William Bronchick – Creative Real Estate Financing Course

$997.00 Original price was: $997.00.$32.00Current price is: $32.00.

William Bronchick Creative Real Estate Financing Course [Instant Download]

What is William Bronchick Creative Real Estate Financing?

William Bronchick Creative Real Estate Financing is a course that teaches how to buy and sell properties without banks.

You’ll learn lease options, owner financing, wraparound mortgages, and contracts for deed. These creative financing methods help you control properties with little or no money down.

Based on over 1,000 real deals, the course covers the exact legal forms, contracts, and negotiation strategies that make these transactions work.

📚 PROOF OF COURSE

What you’ll learn in Creative Real Estate Financing Course:

This course teaches everything about creative real estate financing to build wealth without traditional lending. Here’s what you’ll learn:

- Owner financing techniques including contracts for deed, wraps, and nothing-down formulas

- Seven ways to use lease options and create multiple income streams

- How to handle due-on-sale clauses safely and make any loan assumable

- Strategies for buying foreclosures even with no equity

- Complete legal forms and contracts worth over $1,000 if drafted by attorneys

- Tax rules and Dodd-Frank compliance for creative financing deals

You’ll master how to structure deals banks won’t touch and create passive income without being a landlord.

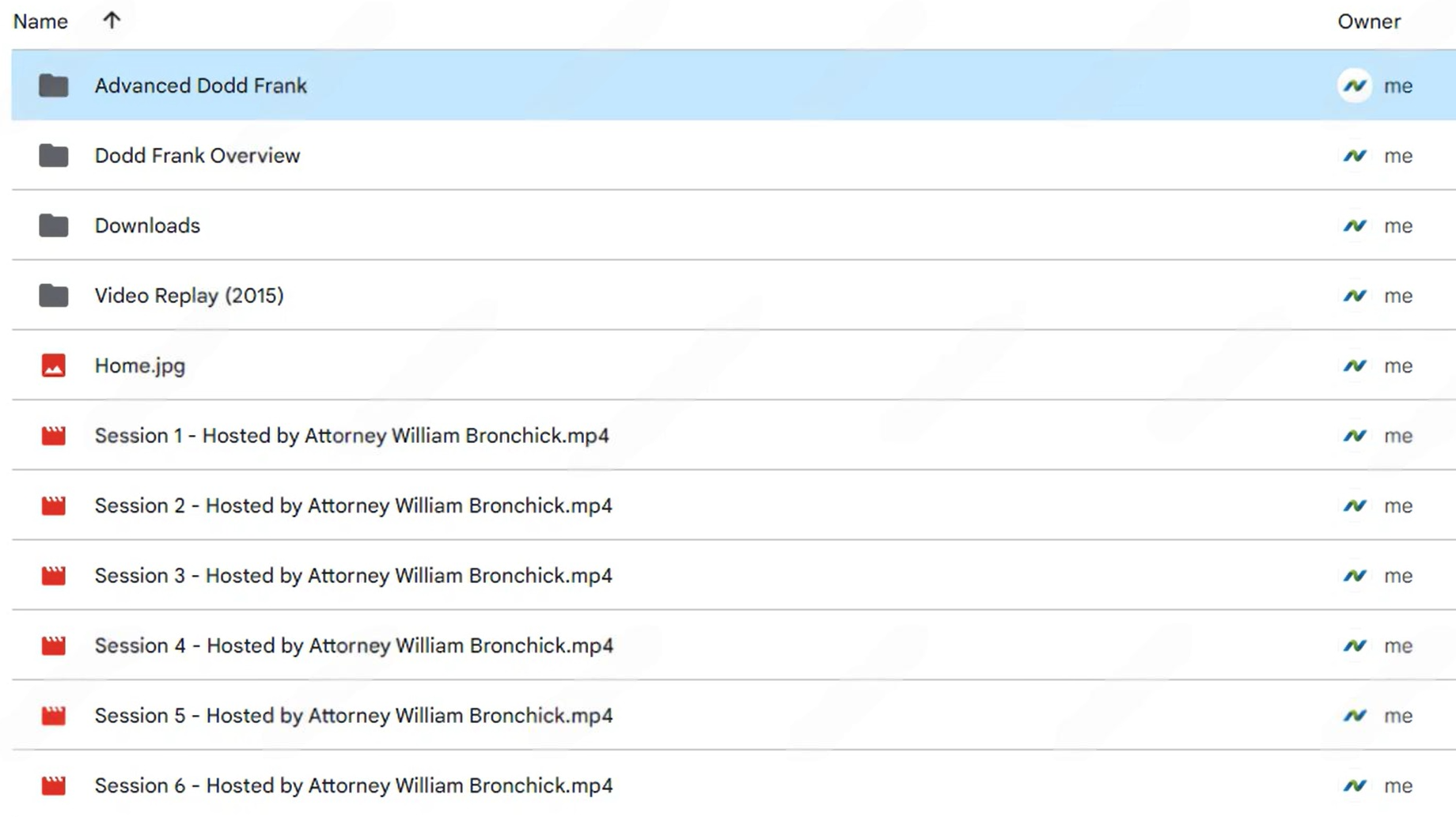

Creative Real Estate Financing Course Curriculum:

✅ Sessions 1-6: Main Course Sessions

The main lessons begin with the basic ideas of creative financing, showing why bank loans aren’t always the best choice for real estate investors. Session 1 teaches key words, basic deal types, and the right thinking needed for creative financing success.

