Trader Divergent – Rule Based Price Action

$378.00 Original price was: $378.00.$12.00Current price is: $12.00.

Trader Divergent Rule Based Price Action Course [Instant Download]

What is Trader Divergent Rule Based Price Action?

Trader Divergent Rule Based Price Action is a trading course that teaches you how to trade markets using clear rules instead of emotions.

The course shows you exactly when to buy, when to sell, and how much risk to take on each trade. Everything is decided before you put money in the market.

You’ll learn special trading strategies called Divergent Systems that work for short-term and long-term trading. These strategies work on forex, crypto, and other markets.

The course fixes the three biggest trading problems: knowing what trades to take, controlling your emotions, and managing your money properly. This helps you stay calm when trading instead of feeling stressed or confused.

📚 PROOF OF COURSE

What you’ll learn in Rule Based Price Action:

The Rule Based Price Action course teaches you a complete system that removes guesswork and emotional decisions from trading. Here’s what you’ll learn:

- Trading strategies: Master Divergent Systems for day and swing trading, with mechanical rules, price action signals, and combined approaches

- Trading psychology: Develop mental models to trade without hesitation and break through limiting beliefs that hold most traders back

- Risk management: Learn practical rules to use before, during, and after trades to run your trading like a real business

- Success blueprint: Follow a step-by-step path that takes you from beginner to professional trader with clear milestones

- Market analysis: Master how to spot trends, measure momentum, and recognize market phases to find better trades

- Entry techniques: Apply specific methods like breakouts, pullbacks, and false breaks using exact rules

This program connects theory with real practice through methods that work on any market and timeframe.

