Anton Kreil – Professional Options Trading Masterclass (POTM)

$2,999.00 Original price was: $2,999.00.$14.00Current price is: $14.00.

Anton Kreil Professional Options Trading Masterclass [Instant Download]

What is Anton Kreil Professional Options Trading Masterclass?

Anton Kreil’s Professional Options Trading Masterclass (POTM) teaches you how to trade options like a Wall Street professional. This 34-hour course teaches proven strategies from Kreil’s experience at Goldman Sachs.

You’ll learn both basic and advanced options trading, from simple puts and calls to complex volatility strategies. Anton Kreil shows you exactly how investment banks manage risk and maximize profits.

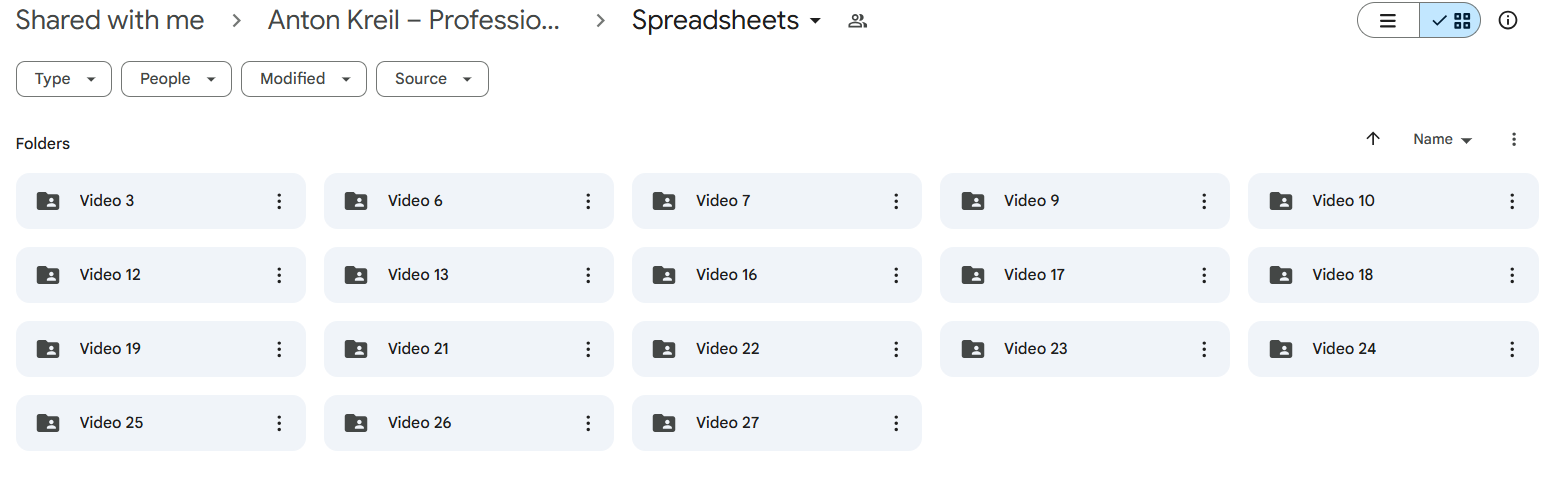

The course gives you real trading tools and methods used by professional traders. You’ll get spreadsheets, calculators, and step-by-step guides to execute institutional-level trades.

