Steve Mauro – Market Maker Method – 4 Day Course with Indicators

$5,000.00 Original price was: $5,000.00.$28.00Current price is: $28.00.

Steve Mauro Market Maker Method Course [Instant Download]

1️⃣. What is Market Maker Method?

Market Maker Method is a Forex trading course that shows you how market makers control price movements.

You’ll learn the three-day cycle pattern that big banks use to hunt stop losses and manipulate price. The course reveals when these institutions accumulate positions and when they plan to move the market.

The 4-day training includes custom indicators to help you spot these institutional moves. You’ll master how to trade with market makers instead of becoming their target, focusing on the Asian session consolidation and the following breakout moves.

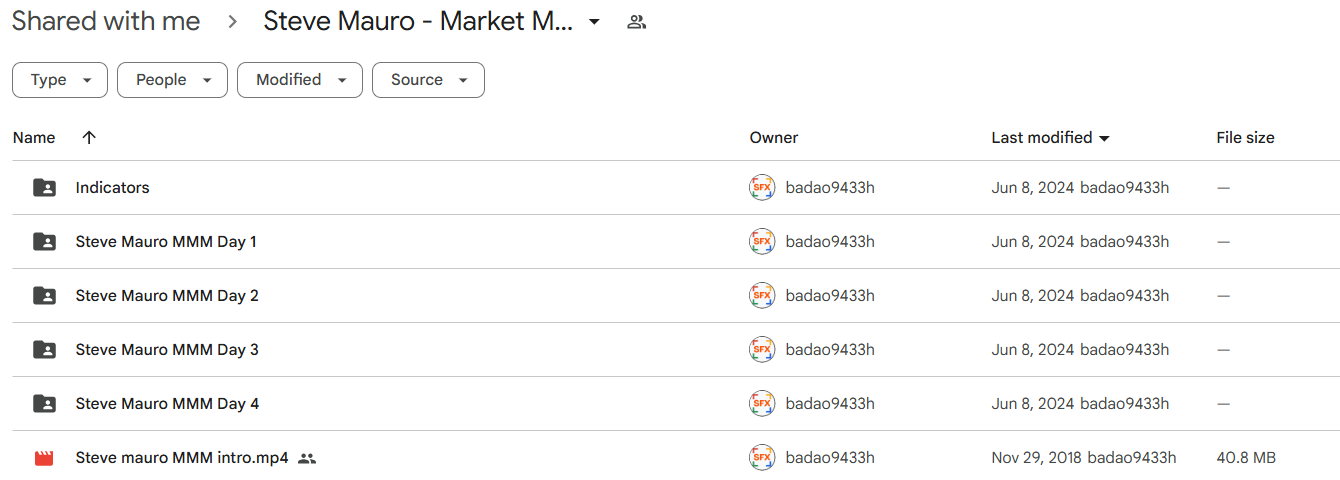

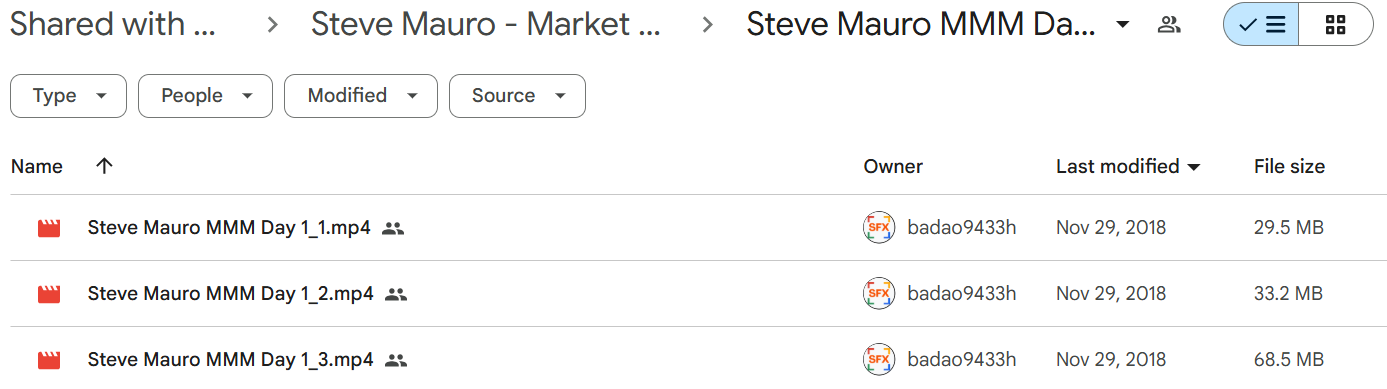

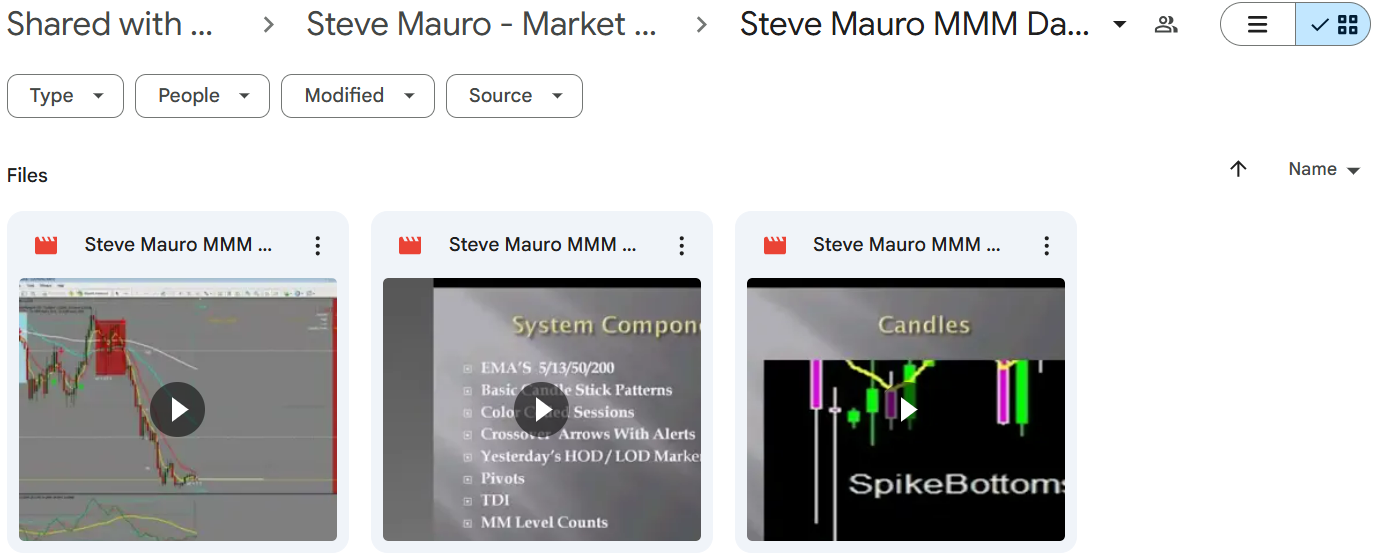

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Market Maker Method?

The Market Maker Method shows you how banks and institutions move the Forex market. Here’s what you’ll learn in 18 Videos:

- Market Patterns: Spot the three-day cycles banks use to move prices and trap retail traders

- Trading Tools: Use special indicators that show where market makers are placing their orders

- Stop Loss Zones: Find where banks hunt for stops and avoid getting caught in these traps

- Asian Session: Learn how institutions build positions during quiet market hours

- Trade Setups: Know exactly when to enter and exit trades based on bank movements

- Money Management: Keep your account safe while trading with institutions

After the course, you’ll be able to spot bank moves before they happen and trade in their direction for better results.

3️⃣. Who is Steve Mauro?

Steve Mauro created the Market Maker Method after studying how banks control Forex markets. He discovered patterns in how these institutions manipulate prices and built a trading system around it.

His expertise comes from years of tracking institutional order flow and market maker tactics. He turned this knowledge into a practical trading approach that retail traders can use.

Mauro focuses on real trading examples to teach his method. He’s taught thousands of traders how to spot and profit from bank price manipulation in the Forex market.

