TradeSmart University – Bollinger Bands Essentials

$497.00 Original price was: $497.00.$28.00Current price is: $28.00.

TradeSmart University Bollinger Bands Essentials Course [Instant Download]

What is TradeSmart University Bollinger Bands Essentials?

TradeSmart University’s Bollinger Bands Essentials teaches you how to spot profitable trades using the Bollinger Bands indicator – a powerful tool that measures market volatility.

The course shows you how to read price patterns, recognize trading setups, and know exactly when to enter and exit trades using the bands.

You’ll learn to combine Bollinger Bands with candlestick patterns to find high-probability trading opportunities in stocks, forex, and crypto markets.

📚 PROOF OF COURSE

What you’ll learn in Bollinger Bands Essentials:

Learn how to trade with confidence using Bollinger Bands. Here’s what you’ll master:

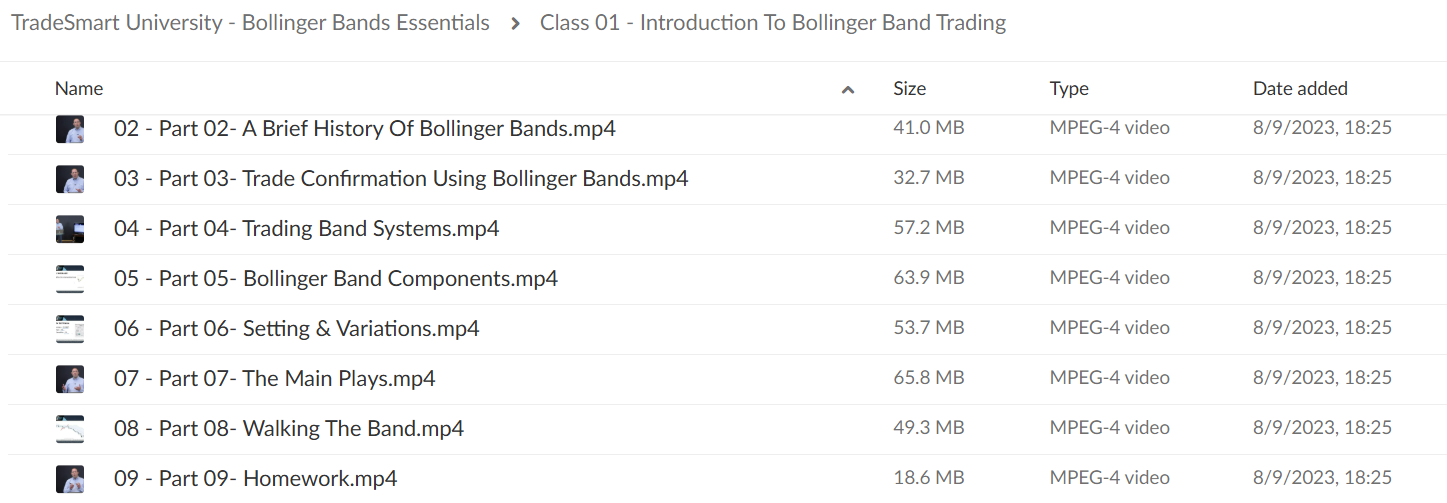

- Core Concepts: Discover how Bollinger Bands work, their history, and how to set them up correctly on your charts

- Trading Setups: Learn to spot the best trading opportunities when prices move within the bands

- Key Indicators: Master Bollinger Band tools like bandwidth and %B oscillator to time your trades better

- Chart Analysis: Use Bollinger Bands together with candlestick patterns to make smarter trading decisions

- Trading Strategies: Learn proven methods for squeeze trades, trend following, and catching reversals

- Protection Rules: Master where to place your stops and how much to trade

After finishing the course, you’ll know exactly how to trade using Bollinger Bands from start to finish.

