TradePro Academy – Options Trading & Order Flow Course

$997.00 Original price was: $997.00.$14.00Current price is: $14.00.

TradePro Academy Options Trading & Order Flow Course [Instant Download]

What is TradePro Academy Options Trading & Order Flow Course:

TradePro Academy’s Options Trading & Order Flow Course teaches you how to trade options using order flow analysis.

You’ll learn to spot profitable trades by analyzing market depth, volume patterns, and institutional trading activity. The course covers day trading options, spread strategies, and weekly income methods.

The program shows you practical risk management and position sizing for consistent trading profits, whether you have a small or large account.

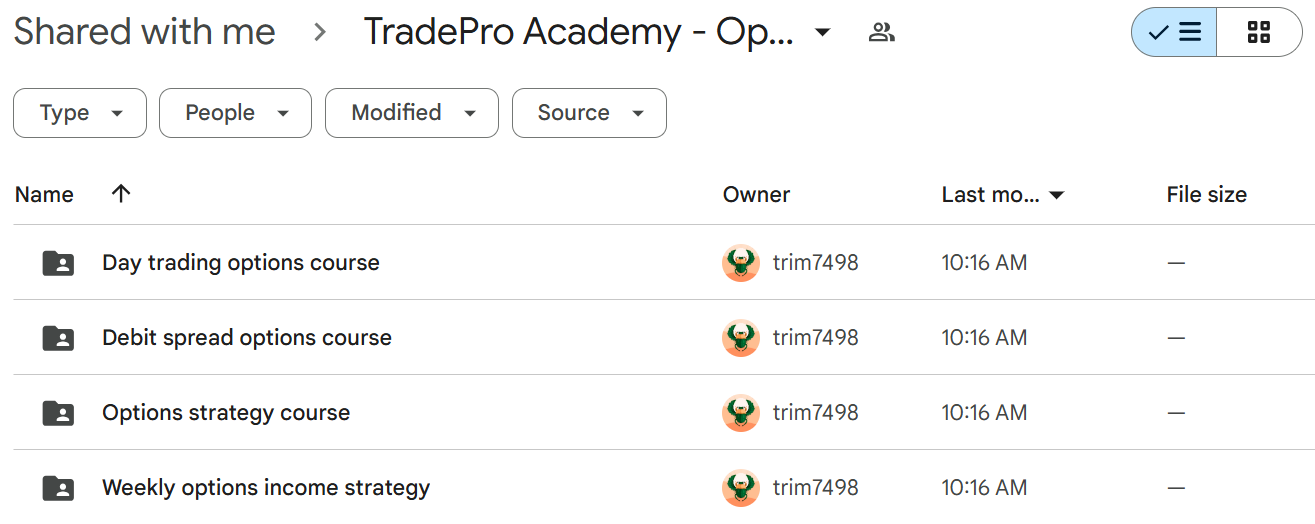

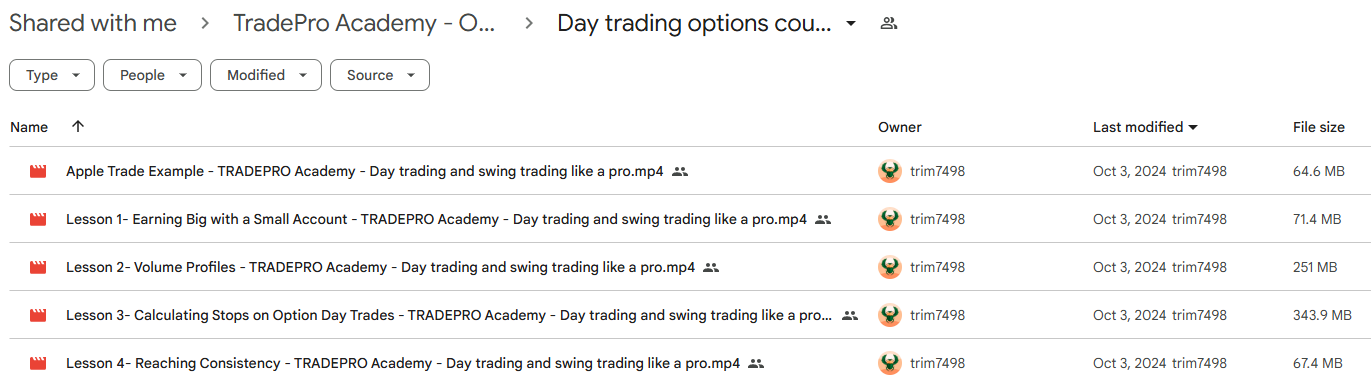

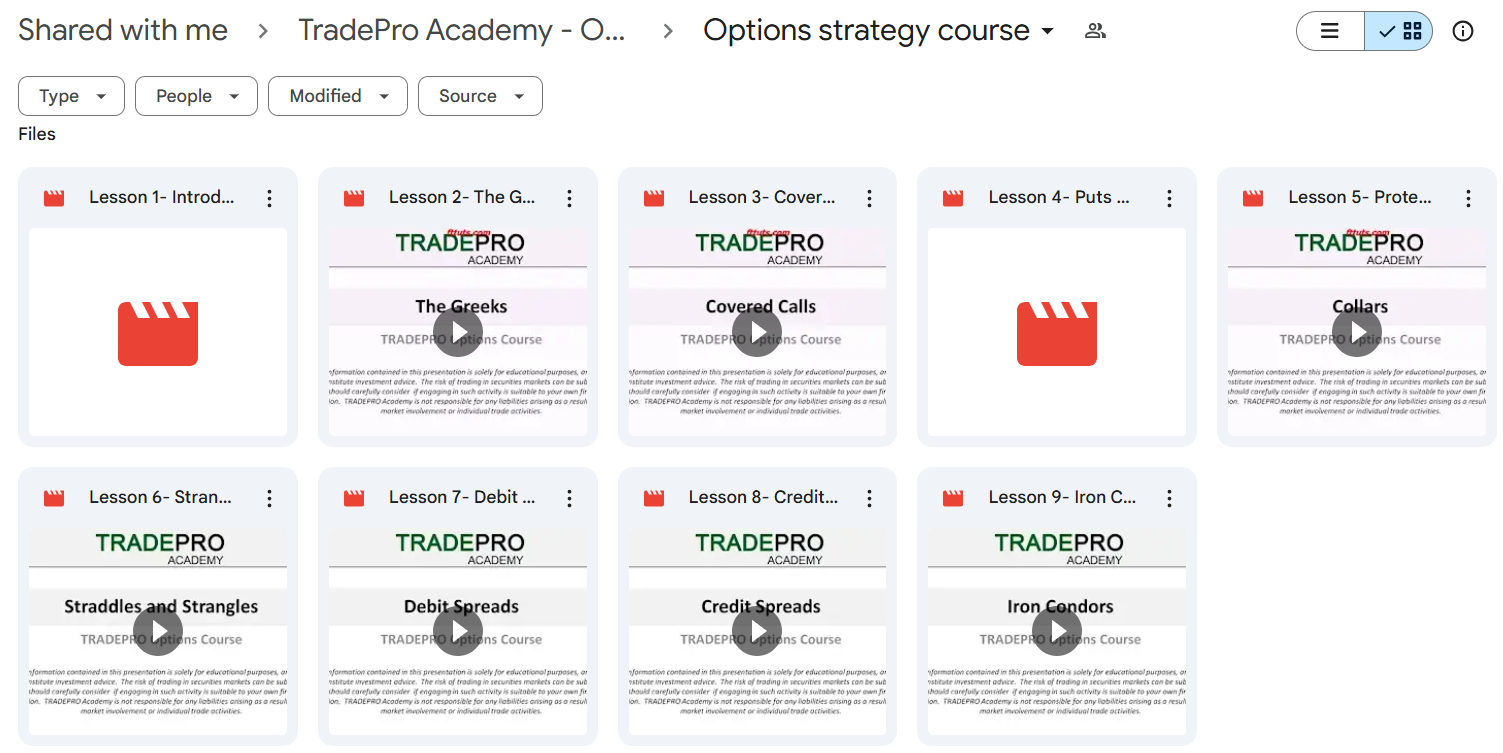

📚 PROOF OF COURSE

What you’ll learn in Options Trading & Order Flow Course:

This course shows you how to profit from options trading. Here’s what you’ll learn:

- Order Flow Analysis: Spot market moves by tracking big traders’ orders and volume patterns

- Trading Strategies: Use spreads, straddles, and iron condors to profit in any market

- Risk Control: Master position sizing and stop-losses to protect your account

- Day Trading: Make profitable trades even with a small account

- Weekly Income: Build consistent income through proven options strategies

- Chart Reading: Use volume profiles to find better trade entries

After finishing, you’ll know how to trade options safely and make regular profits.

Options Trading & Order Flow Course Curriculum:

The Options Trading & Order Flow Course is structured in 4 comprehensive modules. Each builds your skills from basic to advanced trading strategies. The course curriculum includes:

✅ Module 1: Day Trading Options Course

- Apple Trade Example

- Lesson 1: Earning Big with a Small Account

- Lesson 2: Volume Profiles – TRADEPRO Academy

- Lesson 3: Calculating Stops on Option Day Trades

- Lesson 4: Reaching Consistency

✅ Module 2 Debit Spread Options Course

