Wyckoff Trading Practicum Fall 2019 WPTC (Sept – Dec)

$998.00 Original price was: $998.00.$78.00Current price is: $78.00.

Roman Bogomazov Wyckoff Trading Practicum Fall 2019 WPTC Course [Instant Download]

1️⃣. What is Wyckoff Trading Practicum Fall 2019 WPTC:

The Wyckoff Trading Practicum Fall 2019 WPTC teaches you how to analyze stock charts and make profitable trading decisions using the Wyckoff Method.

This 15-session program shows you how to identify trading opportunities through price-volume analysis and market structure. You’ll practice with real-time charts to master pattern recognition and trade management.

Roman Bogomazov guides you through practical exercises to develop your skills in supply-demand analysis, trade timing, and position management. The course helps you build confidence in applying Wyckoff principles to actual market conditions.

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Wyckoff Trading Practicum Fall 2019 WPTC:

Learn to trade confidently using the Wyckoff Method through hands-on practice and expert guidance. Here’s what you’ll learn:

- Chart Analysis: Master trading ranges, including accumulation and distribution patterns that show where price trends begin

- Price and Volume: Learn to read price-volume relationships that reveal market structure and predict moves

- Trade Planning: Master when to enter trades, how to exit, and how much to invest in each position

- Market Strength: Understand supply-demand analysis and how to compare stock strength to find the best trades

- Pattern Reading: Learn to spot and trade Wyckoff patterns as they form in real market conditions

After completing this course, you’ll know how to find and execute profitable trades using proven Wyckoff principles.

