TRADESMART – Trading NQ At The US Open

$1,997.00 Original price was: $1,997.00.$12.00Current price is: $12.00.

TRADESMART Trading NQ At The US Open Course [Instant Download]

What is Trading NQ At The US Open?

TRADESMART Trading NQ At The US Open is a trading course that teaches you how to trade Nasdaq Futures specifically during the morning market open.

The program includes 6 video sessions showing you exactly when to enter trades, where to place stops, and how to calculate profit targets during this volatile trading period.

You’ll learn practical skills like pre-market preparation, gap trading strategies, and pullback identification, all demonstrated through real trading examples. The course includes three days of recorded live trading sessions so you can see these techniques in action.

📚 PROOF OF COURSE

What you’ll learn in Trading NQ At The US Open Course:

Trading NQ At The US Open Course gives you the skills you need to trade the fast-moving Nasdaq Futures market during the US open. Here’s what you’ll learn:

- Pre-market preparation techniques including key checkpoints, divergence/synchronicity study, and market mood checking

- Gap trading strategies for trading upward gaps, downward gaps, retests, and fake outs in the best way

- Target calculation methods to set doable profit goals and measure possible price moves

- Pullback and reversal identification to make money from price drops and direction changes

- Real-time trade execution with examples showing exact entries, targets, and stop placements

- Market scenario analysis covering pre-cash open and post-open patterns for different market conditions

By the end of this course, you’ll understand how NQ moves at market open, build your own trading plans, and get ahead of other traders.

Trading NQ At The US Open Course Curriculum:

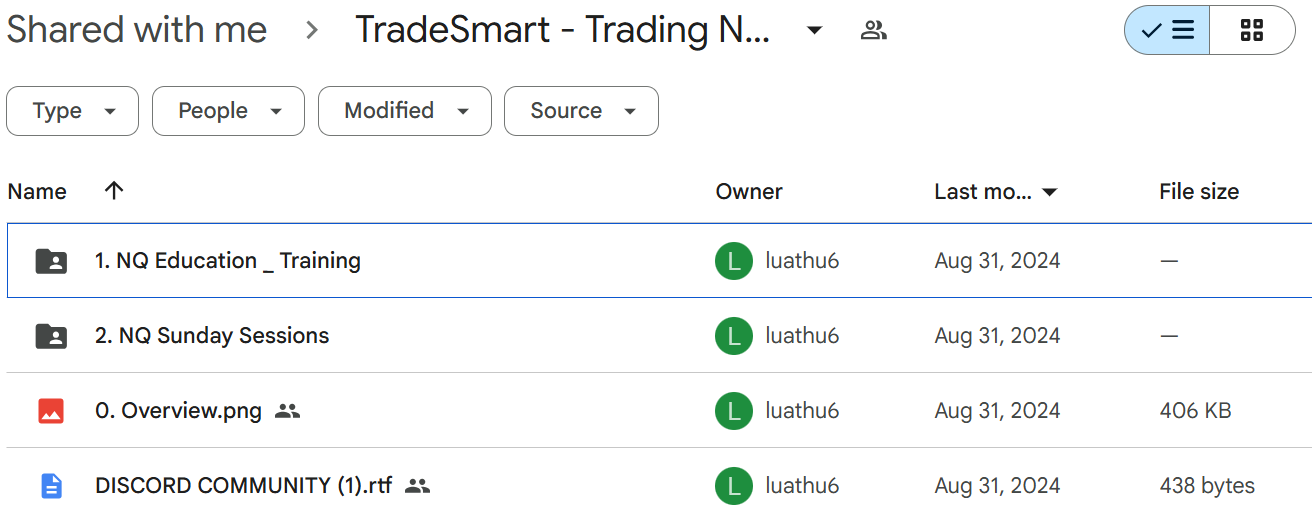

✅ Module 1: NQ Education & Training

This foundational module consists of six sequential training sessions that build a complete understanding of NQ futures trading strategies. The curriculum progresses from basic market mechanics to advanced trading techniques specifically designed for the market open.

Each session builds upon knowledge from previous lessons, creating a cohesive learning path that transforms beginners into confident traders with a specific edge for NQ morning sessions.

The structured approach ensures students develop both the technical skills and psychological mindset necessary for consistent trading during one of the market’s most volatile and opportunity-rich periods.

Key Highlights:

Session 1 introduces students to the fundamental characteristics of NQ futures, including contract specifications, market hours, and the unique dynamics of the US market open period. Students learn to identify optimal trading conditions and understand the importance of proper position sizing.

Session 2 focuses on technical analysis techniques specifically adapted for short-term NQ trading. Students master key chart patterns, support/resistance identification, and momentum indicators that are particularly effective during the opening volatility.

Session 3 delves into order flow analysis and market depth reading, helping traders understand institutional positioning and liquidity dynamics that drive price movement at market open. This session reveals how to interpret volume patterns unique to morning sessions.

Session 4 covers risk management strategies essential for NQ trading success. Students learn precise entry and exit techniques, stop placement methodologies, and position sizing formulas designed to protect capital during fast-moving opening conditions.

Session 5 examines psychological aspects of trading high-volatility environments. Students develop mental frameworks to maintain discipline, manage emotions, and execute their strategy consistently despite the intense pressure of morning trading.

Session 6 integrates all previous knowledge into a complete systematic trading approach for NQ at market open. Students learn to combine technical signals, order flow insights, and risk parameters into a cohesive strategy with clear execution guidelines.

