Small Account Futures (Elite Package) By Joe Rokop

$1,397.00 Original price was: $1,397.00.$12.00Current price is: $12.00.

Joe Rokop Small Account Futures Course [Instant Download]

What is Joe Rokop Small Account Futures?

Joe Rokop Small Account Futures is a futures trading teaches you how to grow small futures accounts fast without big capital.

The program shows you how to make consistent profits in volatile futures markets through systematic risk management and account scaling techniques.

You’ll master Rokop’s tested formula that scaled $10K into $303K in 5 months, focusing on the Small Account Trinity system and Strike Zone entry methods for maximum growth.

📚 PROOF OF COURSE

What you’ll learn in Small Account Futures:

Small Account Futures teaches you Joe Rokop’s proven system for growing small trading accounts fast in any market. Here’s what you’ll learn:

- Account scaling strategies: Simple methods to grow small futures accounts quickly

- Risk management techniques: How to set clear targets that boost profit while limiting risk

- Market volatility trading: Ways to profit from market ups and downs consistently

- Small Account Trinity: The three-part system Joe always uses when trading

- Entry and exit signals: Strike Zone signals for steady returns

- Profit optimization: How Joe’s wins are twice as big as his losses

This complete training helps new and experienced traders get steady results with smaller accounts.

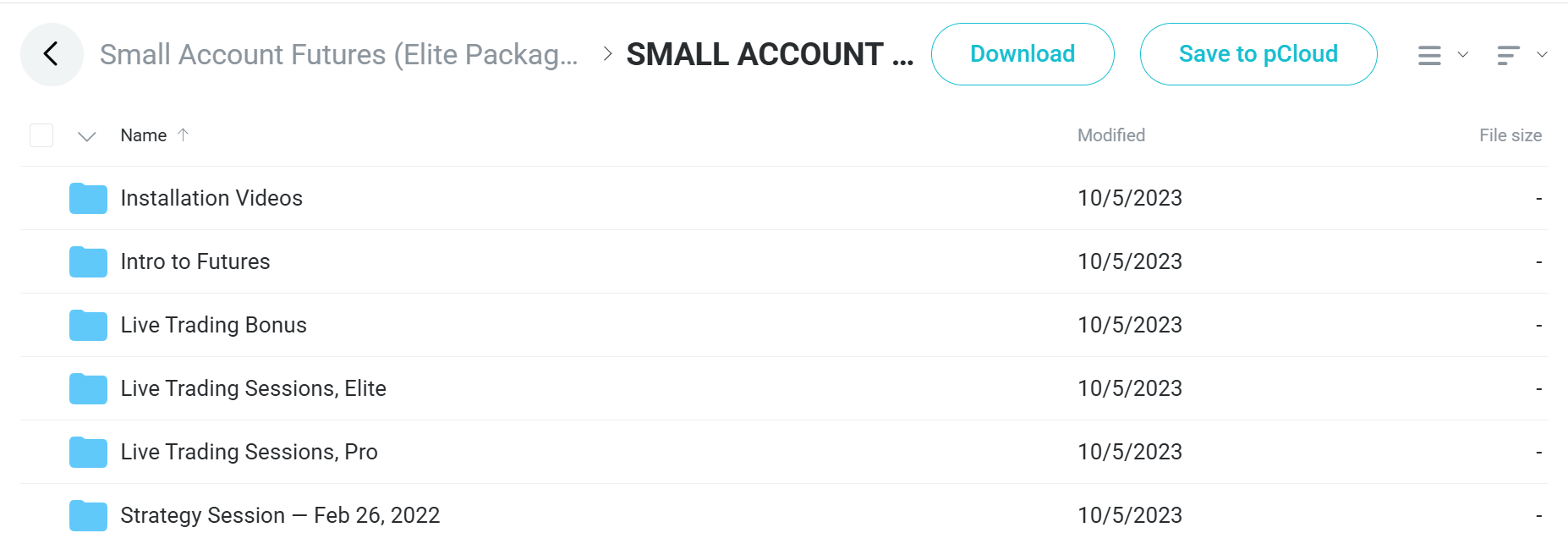

Small Account Futures Course Curriculum:

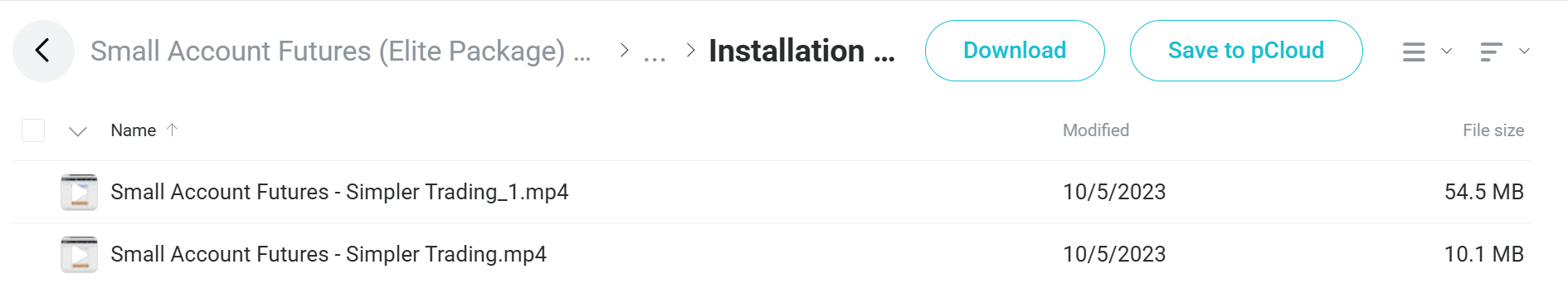

✅ Installation Videos

Students begin with essential setup procedures to ensure their trading platform and tools are properly configured for the strategies they’ll learn. This foundational section removes technical barriers and ensures all participants can follow along with subsequent lessons without software-related obstacles.

