Jeff Ziegler – Credit Spread Trading Made Simple 3.0

$90.00 Original price was: $90.00.$12.00Current price is: $12.00.

Jeff Ziegler Credit Spread Trading Made Simple 3.0 Course [Instant Download]

1️⃣. What is Jeff Ziegler Credit Spread Trading Made Simple 3.0?

Jeff Ziegler’s Credit Spread Trading Made Simple 3.0 is an options trading course that teaches you how to make consistent income in any market condition.

The course shows you three powerful strategies: bear call spreads when markets fall, bull put spreads when markets rise, and iron condors when markets move sideways.

Jeff breaks down complex options concepts into simple steps that anyone can follow, even beginners. His method comes from 15+ years of real trading experience.

The program focuses on low-risk, high-probability trades that can generate weekly or monthly income without needing to predict market direction.

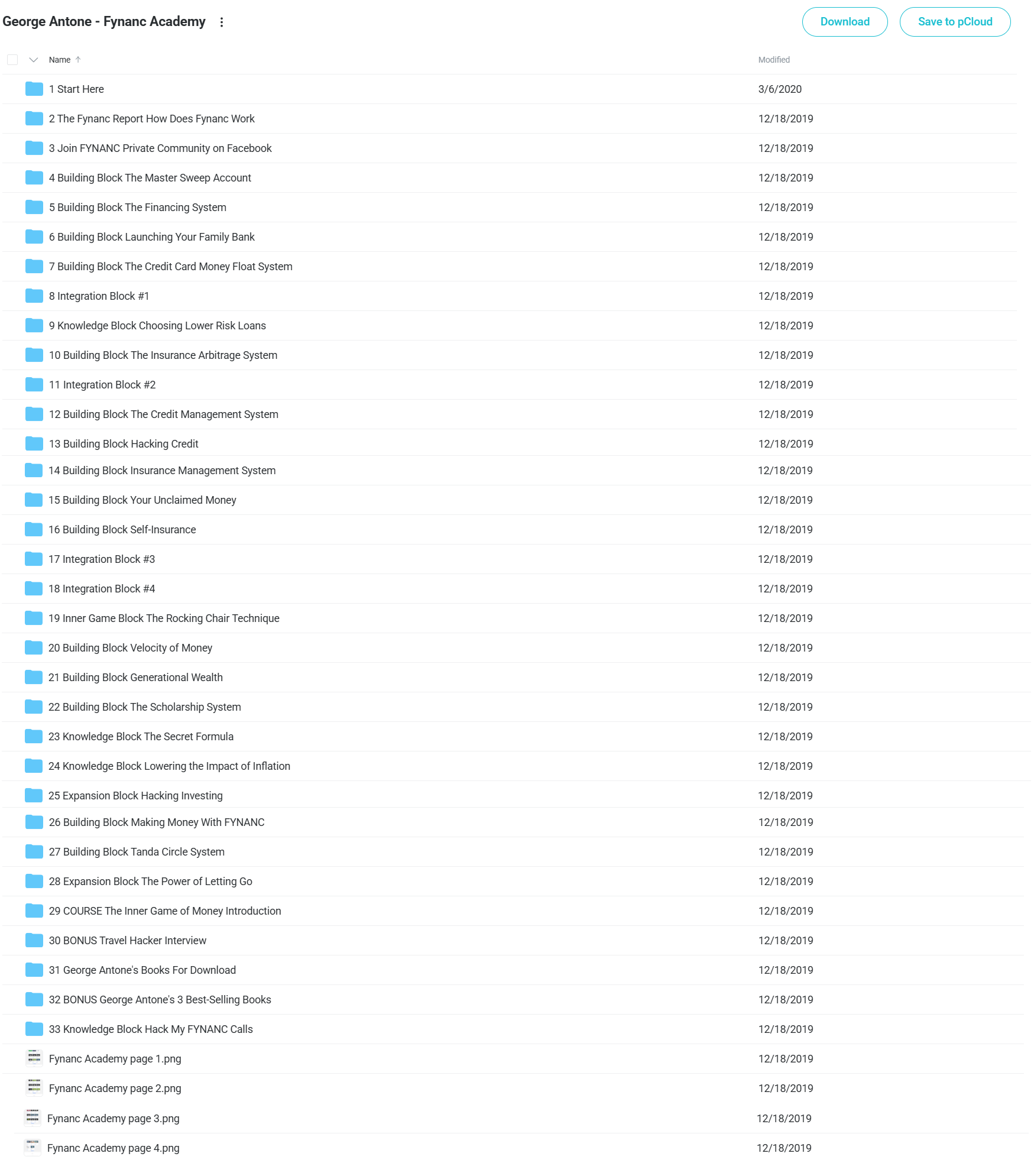

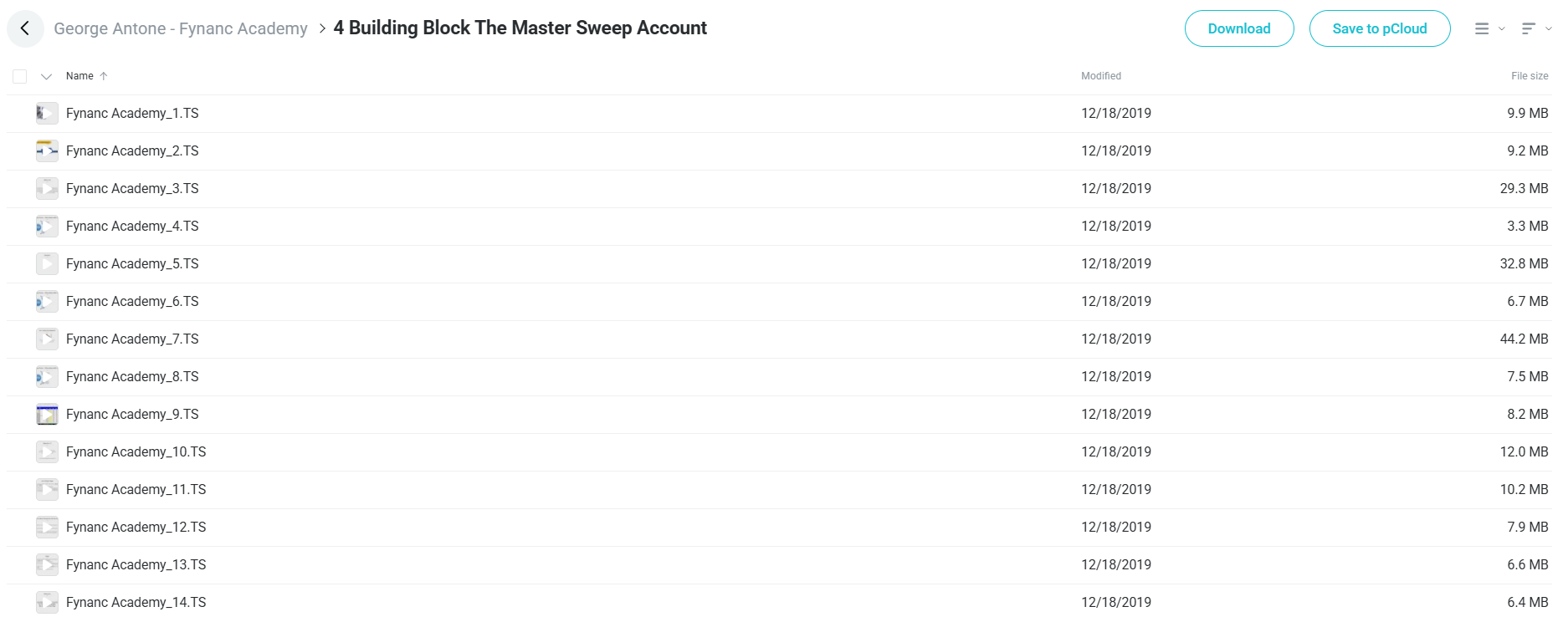

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Credit Spread Trading Made Simple 3.0:

This options trading course shows you how to make steady income using credit spreads no matter what the market is doing. Here’s what you’ll learn:

- Multiple trading strategies: Learn bear call spreads for falling markets, bull put spreads for rising markets, and iron condors for sideways markets

- Technical analysis: Spot important candlestick patterns and find key support and resistance levels for better trade timing

- Risk management: Protect your money while aiming for consistent profits

- Weekly income generation: Create regular cash flow with weekly options trades

- Trading psychology: Develop the mental discipline needed for successful trading

- Practical implementation: Follow Jeff’s simple steps to plan and make profitable trades

When you finish the course, you’ll know how to trade with confidence in any market using proven credit spread methods that actually work.

3️⃣. Credit Spread Trading Made Simple 3.0 Course Curriculum:

✅ Modules 1-3: Foundation

These first modules help you get started and join the community. You’ll learn about the FYNANC system, how it works, and its main ideas for improving your finances. The Facebook group gives you support for questions and lets you share your wins with others.

✅ Modules 4-7: Basic Building Blocks

This section sets up the key money structures you need for credit spread trading. You’ll create a Master Sweep Account as your main money hub, build your own financing system, start your “Family Bank,” and use the Credit Card Money Float System to access interest-free money.

