Walter Peters – Small Account Big Profits

$597.00 Original price was: $597.00.$16.00Current price is: $16.00.

Walter Peters Small Account Big Profits Course [Instant Download]

What is Walter Peters Small Account Big Profits?

Walter Peters Small Account Big Profits is a specialized trading course focused on rapidly growing small trading accounts through trade level compounding strategies.

The course demonstrates why conventional 2% risk rules restrict account growth and provides alternative methods that can potentially transform a $1,000 account into a six figure portfolio.

Unlike typical trading courses that emphasize entry signals, this program prioritizes the psychological aspects and risk management techniques that truly determine trading success.

Students learn practical approaches to position sizing, drawdown management, and mental resilience that work alongside any existing trading system to maximize returns while maintaining disciplined risk control.

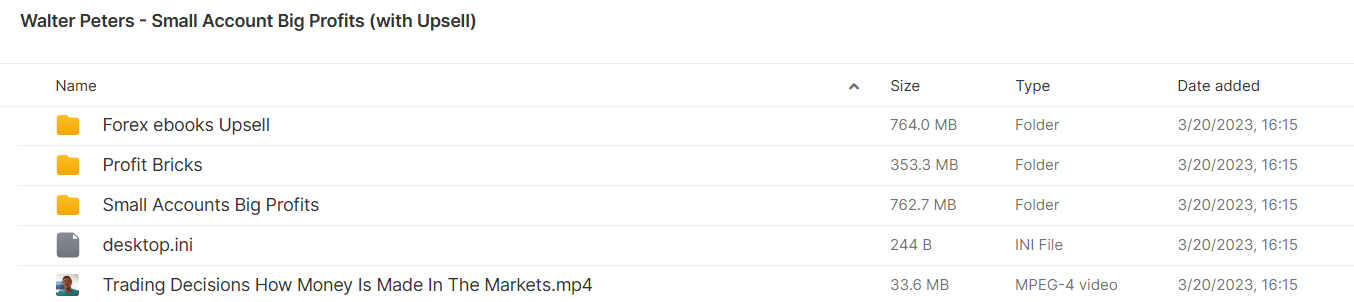

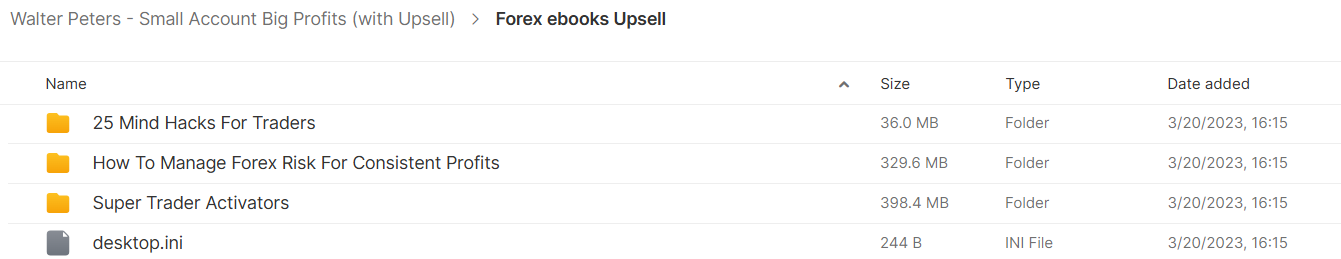

📚 PROOF OF COURSE

What you’ll learn in Small Account Big Profits Course:

Walter Peters’ Small Account Big Profits course teaches you how to grow a small trading account quickly. Here’s what you’ll learn:

- Broker selection: How to avoid bad brokers and find ones that won’t work against your trading

- Trade-level compounding: Learn this risk management method that grows accounts faster than regular approaches

- Drawdown management: Master mental techniques to keep trading through losing streaks

- Profit Bricks system: Use this powerful risk tool that works like “steroids” for any trading system

- Trading resilience: Learn mental techniques billionaire traders use to turn losses into motivation

- Risk optimization: Learn how to safely take more risk per trade for bigger returns without blowing up

This course works with any trading system and focuses on risk management and psychology – the real keys to trading success.

Small Account Big Profits Course Curriculum:

✅ Small Accounts Big Profits (Core Module)

This foundational module introduces the three pillars of successful small account management: aggressive compounding, diversification, and psychological resilience. Students learn essential broker selection criteria and how to properly set up their trading infrastructure.

