AXIA Futures Central Bank Trading Strategies

$3,407.00 Original price was: $3,407.00.$12.00Current price is: $12.00.

AXIA Futures Central Bank Trading Strategies Course [Instant Download]

What is AXIA Futures Central Bank Trading Strategies?

AXIA Futures’s Central Bank Trading Strategies teaches proven methods for trading during major central bank announcements, focusing on BOE, ECB, BOC, and Federal Reserve events.

The course shows you how to analyze market signals, prepare trade setups, and execute profitable trades using order flow analysis during high-impact central bank decisions.

Through market replay drills and live examples, you’ll master specific strategies for trading currency pairs, bonds, and equity futures in response to monetary policy changes.

📚 PROOF OF COURSE

What you’ll learn in Central Bank Trading Strategies:

The AXIA Futures course teaches you how to profit from central bank events. Here’s what you’ll master:

- Market Impact: Learn how central bank decisions move currency, bond, and equity markets

- Trade Setup: Build step-by-step plans for analyzing and preparing trades before major events

- Order Flow: Read market depth and price action to find optimal entry and exit points

- Live Practice: Trade in market replay mode with real examples from past events

- Risk Control: Protect your capital during volatile central bank announcements

You’ll finish with practical skills to trade confidently during any central bank event.

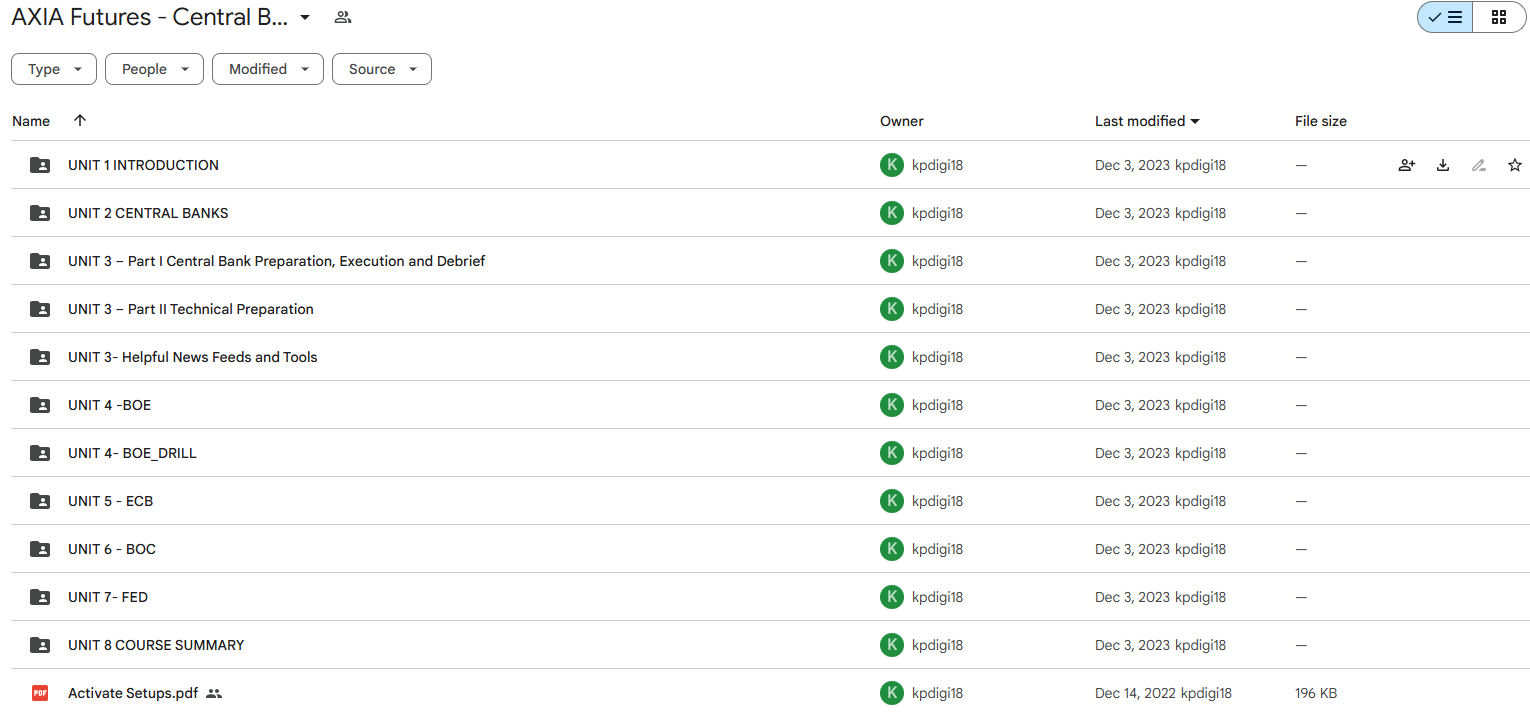

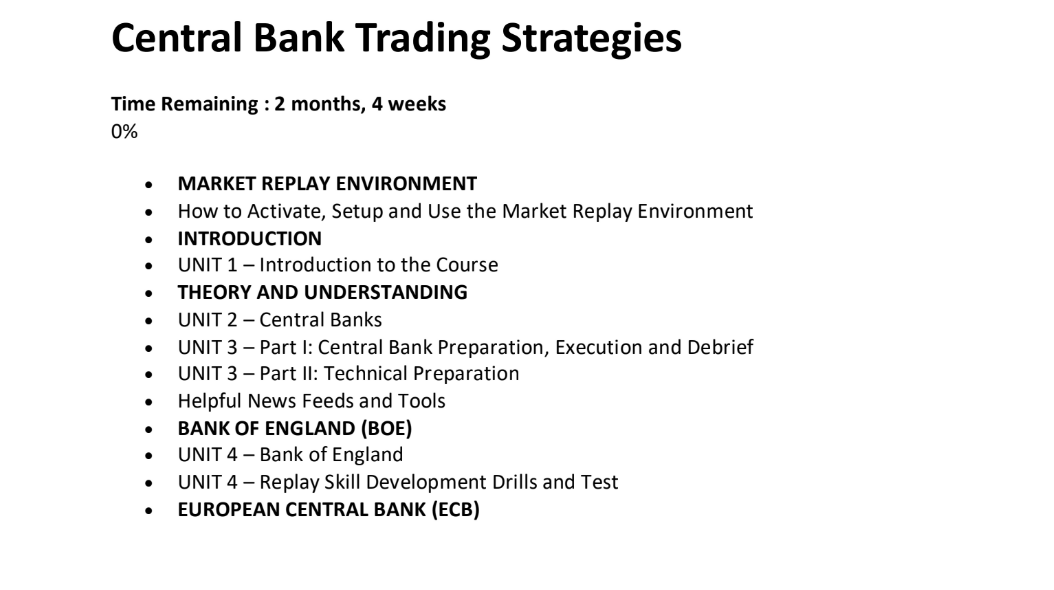

Course Structure:

- Unit 1: Introduction

- Unit 2: Central Banks

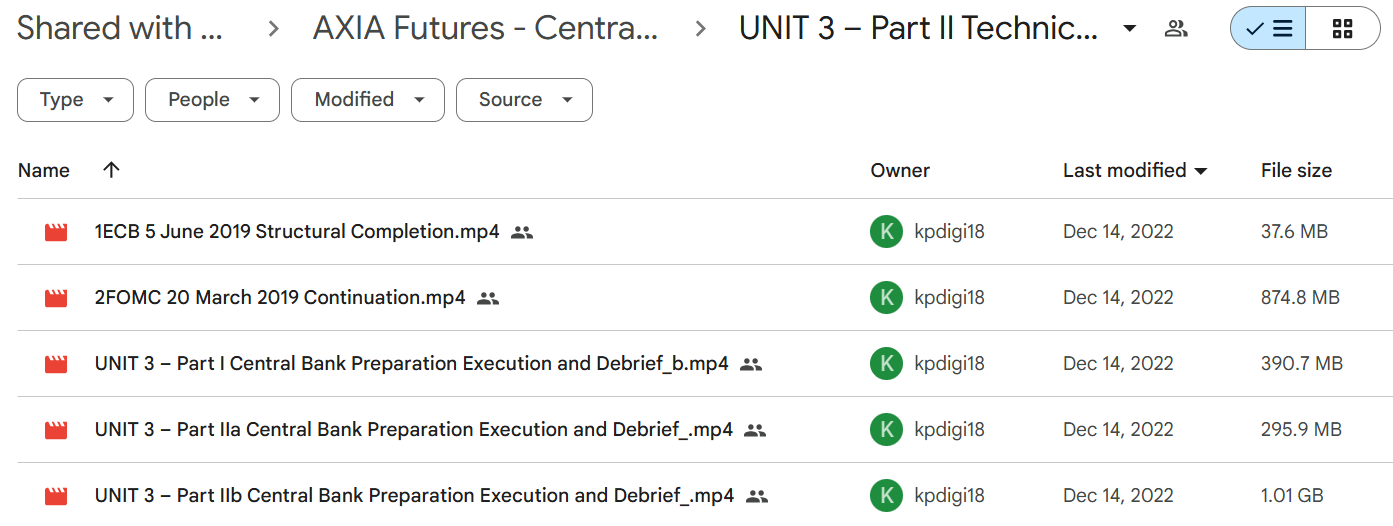

- Unit 3: Part I Central Bank Preparation, Execution And Debrief

- Unit 3: Part II Technical Preparation

- Unit 3: Helpful News Feeds And Tools

- Unit 4: BOE

- Unit 4: BOE DRILL

- Unit 5: ECB

- Unit 6: BOC

- Unit 7: FED

- Unit 8: Course Summary

- Activate Setups [PDF]

By the end, you’ll have practical experience trading all major central bank events using institutional-level strategies.

What is AXIA Futures?

AXIA Futures is a leading trading education provider specializing in institutional-level trading strategies.

They focus on advanced market analysis and professional trading techniques, particularly in futures and derivatives markets.

Their team consists of experienced traders who actively trade global markets, bringing real-world expertise to their educational programs.

AXIA Futures has built a strong reputation in the trading community for their practical, results-oriented approach to trading education.

Be the first to review “AXIA Futures Central Bank Trading Strategies” Cancel reply

Related products

Trading Courses

Forex Trading

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Forex Trading

Base Camp Trading – Explosive Growth Options – Stocks (EGOS) Program – EGOS MINI BUNDLE)

Reviews

There are no reviews yet.