Elliott Wave Street Course – Juan Maldonado

$747.00 Original price was: $747.00.$23.00Current price is: $23.00.

Juan Maldonado Elliott Wave Street Course [Instant Download]

1️⃣. What is Elliott Wave Street Course?

Elliott Wave Street Course teaches you how to trade using Elliott Wave theory and find profitable setups across any financial market.

The program combines Elliott Wave analysis with the Cyclone Revolution Strategy to help you spot the end of waves and enter trades with precision. You’ll also learn volume profile techniques to identify institutional trading zones.

You’ll master wave counting, validate your analysis with technical rules, and learn to execute trades with small stop losses for maximum profit potential.

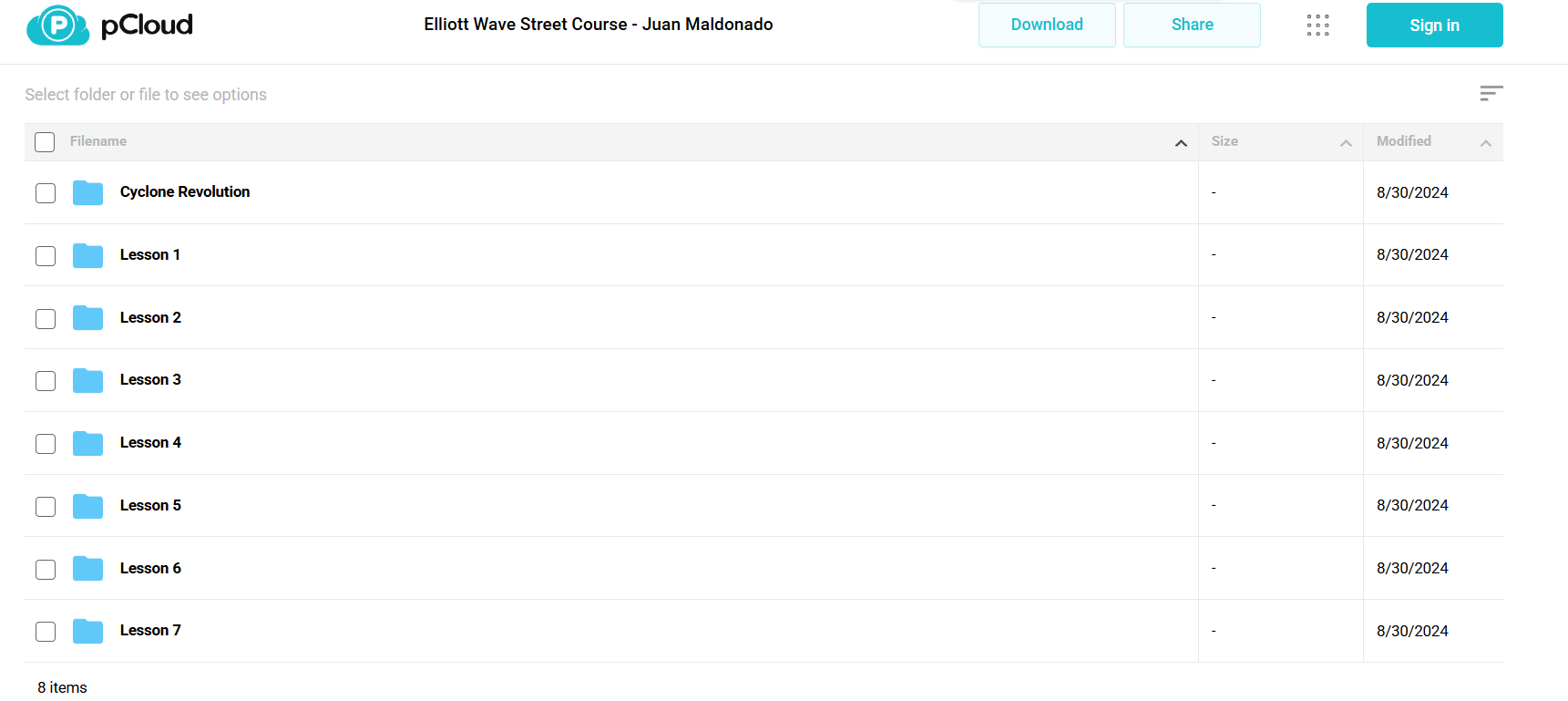

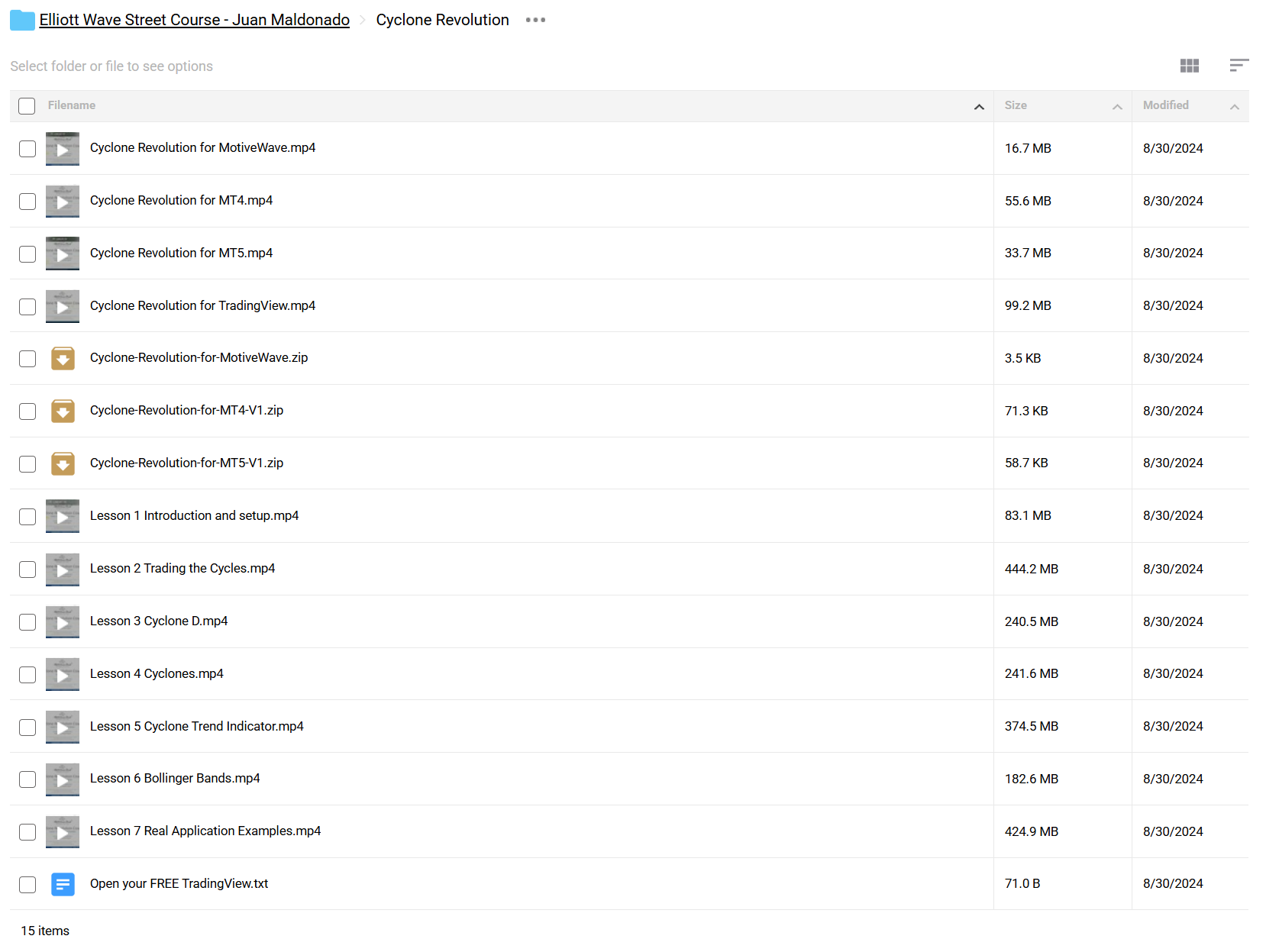

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Elliott Wave Street Course:

The Elliott Wave Street Course teaches you everything needed to trade using wave analysis like a professional. Here’s what you’ll learn:

- Wave Analysis Mastery: Learn to count waves, spot impulse and corrective patterns, and use Fibonacci tools to find precise trade levels

- Cyclone Revolution Strategy: Use this proven system to confirm wave counts and find the best entry points for your trades

- Volume Profile Techniques: Find where big institutions are trading and identify true market value areas

- Risk Control: Trade with tight stop losses while capturing maximum profit from each wave

- Trade Any Market: Use these strategies on Forex, stocks, futures, and cryptocurrencies with the same methods

After completing this course, you’ll know how to analyze markets using Elliott Wave and trade with confidence in any timeframe.

3️⃣. Elliott Wave Street Course Curriculum:

✅ Section 1: Elliott Wave Fundamentals

This foundational section introduces the core principles of Elliott Wave theory and essential Fibonacci concepts. You’ll learn the building blocks needed to understand market structure and wave patterns.

Module 1.1: Introduction to Wave Theory Start with the history and principles of Elliott Wave analysis. Learn the golden ratio, Fibonacci sequence, and their role in market movements. The module includes comprehensive video lessons and visual guides on color coding and pattern recognition.

Module 1.2: Wave Count Foundations Master the essentials of starting your wave counts from scratch. Learn timeframe selection and access professional data feeds for accurate analysis. Includes practical tips for identifying high-probability scenarios.