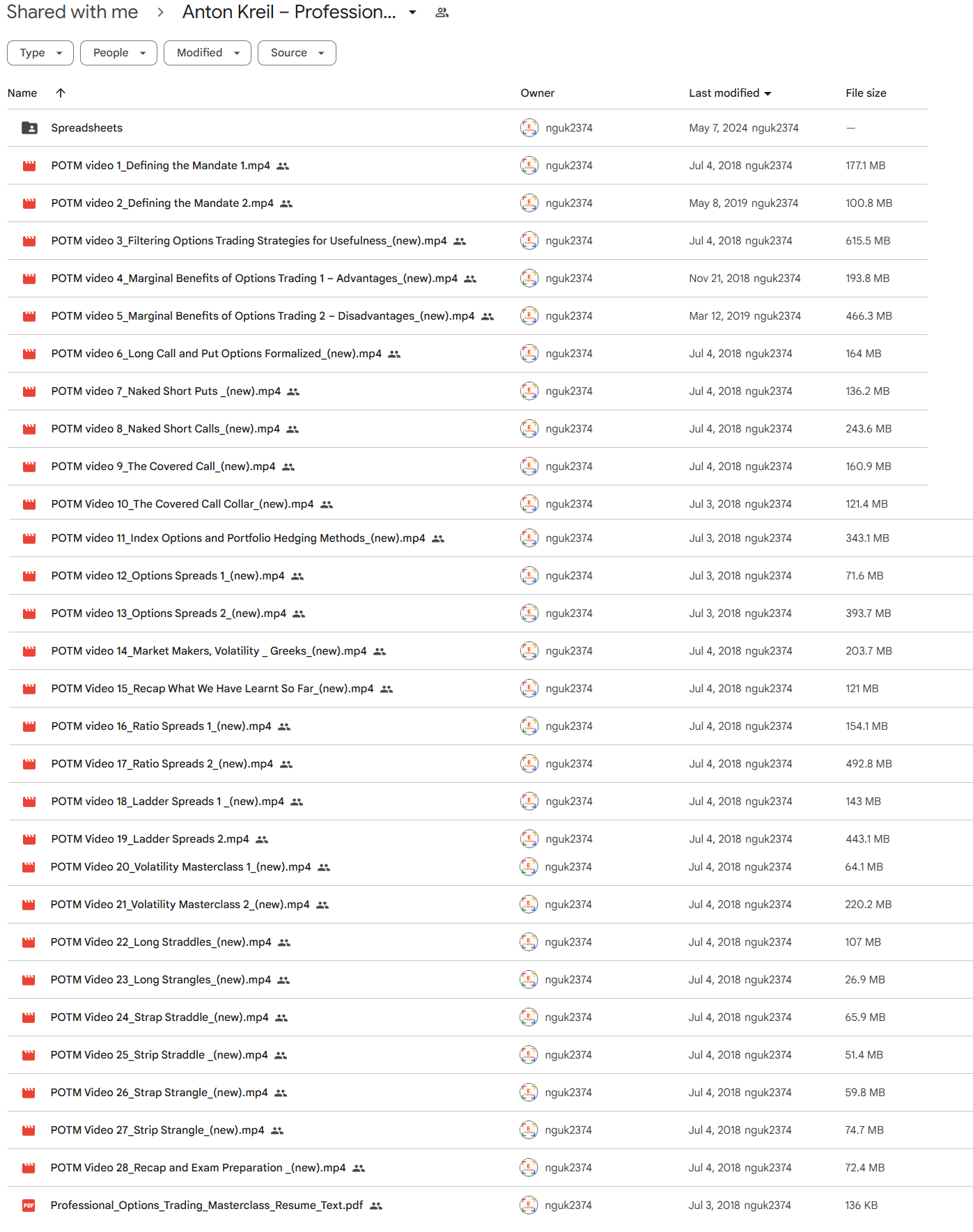

📚 PROOF OF COURSE

What you’ll learn in Anton Kreil POTM course:

This masterclass teaches you how to trade options like the pros. Here’s what you’ll learn in 28 videos:

- Options Strategies: Master spread trading, straddles, and volatility trading – the same methods used by top traders

- Risk Management: Learn how to protect your trades using portfolio hedging and smart position sizing

- Market Understanding: See how market makers work and use Greeks to make better trades

- Volatility Mastery: Learn to analyze and profit from market volatility movements

- Portfolio Defense: Use index options to protect your investments when markets get rough

- Pro Trading Tools: Get the exact spreadsheets and calculators that professional traders use daily

After completing the course, you’ll know how to trade options using proven methods from Wall Street.

Anton Kreil POTM Curriculum:

✅ Section 1: Fundamentals of Options Trading

This introductory section establishes core concepts and trading foundations. Students learn fundamental terminology, market mechanics, and essential decision-making frameworks for options trading.

Module 1.1: Trading Mandate and Strategy Selection Two comprehensive sessions exploring mandate definition and strategy evaluation. Materials include foundational lectures on establishing trading parameters and identifying suitable options strategies. (Video files: POTM video 1, POTM video 2)