He runs an active trading community where he continues sharing his knowledge about institutional trading patterns and bank strategies.

4️⃣. Who should take Steve Mauro Course?

This course is suitable for:

- New traders who want to understand Forex market manipulation and institutional strategies.

- Experienced traders looking to refine their technical analysis and trading execution.

- Day traders & swing traders aiming to improve their trade timing and profit consistency.

- Forex enthusiasts interested in mastering the art of reading market maker movements.

- Anyone looking for a structured approach to trading with a proven method.

If you want to stop losing to market manipulation and start trading with precision, this course is for you.

5️⃣. Frequently Asked Questions:

Q1: How do market makers control price movements?

Market makers influence prices by creating artificial volatility, triggering stop-loss orders, and setting liquidity traps. They use tactics like stop hunts and price consolidation before major moves.

Q2: What role do institutional traders play in Forex?

Institutional traders, such as banks and hedge funds, control vast market volumes. They manipulate liquidity, execute large block trades, and use algorithmic strategies to maintain their market advantage.

Q3: What is a stop hunt in Forex trading?

A stop hunt is when market makers push prices to trigger retail traders’ stop-loss orders before reversing in the original trend direction. This tactic allows them to accumulate liquidity.

Q4: How do market makers create trends?

Market makers build trends by accumulating positions over time, moving prices in a controlled manner. They use liquidity zones and news events to influence long-term market direction.

Q5: How can traders avoid market maker manipulation?

Traders can avoid manipulation by understanding institutional trading patterns, using wider stop losses, analyzing price action, and avoiding emotional trading decisions.

Be the first to review “Steve Mauro – Market Maker Method – 4 Day Course with Indicators” Cancel reply

Related products

Trading Courses

Best 100 Collection

Trading Courses

Forex Trading

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.