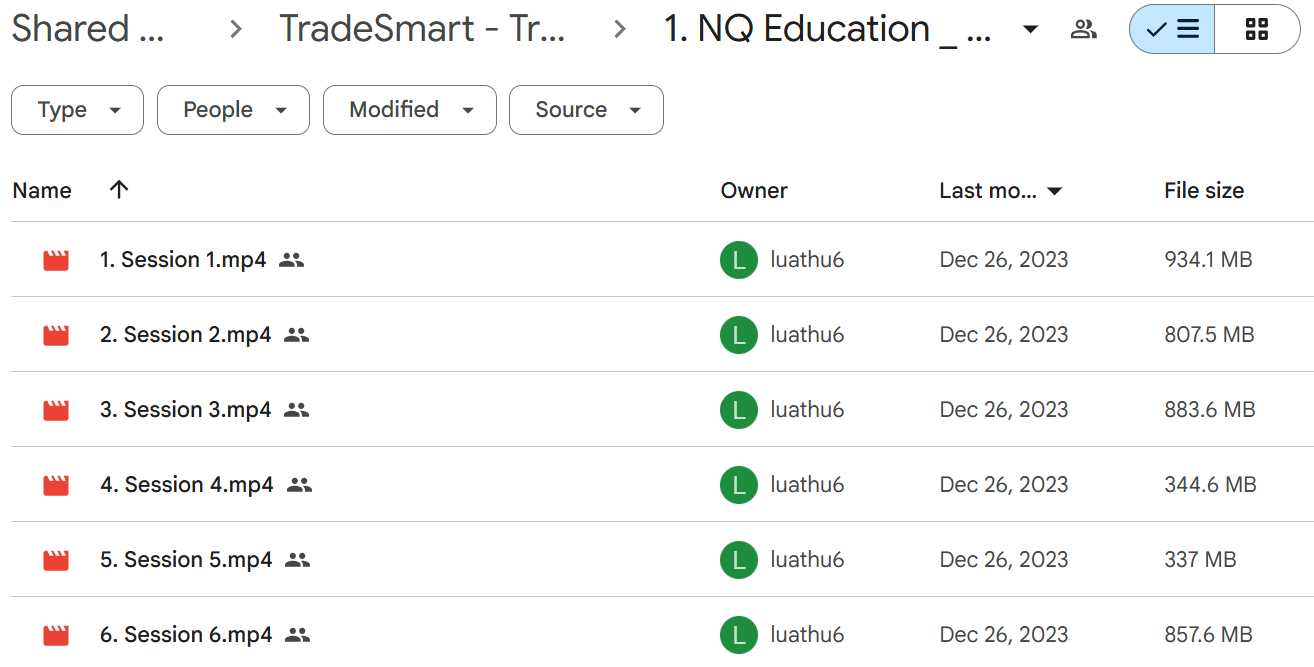

✅ Module 2: NQ Sunday Sessions

This practical application module consists of 13 recorded Sunday trading sessions spanning from July to October 2022. Each session demonstrates the course strategies applied in real-time market conditions.

The chronological progression allows students to witness the evolution of trading techniques as market conditions change throughout different months. This provides invaluable context for adapting strategies to various market environments.

These sessions bridge the gap between theory and practice, showing exactly how the concepts from the educational module translate into actual trading decisions during live market conditions.

Key Highlights:

The Sunday Sessions begin with an Overview document that outlines the purpose and structure of these practical demonstrations, establishing expectations and guiding students on how to maximize learning from the recorded sessions.

Each weekly session shows complete trading workflows from pre-market analysis through position management to session conclusion. Students observe the entire decision-making process, including analysis, entry identification, stop placement, and exit execution.

The July sessions establish foundational implementation, focusing on basic pattern recognition and simple entry techniques that build confidence in the core strategy components.

August sessions introduce more sophisticated order flow analysis techniques, demonstrating how to integrate volume and market depth readings into entry decisions during increasingly volatile conditions.

September recordings showcase adaptation to changing market conditions, as traders adjust their approaches to capitalize on post-summer volatility increases typically seen in this month.

October sessions highlight advanced nuances in the strategy, including techniques for managing positions through earnings season announcements that often impact morning volatility.

The Discord Community resource connects students with fellow traders, providing ongoing support, strategy discussions, and shared insights that extend learning beyond the course materials.

What is TRADESMART?

TRADESMART teaches futures trading strategies, focusing on the Nasdaq (NQ) market. Created by experienced traders, they help simplify complex market patterns.

Their main course “Trading NQ At The US Open” has helped many traders profit during the volatile market opening. They focus on practical trading methods you can use right away, not just theory.

TRADESMART runs websites at tradesmart.kartra.com and tradesmart4x.com with various trading courses. They combine technical analysis with real trading examples through recorded live sessions.

They’ve partnered with Luna Course and BeastCourses to offer more trading education. Their teaching focuses on market preparation, pattern recognition, and trade execution—key skills for futures trading.

What makes TRADESMART special is their focus on high-opportunity trading times like the US market open. Their training turns this challenging but profitable time into a consistent money-making opportunity.

Be the first to review “TRADESMART – Trading NQ At The US Open” Cancel reply

Related products

Futures Trading

Futures Trading

Futures Trading

Futures Trading

Futures Trading

Futures Trading

Reviews

There are no reviews yet.