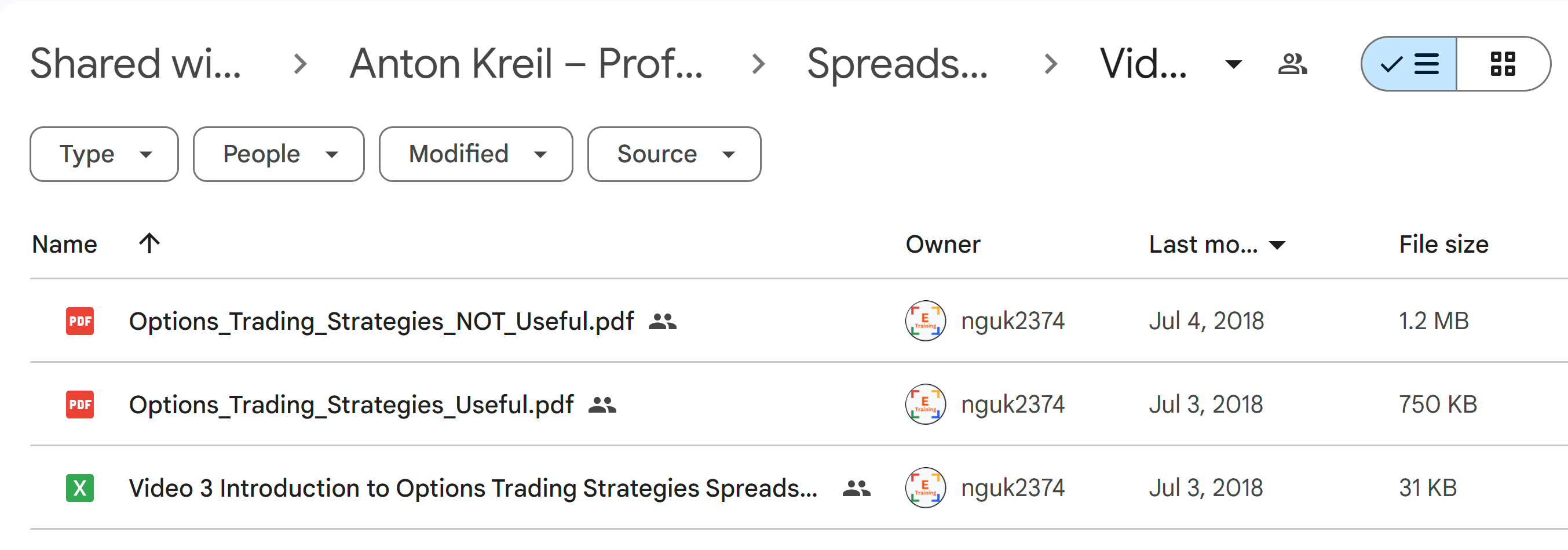

Module 1.2: Strategy Assessment Detailed analysis of viable trading strategies with practical applications. Includes comprehensive spreadsheets for strategy evaluation and comparison. (Files: Options_Trading_Strategies_Useful.pdf, Options_Trading_Strategies_NOT_Useful.pdf)

✅ Section 2: Basic Options Strategies

This section covers fundamental options positions and their applications. Students master essential strategies while understanding their risk-reward profiles and market conditions for optimal deployment.

Module 2.1: Core Options Positions Comprehensive coverage of basic long and short options positions, including detailed analysis of calls and puts. Features practical examples and implementation guidelines. (Files: Video 6 – Long Call & Puts Strategies – Useful.pdf, Video 7 – Naked Short Put Strategy – Useful.pdf)

Module 2.2: Income Generation Strategies Focus on covered calls and collar strategies for portfolio income enhancement. Includes detailed implementation guides and risk management frameworks. (Files: Video 9 – Covered Call Strategy – Useful.pdf, Video 10 – Covered Call Collar Strategy – Useful.pdf)

✅ Section 3: Advanced Options Techniques

This section elevates trading knowledge with sophisticated strategies. Students learn complex spread techniques and volatility-based trading approaches.

Module 3.1: Spread Strategies Advanced spread techniques including bull call, bear put, and ratio spreads. Comprehensive coverage of risk management and position sizing. (Files: Video 12 – Bull Call Spread Strategy – Useful.pdf, Video 13 – Bear Put Strategy – Useful.pdf)

Module 3.2: Volatility Trading In-depth exploration of volatility-based strategies including straddles and strangles. Features practical applications using implied volatility calculator. (Files: POTM_Implied_Volatility_Calculator_Final.xlsm, Video 22 – Long Straddle Strategy – Useful.pdf)

✅ Section 4: Professional Integration

This concluding section synthesizes previous learning into professional trading applications. Students develop comprehensive trading approaches integrating multiple strategies.

Module 4.1: Market Making and Greeks Advanced concepts in options market making and Greek measurements. Includes detailed analysis of volatility trading and risk management. (Files: POTM video 14_Market Makers, Volatility * Greeks*(new).mp4)

Module 4.2: Portfolio Integration Final integration of concepts with focus on portfolio applications and exam preparation. (Files: POTM Video 28_Recap and Exam Preparation (new).mp4, ProfessionalOptions_Trading_Masterclass_Resume_Text.pdf)

Who is Anton Kreil?

Anton Kreil is a professional trader who worked at top Wall Street firms – Goldman Sachs, Lehman Brothers, and JP Morgan. He managed millions in trades and rose to senior trading positions.

He became famous in 2008 as the host of BBC’s “Million Dollar Traders” show, where he taught complete beginners how to trade successfully. After this, he started the Institute of Trading and Portfolio Management (ITPM).

Kreil has now taught over 100,000 people how to trade professionally. He combines his Wall Street experience with practical teaching to help regular traders learn professional methods.

He still actively trades while creating courses based on real market experience. His programs are respected by both major financial institutions and independent traders.

Be the first to review “Anton Kreil – Professional Options Trading Masterclass (POTM)” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Reviews

There are no reviews yet.