Carter Cofield – Tax Free Living Course

$1,497.00 Original price was: $1,497.00.$149.00Current price is: $149.00.

Carter Cofield Tax Free Living – Deduct Everything [Instant Download]

What is Carter Cofield Tax Free Living Course:

Carter Cofield Tax Free Living Course teaches entrepreneurs legal tax saving strategies. It shows how to convert personal expenses into business deductions, potentially saving over $100,000 in taxes.

The course covers making lifestyle tax deductible, tax-free investing, and building generational wealth. It explains the tax code, deductions, and turning personal costs into business write-offs.

Tax deductions reduce taxable income, lowering tax owed. They include business, home office, and charitable expenses. Effective use requires planning, record-keeping, and understanding tax laws.

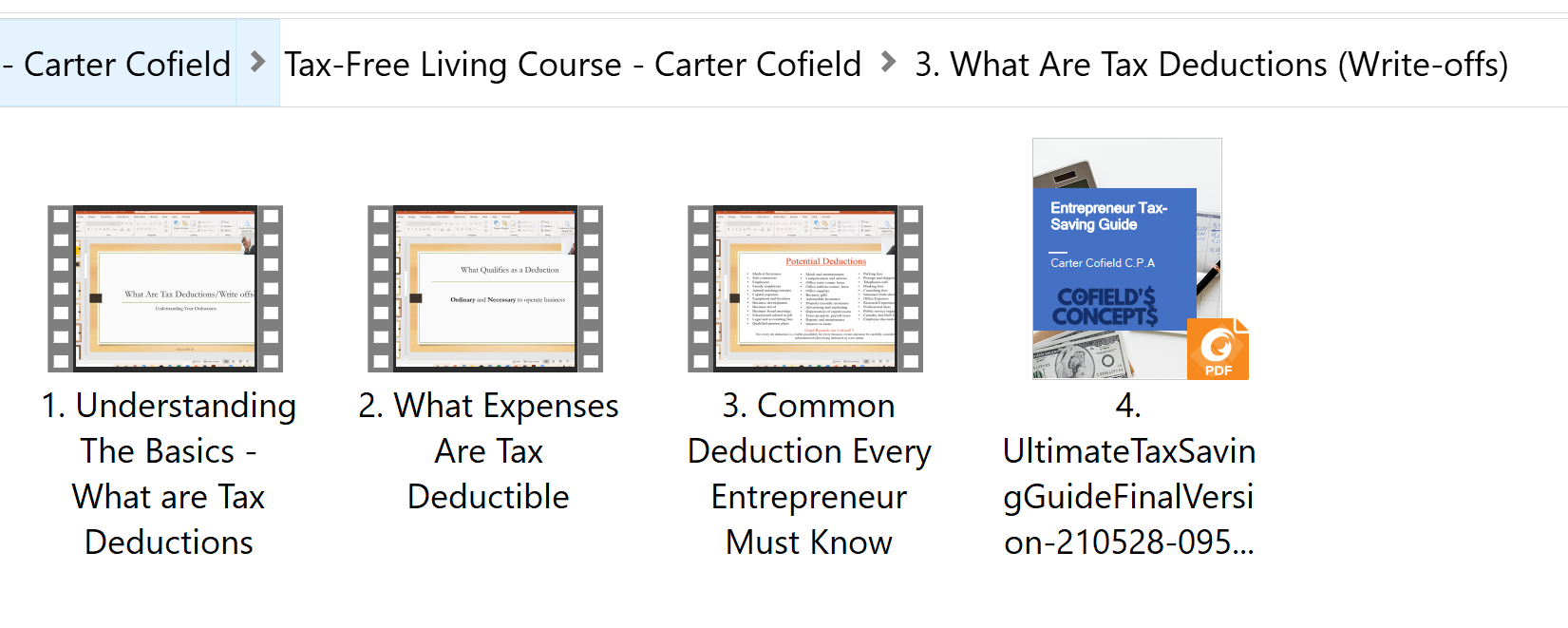

📚 PROOF OF PRODUCTS [2.12 Gb]

What you will learn in Tax Free Living Course:

This course teaches tax savings and money planning. You’ll learn:

- Strategies to save over $100,000 in taxes.

- Converting personal costs into business expenses.

- Creating generational wealth with tax free funds distribution.

- Making your lifestyle tax deductible through intelligent deductions.

