Dave Ramsey – Financial Peace University

$149.00 Original price was: $149.00.$12.00Current price is: $12.00.

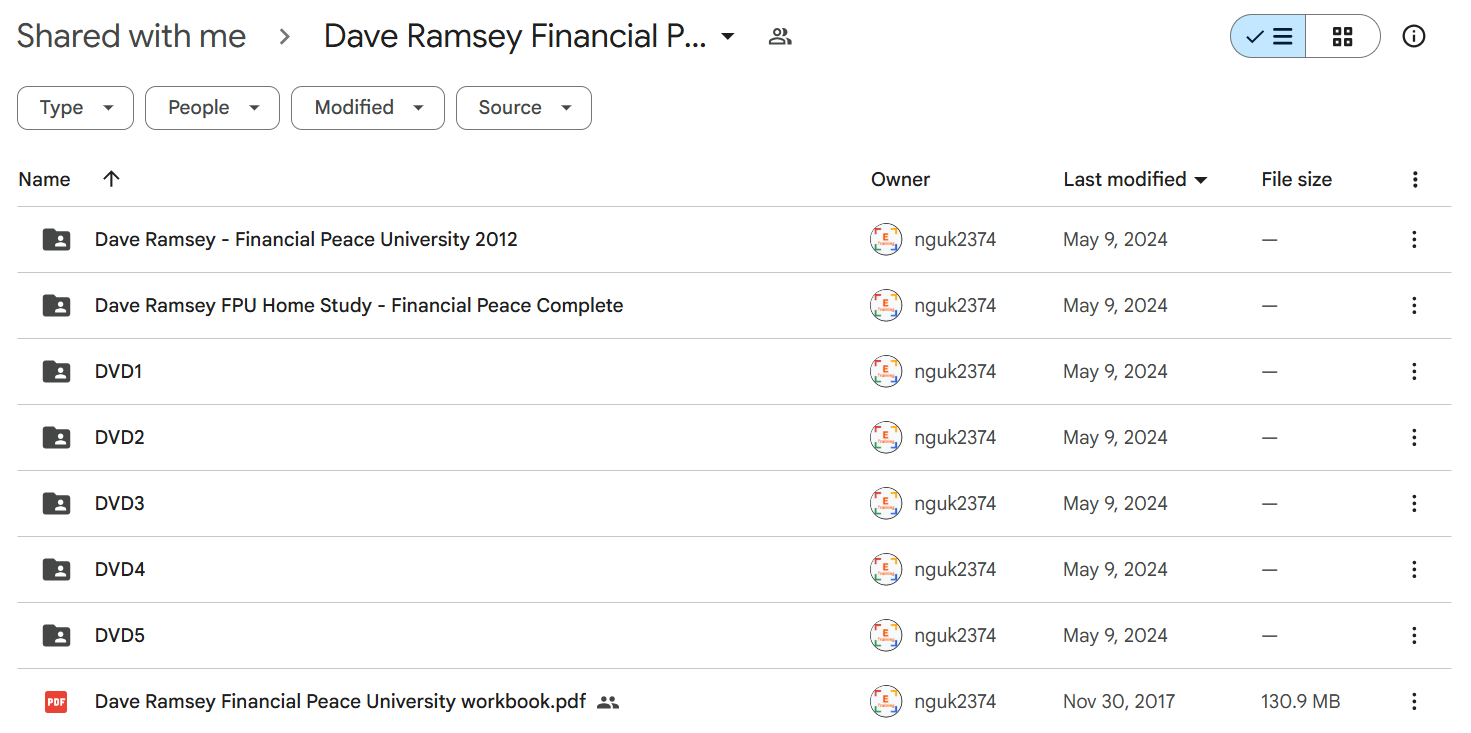

Dave Ramsey Financial Peace University Course [Instant Download]

What is Dave Ramsey Financial Peace University?

Dave Ramsey’s Financial Peace University (FPU) is a comprehensive money management course designed to help you eliminate debt and build lasting wealth. This structured program teaches practical financial strategies based on Dave Ramsey’s proven “Baby Steps” system.

The 9-lesson curriculum provides a clear, step-by-step path to financial freedom through effective budgeting techniques, strategic debt elimination methods, and smart saving and investing principles.

FPU has demonstrated remarkable results, with the average family paying off $5,300 in debt and saving an additional $2,700 within just 90 days of implementing the program’s strategies.

The course transforms your approach to money management by replacing financial stress with a straightforward plan that leads to financial peace and long-term wealth building.

