Learning

The 5 Best Python Quant Courses (2024)

1️⃣. What is Quantitative Trading?

Quantitative trading uses mathematical models and computer algorithms to execute trades. It analyzes market data to identify profitable trading patterns. Python helps process large datasets to find statistical relationships and automate trading decisions.

Quant traders rely on data-driven strategies instead of intuition. They use computational methods to evaluate market conditions, manage risk, and execute trades systematically.

This approach dominates modern markets because computers can analyze data and act faster than traditional methods.

Python’s data analysis capabilities make it essential for developing and testing quantitative strategies.

👉 Read more out Top Python Quant Courses:

2️⃣. Is Python good for Quant Trading?

Yes, Python is great for quant trading. Here’s why:

Python is easy to learn and use, but it’s also powerful. This makes it good for both new and experienced quant traders. It can do many jobs, from looking at data to building trading systems.

✅ Key benefits of Python in quant trading:

Python offers powerful libraries that boost productivity:

- NumPy for fast math calculations and working with arrays

- Pandas for organizing and analyzing financial data easily

- SciPy for advanced math and scientific computing

- Matplotlib for creating charts and graphs

- Scikit-learn for machine learning tasks

Python works well with different data sources and trading platforms. This means you can easily get market information and trade automatically. It’s also good at handling big calculations and lots of data quickly.

In short, Python is simple to use but strong enough for quant trading. That’s why it’s a top choice.

3️⃣. Best Python Quant Courses to Learn in 2024

✅ Quantra Quantinsti – All Courses Bundle:

Quantra Quantinsti – All Courses Bundle teaches you smart trading using math and computers. It covers everything from basic algorithmic trading to advanced strategies with artificial intelligence.

You’ll learn to use Python for analyzing markets and creating trading systems. The courses cover stocks, options, futures, and cryptocurrencies.

With over 50 + courses, you can start from basics and progress to complex techniques. It’s perfect for anyone wanting to master quantitative trading.

Quantra Quantinsti Courses Curriculum:

- TRACK 1: ALGORITHMIC TRADING FOR BEGINNERS – Use 25+ strategies like Intraday Trading, Machine Learning, and Quant techniques to optimize your trading portfolio.

- TRACK 2: TECHNICAL ANALYSIS USING QUANTITATIVE METHODS – Technical indicators and candlesticks, sentiment trading, swing trading, volatility trading and backtesting.

- TRACK 3: QUANTITATIVE TRADING IN FUTURES AND OPTIONS MARKETS – Options pricing models and strategies such as gamma scalping, dispersion and delta hedging diversified futures trading strategies.

- TRACK 4: MACHINE LEARNING & DEEP LEARNING IN TRADING – I – From data cleaning aspects to optimising AI models, learn how to create your prediction algorithms using classification and regression techniques.

- TRACK 5: MACHINE LEARNING & DEEP LEARNING IN TRADING – II – Step-wise training on the complete lifecycle of trading strategies and portfolio management using machine learning. Learn from experts!

- TRACK 7: PORTFOLIO MANAGEMENT AND POSITION SIZING USING QUANTITATIVE METHODS – Apply effective position sizing techniques and optimise your portfolio. Include machine learning to gain a competitive edge.

- TRACK 8: ADVANCED ALGORITHMIC TRADING STRATEGIES – A series of courses where you will learn more than 18+ new strategies such as mean-reversion, index arbitrage, long-short, breakout, ARIMA, GARCH.

This bundle offers a thorough education in quant trading, starting from the basics and progressing to advanced topics. It’s particularly valuable for those looking to gain a comprehensive understanding of the field, with the flexibility to focus on specific areas of interest.

✅ The Python Quants – Python For Algorithmic Trading (Updated 2024):

The Python Quants – Python For Algorithmic Trading by Dr. Yves J. Hilpisch’s teaches you how to use Python for advanced financial applications. It covers asset management, algorithmic trading, and computational finance.

You’ll learn to apply Python to mean-variance portfolio theory, risk parity investing, and option pricing. The course also delves into AI-powered trading using machine learning, deep learning, and reinforcement learning.

With over 330 hours of instruction, 2,500+ pages of documentation, and 85,000+ lines of Python code, you’ll gain comprehensive skills in quantitative finance.

