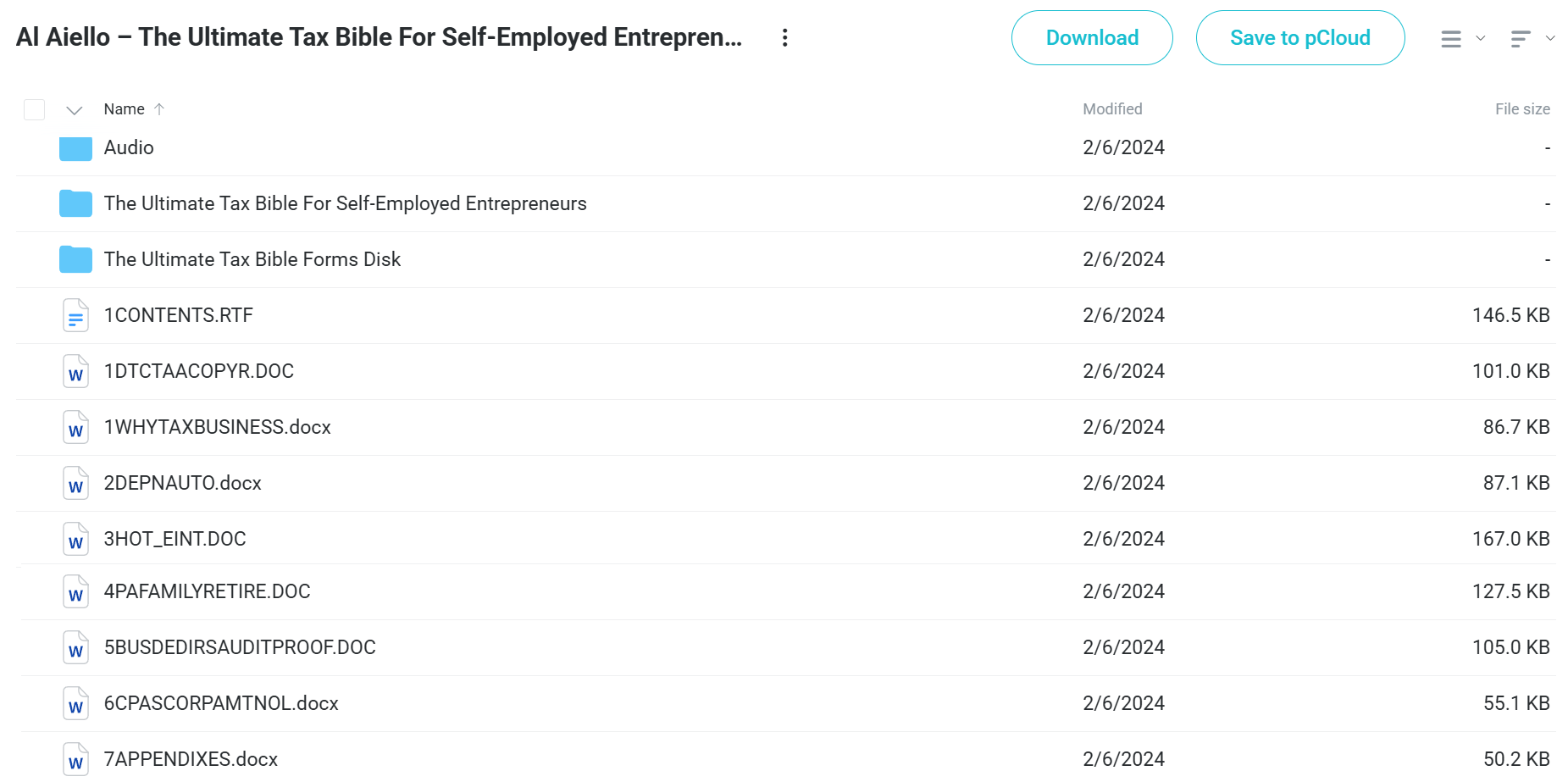

Al Aiello The Ultimate Tax Bible for Self-Employed Entrepreneurs Course [Instant Download]

What is The Ultimate Tax Bible for Self-Employed Entrepreneurs?