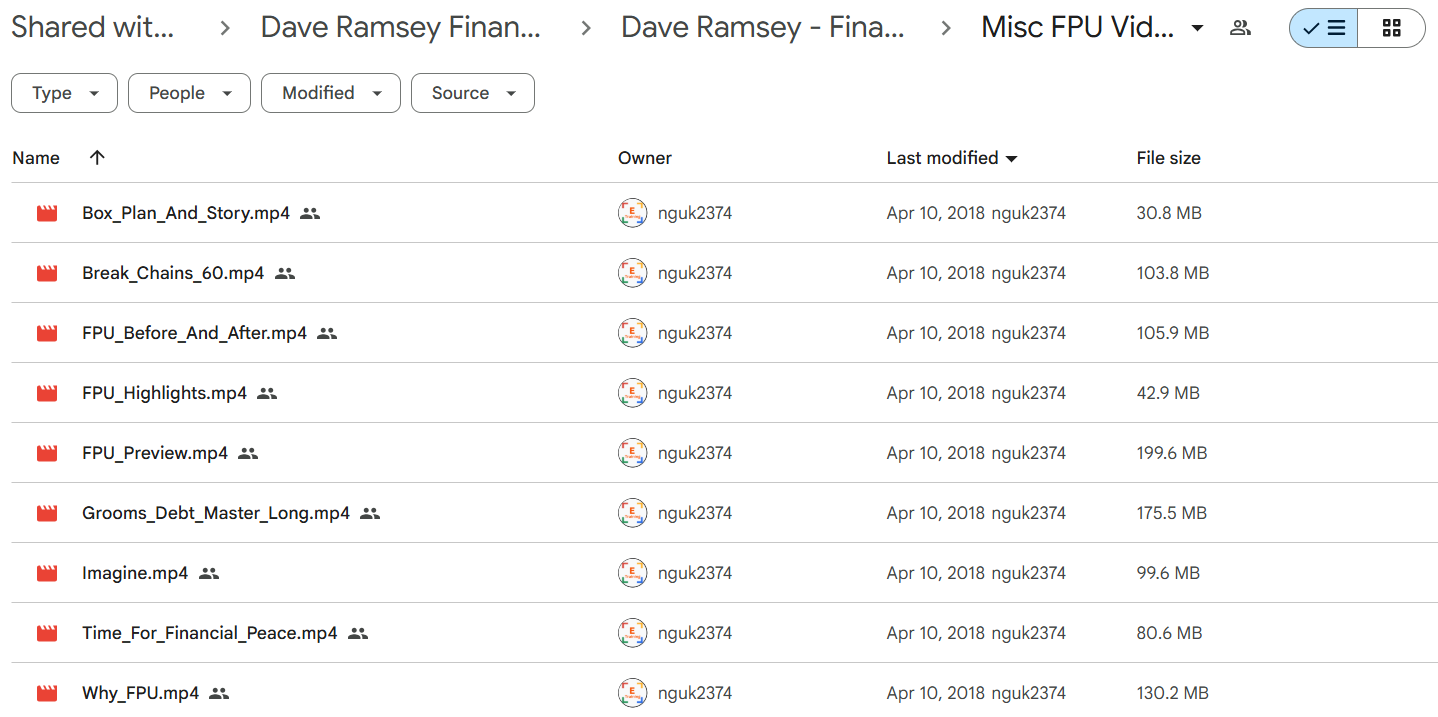

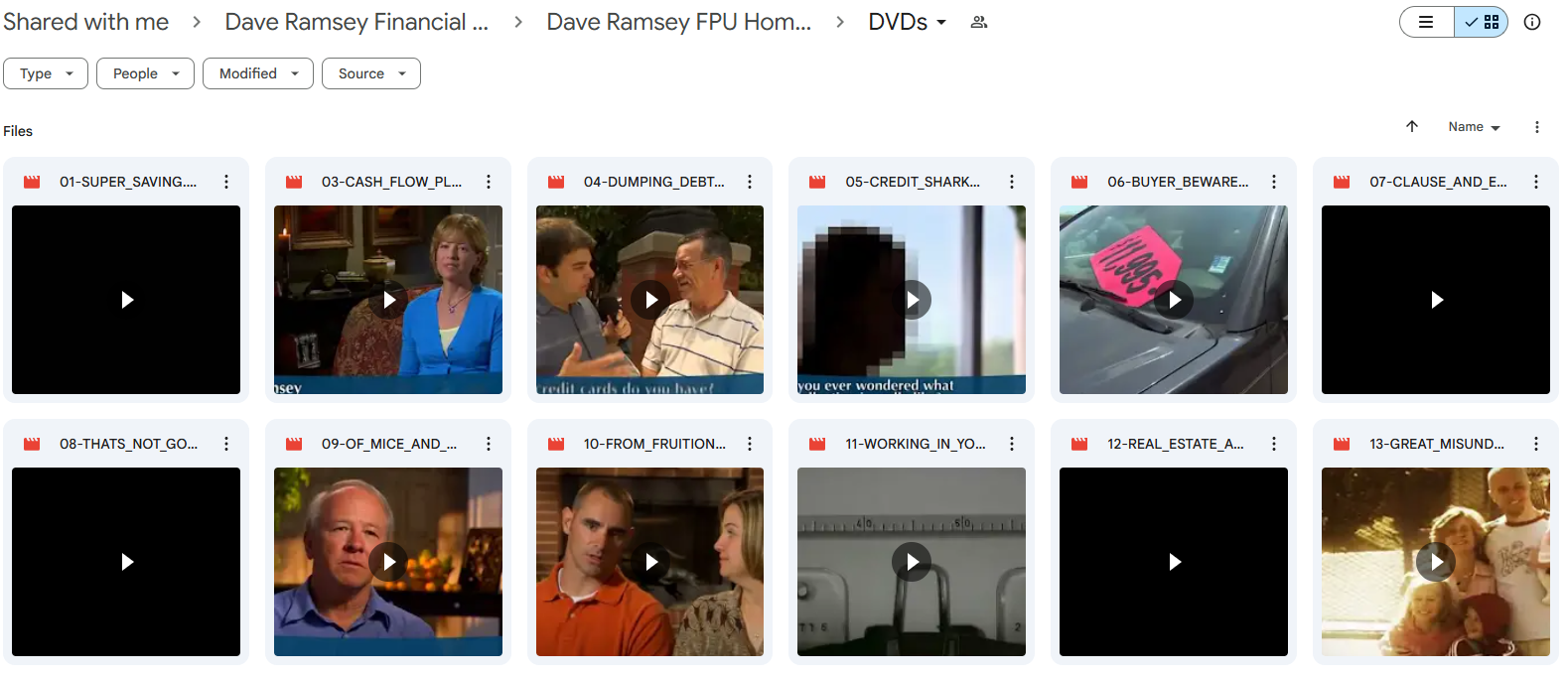

📚 PROOF OF COURSE

What you’ll learn in Financial Peace University:

Financial Peace University gives you tools to control your money and build lasting wealth. Here’s what you’ll learn:

- Debt elimination strategies to break free from money stress using Dave’s proven debt snowball method

- Budgeting techniques that work, helping you live on less than you make with money left over

- Smart saving habits to build emergency funds and save for big expenses

- Investment principles to grow wealth and secure your future

- Insurance guidance to protect your family and assets without paying too much

- Real estate know-how to make smart decisions when buying or selling homes

This course makes money management simple with clear, doable steps. By the end, you’ll have a solid plan to reach financial peace and build wealth for generations.

Dave Ramsey Financial Peace University Course Curriculum:

✅ Lesson 1: Super Saving

This foundational module introduces the concept of emergency funds and the importance of saving. Students learn Ramsey’s “Baby Steps” approach to financial freedom, starting with building a $1,000 emergency fund while working through the program.

The lesson emphasizes the psychological security that comes from having cash reserves and teaches practical saving strategies. Students also learn about the power of compound interest and how small, consistent savings can grow substantially over time.

✅ Lesson 2: Relating with Money

This module explores the emotional and relational aspects of money management, focusing on how couples and families can communicate effectively about finances. Participants learn techniques for conducting productive budget meetings and resolving financial disagreements.

The lesson includes personality assessments to help students understand different money management styles and how to work with, rather than against, their natural tendencies. Special attention is given to establishing financial unity in marriages and partnerships.

✅ Lesson 3: Cash Flow Planning

Students learn to create and implement a zero-based budget, ensuring every dollar has a purpose. This module introduces various budgeting forms and teaches participants how to track spending with precision.

The lesson provides strategies for managing irregular income and unexpected expenses. Students practice creating monthly cash flow plans and learn to adjust their budgets as circumstances change without abandoning their financial goals.

