Claude Malagoli – Tax Liens Mastery Online

$1,997.00 Original price was: $1,997.00.$79.00Current price is: $79.00.

Claude Malagoli Tax Liens Mastery Online Course [Instant Download]

What is Claude Malagoli Tax Liens Mastery Online?

Tax Liens Mastery Online is a course that teaches you how to invest in tax lien certificates for consistent monthly cash flow. This course shows you how to acquire valuable real estate for pennies on the dollar, potentially earning $33,000 to $120,000+ per transaction.

You’ll learn to access thousands of tax lien certificate lists online and start investing with as little as $10. The program covers everything from basic concepts to advanced strategies in tax lien investing.

The course aims to open doors to financial freedom through safe real estate investments, teaching you how to navigate tax lien auctions and create wealth in this niche market.

📚 PROOF OF COURSE

What you will learn in Tax Liens Mastery Online:

In this course, you’ll learn:

- Understand the fundamentals of tax lien certificates and how they work

- Learn strategies to create consistent monthly cash flow, from $1,200 to $9,300 or more

- Discover techniques to acquire valuable real estate for 5-10 cents on the dollar

- Master the process of accessing thousands of tax lien certificate and tax deed lists online

- Understand how to start investing with as little as $10

- Learn to navigate the foreclosure process and avoid common mistakes

Tax Liens Mastery Online equips you with the tools to potentially earn large profits, sometimes as much as $33,000 to $120,000+ per transaction. The course covers everything from basic concepts to advanced strategies, ensuring you’re well-prepared to enter the tax lien investment market.

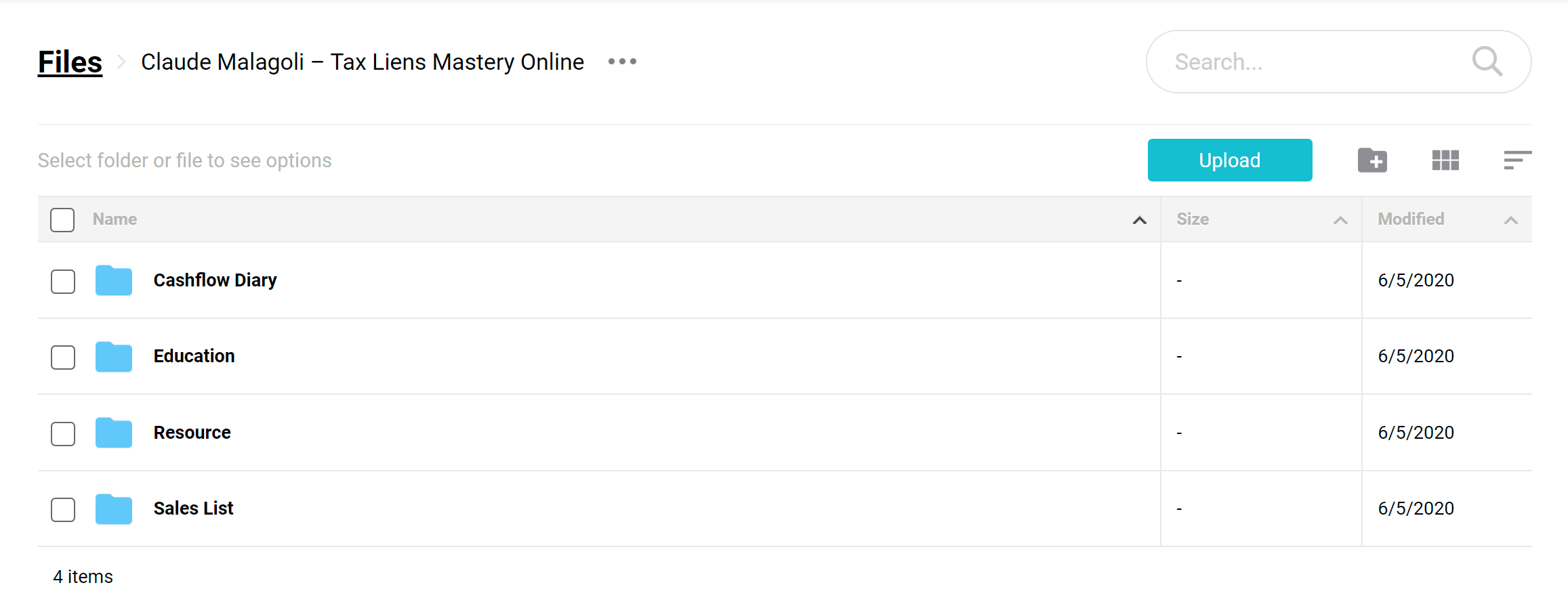

Tax Liens Mastery Online Course Curriculum:

The Tax Liens Mastery Online course offers a comprehensive curriculum designed to take you from beginner to expert in tax lien investing. The course is structured into several key parts, each focusing on crucial aspects of the tax lien investment process.

