[Bundle] Best 8 Michael Jenkins Books

$851.00 Original price was: $851.00.$29.00Current price is: $29.00.

Best 8 Michael Jenkins Books Collection [Instant Download]

What are Best Michael Jenkins Books:

The Michael Jenkins Books are a set of 8 books about stock market trading. They are written by Michael S. Jenkins, a trader with a lot of experience.

These books cover many different parts of trading, from simple day trading ideas to more complex ways of predicting market trends. They are helpful for both new and experienced traders.

The books explain how the stock market works and give readers useful strategies and tools to help them do well in trading.

📚 PROOF OF ITEM

What you will get in this collection:

✅ Book #1: Michael Jenkins Secret Angle Method

✅ Book #2: Michael Jenkins Basic Day Trading Techniques

✅ Book #3: Michael Jenkins Chart Reading For Professional Traders

✅ Book #4: Michael Jenkins Complete Stock Market Trading And Forecasting Guide

✅ Book #5: Michael Jenkins Private Book

✅ Book #6: Michael Jenkins Square The Range Trading System

✅ Book #7: Michael Jenkins The Geometry Of Stock Market Profits

✅ Book #8: Michael Jenkins The Secret Science Of The Stock Market

What you will learn in Michael S. Jenkins Books

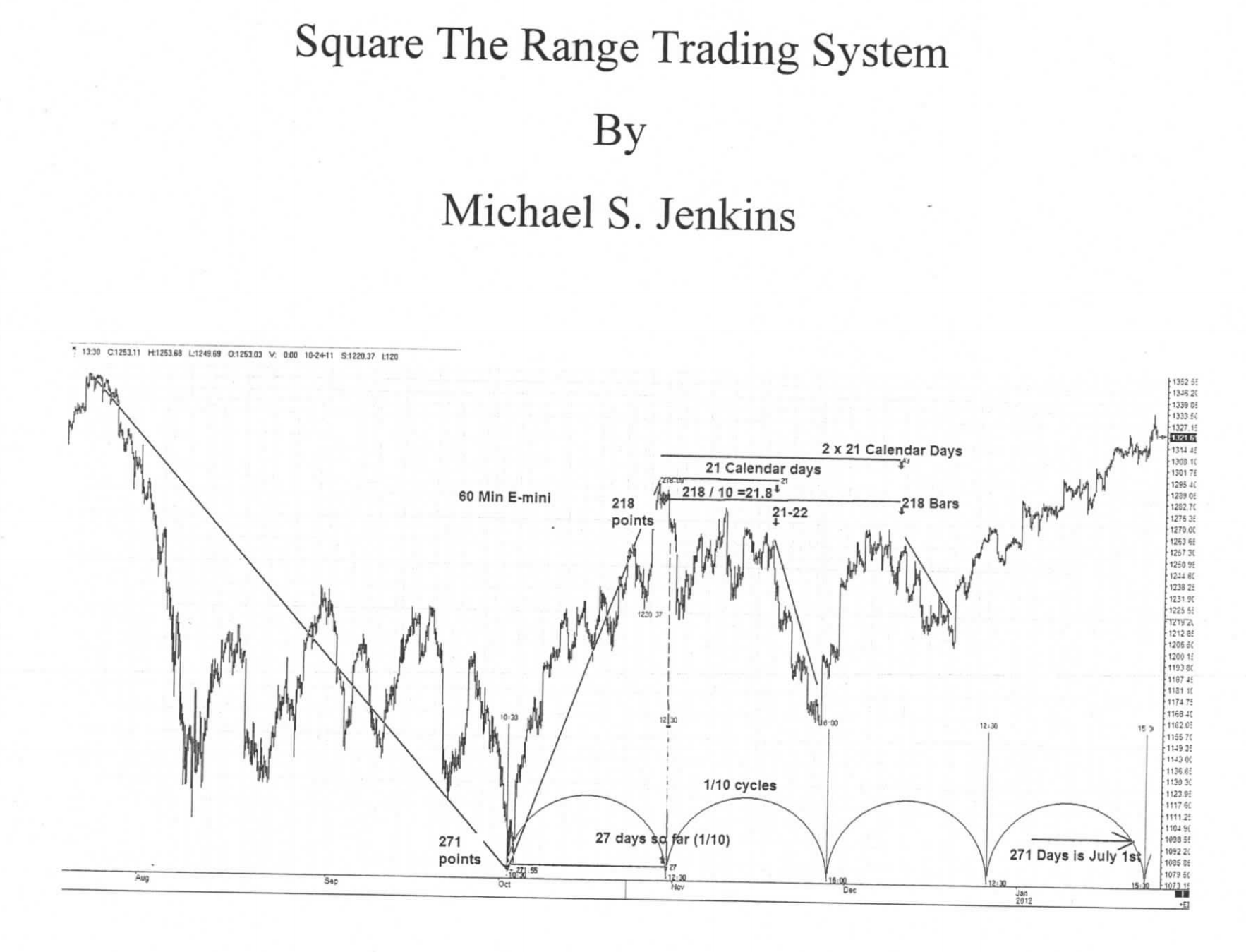

Book: Square The Range Trading System (104 Pages)

Square The Range Trading System by Michael S. Jenkins systematically analyses stock market patterns, focusing on how past trends can predict future movements. Jenkins emphasizes understanding chart patterns, noting that each fluctuation in a chart’s pattern has a precedent in past movements.

He introduces the concept of ‘left-hand/right-hand translation,’ where the timing of market advances and declines varies. This book challenges conventional trading indicators like moving averages and oscillators, arguing that fractal patterns in stock prices offer a more accurate representation of market trends.

Jenkins reveals techniques to identify pivotal points in the market, tracing them back to their origins to predict the duration and magnitude of future movements. He discusses the concept of ‘timing lines’ in stock prices, illustrating how these can predict future highs and lows.

Contents of the book include:

- Time & Price Vectors

- Square The Range

- 360 Degree Time and Price

- Ratio Timing Line Square Outs

- The Nodal Pivot

- Scaling

- Final Concepts

- Step-by-Step Review

This book aims to equip traders with the skills to identify key market turns and make informed trading decisions.

