Trading180 – Supply & Demand Zone Trading Course 2023

$897.00 Original price was: $897.00.$23.00Current price is: $23.00.

[Download] Trading180 Supply & Demand Zone Trading 2023

📚 PROOF OF COURSE

What is Trading180 Supply & Demand Zone Trading Course:

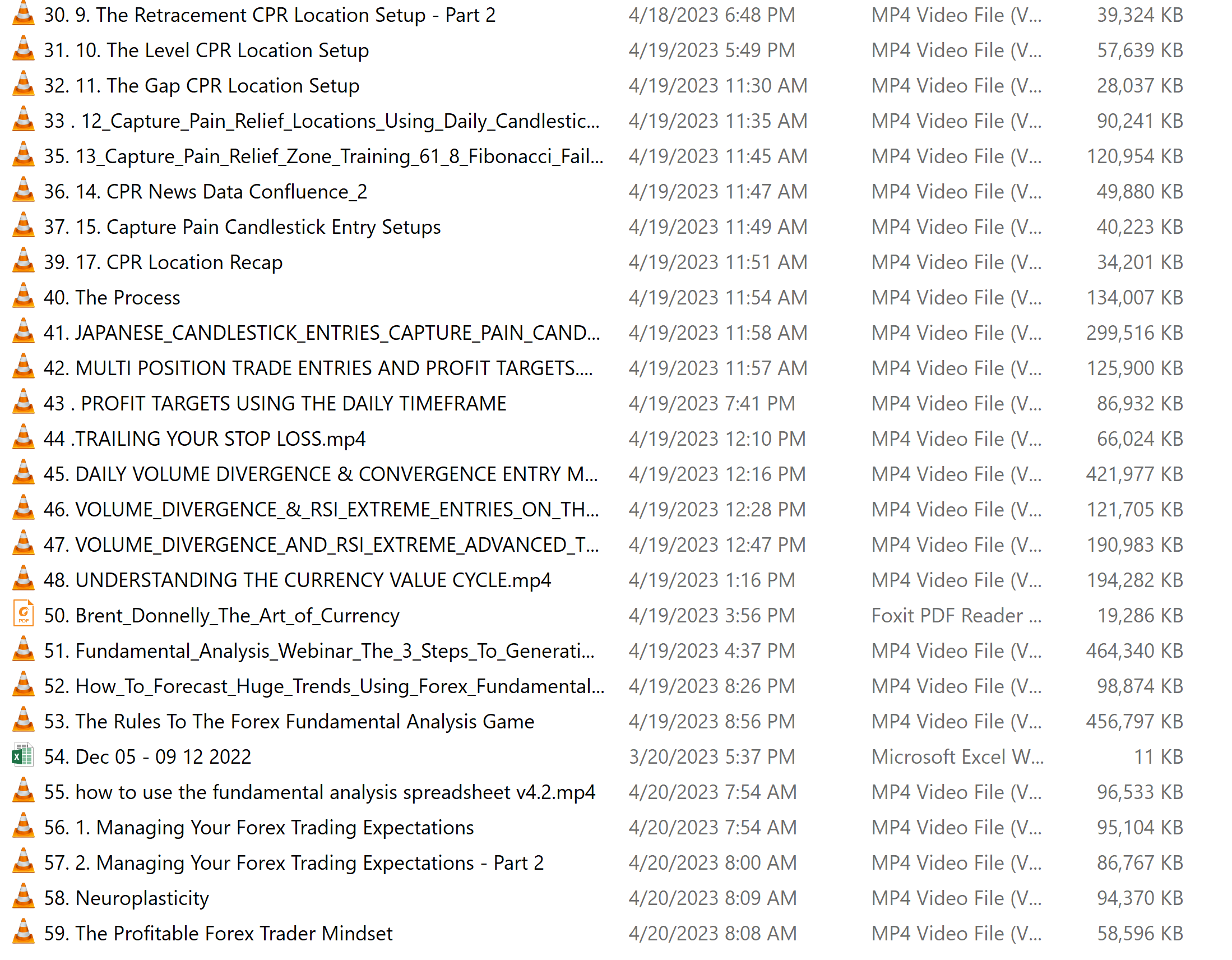

The Trading180 Supply & Demand Zone Trading Course 2023 is designed to transform beginners into proficient forex traders. This course reveals Trading180’s unique approach to identifying high-potential supply and demand zones using a mix of technical tools and indicators.