The Python Quants CPF Program Curriculum:

- AI in Finance

- Computational Finance Core

- Financial Data Science

- Python for Algorithmic Trading

- Python for Asset Management

- Reinforcement Learning for Finance

- Linux Basics and Python Software Development

- Natural Language Processing

- Listed Volatility and Variance Derivatives

- Crypto Basics

- Mathematics Basics

- Tools and Skills

This program offers flexible, self-paced learning with indefinite access to resources. It’s ideal for those looking to advance their career in quantitative finance using Python.

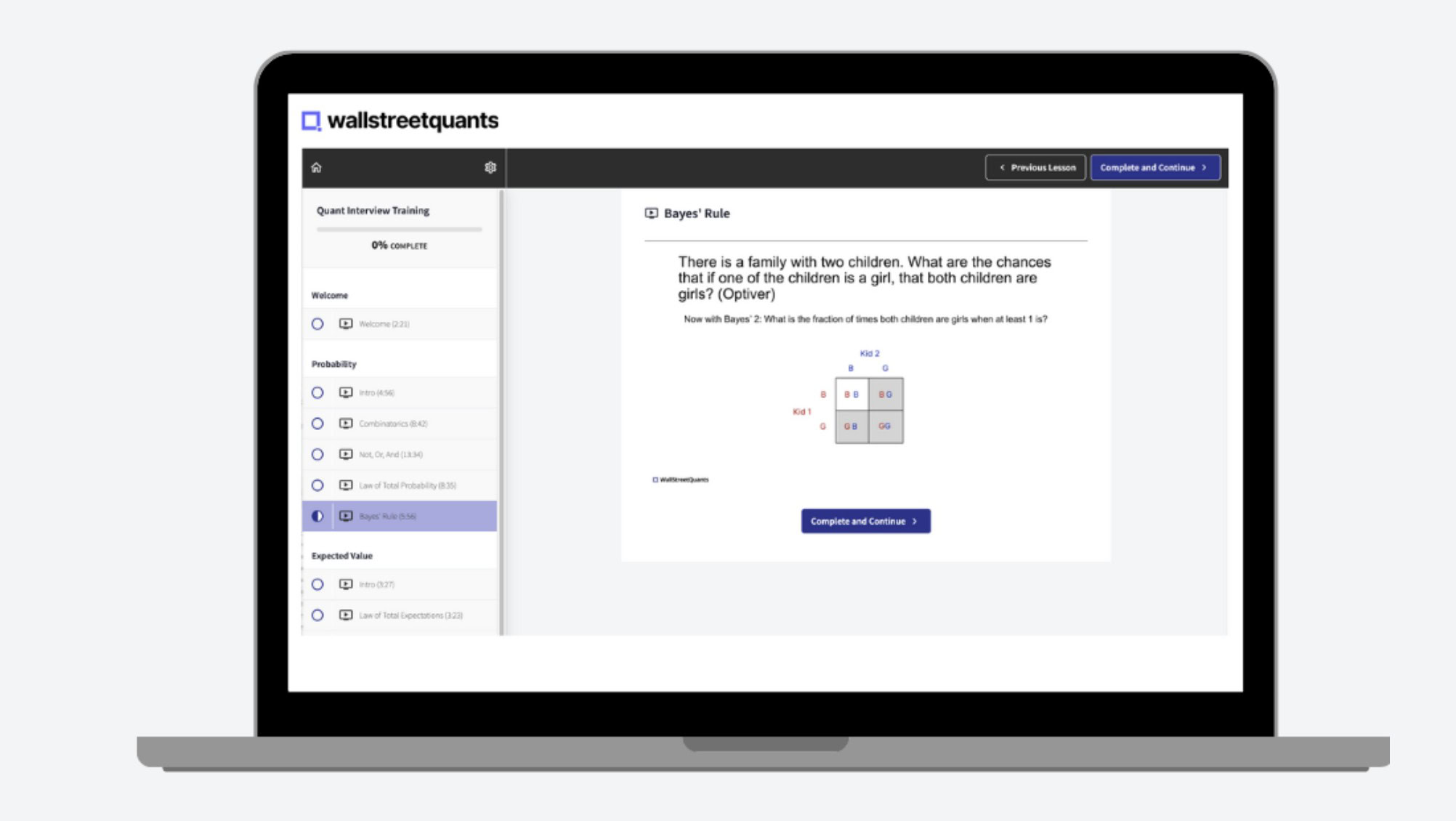

✅ The Wall Street Quants BootCamp

The Wall Street Quants BootCamp is designed to break you into top-tier hedge funds, high-frequency trading firms, and investment banks. It’s run by senior quants from leading firms like Point72, Millennium, and SIG.

