The Art Of Private Money Training

$497.00 Original price was: $497.00.$43.00Current price is: $43.00.

Daniil Kleyman The Art Of Private Money Training Course [Instant Download]

What is The Art Of Private Money Training?

The Art Of Private Money Training is a real estate financing course teaching investors how to raise private money without banks or personal credit.

The program shows you how to find private lenders and convince them to fund your property deals.

You learn step-by-step methods to build relationships with people who have cash but need someone to find and manage real estate investments.

Kleyman’s system helps you secure 100% financing for house flips, rental properties, and development projects. The course teaches you how to turn everyday people into repeat private money partners who eagerly fund your deals.

📚 PROOF OF COURSE

What you’ll learn in The Art Of Private Money Training:

This training shows you how to raise private money for unlimited real estate deals. Here’s what you’ll learn:

- Finding private lenders: Discover where real private money lenders spend time and how to spot qualified prospects who have cash to invest.

- Building relationships: Learn how to build trust and rapport with potential funding partners so they want to work with you.

- Presentation skills: Create powerful deal presentations that get lenders excited to fund your property projects.

- Deal structuring: Set up win-win partnerships that benefit both you and your private money partners on every deal.

- Legal compliance: Navigate SEC rules and use proper legal documents to protect everyone involved in the deal.

- Scaling strategies: Turn one private lender into multiple funding sources through referrals and building your reputation.

The training includes real case studies from students who raised $350,000 to $535,000 in private money. You get proven scripts, legal contracts, and step-by-step systems to start raising capital right away.

