Balance Trader – Market Profile

$497.00 Original price was: $497.00.$15.00Current price is: $15.00.

Frank Buttera Market Profile Course [Instant Download]

1️⃣. What is Frank Buttera Market Profile Course?

Frank Buttera’s Market Profile Course shows you how to find high-probability trades in futures markets using Auction Market Theory and cluster analysis.

The course teaches you to read market structure through price and volume patterns. You’ll learn to spot institutional trading activity and identify key support and resistance levels.

This method helps you take fewer, more profitable trades by understanding market balance cycles and price action. You’ll discover how to adjust your position sizes based on market conditions rather than increasing trade frequency.

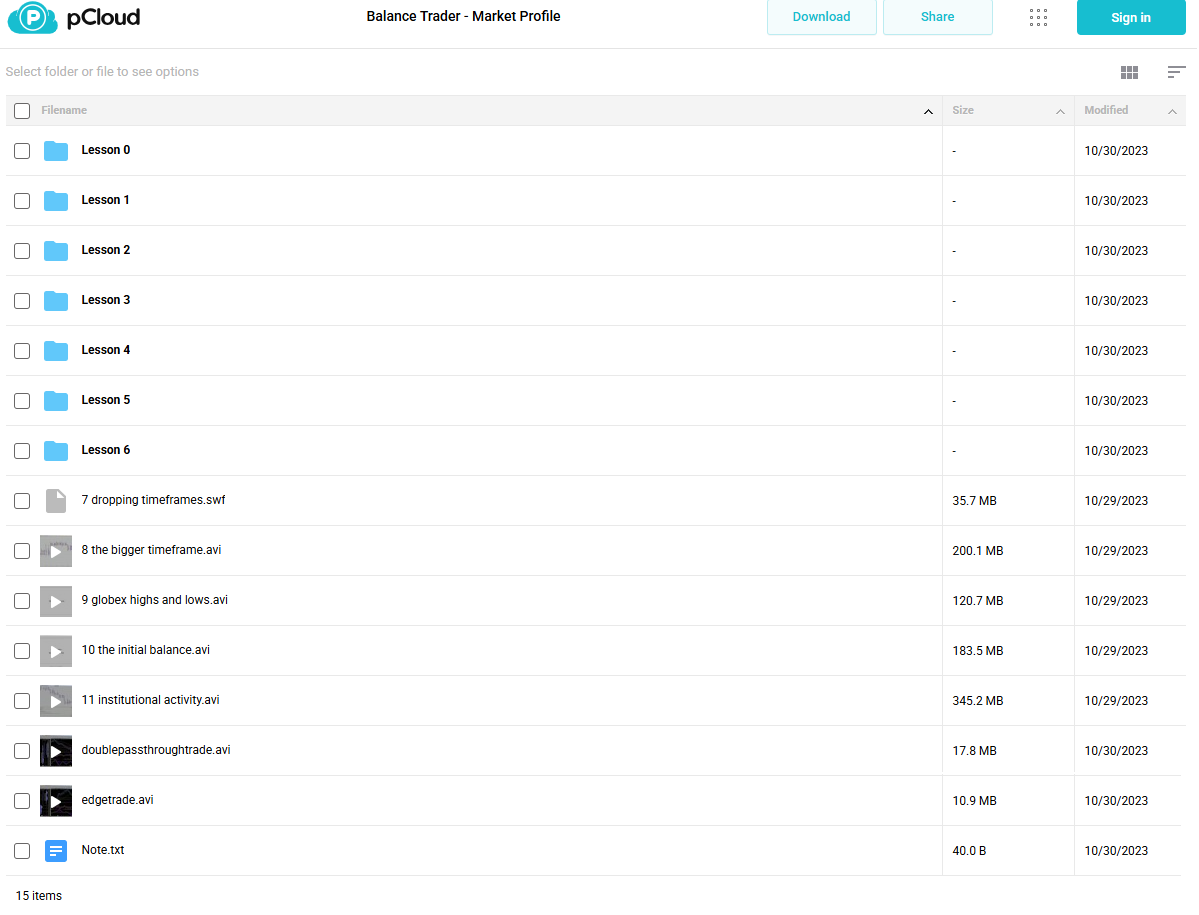

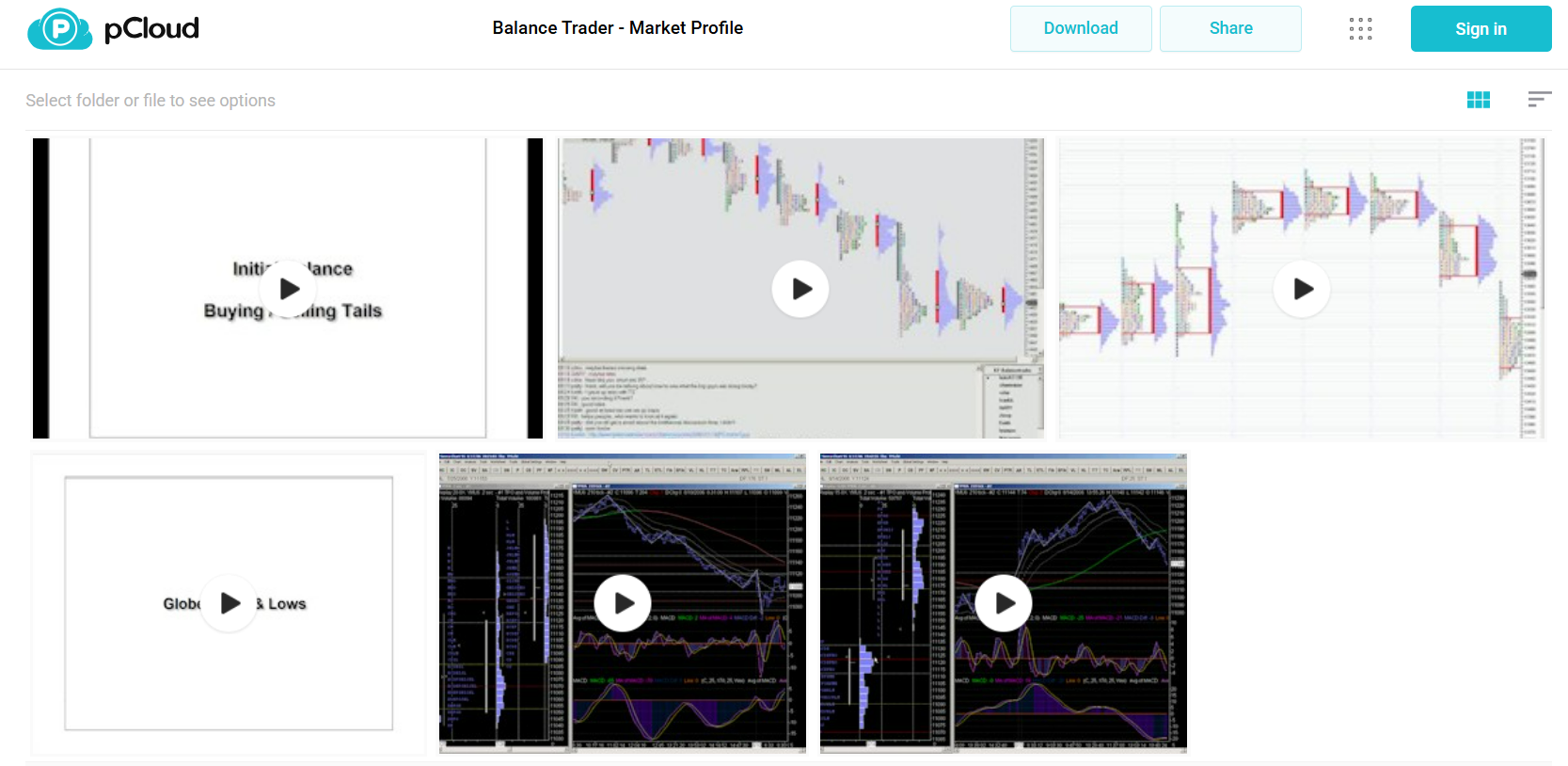

📚PROOF OF COURSE

2️⃣. What you’ll learn in Market Profile:

Learn proven ways to trade futures markets using Market Profile. This course gives you practical tools and strategies that work. Here’s what you’ll learn:

- Market Structure: Learn the three parts of cluster theory to find trading opportunities when markets are in and out of balance

- Trading Strategies: Master three core setups – the Bread & Butter trade, Edge trade, and Double Pass-Through trade for consistent results

- Institution Trading: See how big players move the market and learn to trade alongside them

- Multiple Timeframes: Use charts from day trading to longer swings to find the best trades

- Smart Risk Control: Learn proper position sizing and when to enter or exit trades

By the end of the course, you’ll know exactly how to use Market Profile to find high-probability trades and manage your positions effectively.

3️⃣. Market Profile Course Curriculum:

✅ Section 1: Foundations of Market Profile

Module 1.1: Introduction to Market Profile This foundational module introduces key Market Profile concepts and Auction Market Theory. Students learn the basic framework for understanding price and volume relationships through detailed presentations and supporting documentation. (Includes: BalanceTrader_Lesson_0.pdf, presentation0.mp4)

✅ Section 2: Cluster Theory Framework

Module 2.1: Understanding Market Balance Learn the first level of cluster theory, focusing on how markets maintain and break balance. This module covers essential concepts for identifying trading opportunities through price action analysis. (Includes: BalanceTrader_Lesson_1.pdf, presentation1.mp4)