✅ Part 1: Cashflow

✅ Part 2: Education

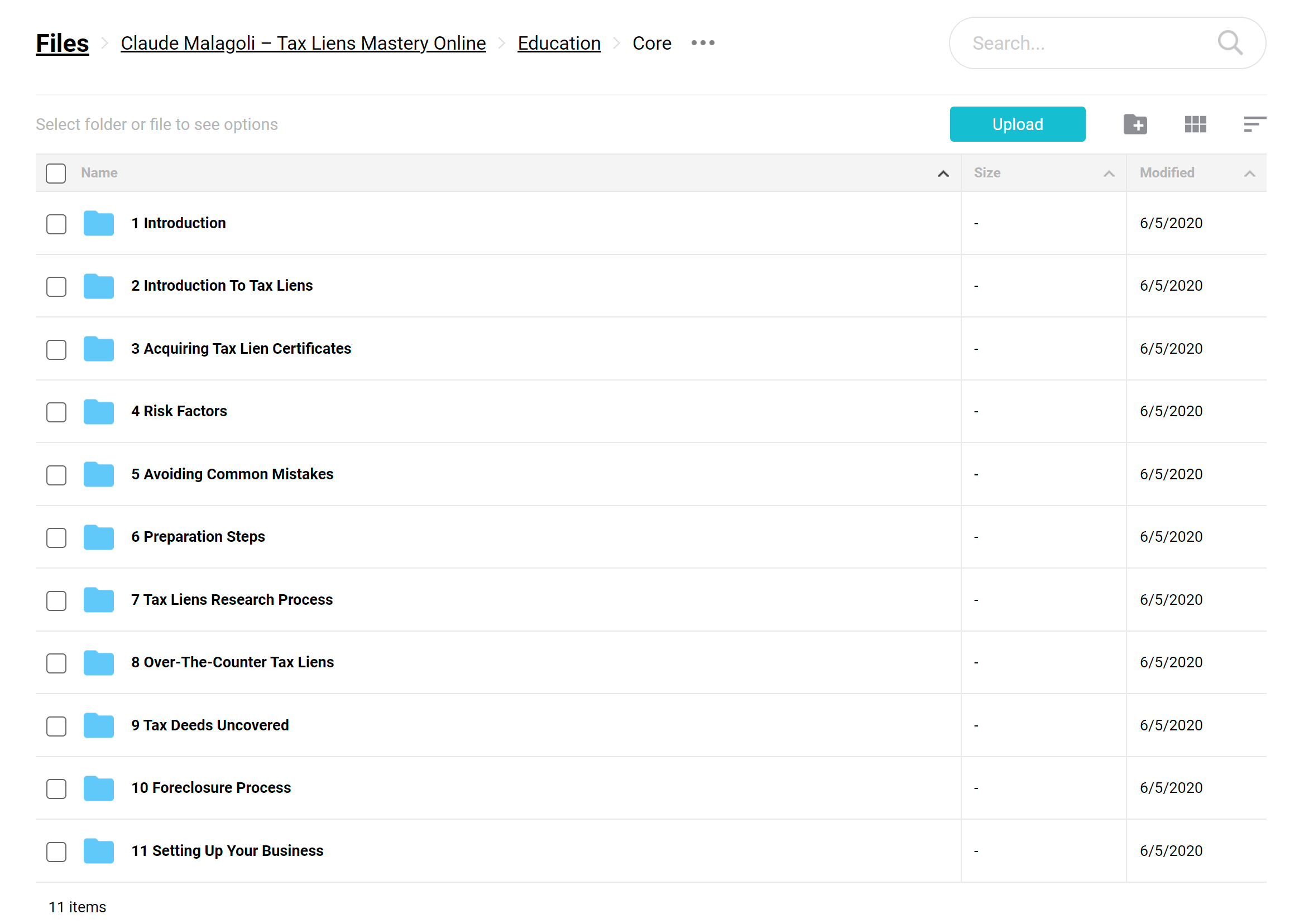

✅ Core Training:

- Module 1: Introduction

- Module 2: Introduction To Tax Liens

- Module 3: Acquiring Tax Lien Certificates

- Module 4: Risk Factors

- Module 5: Avoiding Common Mistakes

- Module 6: Preparation Steps

- Module 7: Tax Liens Research Process

- Module 8: Over-The-Counter Tax Liens

- Module 9: Tax Deeds Uncovered

- Module 10: Foreclosure Process

- Module 11: Setting Up Your Business

✅ Webinar Series:

