Simon McFayden – Bitsgap Accelerator

$1,297.00 Original price was: $1,297.00.$18.00Current price is: $18.00.

Simon McFayden Bitsgap Accelerator Course [Instant Download]

1️⃣. What is Simon McFayden Bitsgap Accelerator?

Simon McFayden’s Bitsgap Accelerator is a crypto trading program teaching people how to grow their cryptocurrency portfolio using automated grid trading.

The course shares actual methods Simon used to build his own $170,000 Bitsgap portfolio, with real examples and proven ways.

It includes 6 weeks of video training, live question and answer sessions, and access to a group of traders. You’ll learn how to set up trading bots that can make money in any market condition.

The program focuses on hands-on methods that work in the real world, not just theory. You’ll learn exactly how to pick coins, set up profitable grid ranges, and track your results to maximize returns.

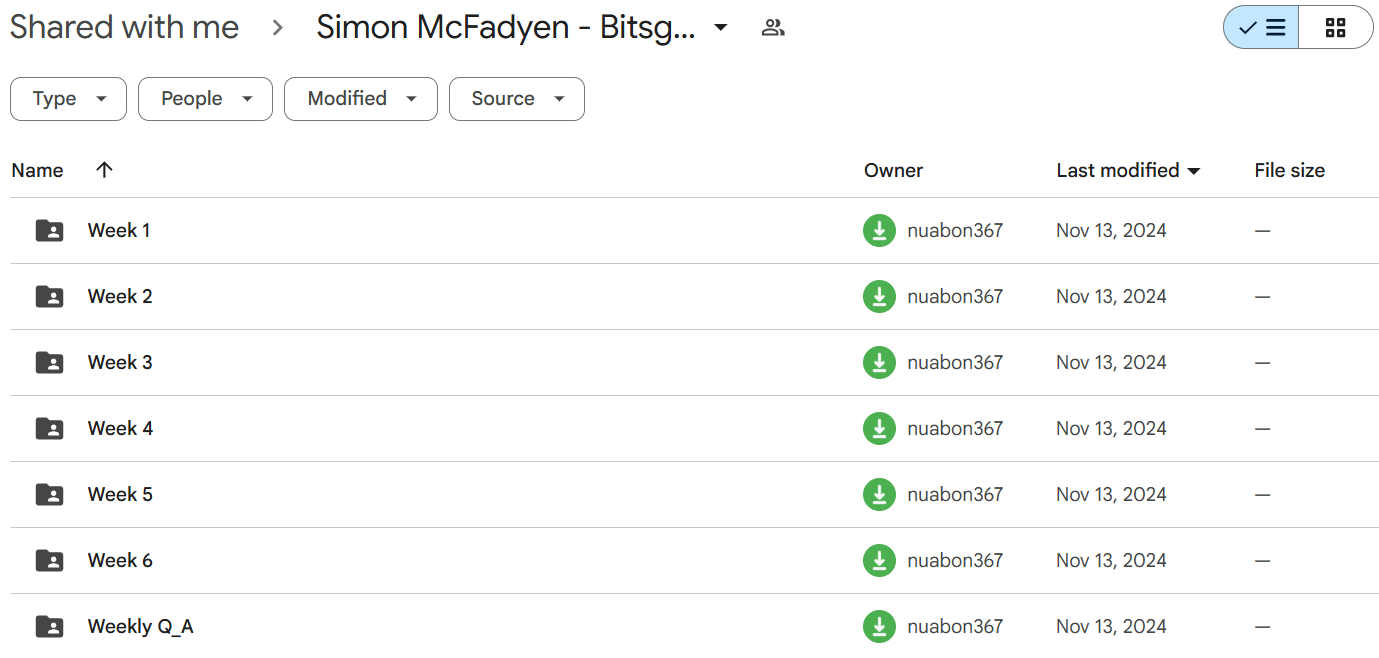

📚 PROOF OF COURSE

2️⃣. What you’ll learn in Bitsgap Accelerator:

Bitsgap Accelerator gives you everything you need to build a profitable crypto portfolio using automated grid trading. Here’s what you’ll learn:

- Grid Trading Mastery: Learn the basics of grid trading and how to set up bots for highest profits

- Strategic Portfolio Building: Create a varied portfolio plan with smart money splits

- Advanced Launch Strategies: Master when and how to start bots with the right take profit and stop loss settings

- Coin Pair Selection: Learn both basic and detailed market review to find profitable trading pairs

- Performance Tracking: Watch your bot and portfolio results closely, knowing exactly when changes are needed

- Troubleshooting Framework: Learn a step-by-step process for fixing poorly-performing bots

By the end of this course, you’ll have the skills to grow your crypto portfolio using automation, using the same strategies that built a $170,000 portfolio.