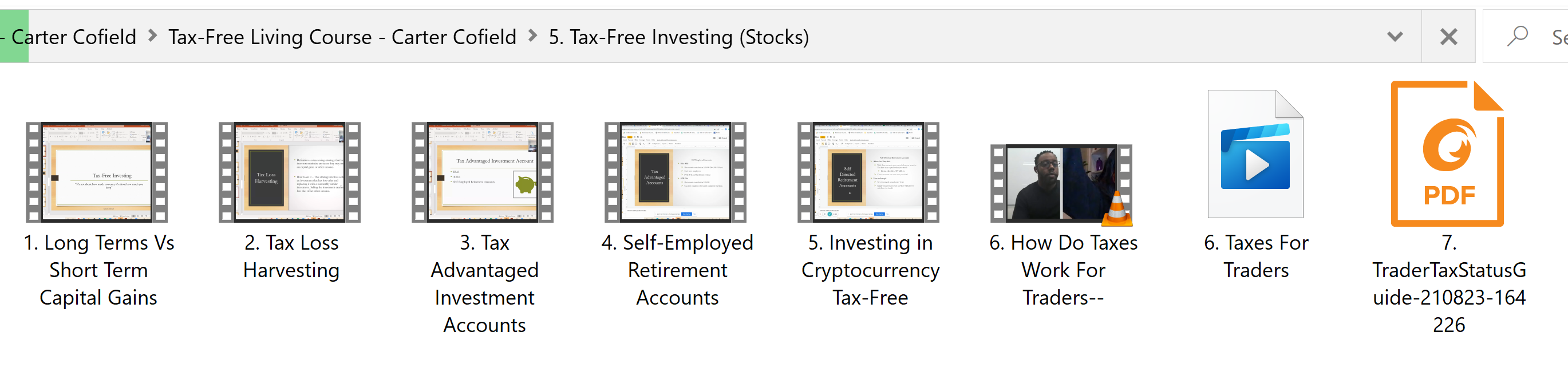

- Insights into tax free investing in stocks and real estate.

✅ First: Welcome to the course!

- A Mess from the instructor

- How to utilize this program

- Before we begin…

- Quick Disclaimer (please read)

- Subtract Everything Power point Slides

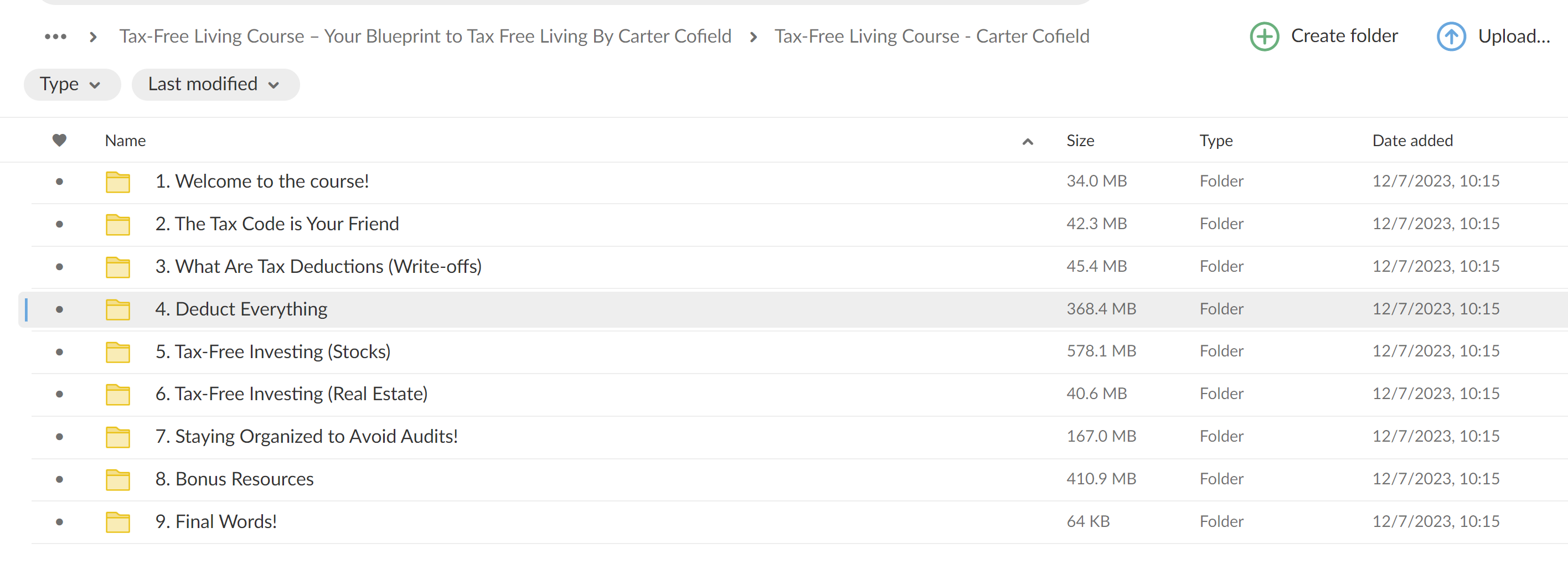

✅ Second: The Tax Code is Your Friend

- How to Make the Tax Code Your Friend

- Employees Vs. Entrepreneurs – The Golden Formula

- The Golden Formula Example

- Bonus: Side Gig Cheat Code!

