The Power of Position Sizing Strategies of Van Tharp

$1,070.00 Original price was: $1,070.00.$29.00Current price is: $29.00.

Van Tharp The Power of Position Sizing Strategies Course [Instant Download]

What is The Power of Position Sizing Strategies Course:

The Power of Position Sizing Strategies Course teaches you how to enhance your trading strategies using Van Tharp’s Position Sizing Strategies and the System Quality Number (SQN) score. It guides you in defining clear trading objectives, evaluating your trading system’s performance, and designing effective position sizing strategies.

The course includes video training, documents, spreadsheets, and software to help you master these strategies and achieve your trading goals. By focusing on position sizing rather than chasing the perfect system, you’ll learn how to improve your trading skills and performance.

📚 PROOF OF PRODUCT:

What You Will Learn in this course:

- Understanding Trading Objectives: Learn how to set clear, achievable trading objectives that align with your trading style and goals.

- SQN Score Application: Discover how to calculate and apply the SQN score to evaluate the effectiveness of your trading systems.

- Position Sizing Strategies: Gain insights into various strategies that match your objectives and trading systems.

- Practical Tools and Simulation: Learn to use Microsoft Excel-based tools, including a Monte Carlo simulator, to reduce uncertainties and make informed decisions about your strategies.

The Power of Position Sizing Strategies Course Curriculum:

- Your Trading Objectives: We’ll guide you in defining clear and complete trading objectives, ensuring they are well-documented, fit your trading style, and drive all aspects of your trading activities.

- Evaluating Your Trading System Performance: Learn to measure your system’s performance across different market types. Understand how to select and monitor your systems based on specific criteria, ensuring they meet your expectations.

- Designing Your Position Sizing Strategies: Discover how to create effective position sizing strategies that are the critical link between your trading objectives and your trading system. These strategies are crucial in helping you meet your trading goals.

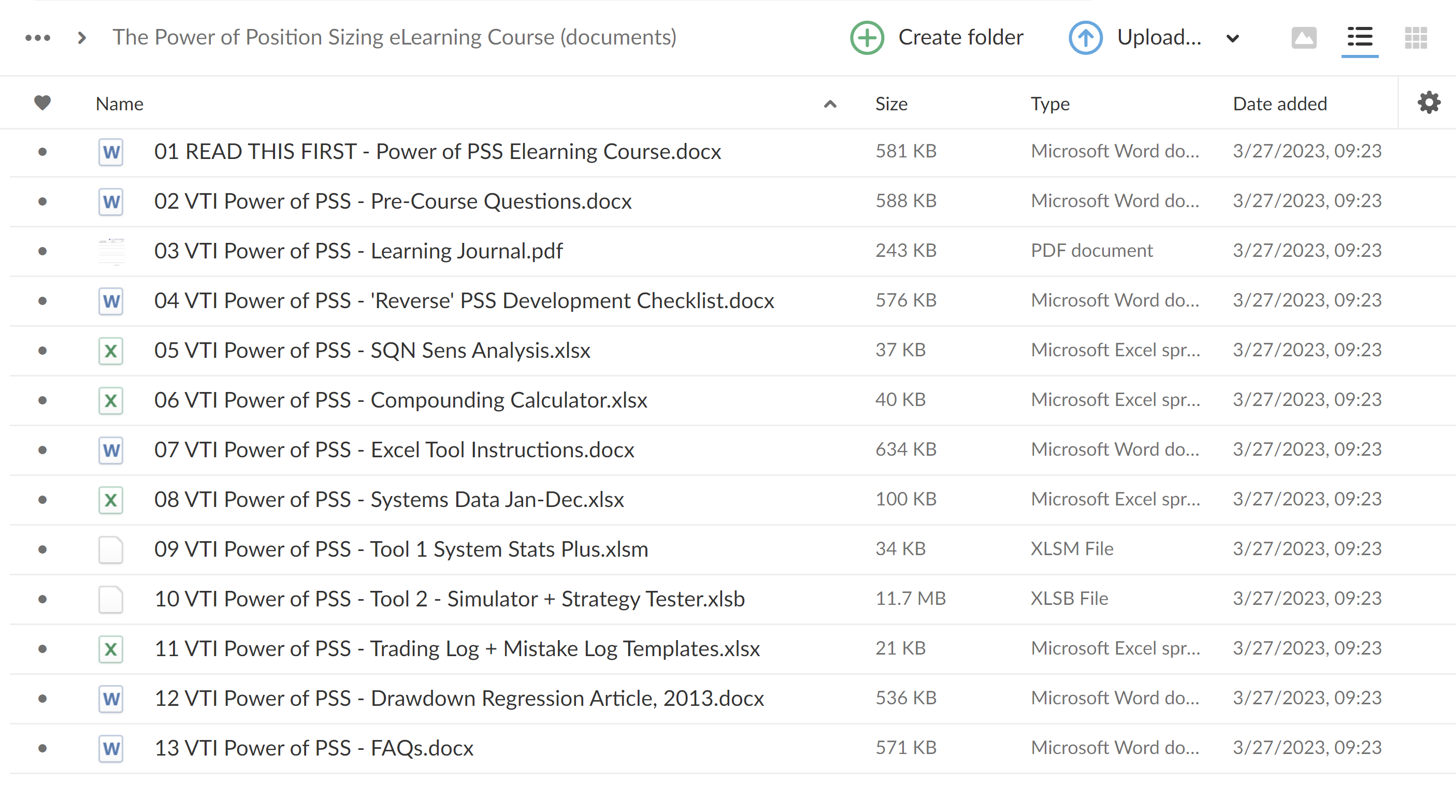

Content Breakdown:

- Video training: 3.6Gb

- Document 1: READ THIS FIRST – Power of PSS Elearning Course

- Document 2: VTI Power of PSS – Pre-Course Questions

- Document 3: VTI Power of PSS – Learning Journal

- Document 4: VTI Power of PSS – ‘Reverse’ PSS Development Checklist

- Spreadsheet 5: VTI Power of PSS – SQN Sens Analysis

- Spreadsheet 6: VTI Power of PSS – Compounding Calculator

- Document 7: VTI Power of PSS – Excel Tool Instructions

- Spreadsheet 8: VTI Power of PSS – Systems Data Jan-Dec

- Spreadsheet 9: VTI Power of PSS – Tool 1 System Stats Plus

- Software 10: VTI Power of PSS – Tool 2 – Simulator + Strategy Tester

- Spreadsheet 11: VTI Power of PSS – Trading Log + Mistake Log Templates

- Document 12: VTI Power of PSS – Drawdown Regression Article, 2013

- Document 13: VTI Power of PSS – FAQs

This course is ideal for traders who want to refine their approach, understand the importance of position sizing, and use practical tools to enhance their trading decisions.

About the instructior: Dr Van K. Tharp

Dr. Van K. Tharp is a distinguished figure in trading and financial coaching. Renowned for his expertise in trading psychology and transformative coaching methods, Dr. Tharp has helped countless traders and investors achieve success.

With a background in psychology and a passion for the stock market, he has developed a unique approach that emphasizes the psychological aspects of trading, believing that personal growth and understanding are key to financial success. Dr. Tharp’s teachings and strategies, particularly in system development and position sizing, are considered groundbreaking and have been instrumental in shaping the trading strategies of professionals worldwide.

Reviews

There are no reviews yet.