✅ Modules 8-9: First Integration & Knowledge Application

Integration Block #1 helps you combine the first building blocks into one working system. The Knowledge Block about choosing safer loans teaches you how to find good lending options with less risk while getting better returns.

✅ Modules 10-16: Advanced Building Blocks

These modules build on your foundation with smarter money techniques. You’ll learn about insurance advantages, better credit management, credit improvement tricks, insurance management, finding money you didn’t know you had, and ways to self-insure to keep more of your money.

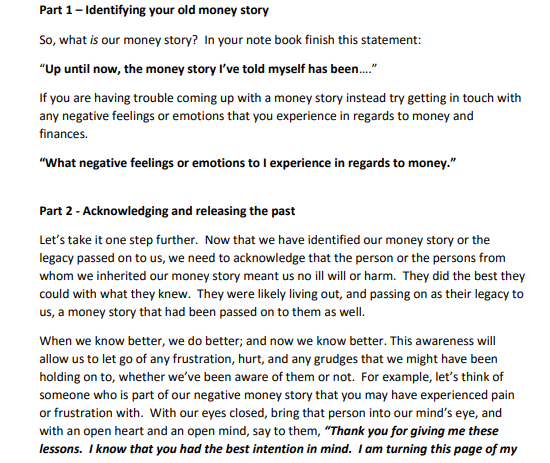

✅ Modules 17-19: Advanced Integration & Inner Game

Integration Blocks #3 and #4 help you combine advanced ideas into one system. The Inner Game Block teaches the Rocking Chair Technique, focusing on the mental side of building wealth and developing the right mindset for long-term money success.

✅ Modules 20-23: Wealth Acceleration

This section focuses on growing wealth faster through smart approaches. You’ll master the Velocity of Money concept to use capital more efficiently, develop family wealth transfer plans, create scholarship systems for education funding, and learn the Secret Formula for finding the best credit spread opportunities.

✅ Modules 24-28: Expansion & Protection

These modules help you protect and grow your wealth. You’ll learn how to guard against inflation, improve investments, make money with FYNANC knowledge, use the Tanda Circle System for group financing, and discover the mental benefits of letting go in financial decisions.

✅ Modules 29-33: Extra Resources

The final section gives you more tools to strengthen what you’ve learned. It includes an intro to The Inner Game of Money, a Travel Hacker interview showing real-world uses, George Antone’s books for deeper learning, and recorded coaching calls covering advanced FYNANC strategies.

4️⃣. Who is Jeff Ziegler?

Jeff Ziegler has been teaching options trading since 2008. With 15+ years in the markets, he focuses on credit spread strategies that work whether markets go up, down, or sideways.

Jeff created the “Credit Spread Trading Made Simple” method after mastering options trading himself. He breaks down complex concepts into clear, practical steps anyone can follow.

As founder of jeffreyziegler.com, Jeff has built a community of traders who use his methods for steady options income. He explains advanced trading ideas without confusing jargon.

Jeff is known for his weekly options expertise and his unique “Green Coats vs. Red Coats” system for finding support and resistance levels. This helps his students find better entry and exit points for their trades.

Jeff offers more than just his main course. He provides his trading book, personal trading plan, and training videos. He shares trading tips on his YouTube channel and Facebook page.

Unlike many trading teachers, Jeff emphasizes safety and consistent income instead of risky trades. His practical methods work for both beginners and experienced traders.

5️⃣. Who should take Jeff Ziegler Course?

Credit Spread Trading Made Simple 3.0 is for people who want to make steady income with options trading. This course is perfect for:

- Options beginners who want safer strategies with higher chances of success instead of risky directional bets.

- Experienced traders who want to add credit spreads to their trading tools for more reliable income.

- Working professionals looking for extra income without watching markets all day.

- Active investors who want to make money in any market—up, down, or sideways.

- Safety-focused traders who like strategies with clear risk limits and exit plans.

This course is right for you if you’re tired of unpredictable results and want a clear system for options trading. The simple, step-by-step lessons make these strategies easy to understand, even for beginners.

6️⃣. Frequently Asked Questions:

Q1: What is a credit spread in options trading?

Q2: How do bear call spreads work?

Q3: How do you manage risk with options trading?

Q4: Can you make money in any market condition with options?

Q5: What technical analysis helps with credit spread trading?

Be the first to review “Jeff Ziegler – Credit Spread Trading Made Simple 3.0” Cancel reply

Related products

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Options Trading

Mastertrader – Master Trader Option Strategies Series for Investors and Active Traders

Best 100 Collection

Options Trading

![[Bundle] Best 14 Dan Sheridan Courses](https://coursehuge.com/wp-content/uploads/2023/09/Bundle-Best-14-Dan-Sheridan-Courses-300x300.jpg)

Reviews

There are no reviews yet.