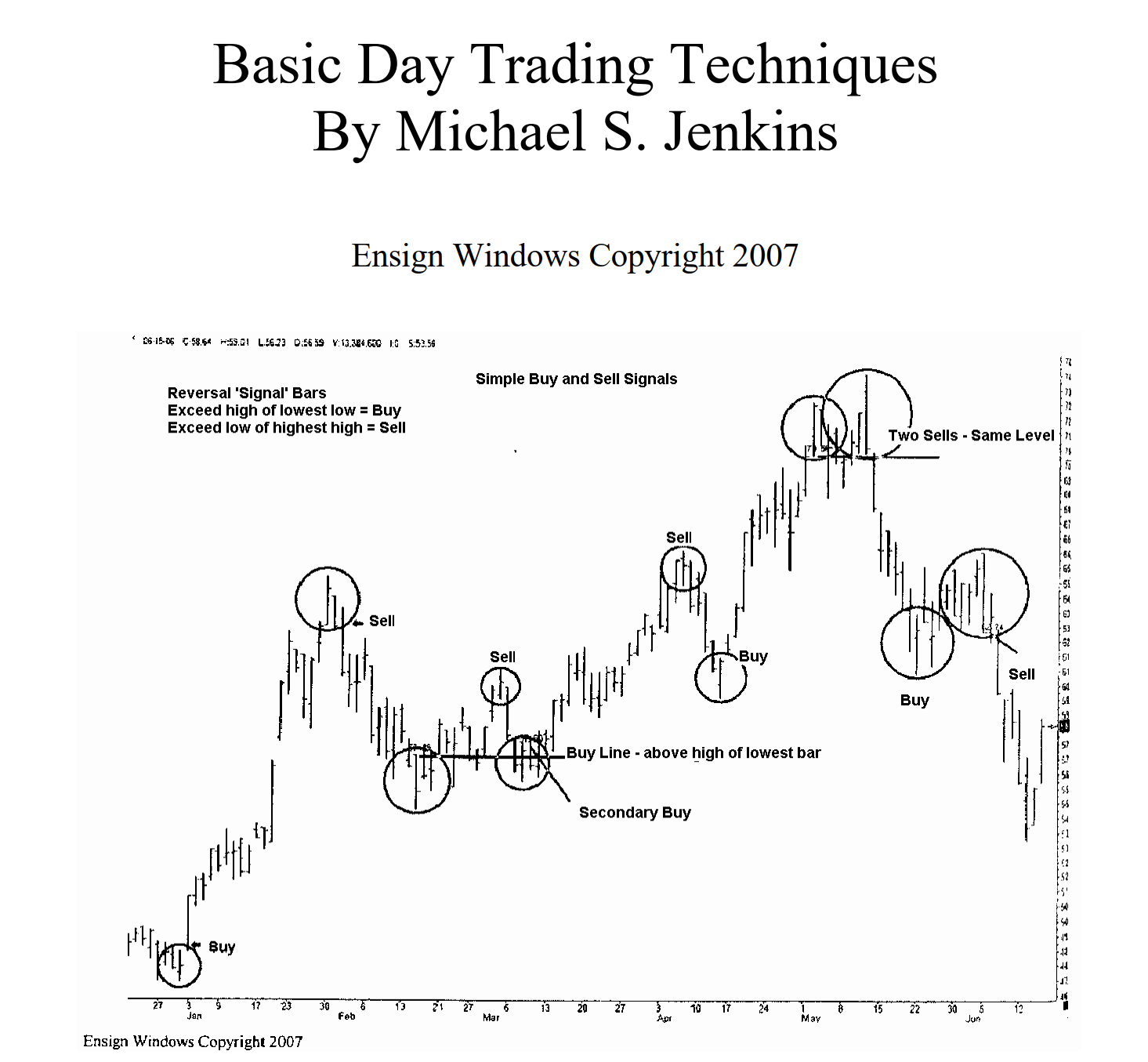

Book: Basic Day Trading Techniques (135 Pages)

Basic Day Trading Techniques by Michael S. Jenkins is a guide focused on teaching the fundamental principles of day trading. This book mainly benefits those struggling to make money in the market consistently. Jenkins emphasizes that understanding and applying basic trading skills is crucial before delving into more advanced concepts.

Jenkins highlights the importance of education, discipline, and a well-defined approach to trading stocks and commodities. He differentiates between gambling and speculation, underscoring traders’ control over speculation risks. The book critiques the common reliance on ‘fundamentals’ and long-term investment strategies, advocating instead for technical analysis.

Jenkins argues that technical analysis, which studies price patterns and volume fluctuations, reveals all known fundamentals in a stock’s price action. He also discusses the roles of ‘tape readers’ and ‘chart readers,’ favouring chart reading for its comprehensive insights and ability to apply time cycle analysis for future predictions.

Contents of the book include:

- Where To Begin

- Stops

- Measured Moves

- Support & Resistance

- Square Roots In Time

- Angles

- Developing Trading Strategies

- Business Plan

- Basic Overlap Methods

- Basket Program Arbitrage

- Options

- How Do They Get Out?

- Volume

- What Goes Round Comes Round

- Gimmicks Short Time Exposure

- Pattern Trades

- Flags, Pennants, & Triangles

- Characteristics of Market Players

- Basic Time Cycles

- Putting Our Game Plan Together

- Moon Cycles

- Review of Charts: Entry and Exits

- The Jenkins Time Conversion Bar

- Recap On Basic Trading Steps

“Basic Day Trading Techniques” aims to provide traders with foundational skills and strategies for successful day trading, emphasizing the importance of technical analysis and disciplined trading practices.

Book: The Geometry Of Stock Market Profits (160 Pages)

The Geometry Of Stock Market Profits by Michael S. Jenkins delves into his unique techniques, focusing heavily on cycle analysis, the application of W. D. Gann’s methods, and the interplay between time and price in the stock market.

Jenkins discusses the significance of stock price and trading volume and how these factors can indicate market accumulation or distribution patterns. He emphasizes the importance of cycle analysis within technical analysis, which allows for predicting potential market highs and lows in advance rather than relying on historical data. Jenkins challenges traditional technical analysis methods, such as trend lines or moving average breaks, arguing that they are reactive rather than predictive.

The book is not just about stock market strategies; it also explores philosophical aspects, including human perceptions and their impact on trading decisions. Jenkins stresses the need for discipline, objectivity, and the ability to accept losses without emotional bias in trading. He insists that understanding and accepting the reality of profit or loss is crucial for success in the stock market.