- Side Hustle BootCamp (Optional)

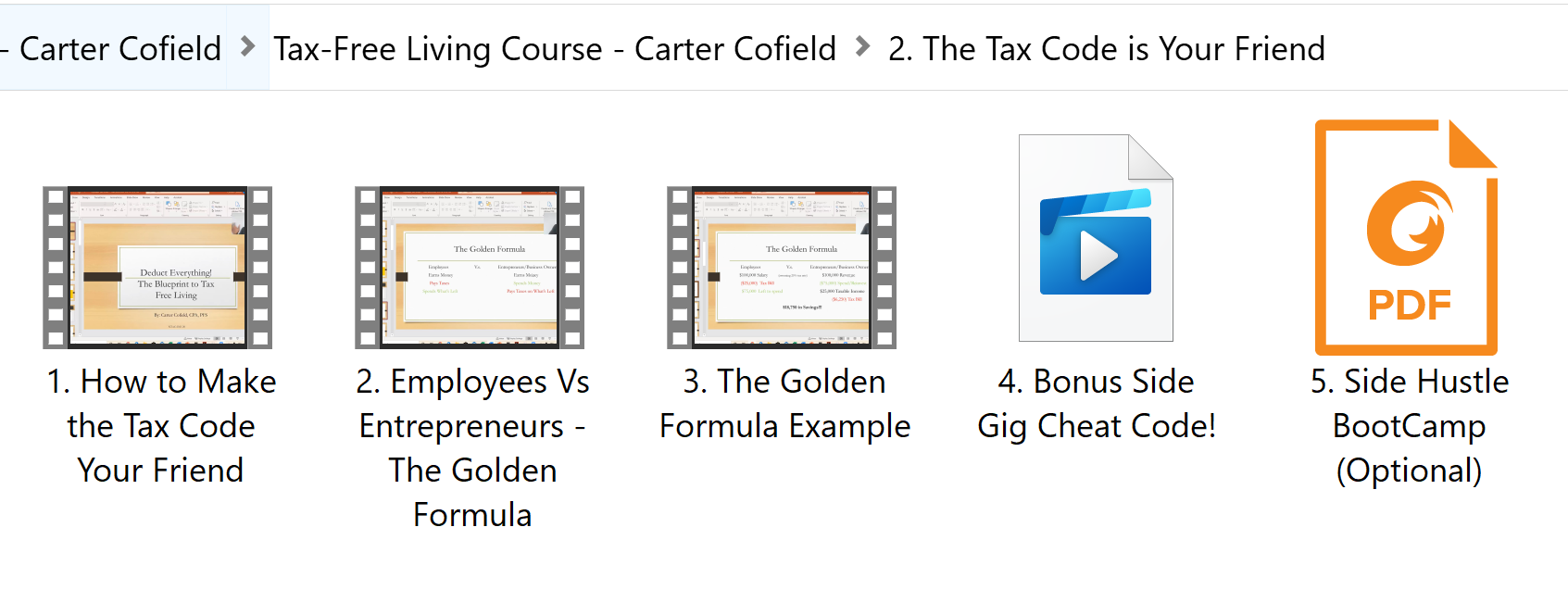

✅ Third: What Are Tax Deductions (Write-offs)

- Understanding The Basics – What are Tax Deductions

- What Expenses Are Tax Deductible?

- Common Deduction Every Entrepreneur Must Know

- Downloadable Freebies!