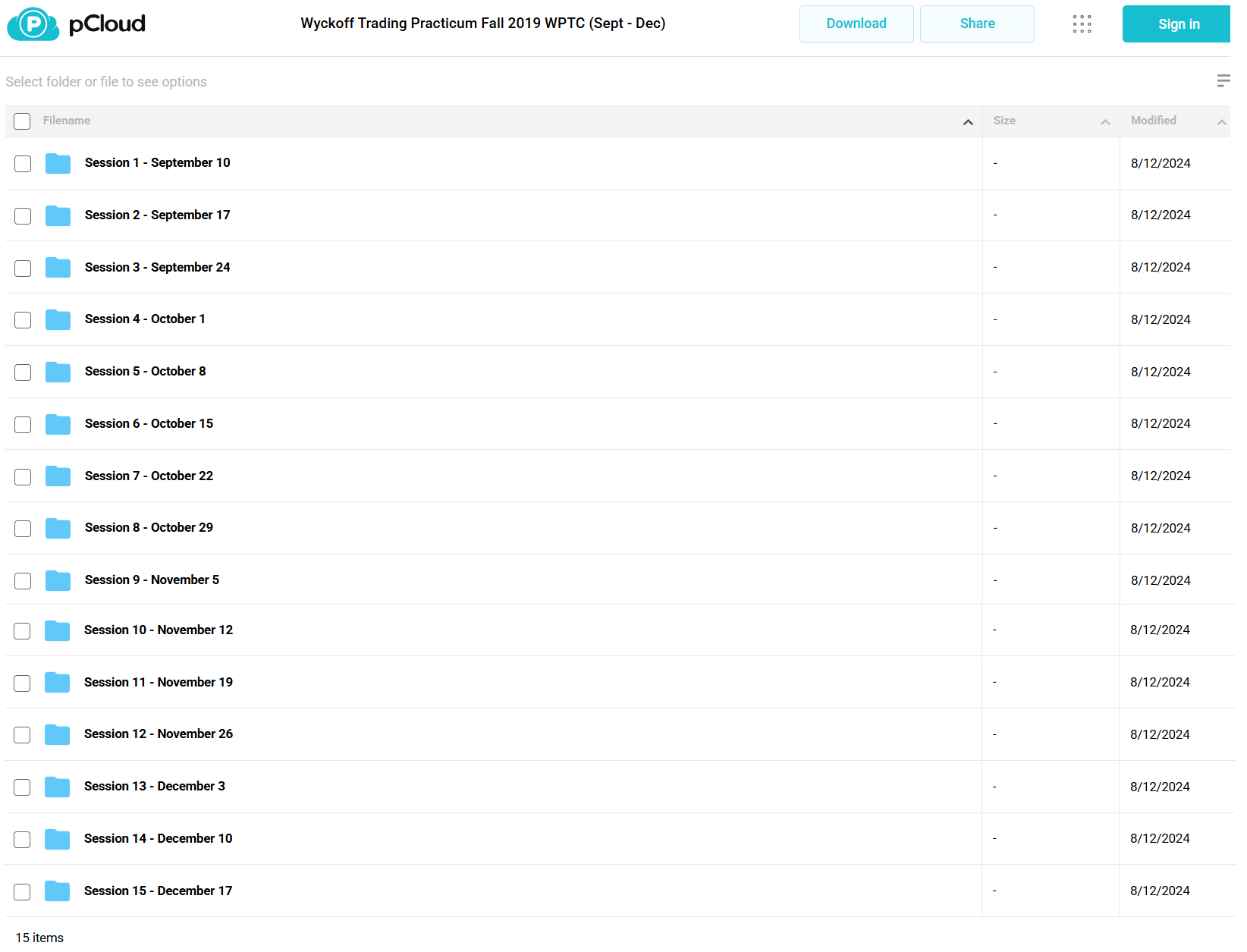

3️⃣. Wyckoff Trading Practicum Fall 2019 WPTC Course Curriculum:

The Wyckoff Trading Practicum curriculum is structured across 15 comprehensive sessions. Each session builds on core Wyckoff principles through practical application and deliberate practice.

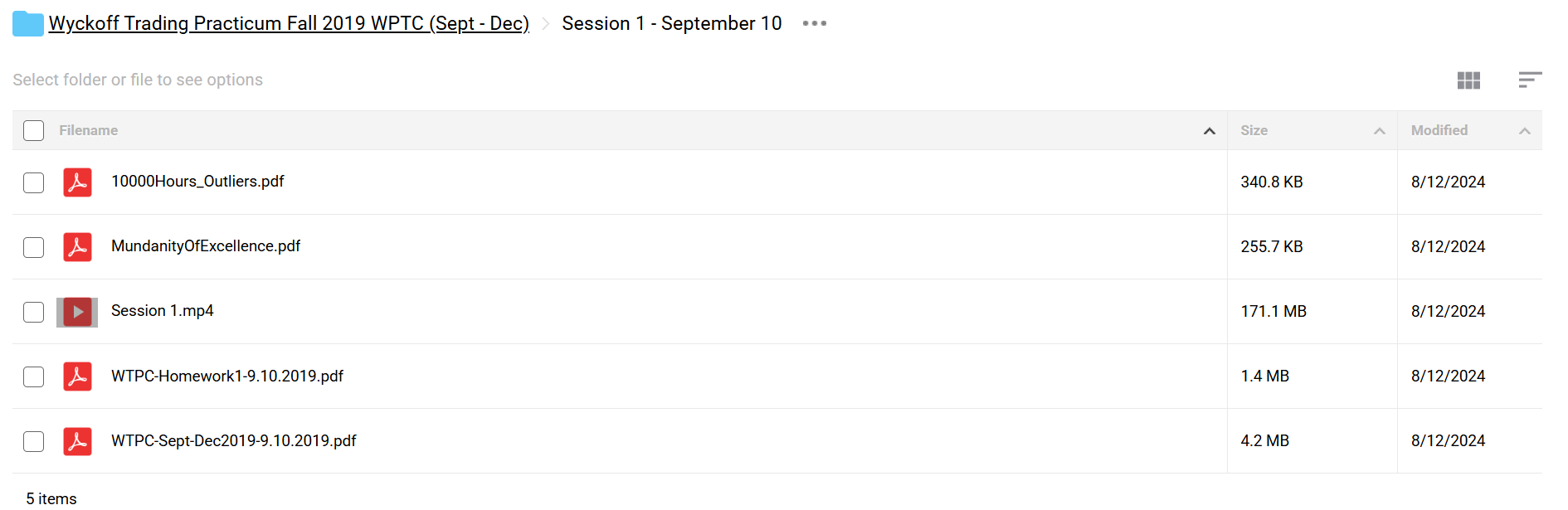

✅ Section 1: Foundation and Excellence (September 10-24)

The first section establishes the mindset and fundamentals of Wyckoff trading. Students begin with core readings on mastery and excellence, then progress through practical chart analysis exercises.