Contents of the book include:

- Introduction to Cycles

- Why Technical Analysis

- Charts

- Theory of Geometry

- The Hourly Chart

- Proportion and Harmony

- Trading Basics

- Impulse Waves

- Trading Options

- Cycles

- What is a Professional?

- Professional Trading

- Common Sense Trading Rules

- Ten Trading Tips to Make You Rich

- Comments on Fundamentals and Economics

“The Geometry Of Stock Market Profits” aims to provide readers with a comprehensive understanding of Jenkins’ trading philosophy, offering insights into the technical and psychological aspects.

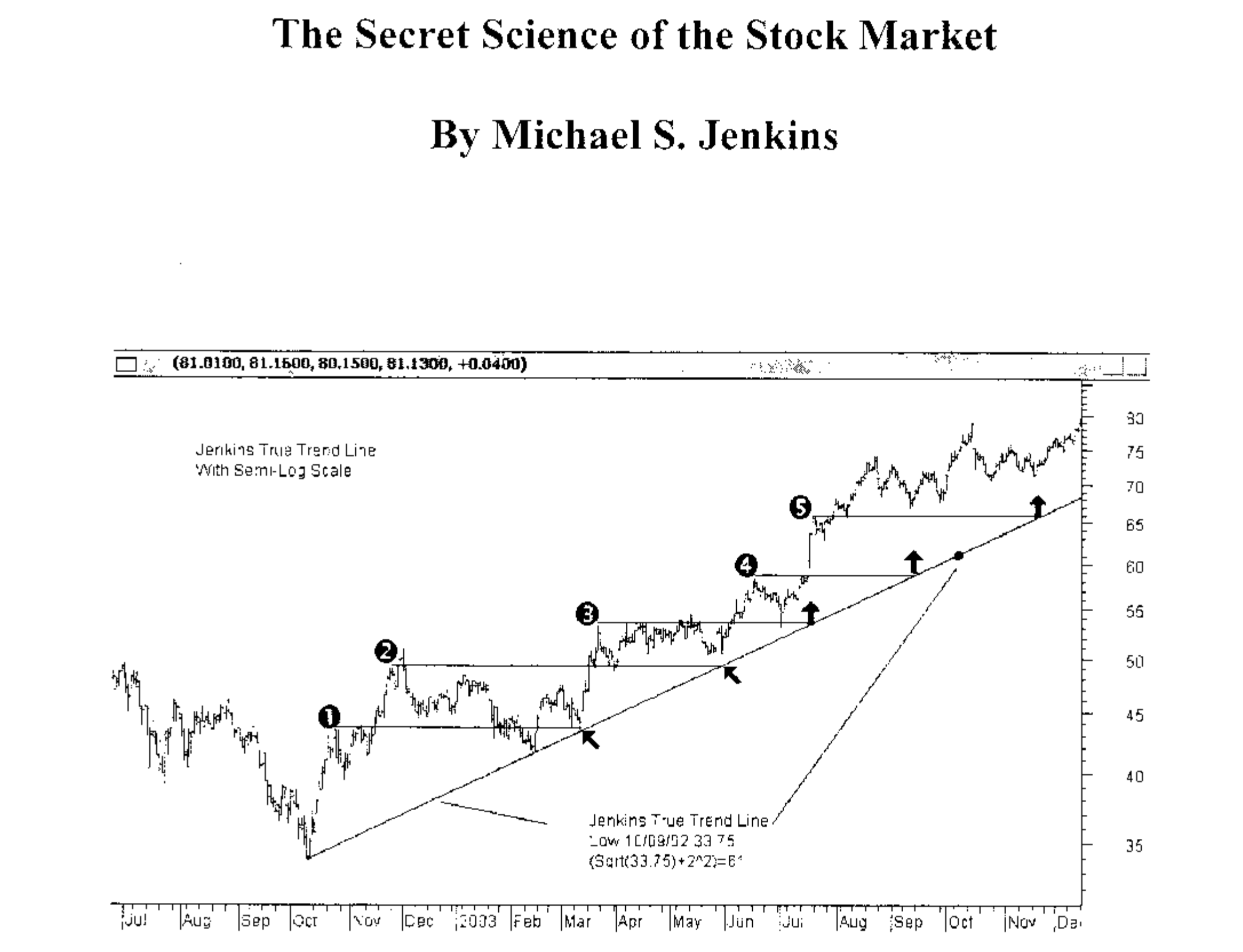

Book: The Secret Science Of The Stock Market (139 Pages)

The Secret Science of the Stock Market by Michael S. Jenkins is a comprehensive exploration of the critical aspects of time and price in stock market trading. The book emphasizes the adage “Timing is everything,” underscoring the importance of buying low and selling high, a concept that is relative and requires precise timing.