The section on Risk-Reward introduces the Matterhorn algorithm and Profit Bricks methodology, giving traders concrete frameworks for position sizing. The Fixed Ratio approach presents a sophisticated method for gradually increasing position sizes as account equity grows.

Drawdown management receives special attention with practical tools like the Risk and Drawdown Calculator, alongside Monte Carlo simulations that help traders understand probable outcomes across different scenarios. The section on weighted systems teaches how to effectively combine multiple trading strategies for more consistent returns.

✅ Profit Bricks System

This module presents a unique approach to trade management and risk assessment. Beginning with a different conceptual framework for viewing trades, students progress to understanding probability theory as applied to trading.

The curriculum introduces specialized spreadsheets that compare Profit Bricks to traditional money management techniques. Students learn to calculate trade expectancy and apply systematic thinking to trading decisions.

Advanced lessons show how to test multiple systems using the Profit Bricks methodology and how to identify and cancel potentially poor trades before execution. The Monte Carlo simulations teach students how to stress-test their strategies against thousands of possible market scenarios.

✅ Psychological Training Components

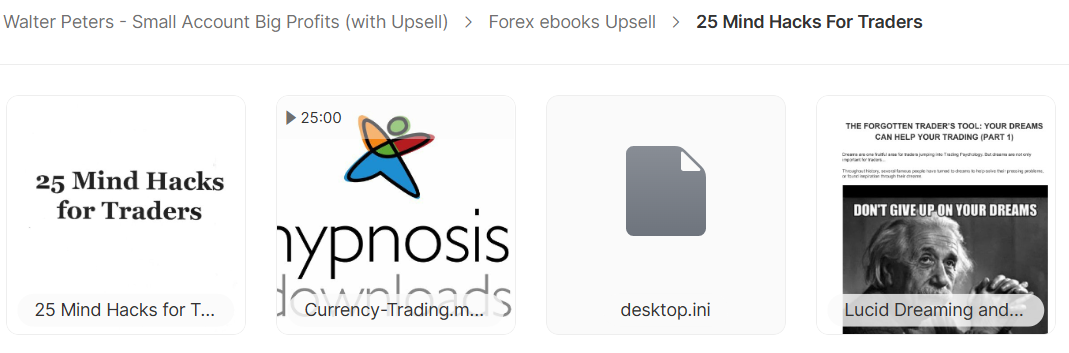

The course dedicates significant attention to the psychological aspects of trading through several specialized modules. The “25 Mind Hacks For Traders” ebook offers practical techniques for maintaining mental clarity during trading sessions.

The “Super Trader Activators” section includes audio programs designed to enhance various mental states beneficial for trading, including alpha, beta, delta, and theta brainwave states. Video modules like “Your Trading Beliefs” and “Your Relationship With Money” help traders identify and transform limiting beliefs.

The Resilience module provides techniques for maintaining psychological balance during drawdowns, including perspective-finding exercises, reframing problems as challenges, and real-time resilience strategies to combat catastrophic thinking patterns during live trading.

✅ Risk Management for Consistent Profits

This section delves deeper into forex risk management principles with tools like the “Risk Calculator” and various spreadsheets for projecting profits. The module explains Larry Williams’ delta concept and introduces “Profit Bricks” as a structured risk management system.

The SQN Risk Management component provides a statistical framework for evaluating trading system quality and making appropriate position sizing decisions. Students learn to optimize their systems while maintaining acceptable risk parameters.

Who is Walter Peters?

Walter Peters is a Forex trader and psychologist known for “naked trading” – trading without indicators. He co-wrote “Naked Forex,” a popular book about this simple trading approach.

With a Ph.D. in psychology, Peters understands both trading techniques and trader mindset. This helps him teach the complete trading package.

Peters hosts the “Truth About FX” podcast and “Think Profit Podcast,” where he shares trading insights and psychology tips.

He’s active on YouTube and social media, sharing valuable trading ideas with the community.

Peters created the Profit Bricks system, a risk management method that improves results with any trading strategy. From his base in Sydney, Australia, he has helped thousands of traders improve their approach to risk and psychology.

Be the first to review “Walter Peters – Small Account Big Profits” Cancel reply

Related products

Forex Trading

Forex Trading

Day Trading

Forex Trading

Forex Trading

Forex Trading

Best 100 Collection

Reviews

There are no reviews yet.