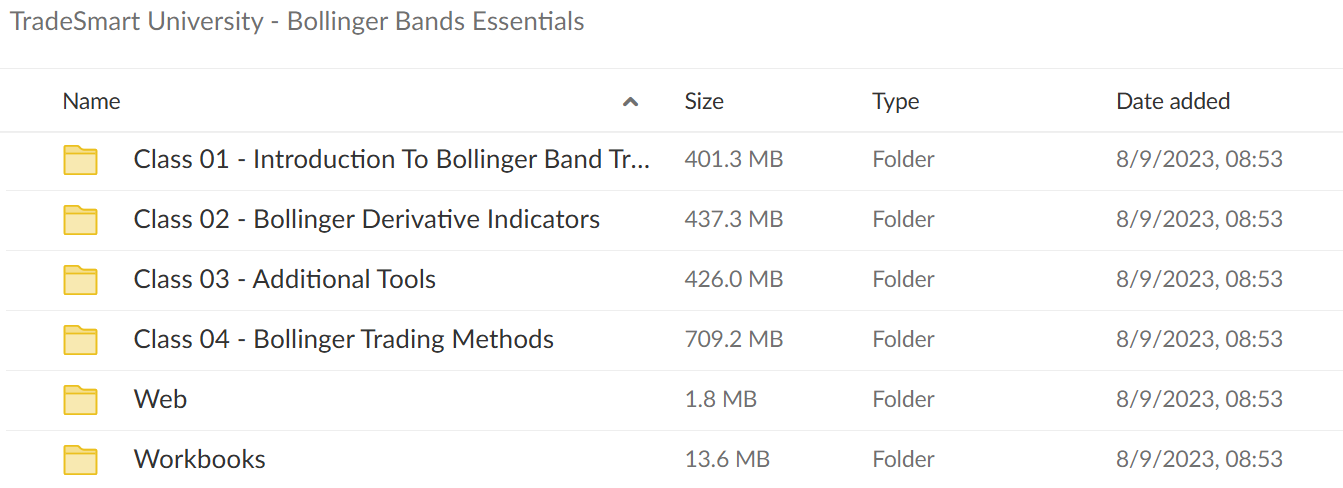

Bollinger Bands Essentials Course Curriculum:

✅ Section 1: Introduction To Bollinger Band Trading

This foundational section introduces students to the core concepts and history of Bollinger Bands. Students learn the fundamental components, settings, and primary trading applications of this versatile technical analysis tool.