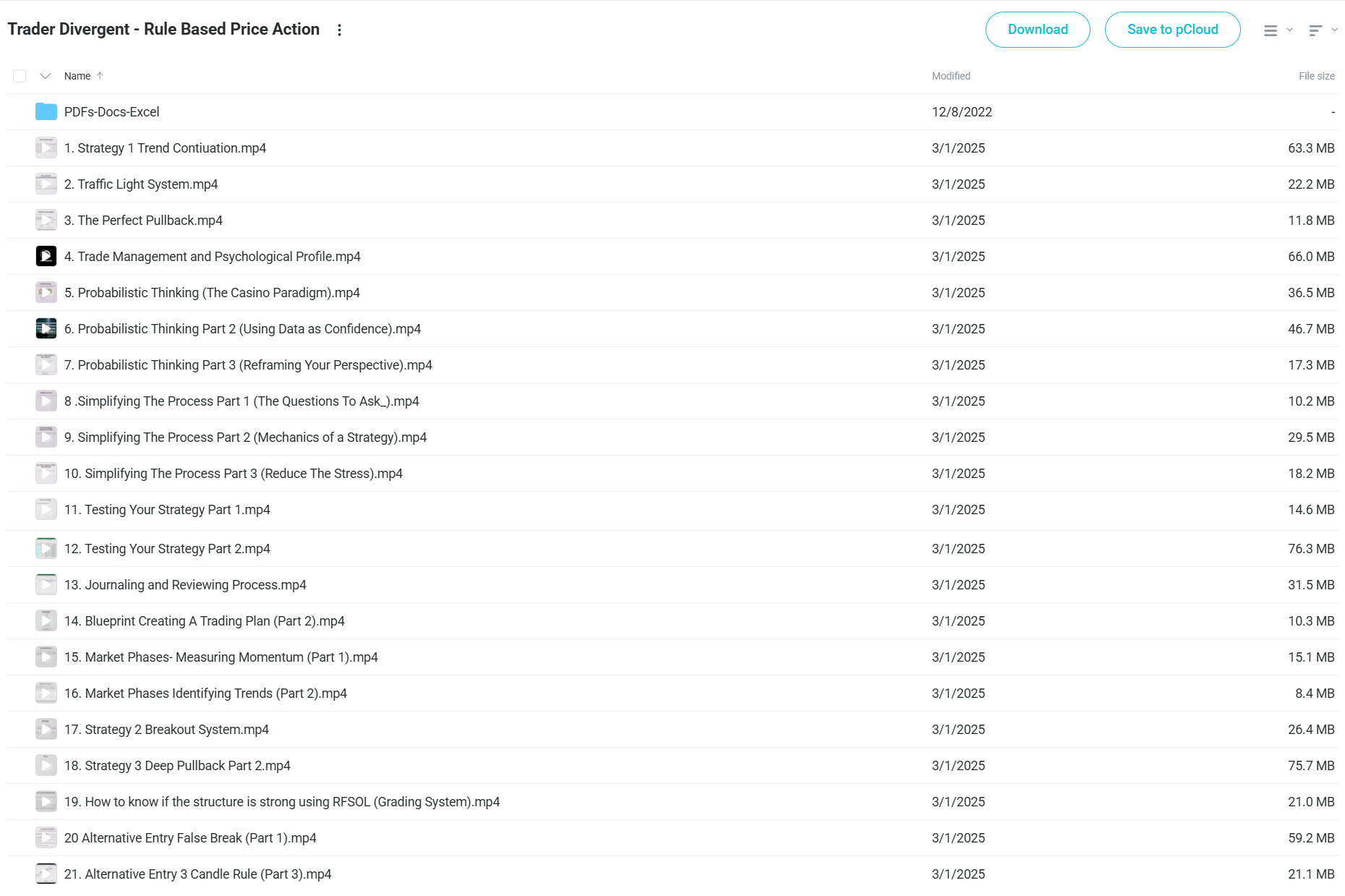

Rule Based Price Action Course Curriculum:

✅ Module 1: Foundation and Introduction

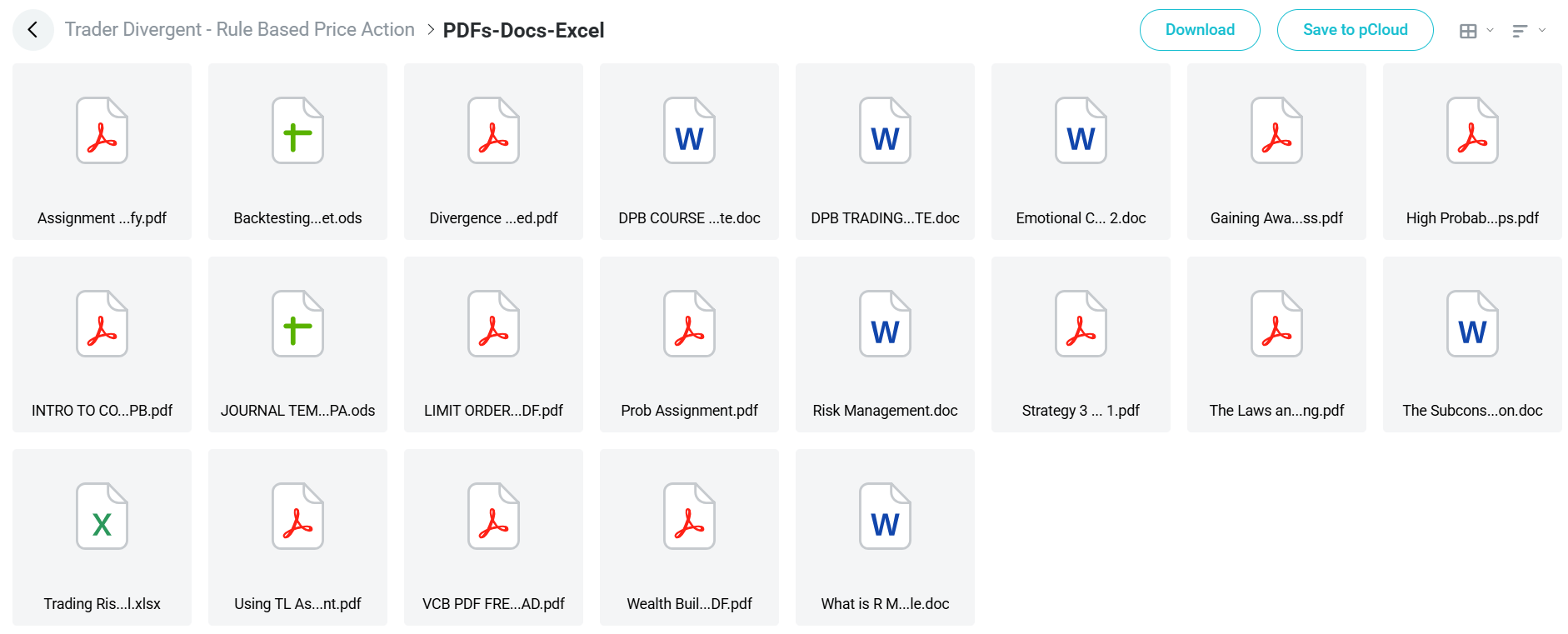

The course starts with key reading materials like “DPB COURSE MUST READ FIRST Update” and “INTRO TO COURSE DPB” that set up the main ideas and mindset needed for good trading. Students learn the basic rules of price action trading and why having a step-by-step approach to market analysis matters.

The first lessons focus on understanding “The Laws and Rules of Trading” which work as guidelines throughout the course. This part helps students move away from random trading to a planned approach based on odds and risk control.