The program teaches you all the skills needed for quant finance, including coding, from the ground up. It mimics the training you’d receive in your first two years at a top-tier firm.

You’ll learn to research and deploy a full-fledged quant strategy, even on real money. The course also covers resume crafting, interview preparation, and recruiting strategies.

The Wall Street Quants BootCamp Curriculum:

- Quant Overview

- Coding Setup and Python Basics

- Advanced Python (Numpy, Pandas)

- Data Handling and Analysis

- Performance Evaluation

- Weighting Strategies

- Backtesting Techniques

- Various Trading Strategies (Event, Value, Momentum, Reversal)

- Execution and Risk Management

- Quant Crypto Strategies

- Optimization Techniques

- Trading Library Implementation

- Quant Research Pitfalls

The bootcamp includes a class project on statistical arbitrage in cryptocurrencies, allowing you to apply your skills to a real-world scenario.

It’s ideal for undergraduate and graduate students, career switchers, and current quants looking to advance their careers in quantitative finance.

✅ QuantFactory – Become A Quant Trader Bundle:

QuantFactory’s Quant Trader Bundle teaches you how to develop, backtest, and optimize profitable trading strategies using Python. It’s designed to help you master algorithmic trading and build your own trading bots.

The course is led by Lachezar “Luke”, a seasoned algorithmic trader with experience at top-tier quant hedge funds. He’s developed over 35 profitable trading strategies and 350 different projects in the field.

The QuantFactory Course Curriculum includes:

Python Fundamentals For Quant Trading

- Introduction to the course

- Installations

- Python Basics

- Pandas Library

- Technical Indicators and Trading Strategy Backtest

Quant Trading Strategies With Python

- Meet Your Instructor & Course Overview

- Why Backtesting Worths The Effort

- Downloads & Installations

- Pandas Refresher

- Backtrader Fundamentals

- Strategy Ideas & Development

- Data Extraction & Features Preparation

- Backtesting The Strategy

- Strategy Optimization

- Out Of Sample Testing

You’ll learn to build trading strategies and turn ideas into working code. The course teaches you how to find market data and test strategies using past price movements.

Starting from basic concepts, you’ll progress to advanced quantitative trading techniques.

This course helps both newcomers starting in quant trading and experienced traders who want to improve their strategy development skills.