It teaches students how to effectively evaluate foreign exchange rates, discerning whether they are undervalued, reasonably priced, or overvalued. Through this course, learners will grasp various entry methods, risk management techniques, and profit-targeting strategies, setting a solid foundation for trading success in the forex market.

What you will learn in Trading180 Supply and Demand Course

- Supply & Demand Zone Identification: Master the skill of spotting key trading zones.

- Risk Management Strategies: Learn to protect your capital and manage trading risks.

- Profit Targeting Strategies: Understand how to set and achieve realistic trading goals.

- CPR Location & Stop Hunt Manipulation: Gain insights into profiting from market manipulations.

- Fundamental Analysis: Dive deep into forex fundamentals with our exclusive spreadsheet tool.

- Community Support: Access the private Discord trade room for mentoring and peer support.

- Live Trading Sessions: Participate in weekly live sessions for real-time learning and support.

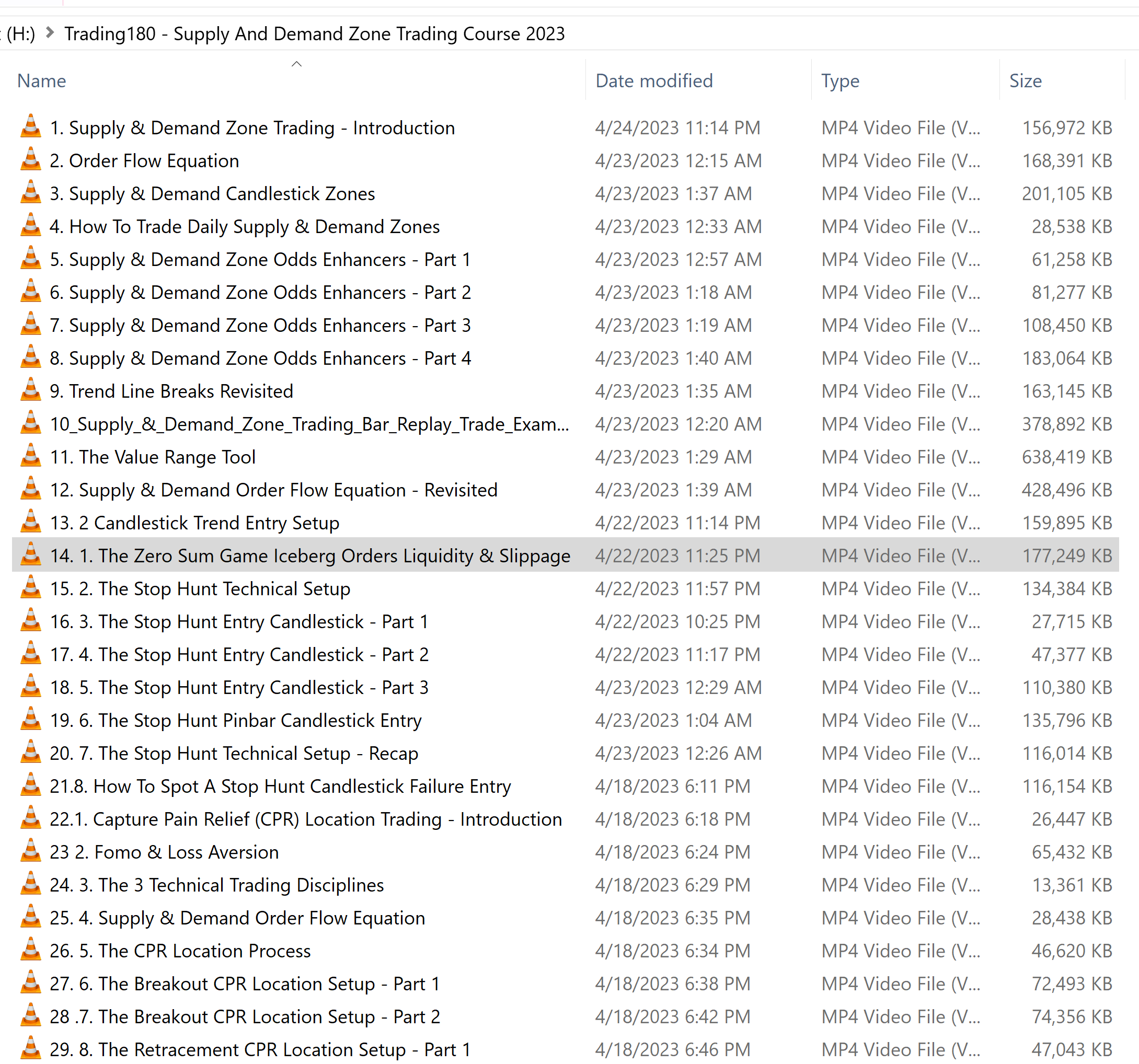

Supply & Demand Zone Trading Course curriculum

✅ Module 1: Introduction & Foundations

- Supply & Demand Zone Trading Introduction

- Order Flow Equation

- Supply & Demand Candlestick Zones

✅ Module 2: Supply & Demand Zone Techniques

- How To Trade Daily Supply & Demand Zones

- Supply & Demand Zone Odds Enhancers Part 1 to Part 4

- Trend Line Breaks Revisited

- Supply & Demand Zone Trading Bar Replay Trade Examples

- The Value Range Tool

✅ Module 3: Advanced Trading Concepts

- Supply & Demand Order Flow Equation Revisited

- 2 Candlestick Trend Entry Setup

- The Zero Sum Game Iceberg Orders Liquidity & Slippage