In the introduction, Jenkins discusses the elusive nature of the absolute high and low points in the market, cautioning against the daily pursuit of these extremes as they can lead to financial ruin. He notes that most traders are trend followers, often continuing to trade in the current trend’s direction until it becomes unprofitable. The book aims to teach traders how to predict trend reversals to enhance their rates of return accurately.

Jenkins asserts that understanding the trend is crucial and can be determined solely through price data. He explains that when correctly interpreted, charts reveal the actual trend and that applying certain principles to longer-term charts can help understand the persistence of these trends.

The book also addresses the confusion that arises from mixing periods in trend analysis, emphasizing the importance of aligning trading strategies with the correct time frame to maximize profits.

Contents of the book include:

- Chapter 1: Lines

- Chapter 2: Logarithms

- Chapter 3: Jenkins True Trend Lines

- Chapter 4: Squaring The Range

- Chapter 5: Circles

- Chapter 6: Squares

- Chapter 7: Pythagorean Theorem

- Chapter 8: Gann Square of Nine

- Chapter 9: Music

- Chapter 10: Ratios

- Chapter 11: Let The Market Tell You

- Chapter 12: Working Examples

The Secret Science of the Stock Market is designed to eliminate common trading mistakes and improve trading habits. It offers a blend of technical analysis and practical advice for traders seeking to improve their market timing and decision-making skills.