3️⃣. Bitsgap Accelerator Course Curriculum:

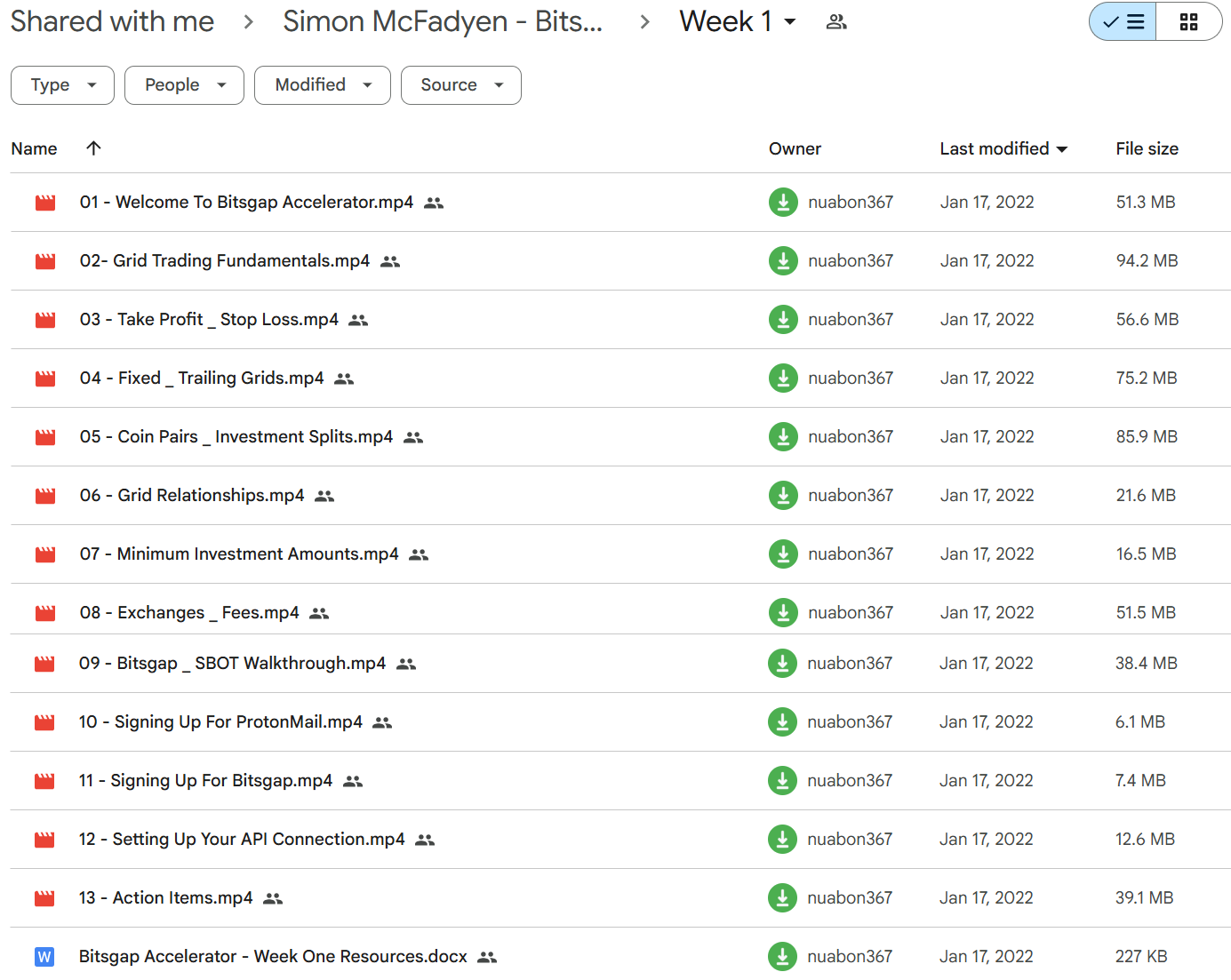

✅ Week 1: Foundation and Setup

Week 1 establishes the groundwork for successful grid trading on Bitsgap. Students begin with grid trading fundamentals, including profit mechanisms and stop-loss techniques, while learning how to configure both fixed and trailing grids for different market conditions.

