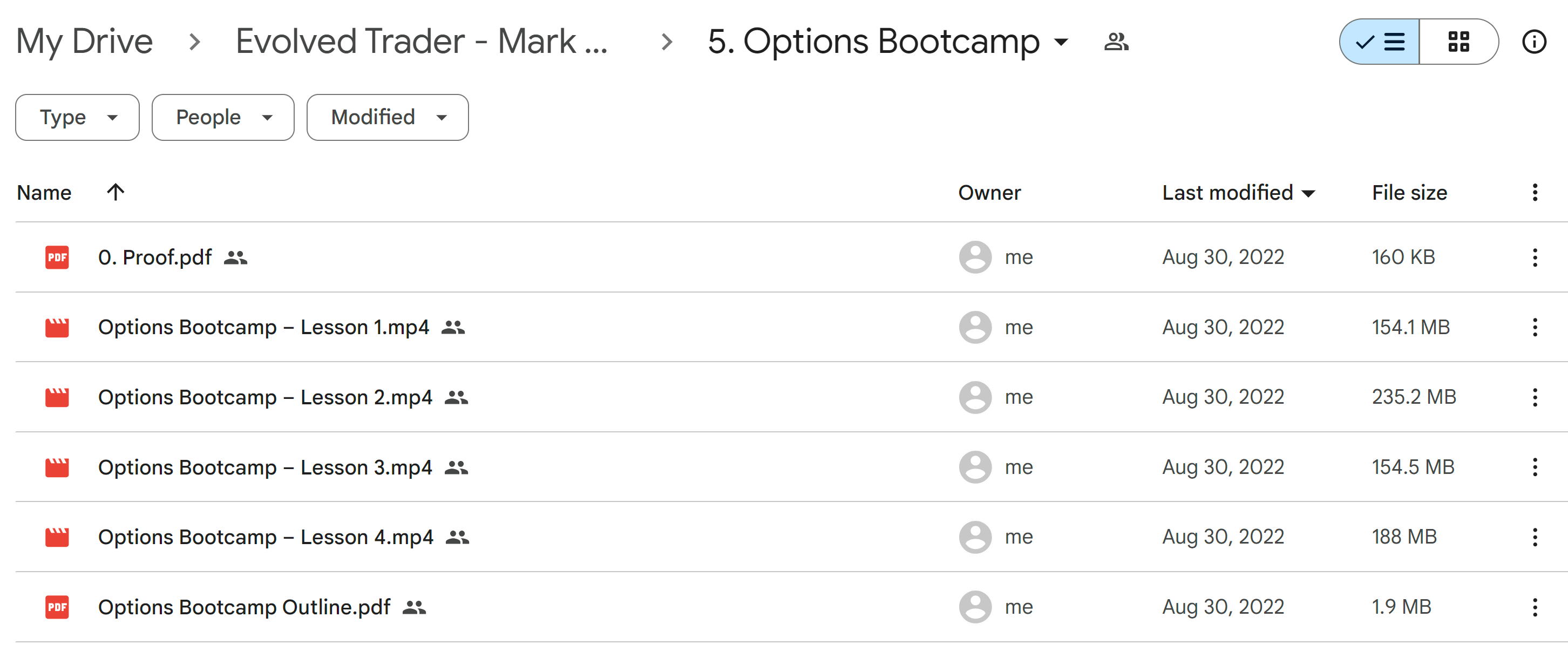

- Options Bootcamp (4 videos + PDF)

