Wallstreet Trapper – Jumping Off The Porch

$47.00 Original price was: $47.00.$12.00Current price is: $12.00.

Wallstreet Trapper Jumping Off The Porch Course [Instant Download]

What is Wallstreet Trapper Jumping Off The Porch?

Wallstreet Trapper Jumping Off The Porch is a stock market investing course teaching you how to choose the right investing strategy before picking any stocks.

The course covers three proven investing methods: dividend investing for passive income, growth investing for long-term wealth, and value investing for undervalued opportunities.

Leon Howard shows you how to build a profitable portfolio that fits your financial goals. This program transforms complete beginners into confident investors who know exactly how to approach the stock market and create generational wealth.

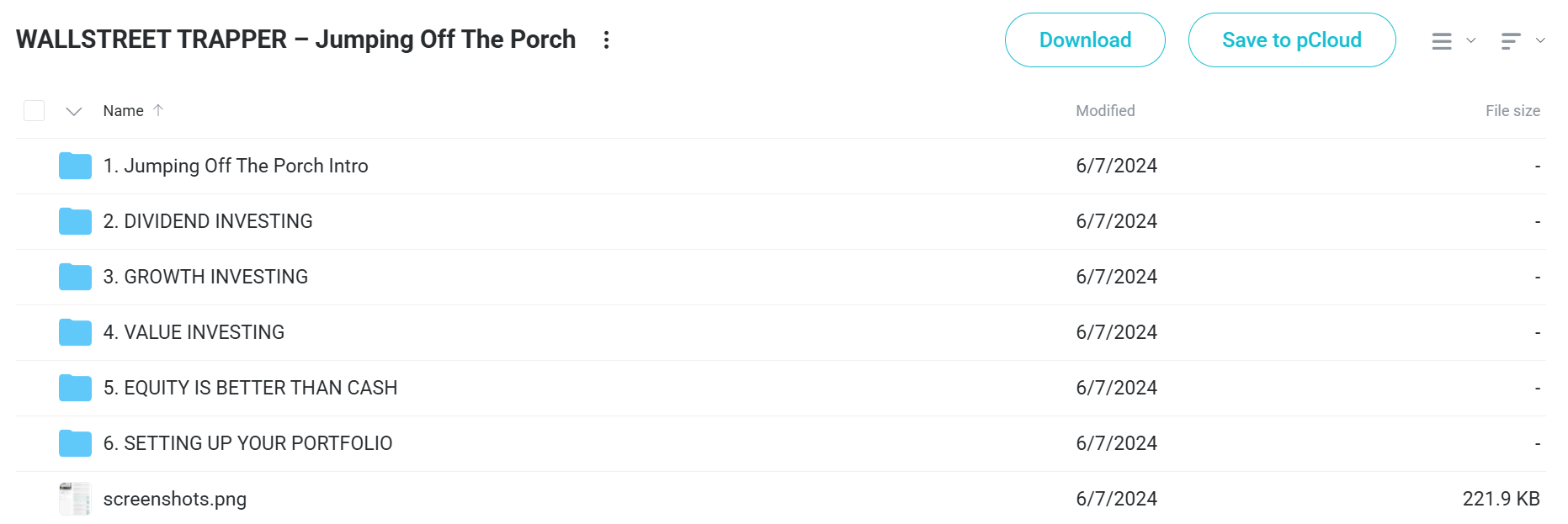

📚 PROOF OF COURSE

2️⃣. What you’ll learn from Wallstreet Trapper Jumping Off The Porch:

This course teaches you the essential investing knowledge that most beginners miss. Here’s what you’ll master:

- Dividend Investing: Learn how to make passive income through dividend-paying stocks

- Growth Investing: Find high-growth companies for long-term wealth building

- Value Investing: Spot undervalued stocks with strong potential

- Portfolio Setup: Build a portfolio that matches your investment goals

- Investment Styles: Find the investing approach that works best for you

- Equity Strategy: Understand why stocks beat cash over time

By the end, you’ll have a clear investment strategy and confidence to build generational wealth through the stock market.

3️⃣. Jumping Off The Porch Course Curriculum:

✅ Module 1: Jumping Off The Porch Introduction

This starting module helps you change your thinking from watching the market to actually investing in it. Students learn why taking the first step into investing is important for building wealth over time and becoming financially free.

The intro content talks about common fears and wrong ideas about stock market investing while setting realistic goals for your learning journey. This module gets students ready mentally and emotionally for making smart investment choices.