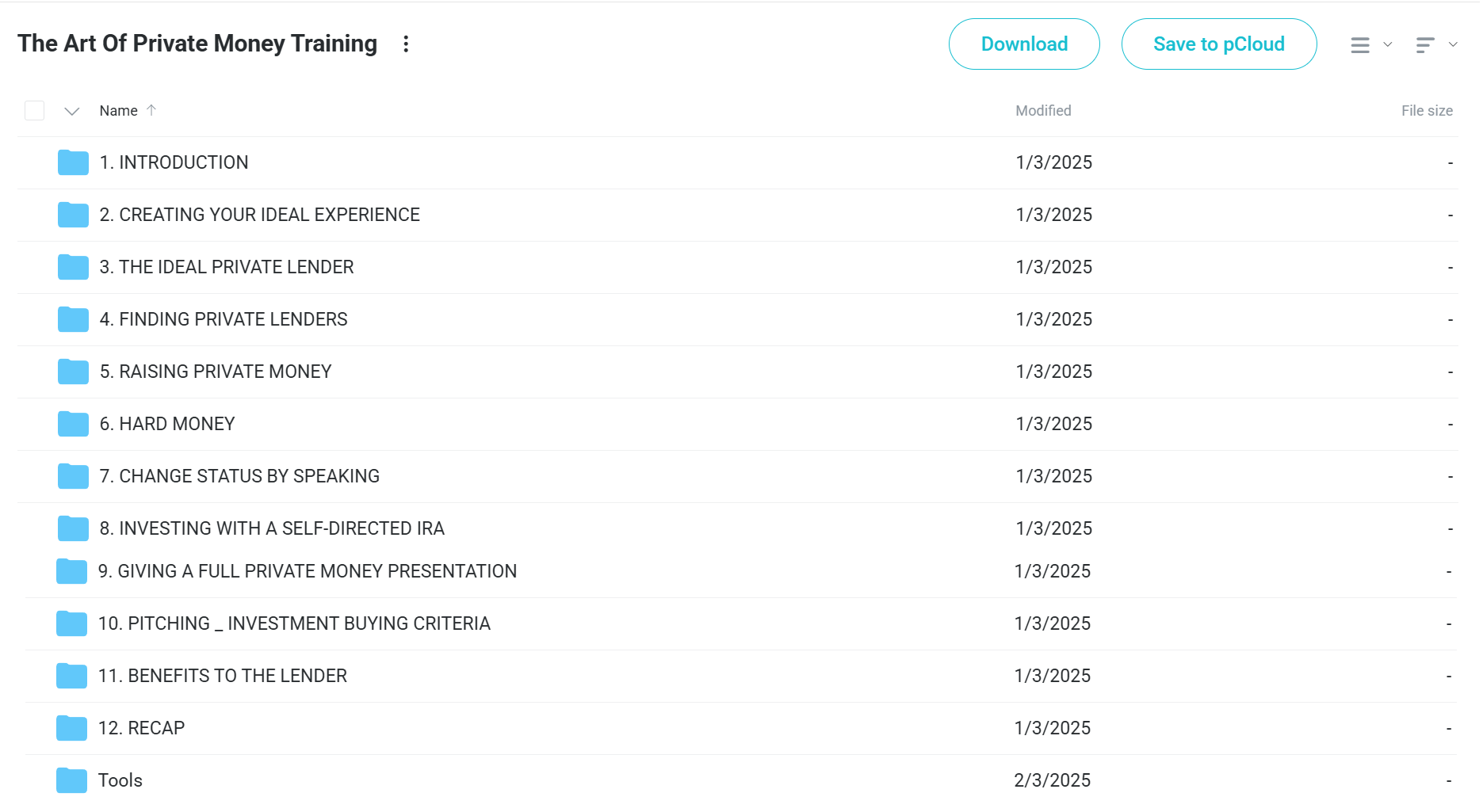

The Art Of Private Money Training Course Curriculum:

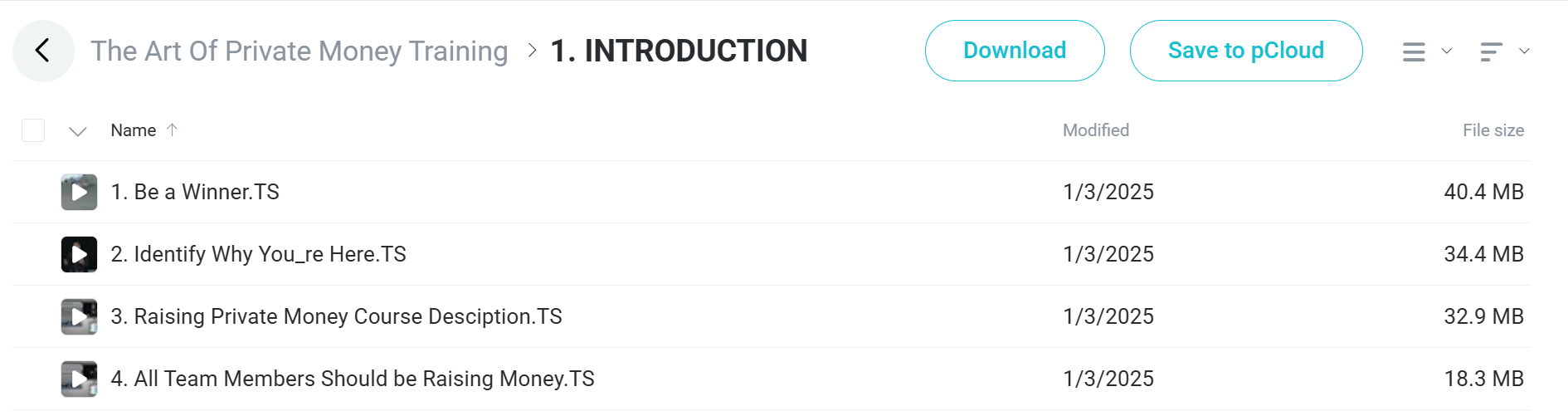

✅ Module 1: Introduction

This starting module helps you get the right mindset for getting private money. Students learn why they want to do this and understand why private money is needed to grow your real estate business.

The section teaches that everyone on your team should help raise money, not just one person. Students get clear on what to expect from the course and learn how to feel confident when talking to people who might lend money.