- Pennystocking Framework

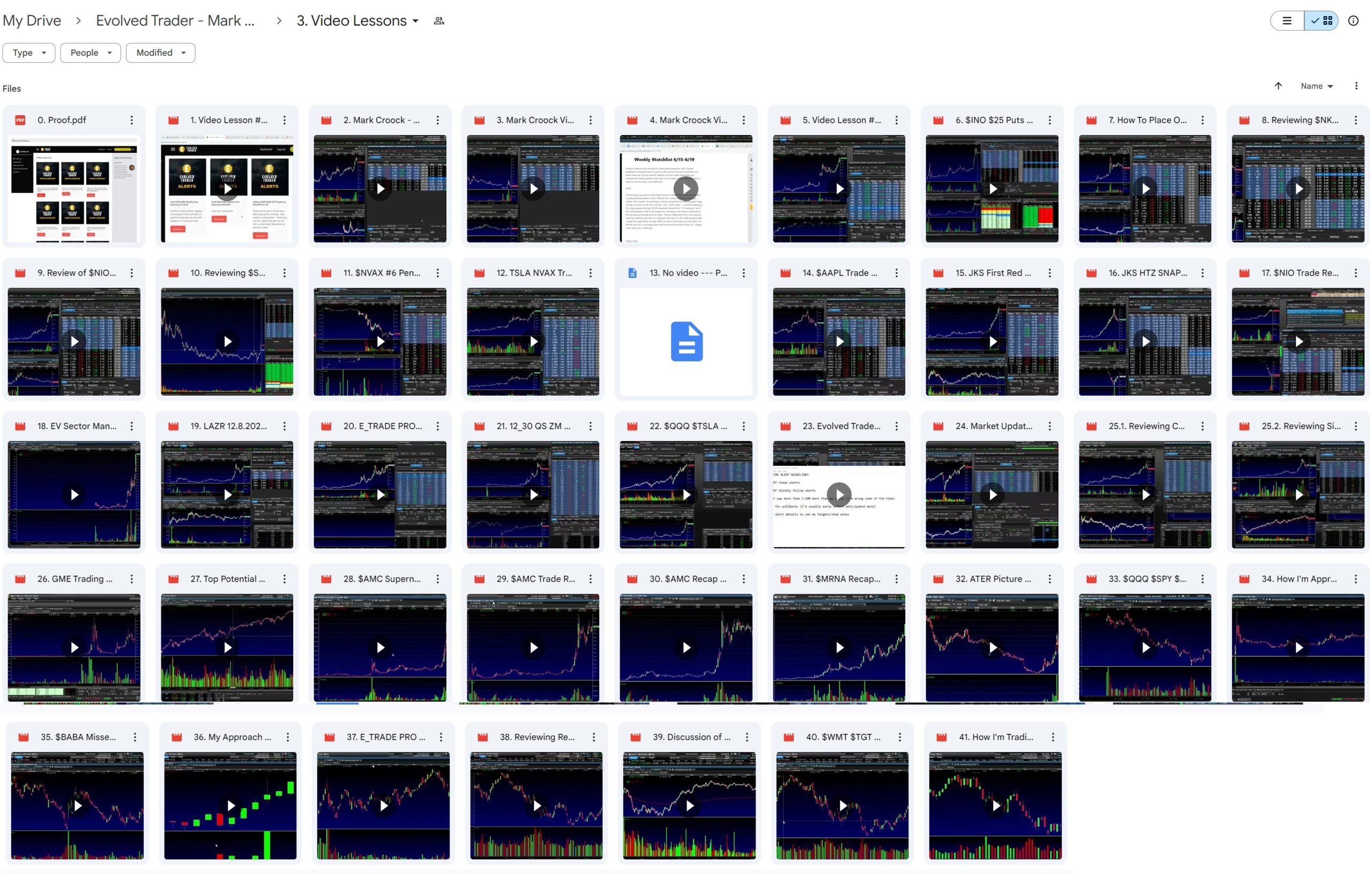

The course features an extensive collection of video lessons covering various topics, such as:

- Trade recaps and analysis

- Sector-specific strategies (e.g., EV sector)

- Risk management and patience in trading

- Technical analysis and chart reading

- Practical demonstrations using trading platforms

This curriculum aims to provide a well-rounded education in options trading, combining theoretical knowledge with practical application.

Who is Mark Croock?

Mark Croock is a successful trader and educator who started his journey by winning a stock market competition in eighth grade. He switched from accounting to full-time trading, joining Tim Sykes’ Trading Challenge in 2011.

Croock became an expert in penny stocks before moving into options trading. He’s known for his disciplined approach, focusing on sector momentum and patience. His big achievement includes growing $3,000 to over $100,000 in three months using his options strategy.

As the creator of the Evolved Trader program, Croock uses penny stock rules for blue-chip options trading. He balances his trading career with family life and wants to create independent traders through his bootcamp. His teaching focuses on realistic expectations, always improving, and trading discipline.

Be the first to review “Evolved Trader – Mark Croock – Options Bootcamp 2023” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Reviews

There are no reviews yet.