Module 1.1: Trading Foundations Session materials include foundational texts on expertise development and trading excellence. Includes required reading “10000 Hours Outliers” and “Mundanity of Excellence” (PDF), followed by practical homework assignments applying these concepts.

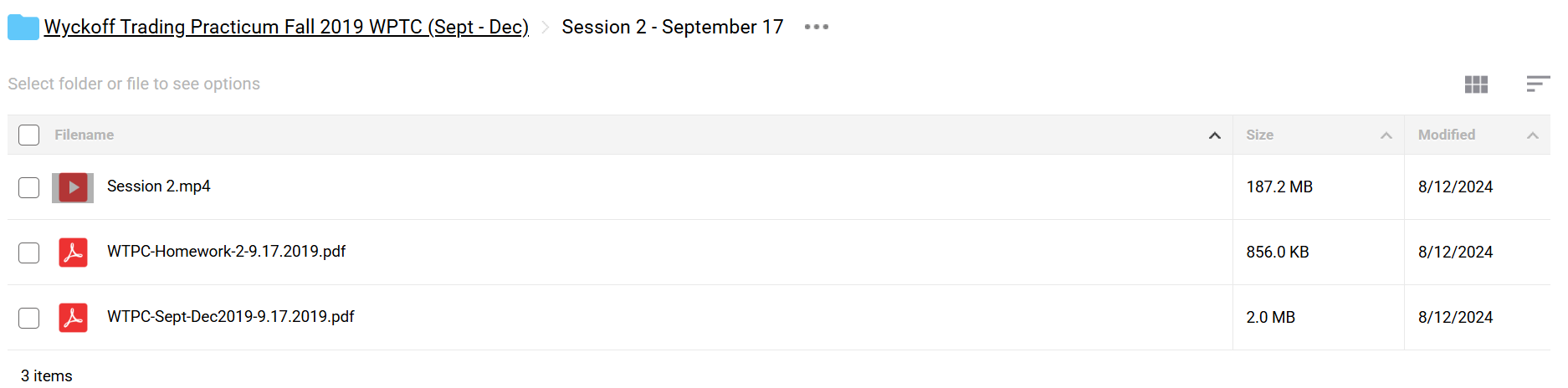

Module 1.2: Chart Analysis Basics Sessions 2-3 focus on developing basic chart reading skills and pattern recognition. Each session includes video instruction, practice materials, and homework assignments for skill reinforcement.

✅ Section 2: Market Structure and Analysis (October 1-22)

This section deepens understanding of market structure and price-volume relationships through intensive practice.

Module 2.1: Price-Volume Analysis Sessions 4-5 cover advanced price-volume analysis techniques. Students learn to identify significant market patterns through detailed chart studies and guided practice.

Module 2.2: Trading Range Analysis Sessions 6-7 focus on trading range analysis, accumulation, and distribution patterns. Practice materials include real market examples and structured homework assignments.

✅ Section 3: Advanced Trading Tactics (October 29 – November 19)

The third section advances into sophisticated trading strategies and position management.

Module 3.1: Trade Management Sessions 8-10 cover entry tactics, position sizing, and exit strategies. Each session includes video instruction and practical exercises.

Module 3.2: Risk Management Sessions 11-12 focus on risk control and portfolio management techniques specific to the Wyckoff approach.

✅ Section 4: Integration and Mastery (December 3-17)

The final section synthesizes all components into a complete trading approach.

Module 4.1: Advanced Applications Sessions 13-14 focus on advanced pattern recognition and trade execution in various market conditions.

Module 4.2: Course Integration The final session brings together all concepts through comprehensive case studies and trading plan development.