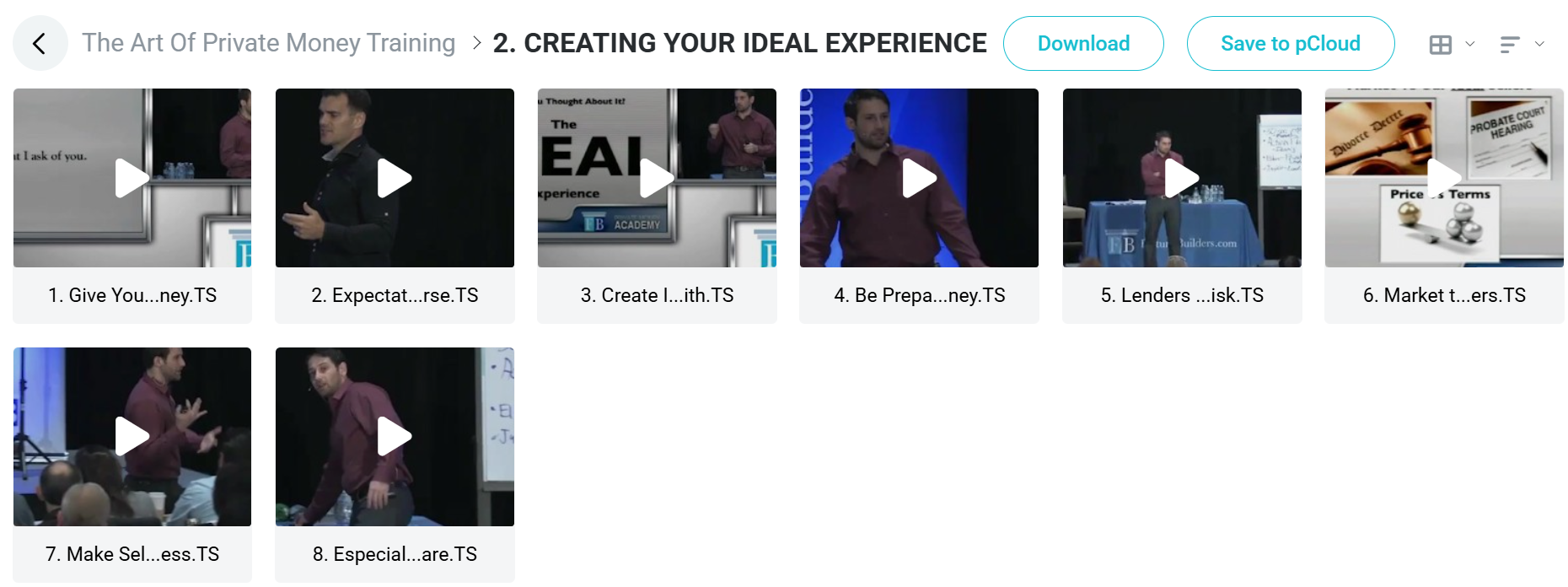

✅ Module 2: Creating Your Ideal Experience

Students learn to give themselves permission to go after private money deals and understand what’s expected in the training. The module focuses on making good experiences for everyone involved in real estate deals, including sellers, buyers, and lenders.

Key lessons include always being ready to talk about money opportunities and understanding that lenders check how you handle risk. Students learn to market well to the right sellers while being open about how they do business with people who might fund their deals.

✅ Module 3: The Ideal Private Lender

This module teaches students to figure out and find their perfect private lender. Students make detailed lists describing what they want in a lending partner and learn to compare these traits to find the best matches.

The section covers building trust within networking groups and showing yourself as someone who brings good opportunities. Students learn to use existing networks and group connections to attract people who might lend money.

✅ Module 4: Finding Private Lenders

Students learn real networking skills to find and connect with private money sources. The module includes making and practicing elevator pitches for networking events, along with good follow-up methods for new contacts.

Key techniques include taking detailed notes during follow-up talks and knowing when to cancel meetings that won’t help your funding goals. Students learn to stay active in their networks while constantly improving their pitch through practice and feedback.

✅ Module 5: Raising Private Money

This advanced section teaches students to pitch well by asking simple, smart questions that get potential lenders interested. Students learn personal branding tricks that bring lenders to them instead of always having to reach out.