The curriculum covers essential concepts like selecting optimal coin pairs, determining investment splits, and understanding how grids relate to market movements. Students also learn about minimum investment requirements and how exchange fees impact profitability.

A highlight of this week is the comprehensive Bitsgap and SBOT walkthrough, providing students with a practical understanding of the platform interface. The module concludes with technical setup guidance, including account creation for ProtonMail and Bitsgap, plus API configuration to connect exchange accounts securely.

✅ Week 2: Strategy Implementation

Week 2 builds on foundational knowledge by introducing smart launch strategies to maximize trading potential. Students gain deeper understanding of profit and loss mechanics, with particular focus on trailing up and down techniques that adapt to market movements.

The module provides detailed instruction on setting effective stop-losses to protect investments during market downturns. Students learn strategic take-profit implementation to secure gains at optimal points, completing their understanding of core grid trading strategy components.

By week’s end, students develop the ability to combine these elements into cohesive trading strategies suitable for various market conditions, utilizing companion resources to reinforce learning and practical application.

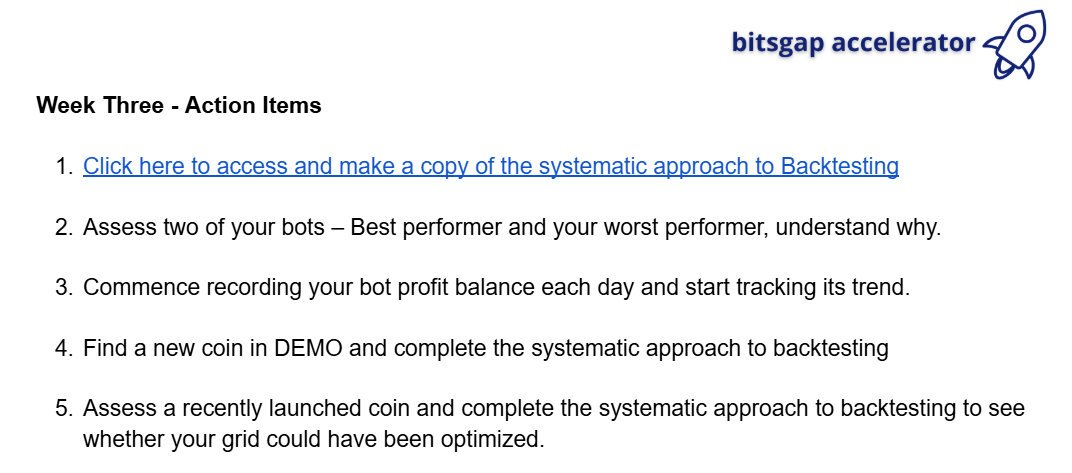

✅ Week 3: Advanced Grid Optimization

Week 3 focuses on optimizing grid bots for maximum profitability. The curriculum explores the factors that determine bot performance and teaches students how to define optimal grid parameters for different market scenarios.

Backtesting emerges as a crucial skill in this module, allowing students to validate strategies using historical data before risking real capital. The detailed exploration of optimum grid development helps students fine-tune their trading parameters for specific coins and market conditions.

This week emphasizes data-driven decision making and strategic refinement, with specific action items guiding students to implement optimization techniques on their existing and future trading bots.

✅ Week 4: Coin Selection and Analysis

Week 4 shifts focus to identifying promising cryptocurrency trading opportunities. Students learn systematic approaches to finding coins with favorable trading characteristics and applying initial “sniff tests” to eliminate poor candidates quickly.

The curriculum covers both fundamental analysis (examining project fundamentals, team quality, and use case) and technical analysis (chart patterns, support/resistance levels, and trend identification) as complementary evaluation methods for potential trading assets.

A highlight of this module is the comprehensive analysis walkthrough, where students observe the instructor applying these techniques to real-world examples. This practical demonstration helps solidify theoretical knowledge into actionable trading decisions.

✅ Week 5: Monitoring and Troubleshooting

Week 5 addresses the critical skills of performance tracking and problem-solving. Students learn systematic portfolio monitoring techniques to identify underperforming bots and diagnose specific issues requiring intervention.