Each session includes:

- Detailed video instruction (MP4)

- Practice materials and assignments (PDF/PPTX)

- Session notes and reference materials

- Homework assignments for skill development

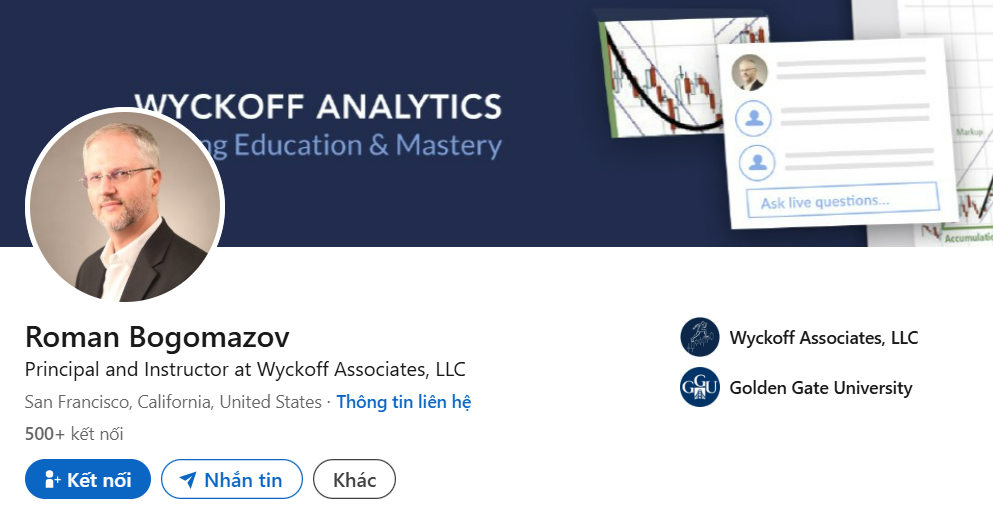

4️⃣. Who is Roman Bogomazov?

Roman Bogomazov has traded using the Wyckoff Method for over 20 years and teaches it exclusively in his trading courses.

He teaches as an Adjunct Professor at Golden Gate University, where he and Hank Pruden created the Wyckoff Method online program. As President of Wyckoff Associates, LLC, he has taught over 700 trading classes in just three years.

Roman leads the trading community at WyckoffAnalytics.com, teaching traders worldwide. He has served on the Board of the International Federation of Technical Analysts and led the Technical Securities Analysts Association of San Francisco.

5️⃣. Who should take Roman Bogomazov’s Course?

The Wyckoff Trading Practicum is designed for traders ready to master advanced trading skills. This course is for:

- WTC Graduates who want to improve their trading using the Wyckoff Method

- Previous Students looking to strengthen their chart reading and analysis

- Active Traders wanting to get better at timing their trades

- Market Professionals ready to enhance their trading results

Important Note: You must have completed the WTC or WTPC course before joining this practicum. This ensures all students have the foundation needed to benefit from the advanced training.

6️⃣. Frequently Asked Questions:

Q1: How do I analyze stock charts effectively?

Focus on identifying trends, support and resistance levels, and price patterns. Use volume analysis and technical indicators like moving averages and RSI to confirm trends.

Q2: What are the key indicators for profitable trading?

Common indicators include Moving Averages, RSI, MACD, and Bollinger Bands. These help identify entry and exit points, momentum, and market conditions.

Q3: How do I manage risk while trading?

Set stop-loss orders, use proper position sizing, and diversify your portfolio. Risk management is crucial to protect capital and sustain long-term profitability.

Q4: What is the role of volume in stock chart analysis?

Volume helps confirm trends and reversals. Increasing volume during uptrends signals strength, while low volume on declines suggests weak selling pressure.

Q5: How can I improve my trading discipline?

Develop a clear trading plan, stick to predefined rules, and avoid emotional decision-making. Keeping a trading journal helps track performance and refine strategies.

Be the first to review “Wyckoff Trading Practicum Fall 2019 WPTC (Sept – Dec)” Cancel reply

Related products

Trading Courses

Forex Trading

Forex Trading

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.