Module 1.3: Technical Setup Learn to use various charting platforms effectively for wave analysis. This module covers universal wave labeling techniques that work across all trading platforms.

✅ Section 2: Advanced Wave Analysis

This section deepens your understanding of wave patterns and technical indicators for precise market analysis.

Module 2.1: Wave Patterns and Structures Explore impulse waves, diagonal patterns, and wave extensions. Learn channeling techniques and exclusive methods for accurate wave counting.

Module 2.2: Technical Tools Integration Master the Awesome Oscillator for objective wave analysis and learn advanced Fibonacci applications for precise support and resistance levels.

✅ Section 3: Cyclone Revolution System

The proprietary trading system that validates Elliott Wave analysis with objective rules and indicators.

Module 3.1: Platform Integration Complete setup guides for MotiveWave, MetaTrader 4/5, and TradingView platforms. Includes custom templates and indicators for each platform.

Module 3.2: Trading Strategy Implementation Learn to trade market cycles, use the Cyclone D indicator for momentum analysis, and master the Cyclone Trend Indicator for precise entries. Includes Bollinger Bands integration and real-market examples across multiple timeframes.

Each module includes high-quality video lessons, practical exercises, and downloadable resources to ensure comprehensive learning. The curriculum follows a logical progression from basic concepts to advanced trading applications.

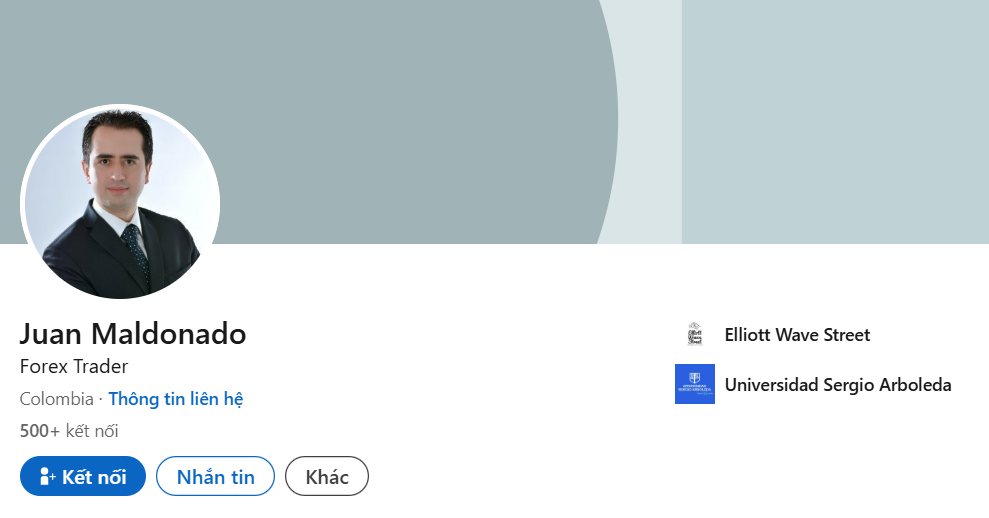

4️⃣. Who is Juan Maldonado?

Juan Maldonado is a professional trader with over 10 years of experience in Elliott Wave trading and technical analysis.

As the founder of Elliott Wave Street, he created the Cyclone Revolution Strategy, combining Elliott Wave theory with modern technical tools. This system has helped over 1,000 traders improve their trading results.

Juan is a member of the Market Technicians Association and teaches traders how to apply Elliott Wave analysis in real market conditions. His focus is on practical trading skills and helping students avoid costly mistakes.

Through his platform, he provides daily market analysis and live trading sessions across different markets and timeframes, from stocks to cryptocurrencies.

5️⃣. Who should take Juan Maldonado Course?

The Elliott Wave Street Course helps traders learn how to use wave analysis to find better trading opportunities. This program is perfect for:

- New Wave Traders who want to start learning Elliott Wave analysis with step-by-step training

- Experienced Traders who want to add Elliott Wave tools to their current trading strategy

- Technical Analysts who want to master wave counting and volume profile methods

- Active Traders who need a clear system for finding the best trade setups

Whether you trade Forex, stocks, futures, or crypto, this course shows you how to read price action using Elliott Wave principles.

6️⃣. Frequently Asked Questions:

Q1: How do you trade using Elliott Wave theory?

Q2: What are the key rules for Elliott Wave trading?

Q3: How does volume profile help in trading?

Q4: What is the best timeframe for Elliott Wave trading?

Q5: How do you confirm an Elliott Wave count?

Be the first to review “Elliott Wave Street Course – Juan Maldonado” Cancel reply

Related products

Trading Courses

Options Trading

Trading Courses

Forex Trading

Trading Courses

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Forex Trading

Trading Courses

Reviews

There are no reviews yet.