The module covers becoming known as a real estate expert and building “star power” that creates a group of potential funding sources. Students find out how to use their knowledge and focus completely on funding goals.

✅ Module 6: Hard Money

Students get a complete understanding of hard money lending, including when and why to use these higher-risk funding sources. The module explains that all successful real estate investors use hard money at different times in their careers.

Key lessons cover the specific information hard money lenders need and how to keep these relationships even after doing 40+ deals. Students learn to see hard money as a useful tool instead of thinking it’s only for desperate situations.

✅ Module 7: Change Status by Speaking

This module turns students into confident public speakers who can build trust by teaching others about real estate investing. Students learn to prepare professional introductions and get audiences interested through smart questioning.

The section covers proper manners for thanking event organizers and earning the right to share knowledge with audiences. Students master setting presentation goals, making session rules, and using fast learning techniques to keep audiences interested throughout their talks.

✅ Module 8: Investing with Self-Directed IRAs

Students learn IRS rules for retirement account investments in real estate along with the good and bad points of using these funds. The module covers different IRA types and available investment options for each account type.

Key lessons include understanding the difference between transfers and rollovers when funding retirement accounts. Students study the John Keeper case study and learn how wholesale assignments can work as real IRA deals under proper guidance.

✅ Module 9: Giving a Full Private Money Presentation

This complete module teaches students to give full private money presentations that turn prospects into active lenders. Students learn social skills and relationship-building methods that create trust with potential funding sources.

The section includes setting proper terms and interest rates while talking about common investor fears about potential problems. Students practice role-playing scenarios and learn to break presentations into easy parts for best results.

✅ Module 10: Pitching & Investment Buying Criteria

Students master the discovery process by learning to ask smart questions about potential lenders’ investment goals and available money. The module covers using home equity and figuring out realistic funding amounts from each prospect.

Key lessons include handling common lender objections through role-play scenarios and building trust through complete company overviews. Students learn to overcome the “new investor” objection and clearly explain their buying criteria while walking lenders through real deal examples.

✅ Module 11: Benefits to the Lender

This module shifts focus to the lender’s side, teaching students to present good terms and conditions that attract funding partners. Students learn to guide lenders through HELOC funding processes and self-directed retirement account options.

The section focuses on changing personal money mindsets and promising to keep learning as key factors in long-term success. Students find out how to explain risk versus reward based on thorough discovery and strong relationship-building with potential lenders.

✅ Module 12: Recap

The final module brings together all previous learning through lots of role-playing exercises and real-world practice scenarios. Students learn that risk versus reward discussions can effectively handle common objections while making sure lenders feel comfortable with their investment decisions.

Key lessons include guiding new hard money lenders and explaining complete systems and support structures. Students master the importance of proper paperwork through promissory notes, mortgages, and trust deeds that protect all parties involved.

The module ends with real-world case studies from successful investors Randy Zimnoch and William Wood, along with golden nuggets for building lasting businesses. Students learn to create their own self-directed IRAs and develop reward programs for lender referrals and joint ventures.

Who is Daniil Kleyman?

Daniil Kleyman is a real estate developer and investor from Richmond, Virginia. He moved from Russia at age 12 and worked on Wall Street before starting his real estate career.

Kleyman owns over 100 rental units and runs a development company. His projects range from single-family rehabs to large commercial developments worth over $60 million.

He created Rehab Valuator, a software that helps investors analyze deals and raise capital. Since 2009, he has focused on multifamily and mixed-use property development.

After losing his job in the 2008 recession, Kleyman moved back with his parents. He discovered private money strategies and used them to build his real estate portfolio and leave corporate work forever.

Today, Kleyman travels internationally 4-5 times per year while running his businesses. His private money methods have helped hundreds of students raise millions in capital for their real estate deals.

Be the first to review “The Art Of Private Money Training” Cancel reply

Related products

Real Estate

Real Estate Finance

Real Estate Finance

Real Estate Finance

Real Estate

Reviews

There are no reviews yet.