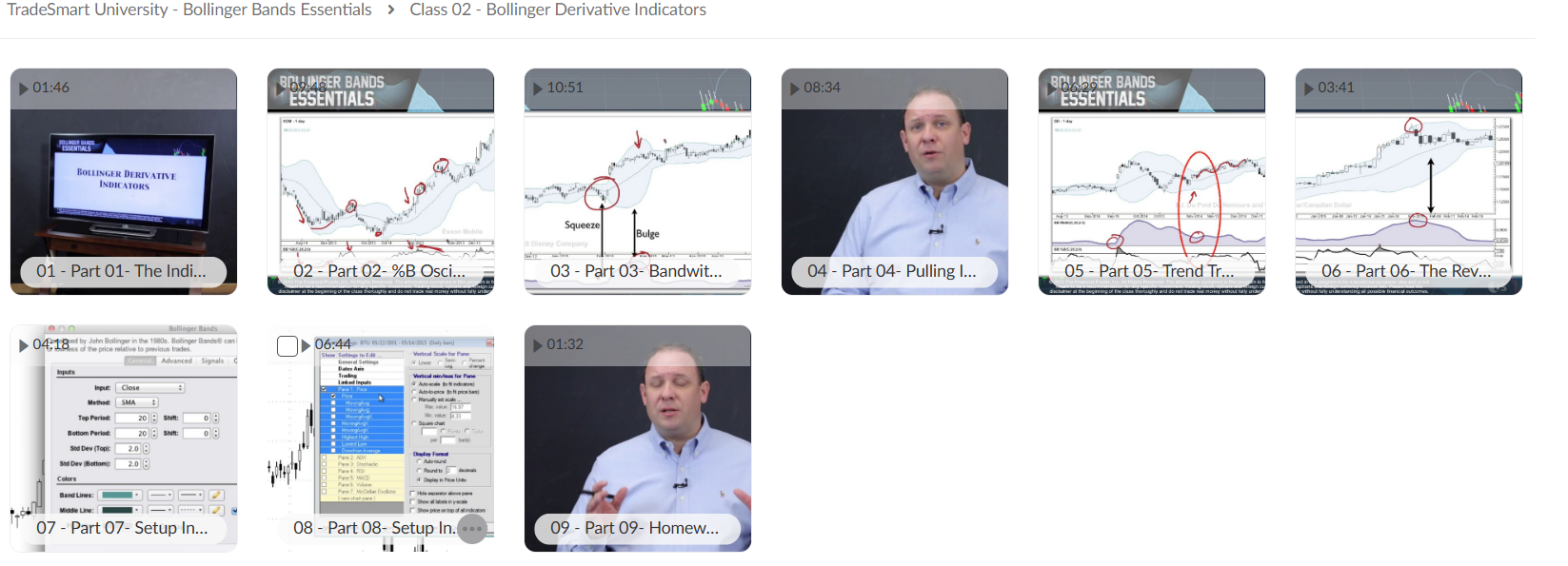

✅ Section 2: Bollinger Derivative Indicators

Module 2.1: Core Indicators

Comprehensive exploration of key Bollinger Band derivative indicators, with special focus on the %B Oscillator and Bandwidth measurements. Students learn to integrate these tools for enhanced trading precision.

Module 2.2: Technical Implementation

Practical instruction in setting up and utilizing Bollinger Band indicators across different trading platforms. Includes specific setup guides for Motive Wave and Trade Navigator systems.

✅ Section 3: Advanced Technical Analysis

Module 3.1: Pattern Recognition

Detailed examination of candlestick patterns and their relationship with Bollinger Bands. Students learn to identify and interpret both bullish and bearish patterns within the Bollinger Band context.

Module 3.2: Risk Management

Strategic approach to stop placement and risk control using Bollinger Bands. The module includes practical implementation of %B and Bandwidth indicators across various trading platforms.

✅ Section 4: Trading Strategy Implementation

Module 4.1: The Squeeze Strategy

In-depth coverage of the Bollinger Band squeeze pattern, including identification, target setting, and practical trading applications. Students develop proficiency in recognizing and trading squeeze setups.

Module 4.2: Trend Trading

Comprehensive instruction in utilizing Bollinger Bands for trend identification and trade execution. Includes practical exercises for developing proper trader conditioning.

Module 4.3: Reversal Trading

Advanced techniques for identifying and trading market reversals using Bollinger Bands. The module emphasizes practical application through trader conditioning exercises.

✅ Section 5: Supporting Resources

Comprehensive collection of workbooks and reference materials supporting each major course section. Includes detailed PDF guides and technical setup documentation for various trading platforms.

The curriculum progressively builds from fundamental concepts through advanced trading applications, with each section incorporating practical exercises and trader conditioning to reinforce learning outcomes.

What is TradeSmart University?

TradeSmart University is an online trading school that teaches people how to trade in financial markets successfully.

Their instructors are active traders who share real trading experience and proven strategies. They explain complex trading concepts in simple, practical ways that are easy to understand.

The platform has taught thousands of traders worldwide. Their Bollinger Bands course shows traders how to use this powerful indicator to find better trading opportunities in any market.

Be the first to review “TradeSmart University – Bollinger Bands Essentials” Cancel reply

Related products

Forex Trading

Investment Management

Trading Courses

Trading Courses

Forex Trading

Trading Courses

Forex Trading

Reviews

There are no reviews yet.