The curriculum distinguishes between troubleshooting underlying losses within grid range versus those outside grid parameters, providing targeted solutions for each scenario. Students also learn to evaluate and improve bot profit percentages when performance falls below expectations.

Advanced bot management techniques are covered, including strategic bot closure to minimize losses and regridding strategies to optimize existing positions for changing market conditions, ensuring students can maintain portfolio health through market fluctuations.

✅ Week 6: Portfolio Management and Psychology

The final week synthesizes previous knowledge into comprehensive portfolio planning. Students learn goal-setting techniques specific to grid trading returns and how to structure grids to achieve these financial objectives over different timeframes.

Investment allocation strategies are covered in detail, with emphasis on portfolio diversification to manage risk across multiple coins, exchanges, and strategy types. The module addresses trading psychology and rule-setting to maintain discipline during emotional market periods.

Students develop personalized bot launch and portfolio plans aligned with their goals, with special attention to beginner strategies and simulated trading for those new to the space. The course concludes with final action items to guide students’ continued trading journey.

✅ Weekly Q&A Sessions

The program includes regular live Q&A sessions where students can get direct answers to their questions and challenges. These sessions provide valuable supplementary learning through the instructor’s responses to real-world trading situations.

Q&A recordings from November to December 2021 allow students to benefit from questions asked by others and gain additional insights beyond the core curriculum. These sessions help clarify complex concepts and address specific scenarios that students encounter in their trading activities.

These interactive components strengthen understanding of course materials while giving students access to expertise on their unique trading circumstances, providing an essential complement to the structured weekly modules.

4️⃣. Who is Simon McFayden?

Simon McFayden is an Australian entrepreneur and crypto investor who built a $170,000 portfolio using Bitsgap’s platform.

He shares his trading journey openly on YouTube, LinkedIn, and Reddit. His focus on real-world strategies has made him trusted in the Bitsgap community.

Simon runs live Q&A sessions twice weekly for his students. His teaching focuses on practical skills and steady growth instead of risky tactics.

He created Bitsgap Accelerator because he saw Bitsgap users needed better training beyond basic settings. He built special tools like the Optimum Bot Settings Calculator and Portfolio Performance Tracker based on his own experiences.

What makes Simon different is his honesty – he shares his actual portfolio data and trading results instead of just theories or unrealistic promises.

5️⃣. Who should take Simon McFayden Course?

The Bitsgap Accelerator is for crypto enthusiasts who want to grow their portfolio using automated trading. This course is perfect for:

- Beginners in crypto trading who want to avoid costly mistakes and use proven grid trading strategies right away.

- Existing Bitsgap users who struggle to get their bots working well or earning consistent returns.

- Experienced traders looking to automate their trading and earn steady, passive income from their crypto.

- Investors with busy schedules who want their money working for them while keeping control of their strategy.

This program gives you everything you need to succeed with Bitsgap’s grid trading platform – the methods, tools, and community support – no matter your trading experience.

6️⃣. Frequently Asked Questions:

Q1: What is cryptocurrency grid trading?

Cryptocurrency grid trading is an automated strategy that places buy and sell orders at fixed price levels. The system automatically buys when prices drop and sells when they rise, making profits from price movements without predicting market direction.

Q2: How much can you earn from automated grid trading?

Most grid traders earn 3-8% monthly in normal markets. Returns depend on your settings, market swings, and the trading pairs you choose. More volatile markets can bring higher returns but also higher risks.

Q3: How much money do you need to start grid trading?

You can start with $100, but $1,000-3,000 works better for spreading risk. Exchanges typically require $20-50 minimum per bot. More money lets you run several bots across different coin pairs.

Q4: Is crypto automated bot trading safe?

Bot trading has risks like all crypto investing but removes emotional decisions. Using stop-losses is essential to protect your money during downtrends. Bots can trade 24/7 based on your settings, which helps manage risk.

Q5: Can beginners use automated grid trading successfully?

Yes, beginners can succeed with grid trading. Platforms like Bitsgap offer simple interfaces with ready-made strategies. Start with stable coins, safe settings, and small amounts while you learn the basics.

Be the first to review “Simon McFayden – Bitsgap Accelerator” Cancel reply

Related products

Forex Trading

Forex Trading

Crypto Trading

Crypto Trading

Crypto Trading

Reviews

There are no reviews yet.