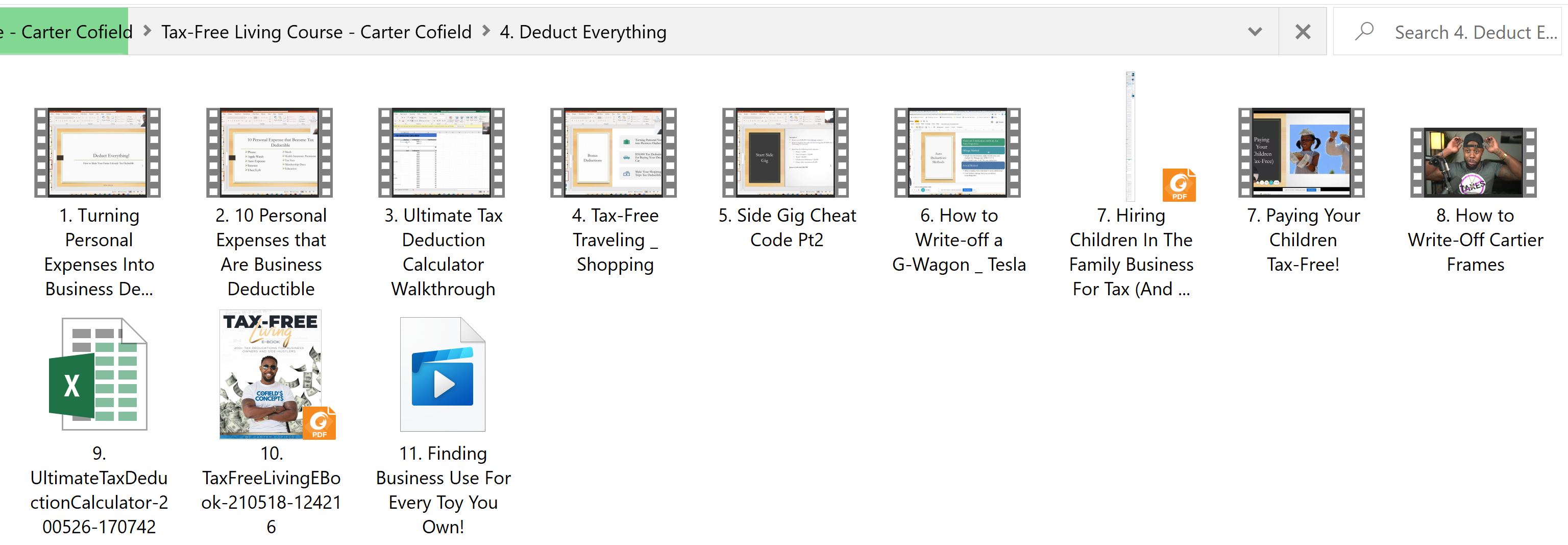

✅ Fourth: Deduct Everything – Making Your Lifestyle Tax Deductible

- Turning Personal Expenses Into Business Deductions

- 10 Personal Expenses that Are Business Deductible

- Ultimate Tax Deduction Calculator Walkthrough

- Tax Free Traveling & Shopping!

- Side Gig Cheat Code Pt.2

- How to Write-off a G-Wagon & Tesla!

- Paying Your Children Tax-Free!

- How to Write-Off Cartier Frames!

- Tax Free Living E-Book! 200+ Tax Deductions!!

- Finding Business Use For Every Toy You Own!

Who is Carter Cofield?

Carter Cofield, is a CPA and PFS, owns Cofield Advisors, LLC. He specializes in helping creative entrepreneurs in entertainment, writing, and social media industries.

Cofield Advisors provides financial, business, and tax support to free creatives from financial stress and save on taxes. Carter’s holistic approach offers comprehensive financial guidance, allowing clients to focus on their creative work.

His virtual business model serves clients across all 50 states. Carter’s expertise in finance management and tax planning makes him valuable for creative professionals navigating wealth management complexities.

Carter Cofield Tax Free Living Course Reviews

I’ve been checking out tax-saving courses, and Carter Cofield’s Tax Free Living Course caught my eye. It claims to offer major savings for business owners, so I decided to investigate thoroughly.

After testing its strategies and doing the math, I’m ready to share what I found. Is it worth your investment? Let’s take a closer look.

What I like about Tax Free Living Course:

- The course teaches practical tax tricks for business owners. It shows how to turn personal expenses into business write-offs, which is gold for small businesses. The lessons on tax-free investing in stocks and real estate are a nice bonus.

- I love the real-world examples, like writing off luxury cars, and the tax deduction calculator. These help students use what they learn. The focus on helping creatives with taxes is unique and needed.

- The e-book with 200+ deductions is a great cheat sheet for later use.

What I don’t like:

- Some tax strategies seem risky. They’re legal, but might catch the IRS’s eye. The course doesn’t talk enough about these risks or what to do if you’re audited.

- It focuses too much on deductions and not enough on other ways to save, like tax credits. It also skips over state taxes, which is a big miss.

- The $1,497 price tag is steep, especially for new business owners or those on a tight budget.

This course has solid tips for entrepreneurs wanting to save on taxes. It’s especially good for creatives. But the aggressive strategies, lack of risk talk, and high cost are downsides. Think hard about your needs and risk comfort before buying.

Be the first to review “Carter Cofield – Tax Free Living Course” Cancel reply

Related products

Real Estate

Reviews

There are no reviews yet.