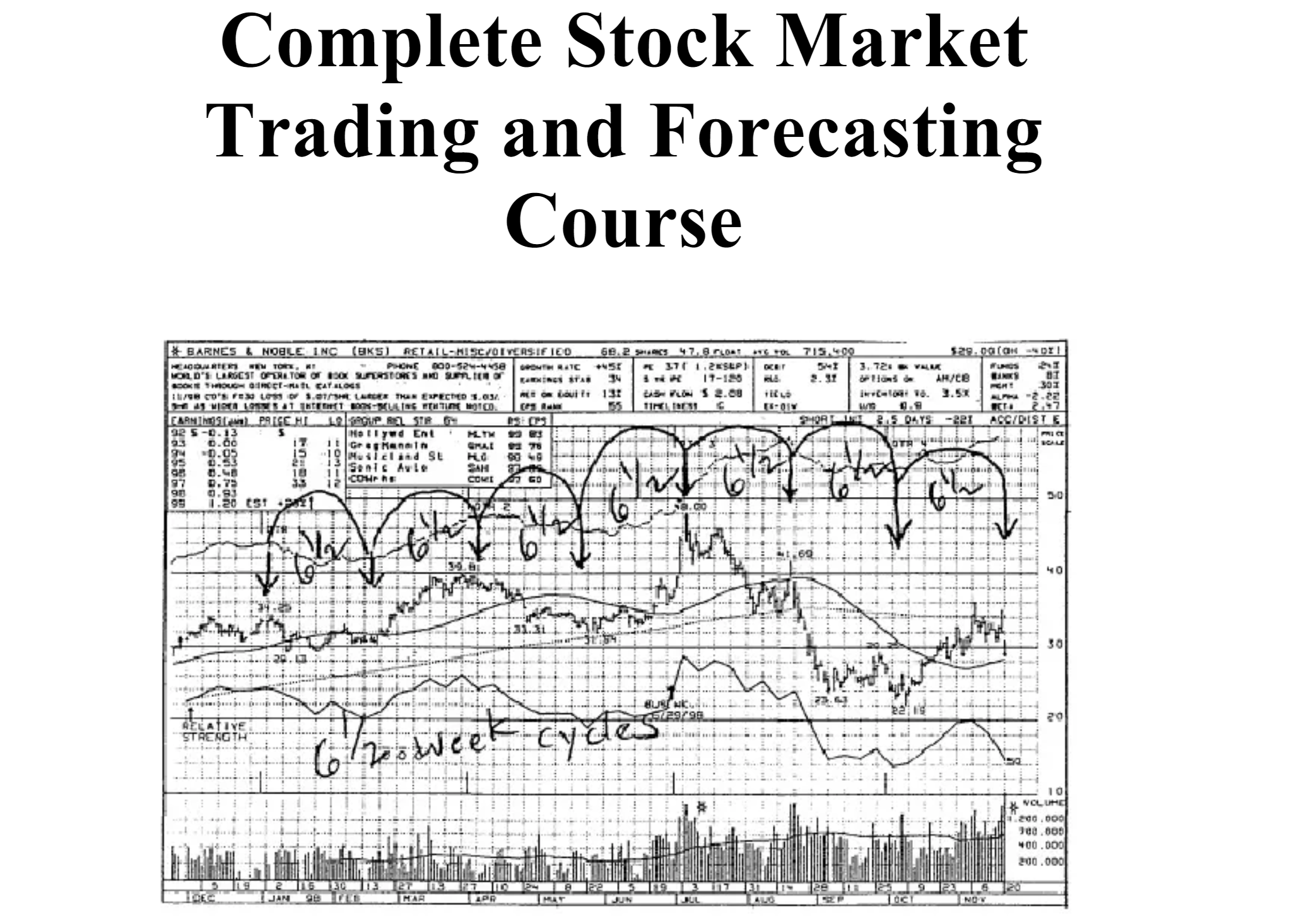

Book #4: Complete Stock Market Trading And Forecasting Guide (305 Pages)

Complete Stock Market Trading & Forecasting Course by Michael S. Jenkins is an extensive guide that delves into the application of W. D. Gann’s methods and techniques in stock market trading and forecasting. Jenkins, while not directly mentioning Gann in his previous works, explicitly acknowledges Gann’s influence in this course and provides detailed insights into how he has adapted and applied Gann’s ideas in his own trading practices.

In the introduction, Jenkins addresses the requests from readers of his earlier books, “Geometry of the Stock Market: A Guide to Professional Trading for a Living” and “Chart Reading for Professional Traders,” for a more structured course on his trading methods and forecasting techniques. This course is designed to teach how to identify the true trend of any market, forecast the duration of trends, determine price targets, and successfully day trade. It is intended for those who aspire to trade professionally and have dedicated time to serious study.

Jenkins emphasizes his approach as a technician, not a fundamentalist, focusing on technical analysis. He believes that all necessary information about a market or stock is reflected in its price and volume. The course underscores the difference between speculation and gambling, highlighting the control traders have in speculation and the use of technical tools to increase the odds of successful trades.

Contents of the course include:

- Who is Gann

- Basics

- Charts

- Reversal of Trend

- Volume

- Hourly Charts

- Time & Price & Squared

- Angles

- Arcs

- Support & Resistance

- Gann Square of Nine

- Gann’s Astrological Methods

- Time Cycles

- Mirror Image Foldbacks

- Waves

- Day Trading Theory & Practice

- Setups

- Advanced Application

Complete Stock Market Trading & Forecasting Course is a comprehensive resource for those looking to deepen their understanding of stock market trading and forecasting, offering a blend of Jenkins’ expertise and Gann’s renowned methods.

Who is Michael S. Jenkins?

Michael S. Jenkins, once a Hedge Fund Manager, is famous for his effective Geometric Trading method. He combines ideas from experts like Beck and Gann with his own strategies. Jenkins is known for his clear, no-nonsense approach.

He insists on respect and focus in his trading community, not tolerating rude or disruptive behavior. His teachings are about smart, tested ways to trade successfully.

Be the first to review “[Bundle] Best 8 Michael Jenkins Books” Cancel reply

Related products

Crypto Trading

Trading Courses

Trading Courses

Trading Courses

Investment Management

Forex Trading

Trading Courses

![[Bundle] Best 8 Michael Jenkins Books](https://coursehuge.com/wp-content/uploads/2024/01/Bundle-Best-8-Michael-S.-Jenkins-Books.jpg)

Reviews

There are no reviews yet.