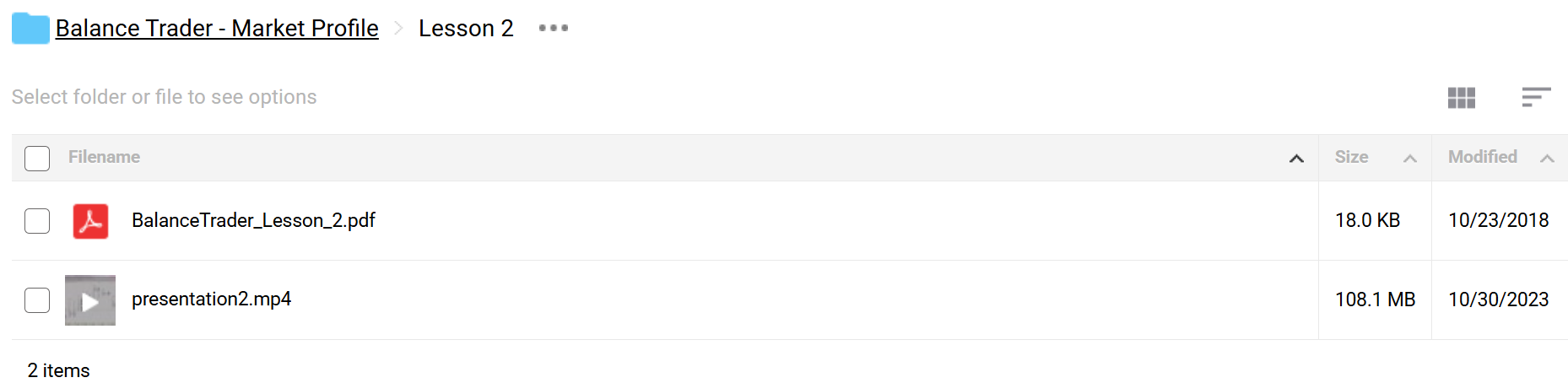

Module 2.2: Advanced Balance Concepts Builds on basic cluster theory with deeper analysis of market structure. Students learn to identify key levels and potential reversal points using Market Profile patterns. (Includes: BalanceTrader_Lesson_2.pdf, presentation2.mp4)

Module 2.3: Cluster Theory Integration The final cluster theory module brings together all concepts for complete market analysis. Focus on practical application and pattern recognition in different market conditions. (Includes: BalanceTrader_Lesson_3.pdf, presentation3.mp4)

✅ Section 3: Trading Strategy Implementation

Module 3.1: Core Trading Setups Introduction to the primary trading strategies including Bread & Butter, Edge, and Double Pass-Through setups. Includes detailed trade examples and execution guidelines. (Includes: BalanceTrader_Trade_Setups.pdf, presentation4.mp4, presentation5.mp4, presentation6.mp4)

✅ Section 4: Advanced Market Analysis

Module 4.1: Timeframe Analysis Learn to analyze multiple timeframes effectively for better trade timing and market context. Covers both intraday and swing trading applications. (Includes: dropping timeframes.swf, the bigger timeframe.avi)

Module 4.2: Market Opening Strategies Master specific techniques for trading market opens and using Globex highs and lows. Focus on Initial Balance concepts and early trading opportunities. (Includes: globex highs and lows.avi, the initial balance.avi)

✅ Section 5: Professional Trading Application

Module 5.1: Institutional Trading Analysis Learn to identify and track institutional trading activity through Market Profile analysis. Includes case studies of actual trades and institutional positioning.

4️⃣. Who is Frank Buttera?

Frank Buttera trades futures markets using Market Profile and Auction Market Theory. He founded Balance Trader to teach traders how to find high-probability trade setups.

Frank’s method focuses on taking fewer, better trades instead of many small ones. He shows traders how to read market structure and spot where big institutions are trading.

His trading approach works – many of his students now trade profitably using his Market Profile methods. Frank developed this course from his real trading experience in futures markets.

5️⃣. Who should take Frank Buttera Course?

This course is perfect for:

- Futures Traders who want a clear method to read market movements

- Day Traders who need better ways to time their trades

- Swing Traders who want to find trades with higher chances of success

- Active Traders who want to understand how big institutions trade

The course works for both beginners learning Market Profile and experienced traders looking to trade more effectively. You’ll learn practical ways to spot good trades and manage your positions.

6️⃣. Frequently Asked Questions:

Q1: How do you find high-probability trades?

Q2: What are the best strategies for futures trading?

Q3: How do you manage risk in futures trading?

Q4: What factors influence futures market movements?

Q5: Is technical analysis effective in futures trading?

Be the first to review “Balance Trader – Market Profile” Cancel reply

Related products

Trading Courses

Options Trading

Trading Courses

Trading Courses

Best 100 Collection

Trading Courses

Trading Courses

Trading Courses

![Mike Aston - Learn to Trade [Trading Template]](https://coursehuge.com/wp-content/uploads/2023/09/Mike-Aston-Learn-to-Trade-Trading-Template-300x300.jpg)

Reviews

There are no reviews yet.