Sessions 2 and 3 show specific methods like seller financing, lease options, and taking over someone’s loan. Students learn how to set up these deals, figure out profits using included spreadsheets, and find sellers who need creative solutions.

The middle sessions (4-5) focus on making deals and studying them carefully. You’ll discover how to make offers that help both you and the seller, handle seller doubts, and use the Cash Cowculator tool to check if deals make money.

Session 6 brings everything together with real examples and action plans. Students learn to mix different methods, create wins for everyone, and build a lasting business using creative financing.

✅ Dodd-Frank Rules Modules

The Dodd-Frank Overview section explains the 2010 financial law and how it affects seller financing. This part shows which deals are covered, who counts as a loan maker, and basic rules real estate investors must follow.

The Advanced Dodd-Frank module gives deeper legal details for complex deals. Students learn about the three-house exception, balloon payment limits, and proper paperwork needed to avoid trouble.

Both modules focus on practical ways to follow rules while still making money. You’ll understand how to set up owner-financed deals that meet government rules without losing investment profits.

✅ Practical Resources and Tools

The Downloads section gives you important forms and calculators to use right away. The Owner Financing Legal Forms package has contracts, notices, and extra pages made for creative financing deals.

The Excel calculators (Cash Cowculator and Lease Option Calculator) help students study deals quickly and correctly. These tools do the hard math for cash flow, return on investment, and best pricing plans.

The Legalwiz Guide works as a complete reference book. This PDF brings together main ideas, legal points, and step-by-step guides for different creative financing methods.

✅ Video Replay Archive (2015)

This bonus section has older versions of the course material, showing how things have changed over time. The four saved sessions offer different examples and stories that add to the main lessons.

Students benefit from seeing how creative financing has changed over the years. The archive shows which methods always work and which have changed with new rules.

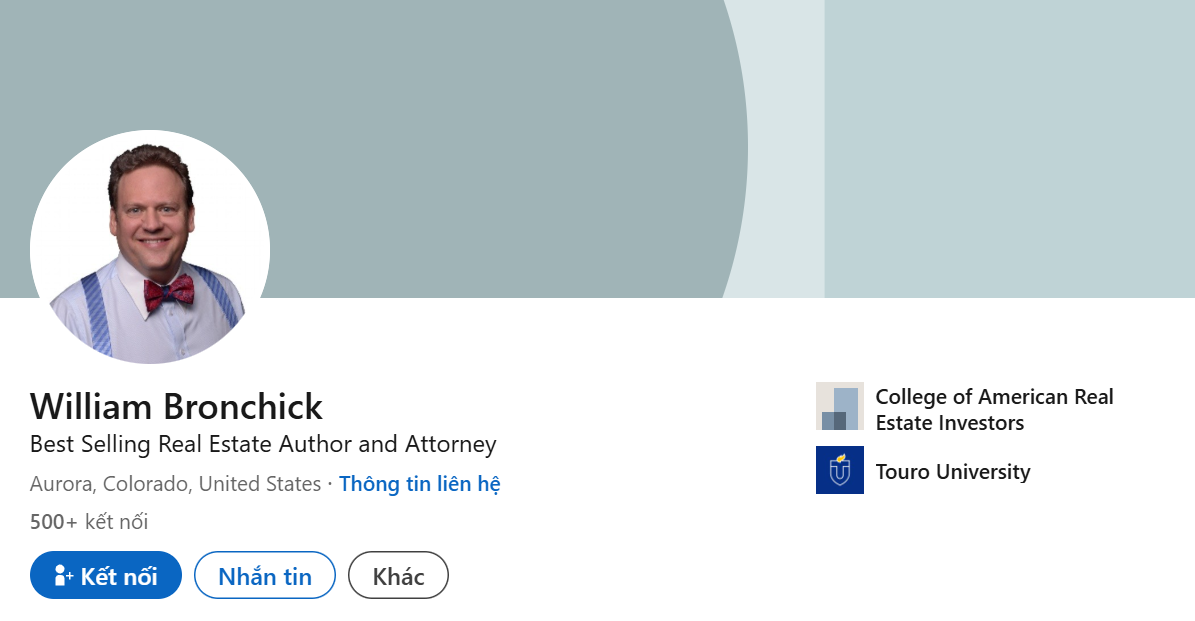

Who is William Bronchick?

William Bronchick is an attorney and real estate investor with over 30 years of experience. He’s closed more than 1,000 creative financing deals.

He wrote best-selling books including “Flipping Properties” and “Financing Secrets of a Millionaire Real Estate Investor.” Bronchick specializes in lease options, contracts for deed, wraparound mortgages, and seller financing.

Bronchick founded Legalwiz to teach creative financing nationwide. He’s trained over 25,000 students in 47 countries and speaks at major real estate events.

His mix of legal expertise and hands-on investing makes him a rare expert in creative financing. Students regularly close profitable deals using his methods and forms.

Be the first to review “William Bronchick – Creative Real Estate Financing Course” Cancel reply

Related products

Real Estate

Real Estate

Real Estate

Real Estate

Lease Options

Real Estate

Real Estate

Reviews

There are no reviews yet.