- Download course resources [2 PDFs]

- Lesson 1: Introduction to Debit Spreads

- Lesson 2: Types of Debit Spreads

- Lesson 3: Building High Probability Spreads

- Lesson 4: Risk and Trade Management

- SPY trade example

✅ Module 3: Options Strategy Course

- Download course resources and preparation notes [ PDF & Images]

- Lesson 1: Introduction to Call Options

- Lesson 2: The Greeks & Pricing

- Lesson 3: Covered Call Strategy

- Lesson 4: Puts & Married Puts

- Lesson 5: Protective Collars

- Lesson 6: Strangles & Straddles

- Lesson 7: Debit Spreads

- Lesson 8: Credit Spreads

- Lesson 9: Iron Condors

✅ Module 4: Weekly Options Income Strategy

- Lesson 1: Strategy Introduction

- Lesson 2: Eligible Securities

- Lesson 3: Entering Trades

- Lesson 4: Money Management

- Lesson 5: Placing Stop Losses

- Lesson 6: Pair Trading – The Secret Sauce

- Lesson 7: Keeping Commissions Low

Each module includes practical examples and real market applications to help you master these trading techniques.

What is TradePro Academy?

TRADEPRO Academy is a leading educational platform that specializes in training traders in financial markets like stocks, options, and futures. Their mission is to empower traders with practical knowledge and advanced strategies to achieve consistent profitability.

With years of experience, TRADEPRO Academy has built a strong reputation for:

- Delivering high-quality, actionable trading education.

- Supporting students through an engaged community of like-minded traders.

- Offering expert guidance in risk management and trading strategies.

TRADEPRO Academy has helped thousands of traders worldwide succeed in the financial markets.

Be the first to review “TradePro Academy – Options Trading & Order Flow Course” Cancel reply

Related products

Options Trading

Futures Trading

TRADEPRO ACADEMY – Futures Day Trading and Order Flow Course

Options Trading

Mastertrader – Master Trader Option Strategies Series for Investors and Active Traders

Options Trading

Options Trading

Options Trading

Options Trading

Reviews

There are no reviews yet.