✅ Lesson 4: Dumping Debt

This critical module presents Ramsey’s “Debt Snowball” method for systematically eliminating debt. Students learn to list debts from smallest to largest balance and focus intense effort on paying off one debt at a time.

The lesson addresses the psychological factors that contribute to debt accumulation and provides scripts for negotiating with creditors. Students also learn about the dangers of credit cards and how to live completely debt-free, including paying cash for major purchases.

✅ Lesson 5: Credit Sharks in Suits

This module exposes predatory lending practices and educates students about the credit industry. Participants learn how credit scores are calculated and why Ramsey advises against credit dependence.

The lesson includes strategies for dealing with collection agencies and understanding consumer rights. Students also learn about credit bureaus and how to dispute inaccurate information on credit reports without relying on credit repair companies.

✅ Lesson 6: Buyer Beware

This module teaches smart consumer behavior and how to resist marketing manipulation. Students learn negotiation tactics and how to research purchases thoroughly before spending money.

The lesson covers techniques for finding the best deals and avoiding impulse purchases. Special attention is given to recognizing the difference between needs and wants, and how to delay gratification for financial benefit.

✅ Lesson 7: Clause and Effect

This module focuses on insurance—what types are necessary and what kinds are wasteful. Students learn about appropriate coverage levels for auto, home, health, and life insurance policies.

The lesson explains how to evaluate insurance offerings and avoid unnecessary add-ons. Participants also learn about the importance of disability insurance and how to self-insure for smaller risks once financial stability is achieved.

✅ Lesson 8: That’s Not Good Enough

This module focuses on negotiation skills and advocating for oneself in financial matters. Students learn how to negotiate better deals on major purchases and how to confidently discuss financial terms.

The lesson emphasizes the importance of researching before making financial decisions and knowing when to walk away from a deal. Participants practice assertive communication techniques for financial situations.

✅ Lesson 9: Of Mice and Mutual Funds

This module introduces investment concepts and Ramsey’s approach to building wealth. Students learn about different types of retirement accounts and how to evaluate mutual fund performance.

The lesson explains the difference between various investment options and emphasizes long-term investing over speculation. Participants also learn about diversification and Ramsey’s recommended allocation across growth-oriented mutual funds.

✅ Lesson 10: From Fruition to Tuition

This module addresses college planning and funding education without incurring student loan debt. Students learn about 529 plans, ESAs, and scholarship strategies.

The lesson covers realistic approaches to education funding and alternatives to traditional four-year colleges. Participants also learn how to balance education savings with retirement planning and other financial priorities.

✅ Lesson 11: Working in Your Strengths

This module focuses on career development and maximizing income potential. Students complete personality assessments to identify their natural strengths and talents.

The lesson provides guidance on career selection, advancement, and potential entrepreneurship. Participants learn how to negotiate salaries and increase their market value through skill development and strategic career moves.

✅ Lesson 12: Real Estate and Mortgages

This module teaches Ramsey’s approach to home buying and mortgage selection. Students learn about the pros and cons of homeownership and how to determine what they can truly afford.

The lesson covers different types of mortgages and why Ramsey recommends 15-year fixed-rate loans with at least 20% down. Participants also learn about the home buying process and how to avoid common pitfalls in real estate transactions.

✅ Lesson 13: The Great Misunderstanding

The final module addresses wealth building, generosity, and leaving a legacy. Students learn about charitable giving strategies and how to develop a giving plan aligned with their values.

The lesson explores the connection between generosity and personal fulfillment. Participants also learn about estate planning basics and how to ensure their financial legacy benefits others according to their wishes.

Who is Dave Ramsey?

Dave Ramsey is America’s trusted voice on money. After going bankrupt early in life, he rebuilt his finances using biblical principles and practical strategies that became Financial Peace University.

As founder of Ramsey Solutions, Dave helps millions escape debt through his radio show, books, and courses. The Dave Ramsey Show reaches 18 million weekly listeners on over 600 stations.

Dave wrote seven bestselling books, including “The Total Money Makeover” with over 5 million copies sold. His no-nonsense money approach makes him a top financial expert.

He leads Ramsey Solutions, a Nashville-based company with 1,000+ team members teaching financial education.

Dave teaches with humor, personal stories, and biblical wisdom. His “Seven Baby Steps” have helped countless Americans turn around their finances.

Be the first to review “Dave Ramsey – Financial Peace University” Cancel reply

Related products

Internet Marketing

Business & Finance

Business & Finance

Business & Finance

Painting

Productivity

Business & Finance

Reviews

There are no reviews yet.