✅ Module 4: Stop Hunt Strategies

- The Stop Hunt Technical Setup

- The Stop Hunt Entry Candlestick Part 1 to Part 3

- The Stop Hunt Pinbar Candlestick Entry

- How To Spot A Stop Hunt Candlestick Failure Entry

✅ Module 5: Capture Pain Relief (CPR) Trading

- Capture Pain Relief Location Trading Introduction

- The CPR Location Process

- The Breakout & Retracement CPR Location Setup Part 1 & Part 2

- The Level & Gap CPR Location Setup

✅ Module 6: Additional Resources & Techniques

- Capture Pain Relief Locations Using Daily Candlestick Price Action

- CPR News Data Confluence 2

- Capture Pain Candlestick Entry Setups

- CPR Location Recap

✅ Module 7: Trading Tools & Analysis

- Japanese Candlestick Entries Capture Pain Candlestick And 2 Candle

- Multi Position Trade Entries And Profit Targets

- Profit Targets Using The Daily Timeframe

- Trailing Your Stop Loss

✅ Module 8: Volume & Sentiment Analysis

- Daily Volume Divergence & Convergence Entry Method

- Volume Divergence & Rsi Extreme Entries On The 4 6 8 & 12H Timeframes

✅ Module 9: Forex Fundamental Analysis

- Understanding The Currency Value Cycle

- Brent Donnelly The Art Of Currency

- Fundamental Analysis Webinar Series

- How To Forecast Huge Trends Using Forex Fundamental Analysis Webinar

✅ Module 10: Mindset & Expectations Management

- Managing Your Forex Trading Expectations Series

- Neuroplasticity

- The Profitable Forex Trader Mindset

1 review for Trading180 – Supply & Demand Zone Trading Course 2023

Add a review Cancel reply

Related products

Trading Courses

Trading Courses

Investment Management

Forex Trading

Trading Courses

Trading Courses

Crypto Trading

Adam (verified owner) –

Great product and quality.