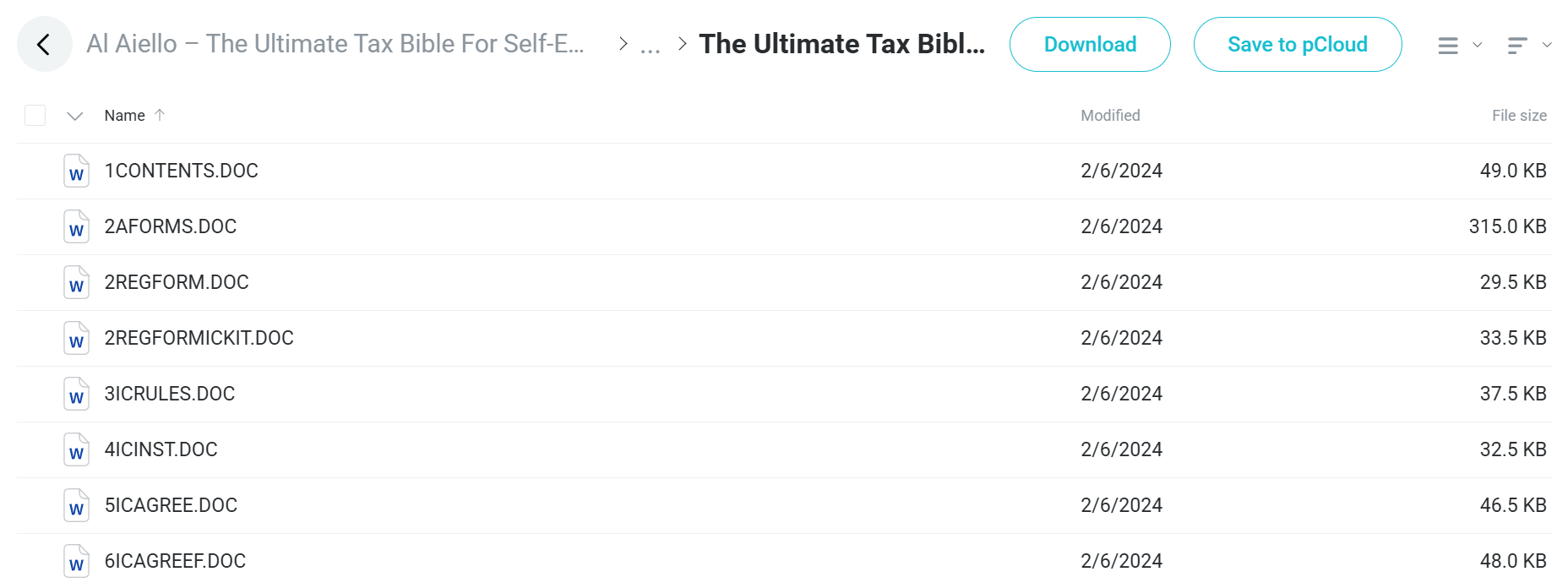

Al Aiello’s Ultimate Tax Bible is a tax reduction course teaches entrepreneurs how to legally cut their tax bill using 200+ strategies most CPAs don’t know.

The program shows you how to maximize business deductions, select the best entity structure for your business, and audit-proof your tax returns to avoid IRS problems.

You’ll master depreciation methods, auto expense deductions, home office write-offs, and retirement plan strategies that save thousands in taxes every year.

📚 PROOF OF COURSE

What you’ll learn in this The Ultimate Tax Bible course:

This tax course teaches you everything needed to cut your tax burden as a self-employed entrepreneur. Here’s what you’ll learn:

- Tax Reduction Strategies: 200+ little-known methods to legally cut your tax bill

- Business Entity Selection: Choose the right structure (LLC, S-Corp, C-Corp) for maximum tax savings

- Audit Protection: 18 proven ways to audit-proof your returns and avoid IRS problems

- Deduction Strategies: Over 250 business deductions including auto, home office, and medical expenses

- Retirement Planning: 9 ways to create tax-free wealth with retirement plans

- Family Tax Strategies: Use family members to reduce taxes and help your business grow

By the end, you’ll have a complete tax system that saves you thousands every year while keeping you safe from audits.

Al Aiello The Ultimate Tax Bible Course Structure:

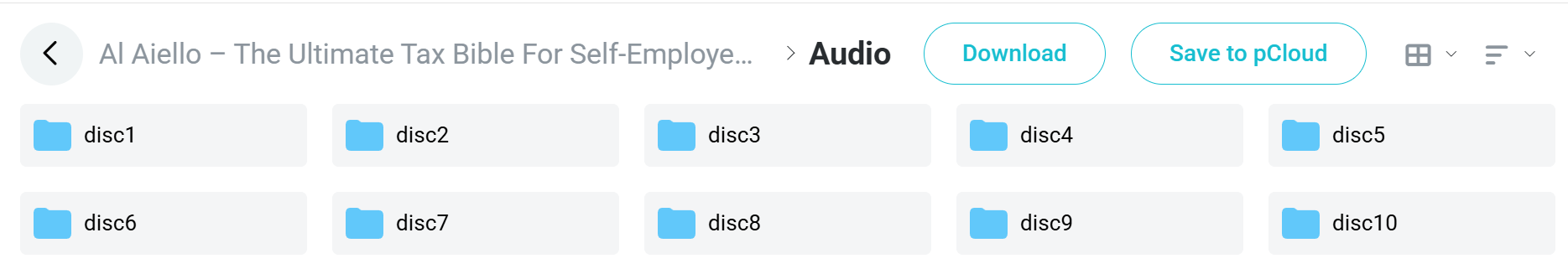

✅ Disc 1: Business Tax Basics

This first module introduces the tax benefits of running a business and explains depreciation strategies. Students learn how to get the most from depreciation deductions through first-year write-offs and other approaches that can greatly lower taxable income.