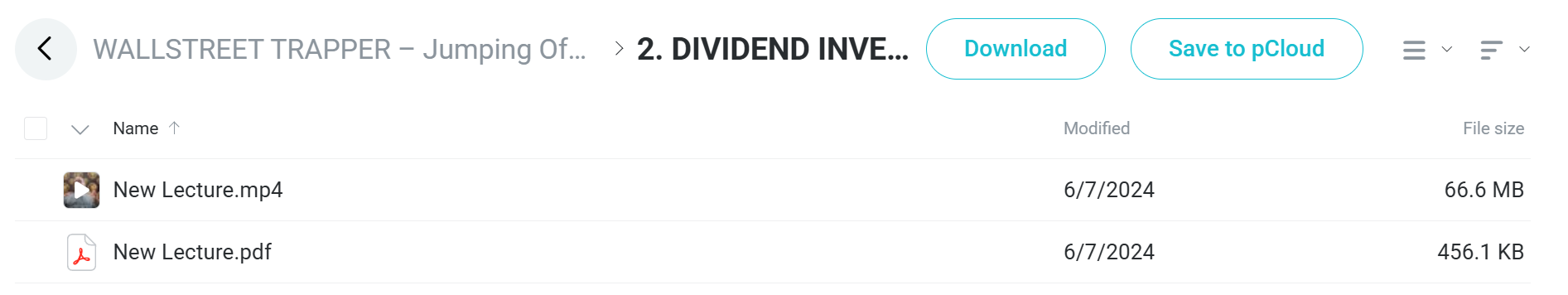

✅ Module 2: Dividend Investing

Students learn how to make steady income through stocks that pay dividends and build a base for long-term wealth building. The module covers how to look at dividend rates, payout amounts, and why dividend growth over time matters.

Key lessons include finding reliable dividend-paying companies, understanding dividend dates, and calculating dividend returns. Students learn to judge companies based on whether they can keep paying and growing dividends, not just how much they pay now.

The content focuses on building a dividend plan and reinvesting techniques that grow your returns over time. Students gain hands-on skills in searching for quality dividend stocks and avoiding dividend traps.

✅ Module 3: Growth Investing

This module teaches students to find companies with great growth potential and understand how to profit from expanding businesses. Students learn to look at revenue growth rates, market expansion chances, and competitive advantages that drive long-term stock price increases.

The course covers growth numbers like price-to-earnings growth ratios, steady sales growth, and market share expansion. Students learn how to spot new trends and find companies that will benefit from technology or population changes.

Advanced techniques include judging management quality, understanding businesses that can grow easily, and timing when to buy for maximum growth. Students learn to balance growth potential with fair pricing to get the best risk-adjusted returns.

✅ Module 4: Value Investing

Students learn the skill of finding undervalued companies trading below what they’re really worth using basic analysis techniques. The module covers Benjamin Graham and Warren Buffett’s methods for finding value and safety margin principles.

Key analysis tools include price-to-book ratios, earnings multiples, free cash flow analysis, and asset valuation methods. Students learn to read financial statements carefully and find temporary market mistakes that create buying opportunities.

The content focuses on patience and discipline in value investing, teaching students when to hold positions and when the market will likely recognize the value. Students develop skills in thinking differently and learn to profit when the market is too negative about good companies.

✅ Module 5: Equity Is Better Than Cash

This important module shows why owning stocks consistently beats keeping cash over time and how inflation reduces your buying power. Students learn the math advantage of owning pieces of profitable businesses versus holding money that loses value.

The content covers historical return comparisons, inflation impact analysis, and the wealth-building power of compound growth through stock price increases. Students understand how successful businesses create value that benefits shareholders through both price increases and dividend payments.

Real-world examples show how stock positions in quality companies provide protection against economic uncertainty while cash positions lose value over time.

✅ Module 6: Setting Up Your Portfolio

The final module brings together all previous learning into practical portfolio building and management strategies. Students learn asset allocation principles, position sizing techniques, and how to balance dividend, growth, and value investments within a unified strategy.

Multiple lectures cover brokerage account setup, order types, portfolio monitoring techniques, and rebalancing strategies. Students gain hands-on experience with portfolio tracking tools and learn to judge overall portfolio performance beyond individual stock movements.

The complete approach includes risk management techniques, diversification principles, and long-term maintenance strategies that ensure portfolio success. Students leave with a complete blueprint for implementing and managing their investment strategy on their own.

4️⃣. What is Wallstreet Trapper?

Leon Howard, known as Wallstreet Trapper, is a financial educator from New Orleans who teaches stock market investing. He learned investing during a 10-year prison sentence and now helps others build wealth through stocks.

Through his platform “From the Trap to Wallstreet,” Leon makes investing simple for everyone. He breaks down barriers and makes wealth building easy to understand.

Leon has over 700,000 followers called “Trappers.” His teaching connects with people from all backgrounds, especially those who never had access to financial education.

His company offers courses, ebooks, and private groups. Leon shows that anyone can build generational wealth through the stock market with the right education.

Be the first to review “Wallstreet Trapper – Jumping Off The Porch” Cancel reply

Related products

Trading Courses

Trading Courses

Stock Trading

Trading Courses

Stock Trading

Stock Trading

Day Trading

Reviews

There are no reviews yet.