✅ Intro to Futures

This introductory module establishes the fundamental concepts of futures trading, covering market mechanics, contract specifications, and the unique characteristics that make futures attractive for small account trading. Students learn why futures can offer better leverage and capital efficiency compared to other trading vehicles, setting the stage for the strategic approach taught throughout the course.

✅ Module 1: Foundation Building

The opening module introduces students to the core philosophy of small account trading, emphasizing risk management principles that are crucial when working with limited capital. Students learn to think like professional traders while adapting strategies specifically for smaller position sizes.

✅ Module 2: Market Terminology

A dedicated terminology session ensures students understand the language of futures trading, from basic contract terms to advanced trading concepts. This vocabulary foundation prevents confusion in later modules and enables students to communicate effectively about their trades.

✅ Module 3: Market Analysis Framework

Students develop skills in reading market structure and identifying high-probability trading opportunities using technical analysis specifically tailored for futures markets. The three-part progression builds from basic chart reading to advanced pattern recognition that forms the backbone of the trading strategy.

✅ Module 4: Core Strategy Development

This extensive six-part module introduces the primary trading methodology, covering entry signals, position sizing, and initial risk management rules. Students learn to identify the specific market conditions where the strategy performs best and how to avoid common pitfalls that trap inexperienced futures traders.

✅ Module 5: Trade Management Techniques

The focus shifts to managing open positions, with emphasis on scaling techniques and dynamic stop-loss adjustments that maximize profits while protecting capital. Students learn the psychological aspects of trade management and how to maintain discipline during both winning and losing streaks.

✅ Module 6: Advanced Signal Recognition

This comprehensive six-part section, culminating in the “Signals & Set Ups” lesson, teaches students to recognize high-probability trade setups with precision. The progression moves from basic signals to complex multi-timeframe analysis, enabling students to enter trades with greater confidence and timing accuracy.

✅ Module 7: Risk Management Mastery

Students learn sophisticated risk management techniques that go beyond basic stop-losses, including portfolio heat management and correlation awareness. This three-part module ensures students can preserve capital during inevitable losing periods while positioning for maximum growth during favorable market conditions.

✅ Module 8: Profit Taking and Account Growth

The “How do you Pay Yourself” lesson addresses the critical question of when and how to extract profits from a growing trading account. Students learn to balance reinvestment for account growth with the practical need to realize gains, including tax considerations and cash flow management.

✅ Module 9: Advanced Market Scenarios

This five-part advanced module challenges students with complex market situations, including trending markets, choppy conditions, and news-driven volatility. Students learn to adapt the core strategy to different market environments while maintaining consistent risk management principles.

✅ Module 10: Mastery and Assessment

The final module synthesizes all previous learning through practical exercises and includes a comprehensive quiz to test understanding. Students demonstrate their ability to identify trades, manage risk, and execute the complete trading process from setup identification through profit realization.

✅ Pro Level Sessions

Four recorded live trading sessions demonstrate the strategy in action during real market conditions, showing students how theoretical concepts translate into actual trades. These sessions reveal the decision-making process in real-time, including how to handle unexpected market moves and adjust strategies on the fly.

✅ Elite Level Sessions

Five advanced live trading sessions showcase more sophisticated applications of the strategy, including larger position management and complex market scenarios. These sessions are designed for students who have mastered the basics and are ready to see how experienced traders handle challenging situations.

✅ Live Trading Bonus

An additional live session provides extra examples and addresses common student questions that arise during the learning process. This bonus content helps bridge the gap between classroom learning and independent trading execution.

✅ Strategy Session — February 26, 2022

This comprehensive 10-part special session captures a complete trading day, from pre-market analysis through position management and closing procedures. Students observe the entire workflow of a professional futures trader, gaining insights into daily routines, market preparation, and the mental aspects of consistent trading performance.

Who is Joe Rokop?

Joe Rokop is the Managing Director of Commodities and Equities at Simpler Trading with 15 years of professional trading experience.

He started his career on the floor of the New York Mercantile Exchange where he learned pattern recognition, volume analysis, and trading strategies.

Rokop trades commodities, indexes, and equities through futures, options, and derivatives in commercial and proprietary trading.

His floor trading background gives him deep market flow and volume knowledge that most traders don’t have.

At Simpler Trading, Joe helps traders get better results through practical strategies and real-time coaching. He’s famous for turning $10K into $303K in 5 months using his proven Small Account Futures formula.

Be the first to review “Small Account Futures (Elite Package) By Joe Rokop” Cancel reply

Related products

Futures Trading

Best 100 Collection

Futures Trading

Futures Trading

Futures Trading

Futures Trading

![[Bundle] Best 4 FutexLive Courses](https://coursehuge.com/wp-content/uploads/2024/08/Bundle-Best-4-FutexLive-Courses-300x300.jpg)

Reviews

There are no reviews yet.