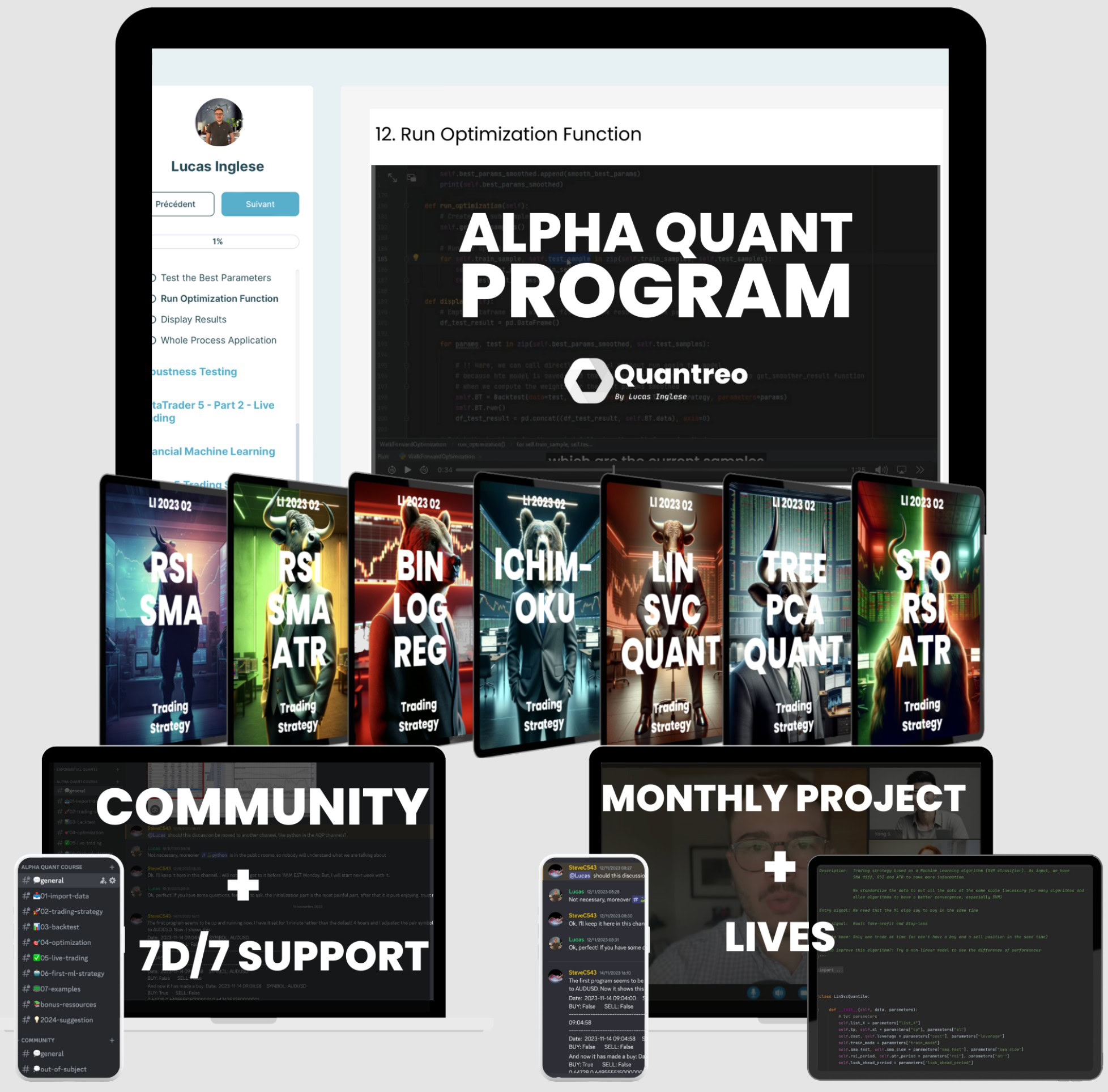

✅ Course No #5: Quantreo – Alpha Quant Program

Quantreo Alpha Quant Program teaches you how to create profitable trading bots in just one month. This comprehensive course covers everything from building trading strategies to live trading implementation.

You’ll learn to create strategies using technical indicators and machine learning, properly evaluate them, and implement them in live trading environments.

Alpha Quant Program Curriculum:

- Introduction

- MetaTrader – 5 – Part 1 – The Basics

- Trading Strategy Building

- Based-Event Backtest

- Trading Strategy Optimization

- Robustness Testing

- MetaTrader 5 – Part 2 – Live Trading

- Financial Market Learning

- Bonus – 5 Trading Strategies

- Monte Carlo Simulations

The course provides numerous templates for each section, allowing you to quickly apply what you’ve learned to real-world scenarios.

It’s ideal for those looking to create and implement their own automated trading strategies, from beginners to more experienced traders wanting to enhance their skills in quantitative trading.

4️⃣. Frequently Asked Question about Python Quant Trading:

Q1: Do quant traders use Python?

Q2: How long does it take to learn Python for trading?

Q3: What is the salary of a quantitative trader?

Q4: Is algorithmic trading risky?

– Technology failures or bugs in code

– Unexpected market events not accounted for in algorithms

– Overfitting of strategies to historical data

However, when implemented correctly, algo trading can reduce emotional decision-making and execute trades more efficiently. A study by the Bank for International Settlements found that algorithmic trading generally improves market liquidity and reduces short-term volatility.

Q5: Do you need a PhD to be a quant?

– 35% of quants have PhDs

– 45% have master’s degrees

– 20% have bachelor’s degrees

Many successful quants have degrees in fields like mathematics, physics, computer science, or engineering. What’s most important is strong analytical skills, programming ability, and a deep understanding of financial markets. Some firms offer junior quant roles to exceptional candidates with bachelor’s degrees, providing on-the-job training.