- Introduction To Tax Lien Certificates

- Business Structure

- Getting Started

- County Research Questions

- U.S. Taxes for AUS & NZ Clients

- Research Process

✅ Part 3: Resource

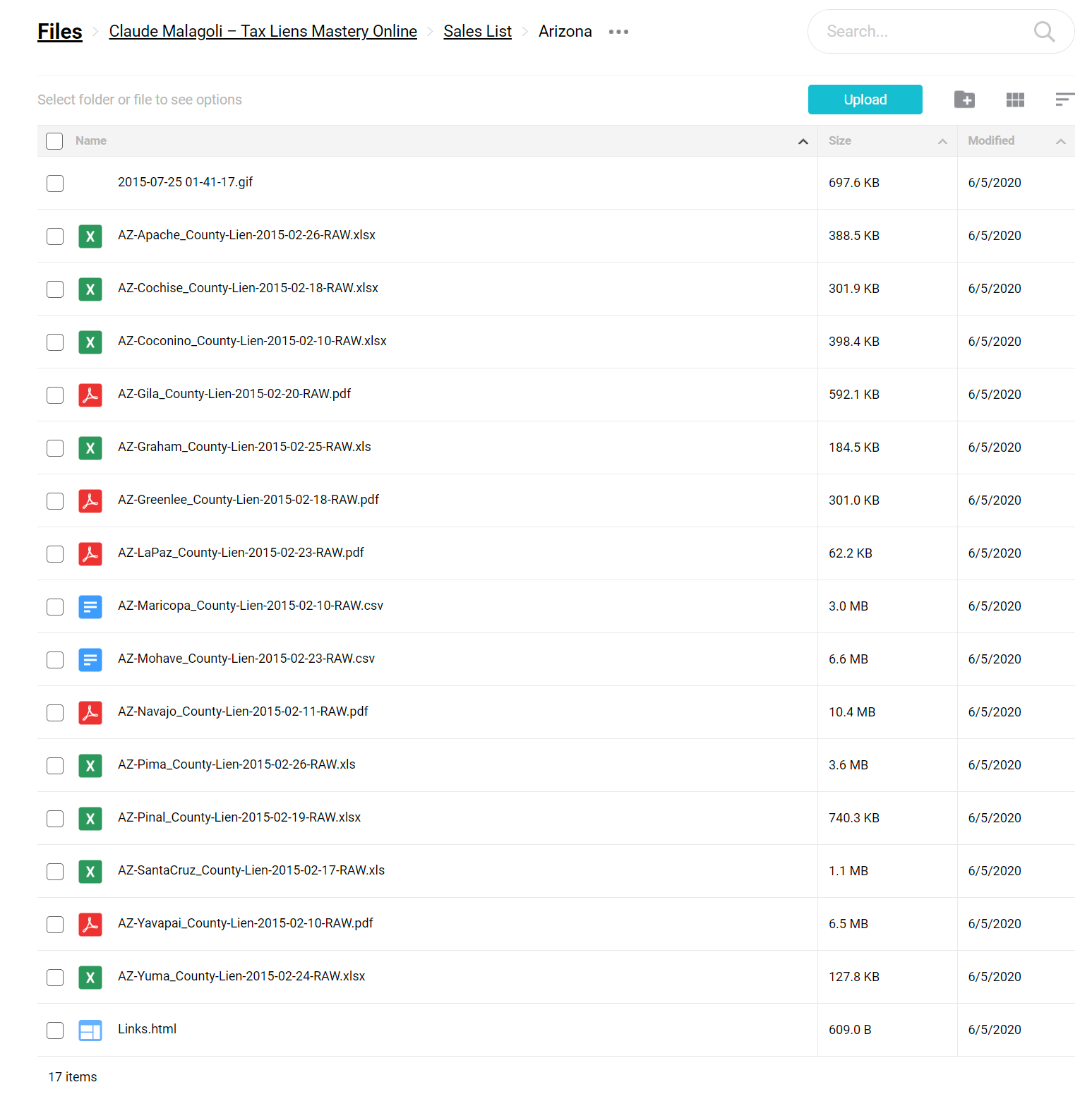

✅ Part 4: Sales List (55 States of America)

Who is Claude Malagoli?

Claude Malagoli is a tax lien investing expert and real estate educator. He’s known for his deep understanding of tax lien certificates and their potential for consistent cash flow.

Malagoli created the Tax Liens Mastery Online course to share his knowledge. His teaching makes complex concepts accessible to both beginners and experienced investors.

He specializes in strategies to acquire valuable properties at a fraction of their market value, often for 5 to 10 cents on the dollar. Malagoli has helped thousands of students navigate tax lien auctions and avoid common pitfalls.

Staying current with industry trends and legal changes, Malagoli ensures his students receive up-to-date information. His reputation is built on student success stories, with many achieving substantial monthly cash flows and acquiring valuable properties through his teachings.

Be the first to review “Claude Malagoli – Tax Liens Mastery Online” Cancel reply

Related products

Real Estate

Property Management

Reviews

There are no reviews yet.