Key Lessons: The section on “Huge Deduction with First-year Expensing” shows practical ways to write off major purchases, potentially saving thousands in the first year.

✅ Disc 2: Getting the Most from Vehicle Deductions

This module covers smart ways to handle car expenses in your business. Students learn the good and bad points of standard mileage versus actual expense methods, with useful tips to increase business mileage and decide whether leasing or buying is better for their situation.

Key Techniques: The comparison between leasing and buying vehicles gives clear guidance based on how you use vehicles in your business, helping owners make smart money choices.

✅ Disc 3: Travel, Entertainment, and Home Office Write-offs

This section teaches business owners how to properly record and maximize deductions for entertainment costs, business trips, and home office use. Students learn what expenses qualify and how to increase the amount they can deduct.

Key Strategies: The home office deduction lessons show how to properly split expenses and get the most from this often-missed deduction while avoiding red flags with the IRS.

✅ Disc 4: Family Tax Planning

This module shows strategies for including family members in your business to create legal tax benefits. Students learn how to properly classify workers, deduct payments to family members, and set up benefits and leasing arrangements for more tax savings.

Key Technique: The section on “More Family Tax Strategies via Leasing” shows how family-owned items can be leased to the business, shifting income while creating business deductions.

✅ Disc 5: Retirement Planning

This module covers various retirement plan options for business owners. Students learn about Keogh Plans, SEP Plans, traditional and Roth IRAs, with guidance on picking the right mix of retirement accounts for their needs.

Key Lesson: “How to Take Out Tax-free Money from IRAs and Other Tips” shows smart ways to access retirement funds without paying taxes, an important skill for money planning.

✅ Disc 6: Audit Protection

This important module teaches business owners how to properly document their activities to stand up to IRS review. Students learn specific strategies for filing extensions, maximizing Schedule C deductions, and showing they truly intend to make a profit.

Key Strategy: The “Audit-Proofing Statements” lesson provides specific wording and record-keeping approaches that help support business deductions and lower audit risk.

✅ Disc 7: Business Structures

This advanced module explores using different business types to pay less tax. Students learn strategies for using S-Corporations to lower Social Security taxes, setting up medical reimbursement plans, and choosing between LLCs, S-Corps, and C-Corps based on their needs.

Key Technique: The section on “Using an S-Corp with a Medical Reimbursement Plan” shows a powerful combined strategy that can greatly reduce both income and payroll taxes.

✅ Disc 8: Advanced Tax Planning

This module covers ways to handle business losses, quarterly tax payments, and fixing past tax returns. Students learn how to use Net Operating Losses (NOLs) to get tax refunds and how to pick the right tax advisor to help with these advanced strategies.

Key Lesson: “Safely Filing Amended Returns for Hidden Tax Dollars” teaches business owners how to claim missed deductions from past years without raising audit risk.

✅ Disc 9: Business Deductions and Year-End Planning

This practical module highlights often-missed business deductions and timely year-end tax planning strategies. Students learn step-by-step approaches to figure out why they’re paying too much tax and specific actions to fix the problem.

Key Strategy: The “Year-end Tax Planning Strategies” lesson gives a complete checklist of actions to take before December 31st to legally lower tax bills.

✅ Disc 10: Building Wealth Through Tax Law

This final module teaches business owners how to use tax law not just for yearly savings but for long-term wealth building. Students learn how smart tax planning works together with overall money planning to build lasting wealth.

Key Lesson: “Using Tax Law to Make You Wealthy” changes the focus from just following tax rules to using tax planning as a wealth-building tool.

Who is Al Aiello?

Al Aiello was a CPA and tax strategist with over 30 years of experience helping self-employed entrepreneurs cut their taxes.

He held a Master’s degree in Taxation with highest honors and taught courses on partnerships, corporations, and real estate taxation as a professor.

Al specialized in tax reduction strategies, audit-proofing techniques, and asset protection methods. He helped thousands of business owners legally reduce their tax bills.

He wrote “The Renaissance Goldmine of Brilliant Tax Strategies For Real Estate Investors” and became a recognized expert in business taxation and entity optimization.

His Ultimate Tax Bible course uses decades of proven strategies that have saved students thousands of dollars in taxes.

Be the first to review “Al Aiello – The Ultimate Tax Bible For Self-Employed Entrepreneurs” Cancel reply

Related products

Real Estate

Property Management

Reviews

There are no reviews yet.