✅ Module 2: Trading Psychology and Mindset

A big part of the course looks at the mental side of trading through files like “Emotional Control 2,” “Gaining Awareness,” and “The Subconscious and Self-limiting Beliefs.” These help traders spot and fix mental blocks that often stop them from making steady profits.

The psychology lessons teach students to notice their feelings during market moves and how to stay disciplined during both winning and losing streaks. This section gives real tools for handling trading emotions rather than just theory.

✅ Module 3: Trading Strategies

The course features three main trading strategies taught through videos and support files. Strategy 1 focuses on trend continuation setups, helping students spot and trade with existing market movement for better entry points.

Strategy 2 teaches a breakout system that profits from price moving beyond key levels, with clear rules for entry, stop placement, and trade handling to keep risk in check. This strategy builds on what was learned in the trend continuation module.

Strategy 3 covers deep pullback situations, split across two videos and a PDF, showing students how to find counter-moves that offer good entry chances before price continues in the main trend direction. This advanced strategy needs good understanding of earlier concepts.

✅ Module 4: Market Analysis Framework

The “Traffic Light System” video gives a clear framework for market analysis, helping students sort market conditions into simple signals for action or caution. This system makes decision-making easier during live trading.

The “Market Phases” videos (lessons 15-16) teach students to measure momentum and spot trends, creating a base for knowing when to use which strategy. This section helps traders match their approach to current market conditions instead of forcing trades.

✅ Module 5: Entry Techniques and Setup Grading

Several videos and files cover specific entry methods, including “The Perfect Pullback,” “Using TL As Entry Point,” and other entries like “False Break” and “3 Candle Rule.” These give exact, rule-based ways to enter trades with good risk-reward.

The “High Probability Guide For Grading Setups” and “How to know if the structure is strong using RFSOL” lessons teach a step-by-step way to rate trade setups, helping students focus on the best chances and skip weaker setups.

✅ Module 6: Risk and Trade Management

The course stresses good risk management through materials like “Risk Management.doc,” “Trading Risk Management Tool.xlsx,” and “What is R Multiple.doc.” These lessons set up a system for position sizing, risk calculation, and measuring returns compared to risk taken.

Trade management techniques are covered in lesson 4, teaching students how to handle open trades through different market conditions. This includes when to take some profits, move stops to breakeven, or let winners run based on price signals.

✅ Module 7: Probabilistic Thinking

Three videos (lessons 5-7) focus on building a probability-based mindset, teaching students to see trading as a numbers game rather than single trades. The “Casino Paradigm” idea helps students think of trading as playing the odds.

These lessons show how to use past results to build trust in trading strategies and change your market view to stay calm during losing streaks. This section changes how students see market action and their own trading results.

✅ Module 8: Process Simplification and Testing

Lessons 8-10 focus on making the trading process simpler by asking the right questions and cutting stress through rule-following. These videos help students build a trading routine they can stick with daily.

The course includes guidance on testing strategies (lessons 11-12) and using tools like the “Backtesting Spreadsheet.ods” to check approaches before risking real money. This testing builds confidence in the trading method.

✅ Module 9: Documentation and Review

The “Journaling and Reviewing Process” lesson and “JOURNAL TEMPLATE RBPA.ods” provide a clear system for recording trades and finding useful insights from your trading. This review process speeds up learning and strategy improvement.

The course emphasizes ongoing improvement through good record-keeping, helping students find patterns in their trading behavior and results. This feedback loop is key for long-term trading growth and profits.

✅ Module 10: Trading Plan Development

The “Blueprint Creating A Trading Plan” video and “DPB TRADING PLAN TEMPLATE” document guide students in making a complete trading plan that brings together all course ideas into a personal framework for steady trading.

The “Wealth Builder Checklist” and other final materials help students move from learning to doing, providing a roadmap for using course principles in real trading. This section ensures students know what to do after finishing the course.

What is Trader Divergent?

Trader Divergent (Alan Edward) is a funded prop trader who trades with a rule-based system. After many years in the markets, he created a method that removes guesswork and emotions from trading.

Alan trades his own money and for investors, proving his strategies work in real markets. While he mainly trades forex, his methods work well in all markets including crypto.

As the creator of Rule-Based Price Action (RBPA), Alan helps struggling traders overcome obstacles to consistent profits. He focuses on simple, mechanical rules and building the right trading mindset.

What makes Trader Divergent different is that he gives you complete trading systems, not just ideas. His methods use high probability setups with clear rules that you can adjust to fit your own style.

Be the first to review “Trader Divergent – Rule Based Price Action” Cancel reply

Related products

Forex Trading

Stock Trading

Forex Trading

Trading Courses

Trading Courses

Best 100 Collection

Trading Courses

Reviews

There are no reviews yet.